XRPUSD trade ideas

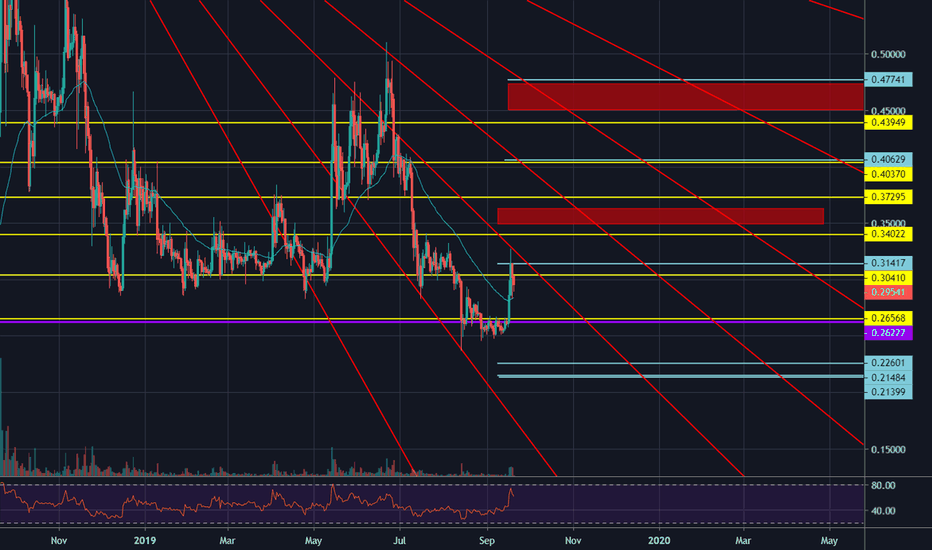

Don't miss the great buy opportunity in XRPUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.2188). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XRPUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 65.

Take Profits:

TP1= @ 0.2521

TP2= @ 0.3278

TP3= @ 0.3785

SL= Break below S2

There is a possibility for the beginning of an uptrend in XRPUSDTechnical analysis:

. Ripple/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 42.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.18300 to 0.148). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.183)

Ending of entry zone (0.148)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.2300

TP2= @ 0.2805

TP3= @ 0.3300

TP4= @ 0.3800

TP5= @ 0.4240

TP6= @ 0.4800

TP7= @ 0.5700

TP8= @ 0.7615

TP9= @ 0.9145

TP10= @ 1.37050

TP11= Free

Don't miss the great buy opportunity in XRPUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.2236). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XRPUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 34.

Take Profits:

TP1= @ 0.2495

TP2= @ 0.3145

TP3= @ 0.3800

SL= Break below S2

Ethereum’s New Innovation & Pillar named “Athereum”The mysterious group named The Rocket Team uncovered Avalanche which is a ground-breaking understanding component between the new Snow-Avalanche group of conventions, which is presently expedited the main savvy contract stages “Ethereum”. A rising mix of these two is seen in the crypto economy.

Emin Gun Sirer who is Cornell educator and AVA labs organizer unveiled about Athereum in the ongoing held DEVCON 5, Athereum viewed as the Avalanche — put together matrix with respect to AVA, which is bolstered on “Blockchain 3.0” systems. AVA labs detailed with Medium Post that the Athereum task is an “Inviting Fork” which is utilized for the welfare of the Ethereum environment utilizing new advancement and research conceivable outcomes.

Source: TheCoinRepublic

There is a possibility for the beginning of an uptrend in XRPUSDTechnical analysis:

. Ripple/Dollar is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 75.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.28000to 0.24000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.28000)

Ending of entry zone (0.24000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.33000

TP2= @ 0.38000

TP3= @ 0.42415

TP4= @ 0.48000

TP5= @ 0.57000

TP6= @ 0.70580

TP7= @ 0.79100

TP8= @ 0.96000

TP9= @ 1.41000

TP10= Free

There is a possibility for the beginning of an uptrend in XRPUSDTechnical analysis:

. Ripple/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 34.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.29000 to 0.26000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.29000)

Ending of entry zone (0.26000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.35000

TP2= @ 0.38230

TP3= @ 0.42415

TP4= @ 0.48000

TP5= @ 0.57000

TP6= @ 0.70580

TP7= @ 0.79100

TP8= @ 0.96780

TP9= @ 1.41240

TP10= Free

A second Chance to Buy in XRPUSDMidterm forecast:

0.370 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 61.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (0.370). if so, traders can set orders based on Price Action and expect to reach short-term targets.

* If you missed our first HUNT , you have a second chance to buy above the suggested support line (0.370).

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Trade Setup:

We opened 11 BUY trade(s) @ 0.32488 based on 'Valley' entry method at 2019.04.30.

Total Profit: 133457 pip

Closed trade(s): 33203 pip Profit

Open trade(s): 100254 pip Profit

Closed Profit:

TP1 @ 0.35520 touched at 2019.05.14 with 3032 pip Profit.

TP2 @ 0.38230 touched at 2019.05.14 with 5742 pip Profit.

TP3 @ 0.42415 touched at 2019.05.14 with 9927 pip Profit.

TP4 @ 0.46990 touched at 2019.05.14 with 14502 pip Profit.

3032 + 5742 + 9927 + 14502 = 33203

Open Profit:

Profit for one trade is 0.46810 (current price) - 0.32488 (open price) = 14322 pip

7 trade(s) still open, therefore total profit for open trade(s) is 14322 x 7 = 100254 pip

All SLs moved to Break-even point.

Take Profits:

TP5= @ 0.57000

TP6= @ 0.70580

TP7= @ 0.79100

TP8= @ 0.96780

TP9= @ 1.41240

TP10= @ 1.61350

TP11= Free

XRP Bull Run Update 14-May-19Hi all!!

Good day! In this post, we are going to analyze Ripple Long Term Bull Market in simple terms.

I observe similarities of 2015-2016 Bear Market in 2018-2019 Bear Market.

The long term investors have only five questions to be answered in a Bear Market.

1. Obviously topping out (Red Text)

2. Finding the first Bottom (Green Text)

3. Finding the second Bottom (Yellow Text)

4. Where are we now? (White Arrow)

5. Where is the target? (Pink Zone)

Answers are marked in the chart.

For more updates, follow me here .

~RPS~

XRP / USD Price Analysis: Flooded MarketXRP / USD Short-term price analysis

Ripple has a bearish short-term trading bias, with the XRP / USD pair tumbling below its 200-period moving average on the four-hour time frame.

The four-hour time frame is showing a large head and shoulders pattern, with XRP / USD sellers now testing towards the neckline of the bearish pattern.

Technical indicators across the four-hour time frame have turned heavily bearish and continue to signal further near-term losses.

Pattern Watch

Traders should note that if the bearish head and shoulders pattern on the four-hour time frame is triggered, the XRP / USD pair could fall to a new 2019 trading low.

Relative Strength Index

The RSI indicator is bearish on the four-hour time frame, although the indicator is attempting to correct from oversold territory.

MACD Indicator

The MACD indicator has turned bearish on the four-hour time frame and is still generating a sell signal.

Fundamental Analysis

Over the past weeks XRP has been hampered by a number of negative catalysts. CTO David Schwartz has sold a share of his tokens, and the company also announced that it has increased the share of sold XRP by 31% in comparison to the previous quarter. With the current sell-off for alt coins, the increased supply of tokens has likely created additional downward pressure on the token price.

XRP / USD Medium-term price analysis

Ripple has a bearish medium-term trading outlook, with the XRP / USD pair falling to its weakest trading level since late January 2019.

The daily time frame shows that a bearish technical breakout is underway, with the XRP / USD pair now trading below a large triangle pattern that has been dominating the daily time frame this year.

Indicators on the daily time frame have turned bearish and show scope for further downside.

XRP / USD Daily Chart by TradingView

Pattern Watch

Traders should note that the overall downside protection of the triangle pattern on the daily time frame is close to $20.00.

Relative Strength Index

The Relative Strength Index Indicator on the daily time frame has turned bearish and shows scope for further downside.

MACD Indicator

The MACD indicator on the daily time has turned bearish and is issuing a strong sell signal.

Fundamental Analysis

Although Ripple continues to expand its partner network, there is still little information on how the company is progressing with adoption of xRapid, which directly utilizes XRP for cross-border payments. The absence of positive news and development in this direction could have a negative effect on the value of the project.

Conclusion

Ripple has a bearish outlook across both time frames with the third largest cryptocurrency by market capitalization erasing all of its hard-earned gains from earlier this month.

The XRP / USD pair could come under significant pressure over the medium-term if the recent bearish triangle pattern breakout on the daily time frame is confirmed.