Part 6 Learn Institutional Trading Black-Scholes Model

A widely used formula to calculate option prices using:

Stock price

Strike price

Time to expiry

Volatility

Risk-free interest rate

Greeks

Delta: Measures sensitivity of option price to underlying price changes.

Gamma: Measures delta’s rate of change.

Theta: Measures time decay of option.

Vega: Measures sensitivity to volatility.

Rho: Measures sensitivity to interest rates.

Understanding Greeks is critical for managing risk and strategy adjustments.

BANKNIFTY1! trade ideas

Bank nifty Futures- Consolidation ankNifty Futures (Index) daily

Technical analysis + sector (banking industry) fundamental overview + a learning summary for students.

Technical Analysis (Daily Chart) Candlestick & Chart Pattern👉

Recent candles show selling pressure after the peak near 57,800 (upper trendline rejection).

Current candles look like lower highs + lower lows = possible descending channel formation.

The long wicks at support zones indicate buyers are defending near 52,800- 53,000.

Swing Analysis

Major swing high: 57,850

Swing low: 47,750

Retracement happening between 0.382 (53,992) and 0.236 (55,466) Fibonacci levels.

Pattern in Progress

Falling Wedge / Descending Channel forming- often bullish if breakout happens above resistance trendline.

👉If price breaks below 52,800, then deeper correction possible.

Key Levels

-Support

52,800 - 53,000 (critical Fib support)

50,400 - 50,500 (strong demand zone)

48,500 (swing support)

-Resistance

55,000 - 55,500 (Fib cluster + recent rejection)

57,800 (swing high, big breakout point)

60,000 psychological level

Entry Points-

For Long (Investors/Positional)

-Enter near 52,800- 53,000 with SL below 52,500.

Add more if it breaks and sustains above 55,500.

-For Short (Traders):

Below 52,800, short with target 50,400 - 48,500.

Keep SL near 53,600.

Industry Analysis (Banking Sector)

Indian banks are in a strong credit growth cycle (loan demand high, NPA ratios declining).

-RBI’s monetary policy easing in future may improve margins further.

-PSU Banks are gaining strength, but private banks (HDFC, ICICI, Kotak) still dominate.

-Key Fundamental Ratios (Peer Banks)

-ICICI Bank: RoE - 16%, NIM - 4.5%, GNPA <2%

-HDFC Bank: RoE - 15%, NIM - 4.1%, GNPA - 1.5%

-SBI: RoE - 14%, NIM - 3.6%, GNPA - 2.5%

👉 Overall, sector health is positive, but valuation of large banks is already at premium.

-Student Learnings

1. Chart Patterns:

Descending channel/falling wedge = watch for breakouts.

2. Candlestick Wicks:

Long lower shadows = hidden buying.

3. Swing + Fibonacci:

Key tool to identify retracement zones.

4. Support & Resistance:

Always mark levels - entry becomes safer.

5. Fundamentals in Sector Indices:

Index = basket - study sector & top-weight banks, not single balance sheet.

⚠️ Disclaimer

This analysis is for educational purposes only. It is not financial advice. Trading in derivatives (like BankNifty Futures) is highly risky and may lead to capital loss. Please consult your financial advisor before investing.

Follow👣 for more🚩

#BankNifty #StockMarketIndia #TechnicalAnalysis #CandlestickPatterns #SwingTrading #SupportAndResistance #InvestingBasics #BankingSector #StockMarketEducation #FinanceStudents #MarketAnalysis

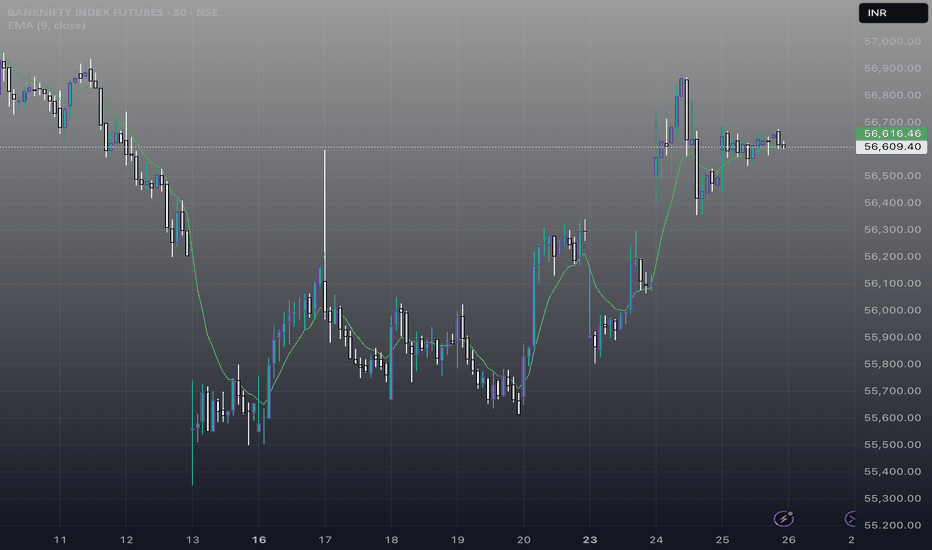

BANKNIFTY :-Smart traders are watching closely..Are you ?💡 Smart traders are watching closely… Are you?

🚀 **BankNifty Futures Update** 🚀

📊 **Support Zone:** 53,950 – 54,275

💹 **CMP:** 55,071

📈 After forming a bullish pattern near this zone, BankNifty could rally **+2,000 to +3,000 points**!

🔍 Current Market Scenario:

BankNifty Futures is currently trading at CMP 55,071. Over the last few sessions, the index has witnessed consistent selling pressure, but a crucial support zone has now emerged between 53,950 – 54,275. Historically, this zone has triggered strong buying interest and initiated significant reversals.

📊 Technical Observation:

📌 Support Zone: 53,950 – 54,275

📌 CMP: 55,071

📌 Price Action: A bullish reversal pattern (such as a double bottom or bullish engulfing) forming near this zone could trigger a strong upside rally.

📌 Upside Potential: 2,000 – 10,000 points (stage-wise target).

📈 Trading Strategy:

If price tests the support zone and forms a bullish pattern, traders may consider initiating long positions.

Initial target ~ 56500,000, extended target ~ 57,500+.

Maintain a stop-loss below the support zone to manage risk effectively.

💡 Market Psychology Insight:

Currently, sentiment in the financial sector is cautious but prepared. If institutional buying emerges around the support zone, short covering could accelerate, triggering a sharp upward movement.

⚠️ Disclaimer: This analysis is for educational purposes only. Please do your own research and manage risk before trading.

📆 Stay alert, plan your entries, and ride the wave! 🌊

Learn Institutional Option Trading Part-6Mutual Funds in India:

Mutual funds pool money from multiple investors and invest in a diversified portfolio.

Types:

Equity Mutual Funds

Debt Mutual Funds

Hybrid Funds

Index Funds & ETFs

Systematic Investment Plan (SIP) is a popular method to invest monthly with discipline.

Government Schemes:

PPF (Public Provident Fund)

NSC (National Savings Certificate)

EPF (Employees Provident Fund)

These are safe, tax-efficient, and suitable for conservative investors.

DAILY TIMEFRAME BANKNIFTY A triangle breakout is a key technical pattern in trading that signals a potential continuation or reversal of a trend. It occurs when price action breaks out of a triangle formation, which can be ascending, descending, or symmetrical.

- Ascending Triangle: Bullish pattern where price breaks above resistance.

- Descending Triangle: Bearish pattern where price breaks below support.

- Symmetrical Triangle: Neutral pattern where price can break in either direction.

Traders often look for high volume confirmation to validate the breakout and set targets based on the triangle's height. False breakouts can occur, so risk management is crucial.

Banknifty 2025-2026 (Expected level)Banknifty. (Only for Experienced traders" )

Enter after " Breakout and Retracement ".

Leave a " Like If you agree ".✌.

Follow for regular updates 👍

.

For " long "

entry: 56000 / 56500

target: 60000- 62350

stoploss: 54800

Enter only if market Breaks

"Yellow box" mentioned.

.

.

For " Short"

entry: 54000

target:51000- 49500

stoploss: 54600

Enter only if market Breaks

"Yellow box" mentioned.

.

Wait for proper reversal and conformation.

.

Don't make complicated trade set-up.📈📉

Keep it " Simple, Focus on Consistency "💹.

Refer our old ideas for accuracy rate🧑💻.

Valuable comments are welcomed-✌️

.

.

Disclaimer:

Our Trading style is not to capture "10-20" points per trade.📊

We take entry only for min "200-300" points without any distractions.💹

So, our ideas may not be preferable for small traders, who just focusing on too much of support and resistance.📈📉📈

So, please consider others ideas.

This is for educational purposes.🧑💻

BankNifty Set for All-Time High in Late May 2025:Exercise CautioThe Bank Nifty index is poised for a potential all-time high (ATH) in the fourth week of May 2025, possibly surpassing its previous peak of 56,200. This bullish momentum is supported by recent technical indicators, such as a golden crossover (50-day EMA crossing above 200-day EMA) and a breakout from long trendlines, signaling strong upside potential. Positive sentiment is driven by factors like improved credit growth, falling bond yields, and robust quarterly earnings from major banks, with institutional buying (FIIs and DIIs) adding strength to the rally.

However, caution is warranted. The index is trading near overbought levels, with key indicators suggesting a possible temporary pullback or consolidation. A sharp decline, similar to the one seen in June 2024, is a risk, potentially driving the index toward 51,385, with support at 50,600. A gap around these levels may be filled, offering temporary support, but a break below could see the index test 48,049. There are warning of a potential 50% crash, citing historical patterns where ATHs preceded major corrections.

Key Levels to Watch:

Resistance: 55,939–56,300 (near ATH).

Support: 54,771, 50,600, 48,049.

Risk: Overbought conditions and historical crash patterns.

Traders should remain vigilant, using dips as buying opportunities but setting stop-losses to manage downside risks. Always consult professional advice before trading, as market movements are subject to high volatility

Bank nifty Futures 28.04.25I would expect a gap down opening. however, incase not gap down I would still prefer to sell on rise. For this important locations/ absorption/ trap of buyers would be seen. In case I do not find things going as planed I will prefer to stay out. Bearishness is still predominant.

Banknifty day chart formation Banknifty makes double bottom on day chalso the breakout done after neck line testing or respecting 20 Ema again banknifty gives good move in upside so bottom is @ 47900 & neckline is @ 50900 so almost 3000 pts upmove comes from breakout .....it's my view . Decision is your . Enjoy trading .