NG1! trade ideas

MCX Natural Gas – Impulsive Wave SetupA new impulsive structure has emerged from the low of 265.5 in natural gas. Price has accomplished wave (5) and started the zigzag correction at 801.

Currently, Natural gas is forming sub-wave 5 of impulsive wave C. Natural gas has also broken down 200 EMA and the base channel of 2 – 4 wave, which signals bearish momentum. It has faced strong support of 515 , but the price didn’t respect the level and ended up losing bullish momentum.

Wave C has traveled the same distance as wave A. Hence, Wave A = Wave C. If the price sustains below 516, traders can trade for the following targets: 486 – 462 – 440 .

I will update further information soon.

#Natural gasNatural gas corrected from $9.2/MMBtu to $2.2/MMBtu.

The latest EIA report showed US utilities added 75 bcf of gas into storage last week, more than market expectations of a 69 bcf increase, as mild weather kept heating demand low

Technically, now Natural gas is forming narrow wedge with some diversions seen in RSI. Despite fundamentally it is negative, diversions on weekly charts shows Natural gas can touch $3.4/MMBtu by May

#Natural gas #Cup&HolderProduction continues to fluctuate in the high 90s Bcf/d to low 100s Bcf/d as pipeline maintenance events temporarily curb gas flows

Preliminary data showed gas output fell to a three-week low of 100.8 billion cubic feet per day on Thursday.

At the same time, gas demand is expected to increase from 91.3 bcfd this week to 91.6 bcfd next week as warmer weather is making more people turn on their air conditioners.

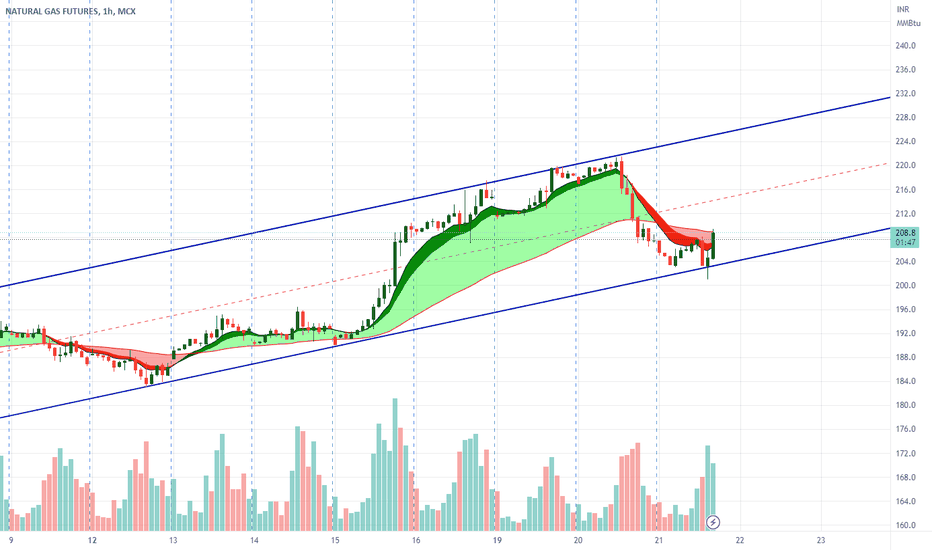

Technically

Forming Cup & Holder formation on Daily chart breaking above 194 can take NG to 220 levels

NATURALGASHi guys, In this chart i Drew My Best Levels in NATURALGAS for Long position using 15min Time frames.... I found a good level here. I Observed these Levels based on price action and Demand & Supply which is My Own Concept Called "PENDAM ZONES" ... Don't Take any trades based on this chart/Post...because this chart is for educational purpose only not for Buy or Sell Recommendation.. Thank Q

Naturalgas reversal zones 11-5-2023Note: Always try to find a good price action patterns or any candle stick patterns in marked zones in smaller timeframe to take entry with small stop loss. Or can take entry based on one 5 min candle close below or above the zone with SL previous candles high or low (*try to avoid big candles).

(Color code for Support & Resistance zones: Red - Sell, Green - Buy, Price once cross above resistance it is obvious it will work as support, vis versa price cross below support zone ). Please understand that market can break all the support and resistance anytime. If any doubt for take entry in price action patterns, please ask in comment box, i will try to help.

Disclaimer: Im not tip provider and this chart is not indented to take trade in my levels, It is shared here for learning purpose. Trading in this pattern is all your own risk. #NG, #Naturalgas

NATURAL GAS S/R ZINES FROM 278 TO 129MCX:NATURALGAS1! NATURAL GAS is at yearly to minthly buying / support zones, can commense major trend reversal on monthly, quarerly and yearly time frame, major s/r levels till 278 targets have been marked along with s/r level till 129 if doeas go downside.

respect the zones and trade only if you know how to trade the support/resistance areas effectively.

Natural gas reversal zones 29-3-2023Note: Always try to find a good price action patterns or any candle stick patterns in marked zones in smaller timeframe to take entry with small stop loss. Or can take entry based on one 5 min candle close below or above the zone with SL previous candles high or low (*try to avoid big candles).

(Color code for Support & Resistance zones: Red - Sell, Green - Buy, Price once cross above resistance it is obvious it will work as support, vis versa price cross below support zone ). Please understand that market can break all the support and resistance anytime. If any doubt for take entry in price action patterns, please ask in comment box, i will try to help.

Disclaimer: Im not tip provider and this chart is not indented to take trade in my levels, It is shared here for learning purpose. Trading in this pattern is all your own risk. #NG, #Naturalgas