XAUUSD trade ideas

Gold’s Weekly Start: Price Gap Sparks Key Trading Opportunities📉 Daily Plan for XAUUSD: Gold Opens the Week with a Price Gap

🔍 Market Overview

As anticipated in last week's analysis, the market opened this Monday with a price gap (GAP) due to the strong selling pressure seen late last week. The gap spans approximately 5 points, with gold dropping from $2,770 to $2,764.9.

This movement aligns with previous views that gold has revisited its all-time high, where significant sell orders awaited, resulting in a dominant SELL momentum at this level. Confirmed reversal patterns are now visible on H4, H2, and H1 timeframes.

📊 Technical Insights

Current Price Range:

Gold is fluctuating between $2,773 and $2,756, forming a temporary range of about 17 points. This range is expected to hold during the Asian and European sessions unless disrupted by key market data later in the week.

Key Levels to Watch:

Resistance Zones:

$2,786 - $2,784 (Major Resistance)

$2,778 - $2,772 (Short-Term Resistance)

Support Zones:

$2,759 - $2,761 (Immediate Support)

$2,750 - $2,745 - $2,735 (Stronger Support Zones)

Market Behavior:

If price remains below $2,773, SELL momentum will likely dominate.

A breakout above this level will invalidate short-term sell strategies, prompting the need to wait for higher entries.

Sideways movement may persist due to lower liquidity during the Asian session.

💡 Trading Strategy Ideas

BUY ZONE: $2,746 - $2,744

Stop-Loss: $2,740

Take-Profit: $2,750 - $2,754 - $2,757 - $2,760

BUY SCALP: $2,759 - $2,757

Stop-Loss: $2,753

Take-Profit: $2,763 - $2,765 - $2,768 - $2,771

SELL ZONE: $2,784 - $2,786

Stop-Loss: $2,790

Take-Profit: $2,780 - $2,776 - $2,772 - $2,768 - $2,764

SELL SCALP: $2,772 - $2,774

Stop-Loss: $2,778

Take-Profit: $2,768 - $2,765 - $2,760 - $2,756 - $2,750

⚠️ Important Notes:

Market Liquidity: The Asian session lacks liquidity today, which could cause erratic price movements.

Risk Management: Always set Take-Profit (TP) and Stop-Loss (SL) levels to safeguard your account during volatile conditions.

📢 What’s Your Take?

Do you think gold will break below its current range or consolidate for a bigger move?

👉 Follow KevinNguyen-SimpleTrade for more in-depth market insights and daily trading plans! 🚀

Gold Hits Record Highs: Is a Reversal Looming?Gold Returns to All-Time High: Is a Major Correction on the Horizon?

🔍 Strong Reaction at Historical Highs

Gold has returned to its all-time high zone, and as it touched this level, prices have seen a significant reaction, dropping $20 to around $2,770.

On the H4 timeframe, candles show strong selling pressure at the highs, signaling a potential deeper correction. As the market opens next week (Monday), there is a high likelihood of a GAP (price gap) forming on smaller timeframes due to the current momentum.

📊 Technical and Fundamental Insights

Double Top Formation:

Gold shows signs of forming a Double Top pattern at its historical peak.

Combined with technical signals, this suggests a possible short-term corrective wave.

Crucial News from FED and Trump:

Next week, the market anticipates critical updates from the Federal Reserve (FED) regarding interest rate policies.

President Trump’s fiscal and monetary policy announcements could also drive significant volatility in gold prices.

Low Liquidity Conditions:

With many Asian nations entering their Lunar New Year holidays, market liquidity is expected to decline, potentially leading to heightened volatility.

🌟 Price Behavior Analysis

Based on insights from DXY, SWAP CHARGE, and FVG analyses:

DXY Weakness: While DXY's weakness supports gold, heavy selling pressure near the highs indicates a possible corrective phase.

SWAP CHARGE Shifts: The shift from buying to selling suggests that selling pressure is currently dominant, supporting the likelihood of a gold correction.

💡 Key Levels to Watch Next Week

Resistance:

$2,786 - $2,790: This is the previous all-time high and a critical resistance level. A breakout above this zone could trigger a stronger bullish trend.

Support:

$2,758 - $2,735 - $2,718 - $2,694: These are the major support zones to monitor in case of a deeper correction.

📢 Conclusion:

Given the current dynamics, gold appears poised for a potential correction after testing its all-time highs. This aligns with technical signals and fundamental developments. Traders should closely monitor key levels and upcoming announcements from the FED and President Trump to stay ahead of market movements.

👉 Follow KevinNguyen-SimpleTrade for more in-depth analysis and market updates! 🚀

Gold potential bearish scenarioWhen a double top or double bottom chart pattern appears, a trend reversal has begun.

Let’s learn how to identify these chart patterns and trade them.

Double Top

A double top is a reversal pattern that is formed after there is an extended move up.

The “tops” are peaks that are formed when the price hits a certain level that can’t be broken.

After hitting this level, the price will bounce off it slightly, but then return back to test the level again.

If the price bounces off of that level again, then you have a DOUBLE top!

the target would be 2300

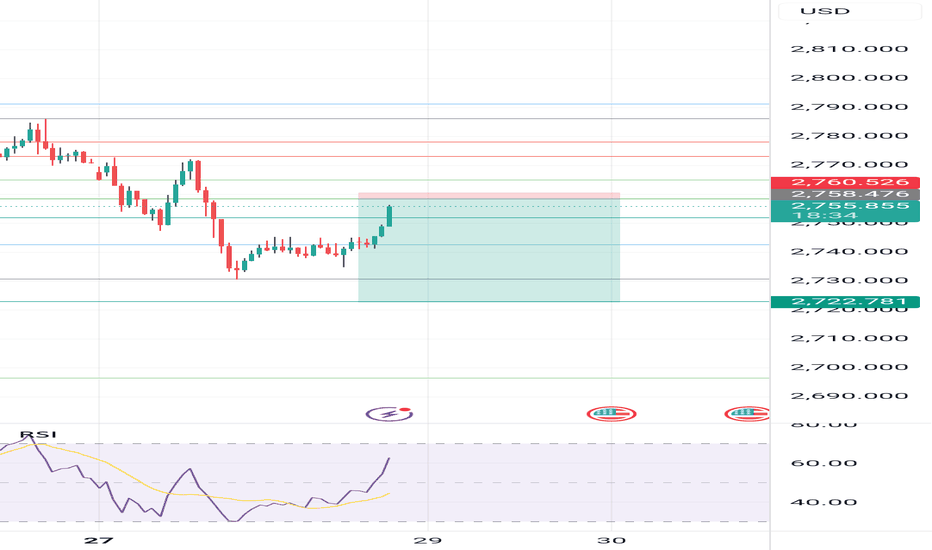

XAUUSD 1H SELL PROJECTION 23.01.24Reason for Sell

Looking at the year ahead and 2025 and it will no doubt be interesting. Geopolitical risk remains a threat with the Middle East still on edge and the Russia-Ukraine situation no closer to a resolution. Just yesterday there were rumors that a proposal by the incoming Trump administration to delay Ukraine joining NATO by 10 years will not be accepted by the Kremlin.

Anyone with knowledge of the situation there will know that this will not change as the main reason for the conflict (at least from a Russian perspective) is Ukraine joining NATO. These developments are likely to keep some geopolitical risk premium in play and keep safe haven demand going.

Global Central Banks were one of the main drivers of the Gold price rise in 2024. This is expected to continue in 2025. The World Gold Council survey revealed in the second half of 2024 that Central Banks are likely to purchase more Gold in the next 12 months. This should further bolster demand for the precious metal.

When it comes to risks affecting Gold prices moving forward, it does get challenging. The reason for this is the incoming Trump administration is expected to do good things for the economy but some policies could lead to higher interest rates. This could weigh on Gold prices.

This is a double-edged sword however, in that the increased risk of uncertainty from Trump policy and concern around the impact of tariffs could actually bolster the demand for safe haven assets and thus Gold.

All in all analysts are largely pricing in further gains for the precious metal in 2025, personally I do see the potential for upside as well. However, I would not rule out a deeper correction before price does actually breach the current ATH resting around the 2790 handle.

Uptrend Intact: Can Gold Break Through 2800?🌟"Uptrend Intact: Can Gold Break Through $2800? 🌟"

Gold is maintaining its bullish momentum, steadily forming higher highs and higher lows while respecting the upward trendline. The key support zone around 2705 (R1), backed by a demand area and Fair Value Gaps , could act as a launchpad if price pulls back to retest. Resistance levels at 2788 (R2) and 2848 (R3) are in sight as potential upside targets. The red circled area is where I am expecting a possible retracement to fill gaps and grab liquidity as per SMT before resuming the upward move. With liquidity resting above swing highs, the overall view remains bullish, and price looks primed to head toward higher levels as long as support holds strong.

Still holding both Gold and Silver in buy as mentioned in previos updates.

XAUUSD SHOWING A GOOD DOWN MOVE WITH 1:7 RISK REWARD XAUUSD SHOWING A GOOD DOWN MOVE WITH 1:7 RISK REWARD DUE TO THESE REASON

A. its following a rectangle pattern that stocked the marketwhich preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for breakC. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules that will help you to to become a bettertrader

thank you

XAU#8+ : Multi-frame analysis GOLD: Price traps soon💎 💎 💎 Plan #7 first helps you make a profit. Please like and follow the channel to follow the earliest trading plan 💎 💎 💎

🔥 Yesterday was the last day of the new year in my country, so I was quite busy and could not update trading plan #8. Today, let's check the trend of GOLD🔥

1️⃣ **Fundamental analysis:**

📊 The US dollar index DXY has increased by nearly 30 points in the short term, non-US currencies have decreased. This is partly the cause of the recent correction wave. However, the financial market's concern about a "mild recession" from Trump's policies is still present. This led to a recovery shortly afterwards

🔴Fed expects to keep interest rates steady, taking time to assess the impact of Trump's policy. 97.3% probability that the Fed will leave interest rates unchanged this week

2️⃣ **Technical analysis:**

🔹 **D frame:** Yesterday marked a recovery after the previous adjustment day

🔹 **H4 frame:** Structurally,

🔹 **H1 frame:** The price structure changed from bullish to bearish. The price has returned to test the resistance area. The price reaction in this area will determine the direction of gold.

3️⃣ **Trading plan:**

⛔ The current price is in an important resistance area that is not suitable for entering orders. The best buying zone is the area where the price structure appears at 2745 as you can see. Remember that the main trend is still up, but the structural breakdown in the H4 frame is showing us a forecast for a short correction. The current price zone will be the confirmation zone for this forecast

✅According to personal experience, I will wait for an entry when the price returns to an important support or resistance zone. Entering an order in this area is no longer good for the R:R ratio and the failure rate is also high. Looking at the price structure, to be able to break this resistance zone, we will need a correction to gain momentum. Otherwise, there is a high possibility that we will witness a false breakout of this area to attract FOMO gamblers. Be patient and wait for the opportunity.

💪🚀 **Wish you successful trading!**

📌 For any questions, please contact directly. I am ready to answer you for free

XAU#7: The bullish wave engulfs the trader's account

💎 💎 💎 Plan #6 above helps you make a profit. Leave a comment and tag your friends to share. 💎 💎 💎

So the bullish wave has reached the old peak as analyzed by #6. Let's see the next comments and trading strategies.

1️⃣ **Fundamental analysis:**

📊 Putin: Ready to discuss the Russia-Ukraine conflict and energy issues with Trump. If there is really a negotiation. Gold prices may be under pressure

🚀Trump hinted at easing tariff policies and called on the Federal Reserve to cut interest rates. This is the driving force that has pushed gold to hover near the record high reached in October last year

2️⃣ **Technical analysis:**

🔹 **W frame:** Last week ended with a strong bullish candle in the resistance area. This confirms that the market sentiment is extremely optimistic about establishing a new price peak.

🔹 **H4 frame:** The uptrend is still very strong with no signs of correction

🔹 **H1 frame:** The price structure is increasing in a stepwise manner. It will be difficult to see a correction.

3️⃣ **Trading plan:**

⛔ In previous articles, my top priority for you is to never go against the market trend at this time. Especially, you are not allowed to hold losses or place SELL orders against the trend. Many accounts have burned because of blocking the gold head when the trend is so strong

✅The uptrend will continue next week. The top priority is still to find a BUY entry point when the price reaches the support zone.

💪🚀 **Wish you successful trading!**

📌 For any questions, please contact directly. I am ready to answer for you for free

#trading #trade #xauusd #newtrader #newbie #xau #forex #tradingview #plants #trader #tradingforex

XAUUSD MONDAY MARKET OPENING PROJECTION 26.01.24he chart illustrates an analysis of Gold Spot (XAU/USD) on a 1-hour timeframe, with a detailed projection for Monday's market opening on January 26, 2025. Key elements of the chart include:

Price Levels:

Current Price: $2,770.885.

Target Price: $2,785.816.

Stop Loss: $2,755.726.

Support Level: Around $2,766.852, marked by a 38.2% Fibonacci retracement line.

Technical Indicators:

Stochastic Oscillator (5,3): Indicates oversold conditions, with values of 16.24 and 20.94.

Relative Strength Index (RSI): Shows a neutral reading of 52.22, suggesting no strong directional bias.

Projection:

The blue arrow anticipates a bullish movement from the current price toward the target price after a potential bounce near the $2,766.852 support zone.

A bearish scenario is mitigated with a stop loss at $2,755.726.

Context:

The analysis implies a buying opportunity around the support zone, aiming for a potential upward move.

This chart represents a calculated setup for traders, combining Fibonacci levels and momentum indicators to define a strategy for Monday's market session.

XAUUSD Analysis: Potential Bearish Pullback Towards Key Support📉 XAUUSD Daily Analysis 🔍

🚨 Potential for a Bearish Pullback 🚨

Gold (XAUUSD) is showing signs of a potential downward move after rejecting a key resistance level. If this momentum continues, we could see the price heading towards the support zone at 2680/2670.

💡 Key Insights:

📌 Market rejection at resistance = possible bearish momentum.

📌 Target support area: 2680/2670.

📌 Risk Management: Stick to 1-2% risk on trades.

⚠️ Historical Note:

When the market last hit an all-time high, it saw a sharp one-day drop. Stay cautious!

💬 Disclaimer: This is for educational purposes only. Always trade responsibly and manage your risk effectively.

XAUUSD triangle breakout A symmetrical triangle chart pattern is a period of consolidation before the price is forced to break out or down. A breakdown from the lower trend line marks the start of a new bearish trend, while a breakout from the upper trend line indicates the beginning of a new bullish trend.

The price target for a breakout or breakdown from a symmetrical triangle is equal to the distance from the high and low of the earliest part of the pattern applied to the breakout price point. For example, a symmetrical triangle pattern might start at a low of $10 and increase to $15 before the price range narrows over time. A breakout from $12 would imply a price target of $17 ($15 minus $10 equals $5, then plus $12 equals $17).

The stop-loss for the symmetrical triangle pattern is often put right below the breakout point. For example, if the security breaks out from $12 with high trading volume, traders will frequently place a stop-loss just below $12.

Symmetrical triangles differ from ascending and descending triangles in that the upper and lower trend lines slope toward a center point. In contrast, ascending triangles have a horizontal upper trend line, predicting a potential breakout higher, and descending triangles have a horizontal lower trend line, predicting a potential breakdown lower.

prior movement.

XAUUSD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

Is correction mode on in the GOLD ?After failing to breach the all-time high resistance of $2,790, gold prices have retreated, signaling a shift in momentum. The inability to maintain levels above $2,765 has led to increased bearish sentiment. On the downside, immediate support is seen in the $2,725-$2,730 zone, with a more robust secondary support at $2,700. A break below these levels could indicate further weakness. Meanwhile, any recovery above $2,765 on a closing basis might attract fresh buying interest, but the overall sentiment appears bearish for the day.