Any idea where it is headed?KO (coca-cola) looks in wave 5 of its primary degree. We have concluded wave 4 near $ 21 in Apr 2009.

Now the wave 5th is in progression, lets see whether it follow the sequence.

The information provided in this analysis is for informational purposes only and should not be construed as financial

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.05 CHF

9.02 B CHF

38.59 B CHF

4.27 B

About Coca-Cola Company (The)

Sector

CEO

James Quincey

Headquarters

Atlanta

Website

Founded

1886

FIGI

BBG002H8LK10

The Coca-Cola Co is the nonalcoholic beverage company, which engages in the manufacture, market, and sale of non-alcoholic beverages which include sparkling soft drinks, water, enhanced water and sports drinks, juice, dairy and plant-based beverages, tea and coffee and energy drinks. Its brands include Coca-Cola, Diet Coke, Coca-Cola Zero, Fanta, Sprite, Minute Maid, Georgia, Powerade, Del Valle, Schweppes, Aquarius, Minute Maid Pulpy, Dasani, Simply, Glaceau Vitaminwater, Bonaqua, Gold Peak, Fuze Tea, Glaceau Smartwater, and Ice Dew. It operates through the following segments: Europe, Middle East and Africa, Latin America, North America, Asia Pacific, Bottling Investments and Global Ventures. The company was founded by Asa Griggs Candler in 1886 and is headquartered in Atlanta, GA.

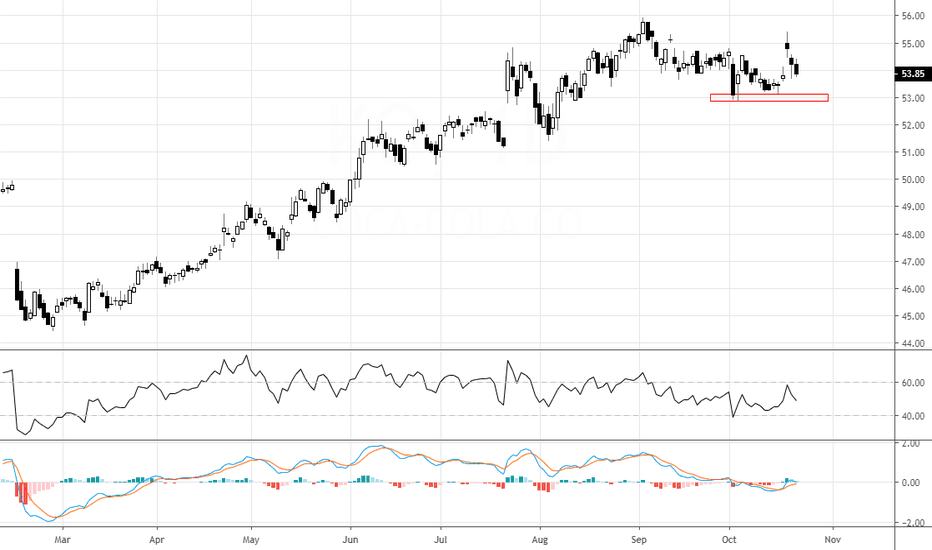

KO : Closed position at around breakevenClosed the position for a profit of about 1.79% on the invested capital. However, I consider this trade only as a breakeven trade.

I took the initial entry when it was technically undervalued. However, later, the market shifted into bear mode and the pattern evolved. I added to the position, increa

Concept of Pair Trading What is a Pair Trading ?

- Pair Trading is a market-neutral trading strategy that involves the simultaneous buying and selling of two correlated or related financial instruments.

- Traders identify two assets that historically move in tandem and take positions based on the expectation that the spre

COCO- COLA - Case Study - Only for Learning Purpose Already gCOCO- COLA - Case Study - Only for Learning Purpose

Already given sell signal on 16t-June 2021- the Bullish Channel is broken on 16th June with a bearish Marubozu

Technically it was weak in last week already given sell signal (shooting Star on weekly CHART)

Shorting levels - 54.5 -56$

Stop

Coca Cola may get bitter here!The stock is in a dominant trend up. Recently a lower high and lower low price pattern has been noticed on the daily charts. The RSI also seems to have shifted the range from bullish 80-40 zones to neutral 60-40 zones in the past few weeks. Important support levels are marked on the charts. Breaking

See all ideas

An aggregate view of professional's ratings.

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where KO is featured.

Frequently Asked Questions

The current price of KO is 49.63 CHF — it hasn't changed in the past 24 hours. Watch COCA-COLA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange COCA-COLA stocks are traded under the ticker KO.

We've gathered analysts' opinions on COCA-COLA future price: according to them, KO price has a max estimate of 73.71 CHF and a min estimate of 56.36 CHF. Watch KO chart and read a more detailed COCA-COLA stock forecast: see what analysts think of COCA-COLA and suggest that you do with its stocks.

KO stock is 0.00% volatile and has beta coefficient of 0.10. Track COCA-COLA stock price on the chart and check out the list of the most volatile stocks — is COCA-COLA there?

Today COCA-COLA has the market capitalization of 239.99 B, it has increased by 0.80% over the last week.

Yes, you can track COCA-COLA financials in yearly and quarterly reports right on TradingView.

COCA-COLA is going to release the next earnings report on Feb 18, 2025. Keep track of upcoming events with our Earnings Calendar.

KO earnings for the last quarter are 0.65 CHF per share, whereas the estimation was 0.63 CHF resulting in a 3.32% surprise. The estimated earnings for the next quarter are 0.46 CHF per share. See more details about COCA-COLA earnings.

COCA-COLA revenue for the last quarter amounts to 10.13 B CHF, despite the estimated figure of 9.84 B CHF. In the next quarter, revenue is expected to reach 9.47 B CHF.

KO net income for the last quarter is 2.41 B CHF, while the quarter before that showed 2.17 B CHF of net income which accounts for 11.34% change. Track more COCA-COLA financial stats to get the full picture.

Yes, KO dividends are paid quarterly. The last dividend per share was 0.41 CHF. As of today, Dividend Yield (TTM)% is 3.04%. Tracking COCA-COLA dividends might help you take more informed decisions.

COCA-COLA dividend yield was 3.12% in 2023, and payout ratio reached 74.52%. The year before the numbers were 2.77% and 80.23% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 21, 2024, the company has 79.10 K employees. See our rating of the largest employees — is COCA-COLA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. COCA-COLA EBITDA is 9.21 B CHF, and current EBITDA margin is 27.45%. See more stats in COCA-COLA financial statements.

Like other stocks, KO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade COCA-COLA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So COCA-COLA technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating COCA-COLA stock shows the buy signal. See more of COCA-COLA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.