Trade ideas

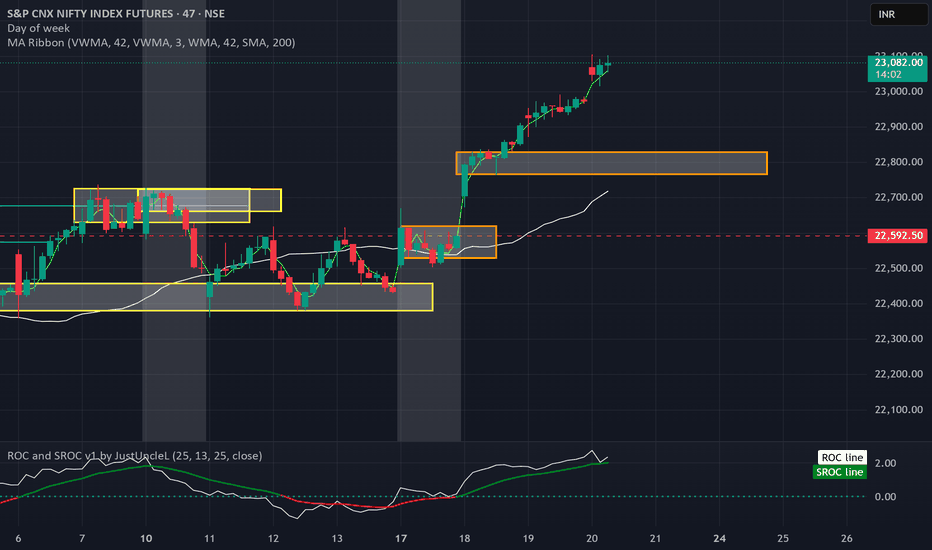

Nifty as predicted 500 point rally In my previous post I posted a prediction on 4H Chart as to how Nifty will get direction.

It was exactly in similar manner with 500 points move in Gift Nifty. I will call it a Triangle Breakout to upside. It was also coming on Perfect Setup Rule. Anyway, if logically a 500 points rally prediction comes true in this highly uncertain scenario, it is a great reliance only on Perfect SetupRules which always give right direction if we are not carried away by EMOTIONS.

Nifty ShortLets take risk of minor 60 points in nifty

Entry- 22830-22840

SL- 22900

Target- 22700 and Can book around according to your risk profil.

Reason- Gap filled RSI overbought in 15 min tf at 90 levels. Previous support which was 22800 may act a resistance now.

Disclaimer- This is just for educational purpose.

Jai Shree Ram

Gift nifty trying to break resistance 22830 to 22850 next TargetHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Can GIFT NIFTY50 will break 22700?Disclaimer:

This is not financial advice. Consult your financial advisor before making any decisions.

We have a strong resistance at 22700, and once it break that level, then next resistance is at 23000-23100 which is a 61.8 fib ratio of recent swing.

With the downside, 22400 will act as a good support for now.

Level for 10 Mar 2025On Friday, I noticed a bunch of buyers, trying hard to take nifty up, key levels I marked for monday are 22720 and 22600 in Nifty Future. So above 22720, I will look for buy, below 22600 I will look only for sell and in between a ping pong but still I will have a buying bias based on live OFA in 22720-22600.

On the contrary, right at opening, I will look for a Sell trade for some points as I believe, market will play a dirty game at start, also I will stop trading once I earn a respectable figure.

Disclaimer: Don't trade with real money, and if things work out, it's probably just luck. I don't have any formal expertise of this topic and am currently learning by studying errors. I myself doing paper trading only.

what if a prolonged bear market ?as not in anywhere in history?As this is the peculiar case ,assuming that the valuations have been high and mad tariff war may extend , there is a meagre chance of prolonged bear market .

Mass liquidity is the reason behind euphoria market rally from 17000 to 26000 in nifty.

A worst case scenario, may take the bear market to sustain to another 5 year, w.r.t to tariff war and the consequential geopolitical tensions.

Believe this should not happen.

Thanks

Gift nifty operator Played game made bottom Target 22500,22730 How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking 2nd D 21.4%

Targets :

Target T1 : 28.3% ( early trade if entry at 11.4% )

Target T1 : 35.1% to 38.2%

Target T3 : 49.1% to 53.2%

T3: 61.8% to 65.1% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point D ( 0% ) .

Target is same as early 21.4% , 28.3 , 35.1 and so on

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Strong support zone 21500, bounch back expectedAs per weekly chart set up of Nifty 50, it is observed that a bounch back likely to come for a short term duration. Investor can start investing into mutual fund, ETFs in SIP mode, do not gamble in the market, as this is the perfect time to buy stocks or continue the SIP in the Mutual Funds. Healthy correction is always good for the market. As on date 13 % market has fallen from its all time high, no one catch the bottom, so start investing into Flexi cap funds, multicap funds or Large and Midcap funds to take advantage of correction, market will move back in next year to give you healthy returns, Do not trade into options and futures. Invest for your loved ones. Happy investing.

Nifty Futures : Finding Real Bottom Date 28.02.2025

Nifty Futures

Weekly Chart

Based on Elliot wave concept

1 Since Wave 1 & Wave 3 both impulsive waves were extended waves therefore, Wave 4 retracement could be deeper.

2 Currently market is under wave 4 corrective phase of ABC which is 3 wave pattern, hence the yellow mark are wave 4 areas

3 Currently at 78.6% on retracement of Wave 4 which is immediate hope, below this on weekly basis lower levels highlighted will be active.

Regards,

ANKUR

option and database trading **SkyTradingZone** is your go-to source for educational content on trading, covering market insights, strategies, and in-depth analysis. Our goal is to empower traders and investors with knowledge to navigate the markets effectively.

---

# **Options Trading and Database Trading: A Complete Guide**

Options trading and database trading are two powerful approaches in the financial markets. While **options trading** involves trading derivatives based on stocks or indices, **database trading** uses structured data and quantitative analysis to make informed trading decisions. Let’s dive deep into both strategies and understand how they can help traders become profitable.

---

# **1️⃣ What is Options Trading?**

**Options trading** is a form of derivative trading where you buy or sell contracts that give you the right (but not the obligation) to buy or sell an asset at a specific price before a set expiry date.

## **Types of Options**

1️⃣ **Call Option** – Gives the right to BUY at a fixed price before expiry.

2️⃣ **Put Option** – Gives the right to SELL at a fixed price before expiry.

📌 **Key Concepts in Options Trading**

✅ **Strike Price** – The price at which you can buy/sell the asset.

✅ **Premium** – The cost of buying an option.

✅ **Expiry Date** – The last day the option contract is valid.

✅ **ITM (In-the-Money)** – The option has intrinsic value.

✅ **ATM (At-the-Money)** – The option price equals the current market price.

✅ **OTM (Out-of-the-Money)** – The option has no intrinsic value.

📌 **Why Trade Options?**

✅ **Leverage** – Small capital can control large positions.

✅ **Hedging** – Protects against losses in stock holdings.

✅ **Flexibility** – Trade in bullish, bearish, or sideways markets.

---

## **2️⃣ Best Strategies for Options Trading**

📍 **A) Buying Calls & Puts (Simple Directional Strategy)**

🔹 **Buy Call Option** – When expecting a stock to rise.

🔹 **Buy Put Option** – When expecting a stock to fall.

📍 **B) Option Selling (High Probability Strategy)**

🔹 **Sell Call Option** – When expecting a stock to stay below a level.

🔹 **Sell Put Option** – When expecting a stock to stay above a level.

📍 **C) Straddle & Strangle (Volatility-Based Strategy)**

🔹 **Straddle** – Buy both Call & Put at the same strike price (for big moves).

🔹 **Strangle** – Buy both Call & Put at different strike prices (cheaper but riskier).

📍 **D) Iron Condor (Risk-Defined Strategy)**

🔹 Sell an OTM Call and Put while buying a further OTM Call and Put to limit losses.

📌 **Pro Tip:** Always check **Open Interest (OI), Implied Volatility (IV), and PCR (Put-Call Ratio)** for strong option trading decisions.

---

# **3️⃣ What is Database Trading?**

**Database trading** refers to using **historical data, algorithms, and quantitative analysis** to execute trades. Instead of relying purely on price action or indicators, traders use **structured data sets** to find profitable trading patterns.

📌 **Key Elements of Database Trading:**

✅ **Backtesting** – Analyzing past market data to test strategies.

✅ **Quantitative Models** – Using algorithms to make trade decisions.

✅ **Big Data Analysis** – Processing large amounts of market information.

✅ **AI & Machine Learning** – Automating trade execution and prediction.

📌 **Why Use Database Trading?**

✅ Eliminates **emotions** from trading.

✅ Provides **high probability trade setups**.

✅ Allows traders to **automate strategies** for efficiency.

---

## **4️⃣ How to Become Profitable in Database Trading?**

📍 **A) Data Collection & Analysis**

🔹 Gather data from **TradingView, NSE/BSE, or Algo Trading platforms**.

🔹 Focus on **historical price movements, options chain data, and order flow**.

📍 **B) Develop Trading Models**

🔹 Use **Python, R, or Excel** for quantitative analysis.

🔹 Create **algorithms that detect price patterns, momentum shifts, or anomalies**.

📍 **C) Backtesting & Optimization**

🔹 Test your strategy on **past market data** before using real money.

🔹 Optimize using **Sharpe Ratio, Win Rate, and Drawdown metrics**.

📍 **D) Execute Trades with Automation**

🔹 Use **Algo Trading Platforms (e.g., Zerodha Streak, AlgoBulls, or Interactive Brokers API)**.

🔹 Set **entry, exit, and risk management rules** for automated execution.

📌 **Pro Tip:** Always validate your trading model with **real-time market data** before full-scale deployment!

---

# **5️⃣ Combining Options Trading with Database Trading**

📌 **How Database Trading Enhances Options Trading?**

✅ Detects **high-probability option trades using market data.**

✅ Identifies **unusual options activity (Smart Money moves).**

✅ Helps in **volatility forecasting (IV spikes, option skew analysis).**

📌 **Example Strategy:**

1️⃣ Use **Database Trading** to analyze **PCR (Put-Call Ratio), IV Crush, and OI changes**.

2️⃣ Identify **high probability trade setups**.

3️⃣ Trade **options strategies (Straddle, Iron Condor, etc.) based on the data-driven insights.**

---

## **Final Thoughts – The Power of Options & Database Trading**

🚀 **Options Trading** is great for leverage, flexibility, and risk management.

🚀 **Database Trading** helps traders make data-driven, systematic decisions.

📌 **To Become a Successful Trader:**

✅ Master **Options Greeks (Delta, Gamma, Theta, Vega).**

✅ Use **Database Trading to build strong backtested strategies.**

✅ Always manage **risk and avoid emotional trading.**

By combining **options strategies with database-driven analysis**, traders can **gain an edge in the markets and improve profitability**. 📈💰

---

🔹 **Disclaimer**: This content is for educational purposes only. *SkyTradingZone* is not SEBI registered and does not provide financial or investment advice. Please conduct your own research before making any trading decisions.

BUY NIFTY 22600 CE 6TH MAR @ 230 - 235 | NIFTY LONG TRADENIFTY 22600 CE 6TH MAR EXP

NIFTY OPTIONS BUYING TRADE

Hi Traders,

Nifty looks good to buy on dips and currently trading near support levels. We anticipate an upside movement from here and one can consider buying the 22600 CE (Call Option) with a 6th Mar 2025 expiry in the price range of 230 - 235.

Target levels: 340, 370

Stop Loss (SL): ₹210

Regards,

OptionsDaddy Research Team

Levels for 19 Feb 2025For 19 Feb 2025, I found Sellers at 23000 in Nifty Future, Buyers at level of 22905 and then 22810

So if price stays above 23000 then buy otherwise sell

if price stays below 22810 then sell otherwise buy

Above are opportunities to look upon and NOT trading guidance, I am NOT sebi registered advisor and don't have any formal knowledge of trading or investing.