PIDILITIND – Support Zone ReactionPIDILITIND – Support Zone Reaction

Price is currently testing a well-established support zone, with signs of stabilization emerging. Recent candles reflect buyer defense and potential base formation. If momentum sustains, this zone could act as a springboard for a swing continuation. Risk remains defined as long as the structure holds.

Will exit within 14 days.

Trade ideas

Buy set up I Consider the Current pattern is oversold or deeply draw down by price in short period of

time , Any close above 3 day close will give sign of reversal

ideally you can Use 3 Line Brake in case You need an stable entry in Speculation of equity or Derivative

This is education content

Good luck

Pidilite Industries (Daily Timeframe) - Potential BreakOut??Pidilite, though with good earnings in the past quarter has not been able to BreakOut of the support turned resistance zone. Few attempts has been made but none of them were successful. The recent past, the stock has been making Equal Highs and Higher Lows. Volume has been decent though. Short-term EMAs are in Positive Cross-Over state.

On upside, the target may be around 3234 & on downside it may go upto 3027.

Monitor the price action in the coming days.

Pidilite Industries Ltd. 4 Hour View While most platforms don’t explicitly publish 4-hour support/resistance levels, we can gather actionable insights from intraday pivot data and community analysis reflecting this timeframe.

Intraday Pivot & Intra-Day Levels

Intraday support levels: ₹3,028.27 and ₹3,006.23

Intraday resistance levels: ₹3,071.17 and ₹3,092.03

Important short-term S/R: Support around ₹3,026.92–₹3,010.53, Resistance at ₹3,073.68–₹3,132.97

These constitute solid reference points for trades over multi-hour windows.

Price Action & Chart Patterns

A trading idea on TradingView highlights a Head & Shoulders formation on the 4-hour chart, with the ₹3,000 round level acting as a potential support (neckline). The suggestion: watch for a breakdown below the neckline followed by a candle-close and retest before considering long trades. If the price rejects again from ₹3,000, that could be a bullish setup.

Quick Summary for 4-Hour Trading

Feature Details

Support Zone ₹3,006–₹3,028 (intraday anchors) and psychological ₹3,000 level

Resistance Zone ₹3,071–₹3,092 and broader zone up to ₹3,130

Pattern Insight 4-hour Head & Shoulders suggests bearish risk if breakdown occurs

Suggested Approach

Watch ₹3,000 closely.

If it holds and price rejects downward moves, look for long setups.

If it breaks decisively with confirmation (e.g., candle close), it may signal further decline—be cautious.

Use intraday pivot levels to anticipate moves.

Support near ₹3,006–₹3,028 can provide entry opportunities for rebounds.

Resistance near ₹3,071–₹3,092 acts as supply zones to monitor for pullbacks or breakout attempts.

Combine with other indicators such as volume, RSI, MACD, or trend filters for stronger signal confirmation.

[Positional] Pidilite Buy Idea Note -

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells at "where" to act in "what direction. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

=======

I use shorthands for my trades.

"Positional" - means You can carry these positions and I do not see sharp volatility ahead. (I tally upcoming events and many small kinds of stuff to my own tiny capacity.)

"Intraday" -means You must close this position at any cost by the end of the day.

"Theta" , "Bounce" , "3BB" or "Entropy" - My own systems.

=======

I won't personally follow any rules. If I "think" (It is never gut feel. It is always some reason.) the trade is wrong, I may take reverse trade. I may carry forward an intraday position. What is meant here - You shouldn't follow me because I may miss updating. You should follow the system I share.

=======

Like -

Always follow a stop loss.

In the case of Intraday trades, it is mostly the "Day's High".

In the case of Positional trades, it is mostly the previous swings.

I do not use Stop Loss most of the time. But I manage my risk with options as I do most of the trades using derivatives

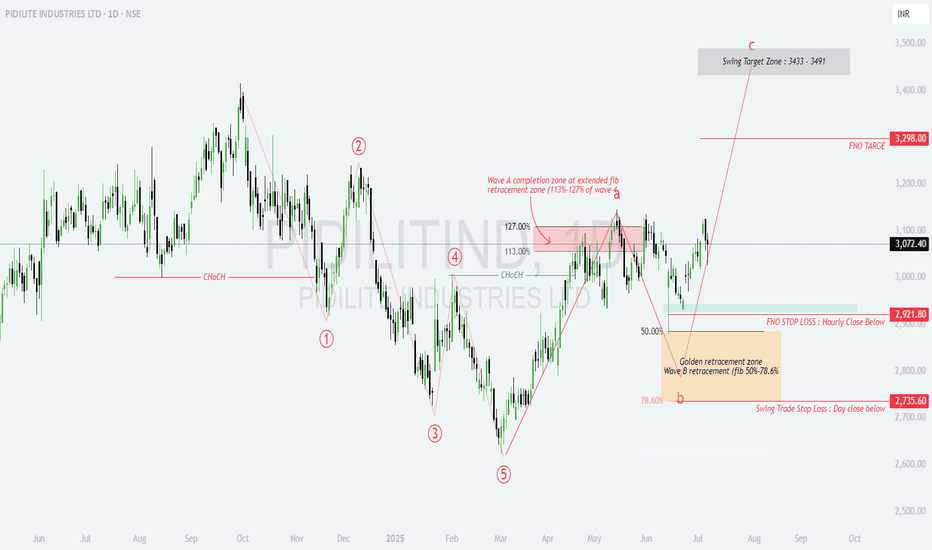

Hidden in Plain Sight – This PIDILITE Setup Screams Opportunity!📊 PIDILITE – Post 5-Wave Fall, ABC Recovery In Progress

Golden Fib confluence + strong structure = high-confidence swing setup

Wave structure aligns with ideal retracements; Wave C potential unfolding with swing targets ahead.

🧩 Elliott Wave Breakdown:

Complete 5-wave decline from swing highs → Wave 5 bottom confirmed

Wave A completed at extended fib zone (113%–127% of wave a)

Wave B retraced to Golden Zone: 50%–78.6% of Wave A

Wave C now progressing toward swing target zone

🔍 Technical Confluences:

Wave A Completion: ₹3130–₹3180 (113–127% extension)

Wave B Golden Zone: ₹2735–₹2921

Strong bullish rejection and follow-through from Wave B lows

CHoCH break confirms trend reversal from Wave 5 low

🎯 Target Zone for Wave C:

Primary Swing Target: ₹3433–₹3491

FNO Upside Level: ₹3298

🛑 Stop-Loss Levels:

Intraday SL: Hourly close below ₹2921.80

Positional SL: Day close below ₹2735.60

📈 Setup Summary:

Clear ABC corrective recovery in play

Ideal Fib alignment at both Wave A and B

Structure favors low-risk, high-reward long opportunity

Entry near ₹3070–3080 offers excellent positioning

A technically sound swing setup with defined structure and reward zones – great candidate for Wave C riders.

#Pidilite #ElliottWave #SwingSetup #WaveTheory #Nifty200 #TradingViewIndia

Pidilite Industries

PIDILITE Industries is forming a Head and shoulders pattern on 4 Hour Time frame, although the chart is looking bullish and the price is also at a round number

support i.e., 3000, but as this indication is on 4 hour we cannot ignore it.

We will wait for the price to breakdown and let the first 30 min candle close below the neckline and do a retest or give us some confirmation candles.

We will also keep a eye, how price is rejecting from 3000 if it gives us some concrete confluences we will looking for long trades only, trend priority

Pidilite Industries Ltd: Building Momentum Towards New Highs📊 Technical Analysis

Pidilite Industries, a dominant player in the adhesives and sealants market, has exhibited a consistent bullish trend over the past two decades, characterized by a pattern of higher highs and higher lows.

All-Time High Resistance: In September 2024, the stock created an all-time high of ₹3,415. Since then, it has faced resistance at this level.

Recent Correction and Support: Amidst a broader market correction starting in September 2024, Pidilite's stock retraced, forming a higher low around ₹2,650.

Positive Momentum: Following robust Q3 FY24 results, the stock has shown appreciation, forming a new higher low, indicating renewed bullish momentum.

Target Levels:

🎯 ₹3,200

🎯 ₹3,300

🎯 ₹3,415 (previous all-time high)

Stop-Loss: A prudent stop-loss can be placed at the recent higher low of ₹2,615.

🔍 Fundamental Analysis:

Pidilite Industries has delivered steady performance in Q3 FY24, reflecting its strong market positioning and resilient business model.

📌 Q3 FY24 Key Financial Highlights:

Total Income: ₹3,369 Cr (vs ₹3,235 Cr in Q2 FY24 and ₹3,130 Cr in Q3 FY23)

Total Expenses: ₹2,571 Cr (vs ₹2,467 Cr in Q2 FY24 and ₹2,388 Cr in Q3 FY23)

Total Operating Profits: ₹798 Cr (vs ₹768 Cr in Q2 FY24 and ₹742 Cr in Q3 FY23)

Profit Before Tax: ₹752 Cr (vs ₹725 Cr in Q2 FY24 and ₹687 Cr in Q3 FY23)

Profit After Tax: ₹557 Cr (vs ₹540 Cr in Q2 FY24 and ₹511 Cr in Q3 FY23)

Diluted Normalized EPS: ₹10.86 (vs ₹10.51 in Q2 FY24 and ₹10.04 in Q3 FY23)

Pidilite has consistently improved its earnings, driven by better volume growth and stable input costs. The Q3 performance reaffirms investor confidence and underlines the company's operational strength and profitability.

📈 Recent Performance Drivers

Volume Growth: The company reported a 9.7% underlying volume growth across categories and geographies, with the B2B segment showing strong momentum.

Margin Improvement: Gross margins improved by 100 basis points year-on-year, primarily due to benign input prices.

Operational Efficiency: The company commissioned additional manufacturing facilities, enhancing its production capabilities and distribution network.

📌 Conclusion

Pidilite Industries continues to demonstrate strong technical and fundamental performance. The formation of higher lows and the recent uptrend suggest potential for the stock to retest and possibly surpass its previous all-time high. Investors may consider monitoring the stock for a breakout above ₹3,415, with appropriate risk management strategies in place.

Disclaimer: lnkd.in

Pidilite Industries Ltd: Building Momentum Towards New Highs📊 Technical Analysis

Pidilite Industries, a dominant player in the adhesives and sealants market, has exhibited a consistent bullish trend over the past two decades, characterized by a pattern of higher highs and higher lows.

All-Time High Resistance: In September 2024, the stock created an all-time high of ₹3,415. Since then, it has faced resistance at this level.

Recent Correction and Support: Amidst a broader market correction starting in September 2024, Pidilite's stock retraced, forming a higher low around ₹2,650.

Positive Momentum: Following robust Q3 FY24 results, the stock has shown appreciation, forming a new higher low, indicating renewed bullish momentum.

Target Levels:

🎯 ₹3,200

🎯 ₹3,300

🎯 ₹3,415 (previous all-time high)

Stop-Loss: A prudent stop-loss can be placed at the recent higher low of ₹2,615.

🔍 Fundamental Analysis:

Pidilite Industries has delivered steady performance in Q3 FY24, reflecting its strong market positioning and resilient business model.

📌 Q3 FY24 Key Financial Highlights:

Total Income: ₹3,369 Cr (vs ₹3,235 Cr in Q2 FY24 and ₹3,130 Cr in Q3 FY23)

Total Expenses: ₹2,571 Cr (vs ₹2,467 Cr in Q2 FY24 and ₹2,388 Cr in Q3 FY23)

Total Operating Profits: ₹798 Cr (vs ₹768 Cr in Q2 FY24 and ₹742 Cr in Q3 FY23)

Profit Before Tax: ₹752 Cr (vs ₹725 Cr in Q2 FY24 and ₹687 Cr in Q3 FY23)

Profit After Tax: ₹557 Cr (vs ₹540 Cr in Q2 FY24 and ₹511 Cr in Q3 FY23)

Diluted Normalized EPS: ₹10.86 (vs ₹10.51 in Q2 FY24 and ₹10.04 in Q3 FY23)

Pidilite has consistently improved its earnings, driven by better volume growth and stable input costs. The Q3 performance reaffirms investor confidence and underlines the company's operational strength and profitability.

📈 Recent Performance Drivers

Volume Growth: The company reported a 9.7% underlying volume growth across categories and geographies, with the B2B segment showing strong momentum.

Margin Improvement: Gross margins improved by 100 basis points year-on-year, primarily due to benign input prices.

Operational Efficiency: The company commissioned additional manufacturing facilities, enhancing its production capabilities and distribution network.

📌 Conclusion

Pidilite Industries continues to demonstrate strong technical and fundamental performance. The formation of higher lows and the recent uptrend suggest potential for the stock to retest and possibly surpass its previous all-time high. Investors may consider monitoring the stock for a breakout above ₹3,415, with appropriate risk management strategies in place.

📜 Disclaimer

This report is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any stock. Please consult your financial advisor before making any investment decisions. Trading and investing in the stock market involve risk.

Pidilite Industries LtdDate : 05.03.2025

Pidilite

Timeframe : Weekly

Grab Grab Grab !!

RSI + Channel

Keep weekly candle low as stoploss

Some Important Highlights

Company is almost debt free.

Company has been maintaining a healthy dividend payout of 44.4%

Company's working capital requirements have reduced from 41.8 days to 24.3 days

Stock is trading at 15.7 times its book value

Stock P/E 68.8

ROCE 29.74%

OPM 22.88%

Profit growth 17.06%

Sales growth 6%

Sales Qtr Rs 3368 Cr

PAT 12M Rs 2003 Cr

Qtr Sales Var 7.36%

EPS 12M Rs 38.43

Regards,

Ankur

PIDILITIND Trading Within Demand Zone PIDILITIND is currently trading at ₹2,657.9, within the demand zone ranging from ₹2,682 (baseHigh) to ₹2,642 (baseLow), identified on 16th February 2024. This zone may serve as a support level, potentially influencing future price action. Investors may watch for signs of demand strengthening at this level.

*Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please perform your own due diligence or consult a financial advisor before making any investment or trading decisions.*

PIDILITIND 1HRSWING TRADE

- EARN WITH ME DAILY 10K-20K –

PIDILITIND Looking good for Downside..

When it break level 2749 and sustain.. it will go Downside...

SELL @ 2749

Target

1st 2735

2nd 2721

FNO

PIDILITIND FEB FUT – LOT 8 (Qty-2000)

PIDILITIND FEB 2840 PE – LOT 8 (Qty-2000)

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

Pidilite Industries - Descending TriangleThe descending triangle chart pattern in Pidilite Industries Ltd. suggests a potential bearish trend. It forms with a horizontal support level and a downward-sloping resistance line. As price consolidates, if breakdown below the support may signal a further decline, indicating possible weakness in the stock. Traders often watch for a breakout confirmation.

Descending Triangle 60% continuation and 40% reversal.

PIDILITE INDUSTRIES LIMITED (EDUCATIONAL PURPOSE ONLY,)There is no guarantee in Stock market and Nothing over week.

STOCK TO STUDY (EDUCATIONAL PURPOSE ONLY, NOT BUY OE SELL RECOMMENDATIONS)

PIDILITE INDUSTRIES LIMITED

TARGET RS 3530

CMP RS 3363.45

ENTRY RANGE RS 3330-3395

STOP LOSS RS 3215

Disclaimer: I am not Sebi Registered.

PIDILITIND: Bullish Breakout Potential with Technical StrengthPIDILITIND has been testing its resistance zone for over three months, demonstrating resilience and a strong uptrend across all time frames—daily, weekly, monthly, and yearly. Today, the stock has formed a classic Morning Doji Star pattern right at the breakout zone, which is a significant bullish signal. This pattern is further confirmed by good trading volumes.

Additionally, I observed a positive crossover between the 9-day EMA and the 20-day EMA, suggesting increased bullish momentum in the short term. With the current market conditions and technical indicators aligning, PIDILITIND is poised for potential gains in the near future.