Part 6 Learn Institutional Trading Black-Scholes Model

A widely used formula to calculate option prices using:

Stock price

Strike price

Time to expiry

Volatility

Risk-free interest rate

Greeks

Delta: Measures sensitivity of option price to underlying price changes.

Gamma: Measures delta’s rate of change.

Theta: Measures tim

Related futures

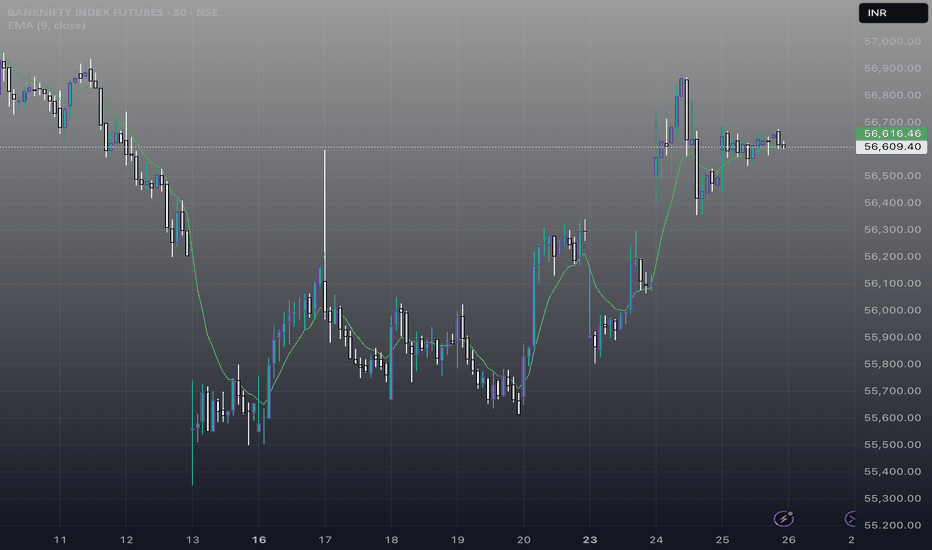

Bank nifty Futures- Consolidation ankNifty Futures (Index) daily

Technical analysis + sector (banking industry) fundamental overview + a learning summary for students.

Technical Analysis (Daily Chart) Candlestick & Chart Pattern👉

Recent candles show selling pressure after the peak near 57,800 (upper trendline rejection).

Curren

BANKNIFTY :-Smart traders are watching closely..Are you ?💡 Smart traders are watching closely… Are you?

🚀 **BankNifty Futures Update** 🚀

📊 **Support Zone:** 53,950 – 54,275

💹 **CMP:** 55,071

📈 After forming a bullish pattern near this zone, BankNifty could rally **+2,000 to +3,000 points**!

🔍 Current Market Scenario:

BankNifty Futures is currently tradi

Learn Institutional Option Trading Part-6Mutual Funds in India:

Mutual funds pool money from multiple investors and invest in a diversified portfolio.

Types:

Equity Mutual Funds

Debt Mutual Funds

Hybrid Funds

Index Funds & ETFs

Systematic Investment Plan (SIP) is a popular method to invest monthly with discipline.

Government Scheme

DAILY TIMEFRAME BANKNIFTY A triangle breakout is a key technical pattern in trading that signals a potential continuation or reversal of a trend. It occurs when price action breaks out of a triangle formation, which can be ascending, descending, or symmetrical.

- Ascending Triangle: Bullish pattern where price breaks above r

Banknifty 2025-2026 (Expected level)Banknifty. (Only for Experienced traders" )

Enter after " Breakout and Retracement ".

Leave a " Like If you agree ".✌.

Follow for regular updates 👍

.

For " long "

entry: 56000 / 56500

target: 60000- 62350

stoploss: 54800

Enter only if market Breaks

"Yellow box" mentioned.

.

.

For " Short"

entry:

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of GIFT NIFTY BANK INDEX FUTURES is 54,278 USD — it has risen 0.06% in the past 24 hours. Watch GIFT NIFTY BANK INDEX FUTURES price in more detail on the chart.

Track more important stats on the GIFT NIFTY BANK INDEX FUTURES chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For GIFT NIFTY BANK INDEX FUTURES this number is 150.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for GIFT NIFTY BANK INDEX FUTURES shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for GIFT NIFTY BANK INDEX FUTURES. Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of GIFT NIFTY BANK INDEX FUTURES technicals for a more comprehensive analysis.