DAILY FOREX SCAN Session – 24 04 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial

U.S. Dollar / Australian Dollar

No trades

Related currencies

AUDUSD – Sell From Weak High RejectionPrice swept the weak high at 0.6772 and immediately rejected, confirming a liquidity grab. Structure shifted bearish, and price is now pulling back toward premium levels for a potential continuation down.

🔍 Bias: Bearish

Entry: 0.67722

Stop Loss: 0.67873 (above sweep)

Take Profit:

TP1: 0.67634

Re

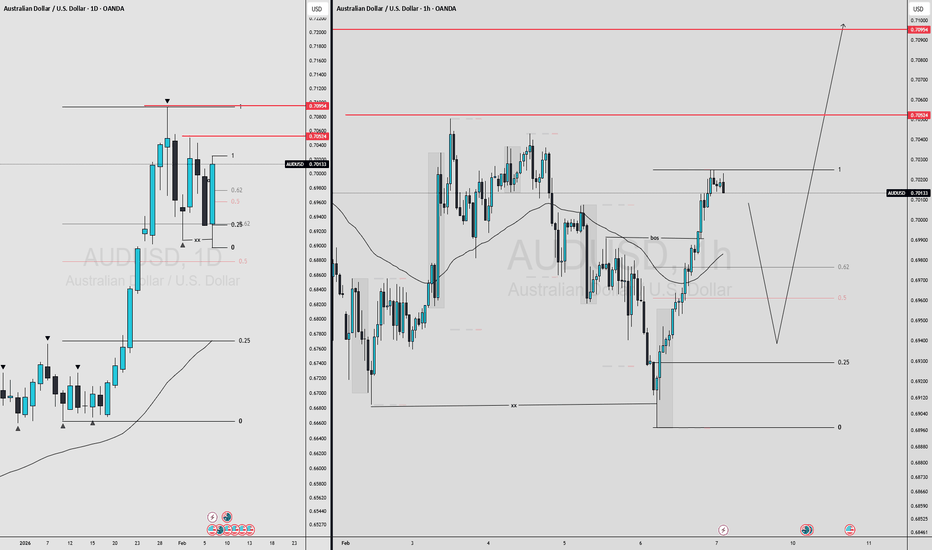

AUDUSD LONG SETUP — Bullish Reversal from DemandAUDUSD has tapped into a strong demand zone aligned perfectly with a long-term ascending trendline, showing signs of potential bullish reversal. Price swept the previous intraday liquidity and reacted strongly, indicating buyers are stepping in.

This confluence makes this area a high-probability lon

AUDUSD Buy Setup | Discount Zone Reaction + Trendline BreakBias: Bullish

Timeframe: 15M

Pair: AUDUSD

Market Structure & Context

AUDUSD has completed a corrective move within a descending channel after a strong impulsive rally. Price has now reached a higher-timeframe discount zone, aligning with a rising trendline support, where we see clear signs of sell

MACRO FX COMPARISON: DXY vs AUDUSDMACRO FX COMPARISON: DXY vs AUDUSD – WHAT STRUCTURAL CHANGE REALLY MATTERS

This is a structure-first, educational view comparing DXY and AUDUSD to understand the broader macro environment — and why most “USD reversal” narratives are premature.

No forecasts.

No trade calls.

Only structure.

🔹 DXY –

Bullish FVG Retracement With RSI & MACD📈 AUDUSD – Bullish FVG Retracement With RSI & MACD Momentum Confluence

This chart highlights a well-defined bullish structure on AUDUSD, characterized by a sequence of Higher Lows (HL) followed by a clean Higher High (HH). The latest impulsive leg upward created multiple Fair Value Gaps (FVGs), ea

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDAUD is 1.4152 AUD — it has decreased by −0.29% in the past 24 hours. See more of USDAUD rate dynamics on the detailed chart.

The value of the USDAUD pair is quoted as 1 USD per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDAUD has the volatility rating of 0.81%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDAUD showed a −1.07% fall over the past week, the month change is a −4.79% fall, and over the last year it has decreased by −11.06%. Track live rate changes on the USDAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

USDAUD is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDAUD technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDAUD shows the sell signal, and 1 month rating is sell. See more of USDAUD technicals for a more comprehensive analysis.