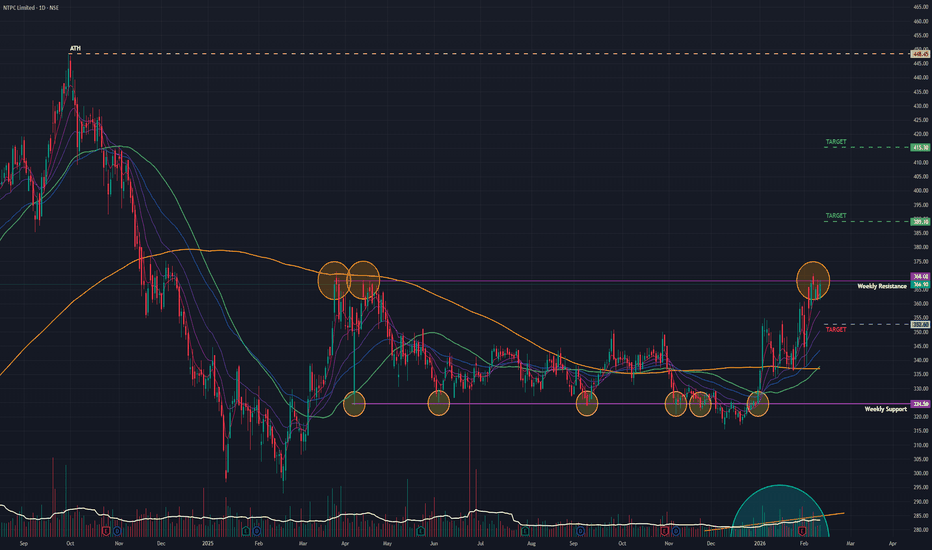

NTPC.. Moved outside the channel..NTPC.. Trying its level best to move.

Selling pressure in market pulled it back and retested the support.

Now things can be interesting..

Moved above this channel then first target can be somewhere around 370, the exact level from where it faced resistance today..

Second can be somewhere around

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.95 INR

234.22 B INR

1.85 T INR

4.74 B

About NTPC Limited

Sector

Industry

CEO

Gurdeep Singh

Website

Headquarters

New Delhi

Founded

1975

IPO date

Oct 7, 2004

Identifiers

2

ISIN INE733E01010

NTPC Ltd. engages in the generation of electric power in coal based thermal power plant. It operates through the Generation of Energy and Others segments. The Generation of Energy segment involves the generation and sale of bulk power to State Power utilities. The Others segment includes provision of consultancy, project management and supervision, energy trading, oil and gas exploration, and coal mining. The company was founded on November 7, 1975 and is headquartered in New Delhi, India.

Related stocks

NTPC - Long• Price has moved above the middle Bollinger Band on the weekly chart. This shows the stock is shifting from sideways to bullish.

• The recent weekly candle is strong and moving toward the upper Bollinger Band. This tells us volatility is expanding on the upside, which usually supports further upsi

NTPC (D): Bullish (Golden Crossover + Base Breakout)(Timeframe: Daily | Scale: Linear)

The stock is on the verge of a major structural breakout from a 10-month consolidation base. The occurrence of a Golden Crossover (50 SMA > 200 SMA) confirms that the long-term trend has officially shifted from "Correction" to "Uptrend."

🚀 1. The Fundamental

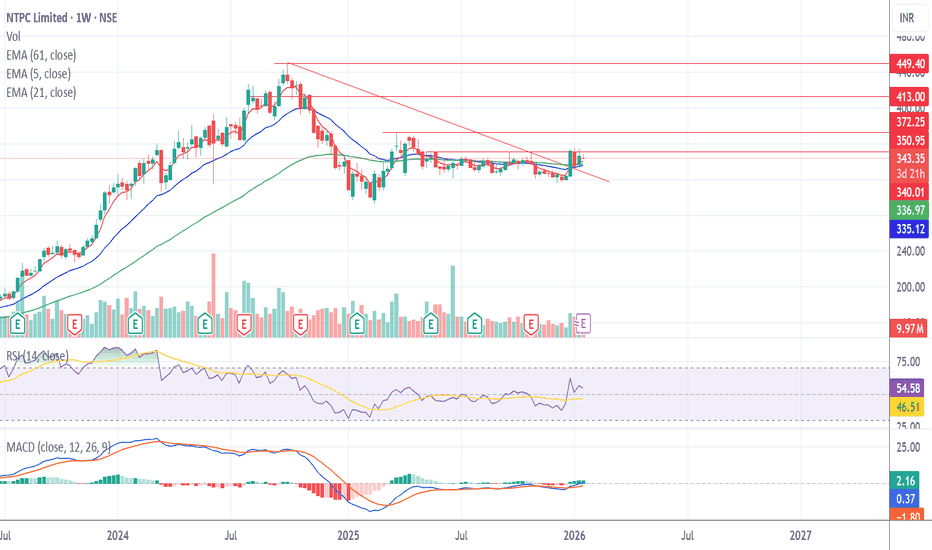

NTPC 1 Week Time Frame 📊 Current Approx Price Range

• Trading near ₹365–₹370 on the NSE this week.

📈 Weekly Resistance Levels (Upside)

• R1: ~₹378 – first reaction resistance this week

• R2: ~₹390 – secondary hurdle before fresh upside

• R3: ~₹410 – extended resistance if bulls dominate

• Fibonacci/Weekly Pivot R2–R3: ~₹

NTPC 1 Day Time Frame 📌 Current Price (approx): ₹367–₹368 on NSE (today’s trading)

📊 Daily Pivot Levels (Key Reference Area)

These are calculated from recent price action & help identify where price may stall or bounce:

Central Pivot / CPR: ~₹364–₹365 (major reference)

Resistance (Upside Levels):

R1: ~₹371

R2: ~₹375

Breakout Stock: NTPCNTPC has been stabilising in a broad range over the past two weeks, above the short-term averages of 20 and 50 daily moving averages. Creating a falling trendline breakout. The stock is projected to resume its ascent. Momentum indicators are positive, indicating strength. Obtaining help from 200 DEM

Investment pick NTPC@344 -fundamental ideaNot a SEBI registered, just sharing idea. Investment pick - NTPC @ 344. In future lot of data centers were build which require huge and continuous power supply. Future will be of Nuclear power plant - NTPC & Adani Power will foray into Nuclear field. NTPC agreement with NPCIL to build nuclear plant

The Principles That Separate Consistent Winners from the Crowd1. Trading Is About Probabilities, Not Certainty

One of the most important trading secrets is accepting uncertainty. Markets are influenced by countless variables—economic data, institutional flows, geopolitics, sentiment, and algorithms. No trader, regardless of experience, can predict outcomes wi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of NTPC is 363.00 INR — it has decreased by −1.43% in the past 24 hours. Watch NTPC Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange NTPC Limited stocks are traded under the ticker NTPC.

NTPC stock has risen by 0.33% compared to the previous week, the month change is a 7.11% rise, over the last year NTPC Limited has showed a 18.57% increase.

We've gathered analysts' opinions on NTPC Limited future price: according to them, NTPC price has a max estimate of 459.00 INR and a min estimate of 325.00 INR. Watch NTPC chart and read a more detailed NTPC Limited stock forecast: see what analysts think of NTPC Limited and suggest that you do with its stocks.

NTPC reached its all-time high on Sep 30, 2024 with the price of 448.45 INR, and its all-time low was 58.35 INR and was reached on Nov 5, 2004. View more price dynamics on NTPC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NTPC stock is 1.61% volatile and has beta coefficient of 0.88. Track NTPC Limited stock price on the chart and check out the list of the most volatile stocks — is NTPC Limited there?

Today NTPC Limited has the market capitalization of 3.52 T, it has increased by 0.92% over the last week.

Yes, you can track NTPC Limited financials in yearly and quarterly reports right on TradingView.

NTPC Limited is going to release the next earnings report on May 15, 2026. Keep track of upcoming events with our Earnings Calendar.

NTPC earnings for the last quarter are 5.32 INR per share, whereas the estimation was 5.39 INR resulting in a −1.30% surprise. The estimated earnings for the next quarter are 7.44 INR per share. See more details about NTPC Limited earnings.

NTPC Limited revenue for the last quarter amounts to 453.71 B INR, despite the estimated figure of 457.75 B INR. In the next quarter, revenue is expected to reach 574.47 B INR.

NTPC net income for the last quarter is 54.89 B INR, while the quarter before that showed 50.67 B INR of net income which accounts for 8.33% change. Track more NTPC Limited financial stats to get the full picture.

NTPC Limited dividend yield was 2.33% in 2024, and payout ratio reached 34.57%. The year before the numbers were 2.31% and 36.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 142.92 K employees. See our rating of the largest employees — is NTPC Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NTPC Limited EBITDA is 547.19 B INR, and current EBITDA margin is 29.35%. See more stats in NTPC Limited financial statements.

Like other stocks, NTPC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NTPC Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NTPC Limited technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NTPC Limited stock shows the strong buy signal. See more of NTPC Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.