[SeoVereign] RIPPLE BEARISH Outlook – August 10, 2025In this idea, I would like to present a bearish outlook on Ripple.

There are three main reasons on which this perspective is based.

First, an arbitrary wave X forms a 1.272 ratio with another arbitrary wave X.

Second, a 1.414 BUTTERFLY pattern has formed.

Third, if the consistently formed trendline is broken to the downside, I believe the likelihood of Ripple’s decline will increase.

Accordingly, the average take-profit target has been set around 3.145 USDT.

Thank you very much for reading, and as time goes by and the chart becomes clearer, I will continue to update this idea accordingly.

Thank you.

Trade ideas

$XRP 2Hr Chart Analysis CRYPTOCAP:XRP 2Hr Chart Analysis

Price is consolidating within a bullish pennant formation after a strong prior impulsive leg. This type of pattern generally reflects a pause in trend before potential continuation, but confirmation is still needed.

🔹Support zone: $3.15 – $3.17 (lower pennant trendline) — maintaining this keeps the bullish structure intact

🔸Immediate resistance: $3.25 – $3.28 (mid-pennant pivot)

🔹Major breakout point: $3.32 – $3.35 (upper pennant boundary)

🔸Macro support: $3.05 – $3.10 (trend invalidation area)

Pattern Structure :

The preceding leg into the pennant was a steep bullish run, indicating strong underlying momentum before consolidation

Price is currently testing the lower support zone; a strong bounce here could set up a retest of the upper boundary

Volume has been contracting during consolidation — typical for a pennant — but watch for a spike in volume to confirm the next move

⚡ Probable Scenarios:

1. Continuation Scenario: Break and close above $3.35 with increasing volume could trigger a bullish leg continuation in line with the pennant pattern’s measured move logic

2. Deeper Pullback: A breakdown below $3.15 could open room for a corrective wave toward the $3.05 – $3.10 macro support before bulls attempt recovery

Conclusion : The structure remains constructive as long as the $3.15 floor holds. Traders should watch for compression to reach its apex — the closer to the tip, the more explosive the eventual breakout tends to be.

$SOL — Weekly Chart Analysis

BINANCE:SOLUSDT

CRYPTOCAP:SOL — Weekly Chart Analysis

On the 1Week timeframe, Solana is forming a potential Head & Shoulders (H&S) pattern — a structure often associated with medium-to-long-term trend reversals when confirmed.

Left Shoulder: Built around $180–$200 before a corrective drop.

Head: Peak near $296, followed by a sharp retracement.

Right Shoulder: Currently developing between $160–$200, mirroring the left shoulder's structure.

Neckline Support: ~$125–$130 → This is the key zone. A decisive weekly close below could trigger a deeper correction.

📌 Key Levels to Watch

Resistance: $200 → Strong supply zone; breakout above would invalidate the bearish H&S narrative.

Support: $160 short-term, $125 critical neckline.

Upside Bias: If SOL breaks above $200 with volume, it could retest $230–$250, negating the H&S bearish potential.

Currently, SOLANA is in a neutral-to-slightly bullish phase as it trades above $160 and is testing right shoulder resistance. The next weekly close will be crucial to determine if bulls can negate the H&S risk or if sellers take control.

$XRP is currently exhibiting a clean Elliott Wave structureCRYPTOCAP:XRP is currently exhibiting a clean Elliott Wave structure on the 1Hr chart

Waves (1)–(4) are already completed, with Wave (4) forming a healthy consolidation above the 3.25–3.30 zone.

Price has now begun shaping Wave (5), which is typically the final bullish push before a larger corrective phase.

Key Support: 3.30 → A structural pivot point; maintaining this zone keeps the bullish outlook intact.

Immediate Resistance: 3.40–3.45 → First breakout test for bulls.

Momentum Zone: Break & hold above 3.45 could attract fresh buyers, opening a path towards higher Fibonacci targets.

📊 Wave (5) Fibonacci Projections

0.618 Fib Extension: 3.44 → Short-term target, often tested first in Wave 5.

1.000 Fib Extension: 3.58 → Likely if breakout volume is strong.

1.618 Fib Extension: 3.82 → Extended target, usually hit if Wave 5 turns impulsive and market sentiment stays bullish.

🔸Failure to hold 3.30 could see price revisit 3.24–3.26, and breaking below 3.20 may signal Wave 5 truncation, shifting momentum back to sellers.

🔹Wave 5 is in motion. A decisive breakout above 3.45 with strong volume could propel XRP towards 3.58–3.82 in the coming sessions.

BINANCE:XRPUSDT

$XRP 4Hr Chart Outlook – Elliott Wave in Play

BINANCE:XRPUSDT

#XRP's 4Hr chart is painting an Elliott Wave sequence, finishing wave (4) and hinting at a move into the final wave (5)! 🚀

🌀 Wave Count Breakdown:

1️⃣ Wave (1): Initiated from sub-$2.00 range with clean momentum

2️⃣ Wave (2): Healthy corrective dip, maintaining bullish structure

3️⃣ Wave (3): Strong impulsive leg topping near $3.70, validating the trend

4️⃣ Wave (4): Ongoing consolidation phase, forming potential bull flag / base

5️⃣ Wave (5): Projected Fibonacci extension at 1.618 targets around $3.67 – $3.70

Support: $3.00 psychological level + local base

Resistance: $3.20 (short-term), followed by $3.66 (1.618 fib extension)

Invalidation: Break below $2.90 could challenge wave structure

With bullish momentum intact and corrections staying orderly, this chart structure aligns with Elliott Wave theory forecasting a final push in Wave 5. Volume confirmation is key on breakout above $3.20.

XRP/USDT Potential Reversal Zone — “Bottom Tested, Bullish!📉 Chart Analysis Summary

The divided chart indicates XRP trading between a critical support zone near $3.05–$3.09 and overhead resistance around $3.19–$3.23, forming what could be a bullish pennant or descending wedge setup on the 30-minute timeframe:

Support Zone (~$3.05–$3.09):

Price retested this level multiple times (labeled as “$$$” and “c”), clearly identifying a demand zone.

Ichimoku cloud support lies nearby, adding technical relevance to the floor.

Resistance Trendline & Green Line (~$3.19–$3.23):

A descending trendline is visible, showing lower highs and building compression.

A breakout above this resistance zone is necessary to signal bullish continuation.

Projected Path:

The schematic arrow suggests a bounce off support, followed by consolidation, and then a breakout above resistance, targeting the $3.25–$3.30+ zone and potentially higher.

🔍 Context from Recent Market Commentary

Support Holding Above $3.11–$3.15: Analysts highlight strong support around $3.11–$3.15, where institutional and retail interest appears concentrated

TradingView

+13

TradingView

+13

CoinCentral

+13

.

Resistance & Consolidation at $3.30: While XRP briefly surpassed $3.30, it encountered rejection and remains rangebound. A confirmed break beyond this level could validate the bullish carry-forward

CryptoPotato

CoinDesk

.

Wave-Elliott Bull Case: Various Elliott Wave scenarios forecast targets as high as $5.25, $6.85, or even $10–$15 should Wave 5 materialize, though this depends on market strength and momentum

CoinCentral

.

✅ Trading Outlook

Bullish Scenario:

Bounce off $3.05–$3.15 support.

Break above $3.23–$3.30 resistance.

Potential upside targets:

Near term: $3.30–$3.40.

Medium term: $4.64 or $5–$6, with strong case for $6.85 if momentum and on-chain demand strengthen

CryptoPotato

+15

TECHi

+15

CoinGape

+15

.

Bearish Scenario:

Failure to hold $3.05–$3.11 risk retest toward $2.95 or lower zones ($2.30–$2.70)

TECHi

.

🧭 What to Watch

Key Level Role

$3.05–$3.11 Critical support/demand zone

$3.19–$3.23 Short‑term resistance/framing compression

~$3.30+ Confirm bullish breakout — key trigger for Wave 5 and higher targets

🧠 Overall Take

This chart is painting a classic consolidation near strong support with a visible descending upper boundary. If XRP holds the ~$3.05 zone and breaks above $3.23–$3.30 with conviction, it could initiate a bull move toward $3.40–$4.00, and potentially even $5–$6+ depending on volume and momentum.

However, breaks below $3.11 may open deeper downside risk. For many traders, this is a simple risk-reward setup: entry near the lower channel with a stop under $3.05 and initial profit targets at $3.30–$3.40.

XRPUSDT – IS YOUR POSITIONING AND NAVIGATION SYSTEM CLEAR ENOUGHXRPUSDT – IS YOUR POSITIONING AND NAVIGATION SYSTEM CLEAR ENOUGH?

Let me share with you the core of the real-time price positioning and mapping system I often use. I’ve shared it widely on other signal channels, because platforms like TradingView have major limitations when it comes to expressing advanced ideas — you're mostly restricted to using standard indicators, and developing custom systems isn’t allowed. I’ve been banned a few times there, so... I’ve grown a bit lazy about posting.

To make a solid buy/sell decision on any coin, you need two things:

A navigation system (to guide you)

A price map (to know where you are)

Just like GPS + Google Maps.

You need to know where the current price is on the chart map, not just on the order book.

When you know where price is in the larger journey, you know whether to buy, sell, or stay flat.

Let’s take XRPUSDT as an example:

I called a buy signal for XRP long ago, when it dropped below $2 — that was shared in a TradingView post.

With our background systems and real-time chart map, it was clear:

There were two solid entry points at the base of XRP’s uptrend

Then, a reloading zone around $1.6 – $1.9

Followed by a push toward the weekly peak (W)

After that, a corrective phase and a new re-entry opportunity

It’s that clear — like looking at a 3D map.

You know where you are, where you’re heading, and what’s coming next.

Easy to make decisions, right?

Absolutely.

Because when the system is clear and the map is solid, there’s no room for hesitation or confusion.

If you don’t have a system like this yet, maybe it’s time to build your own financial GPS.

$XRP – Elliott Wave 5th Wave Loading?

The setup looks primed for a bullish continuation!

We’re mid-cycle in a classic Elliott Wave structure:

(1) Impulsive launch

(2) Healthy retrace

(3) Aggressive rally with volume surge

(4) Controlled correction & consolidation

🔜 (5) Potential move towards 1.618 extension @ $3.67

Price currently sitting around $3.01 – near Wave (4) low.

📍 Bullish Confirmation Levels

✅ Holding above $2.85–2.90 (Wave 4 support)

✅ Higher low on RSI and bullish divergence

✅ Fib target for Wave 5 = $3.67 based on Wave 1 → 3 projection

🎯 Targets

Short-term: $3.40

Main target (Wave 5): $3.67

🚨 STOPLOSS : Below $2.80 for risk-managed setups

If momentum picks up, Wave 5 breakout could turn explosive — Watch volume and 4H candle structure closely!

BINANCE:XRPUSDT

XRP Chart"Lorem ipsum" is a placeholder text commonly used in graphic design, publishing, and web development. It is designed to mimic the appearance of real text without actually conveying any meaning. Its purpose is to allow designers to focus on the visual layout and presentation of a document without being distracted by the actual content.

$XRP just broke its all-time high: $3.66CRYPTOCAP:XRP just broke its all-time high: $3.66 — and this is just the beginning?

After years of waiting, XRP finally explodes past $2 and hits $3.66 this bull run. It’s not just a win for XRP holders — it’s a lesson in patience, conviction, and catching early setups before the hype.

Why it matters now:

🔹 While everyone’s chasing the latest meme coin, XRP silently did a clean 7x from $0.50.

🔹 Regulatory clarity is improving — XRP’s bullish narrative is finally unfolding.

🔹 Market rotation is real: old giants like XRP are moving again, and this signals strength in Layer 1 comeback plays.

Quick breakdown:

📌 First signal at $0.50 → 7x

📌 Second entry below $2 → already 2x

📌 Current price: $3.66 (ATH)

📌 Many ignored it, some mocked it — but price tells the truth.

Patience beats hype. Quality setups > chasing pumps.

Save-worthy takeaway:

If you ever feel FOMO, remember this:

The best trades aren’t loud. They’re early, quiet… and require conviction.

What’s your biggest “I told you so” moment in this bull run?👇

Let’s hear your favorite early calls — drop them in the replies!

xrpKey Analysis: Descending Triangle Pattern

As seen on the chart, XRP price has formed a very clear Descending Triangle pattern since late 2024. The pattern is characterized by:

Upper Trendline (Dynamic Resistance): A descending trendline connecting the lower highs. This indicates selling pressure every time the price tries to move up.

Lower Line (Horizontal Support): A strong horizontal support zone around the $1.52 - $1.85 level. This area has successfully held the price from falling further several times, indicating significant buying interest at this level.

The Descending Triangle pattern is often considered a bearish continuation pattern. However, if it breaks out to the upside (penetrating the dynamic resistance line), it could be a very strong reversal signal.

Trading Scenario and Plan

Based on the structure of this pattern, I see a long (buy) trading opportunity with a very attractive risk/reward ratio.

Entry Point: I see the $1.83 area as a potential entry point. This level is near the horizontal support zone, offering a relatively low price before a potential upside. Currently (early July 2025), the price is retesting this support area, providing an opportunity for accumulation.

Stop Loss: For risk management, I will place a Stop Loss below the key support zone, which is around $1.52. A daily candle close below this level will invalidate my bullish scenario.

Take Profit: My long-term target is at $5.04. This target is based on the psychological resistance level and the potential price movement after a breakout from the long consolidation pattern.

XRP/USDT Bullish Breakout Anticipatio XRP/USDT Bullish Breakout Anticipation 🚀

Technical Analysis:

The chart illustrates a potential bullish setup for XRP/USDT based on price structure, support/resistance levels, and harmonic movements.

🔍 Key Observations:

Rejection From Major Support Zone (1.95 - 2.00):

Price previously tested a strong demand zone (marked as “SUPPORT”) and showed significant rejection with bullish candlestick momentum.

Series of Higher Lows ✅:

The price structure shows consecutive higher lows (green arrows), indicating rising buying pressure and bullish intent.

Break of Intermediate Resistance (2.15 - 2.18):

A breakout from the neckline area confirms bullish continuation. Price is currently retesting this level, turning resistance into support.

Target Zone at 2.35 - 2.36 🟦:

A clean target area marked by historical resistance and previous high (red arrow).

Projection indicates a possible move toward 2.3512 USDT, aligning with the measured move from the breakout structure.

Bullish Harmonic Pattern Completion 🔼:

The chart also displays a harmonic pattern completion near the recent low, suggesting a reversal point aligning with market reaction.

🎯 Trading Plan:

Entry Zone: Current retest around 2.15 - 2.18 is favorable.

Target: 2.3512 (as per projection and prior resistance zone).

Invalidation: Break below 2.10 and especially under the key support (2.00) would invalidate the setup.

📌 XRP/USDT is showing bullish strength as long as it holds above the breakout level. A sustained move could trigger momentum towards the 2.35 target zone. 💪📊

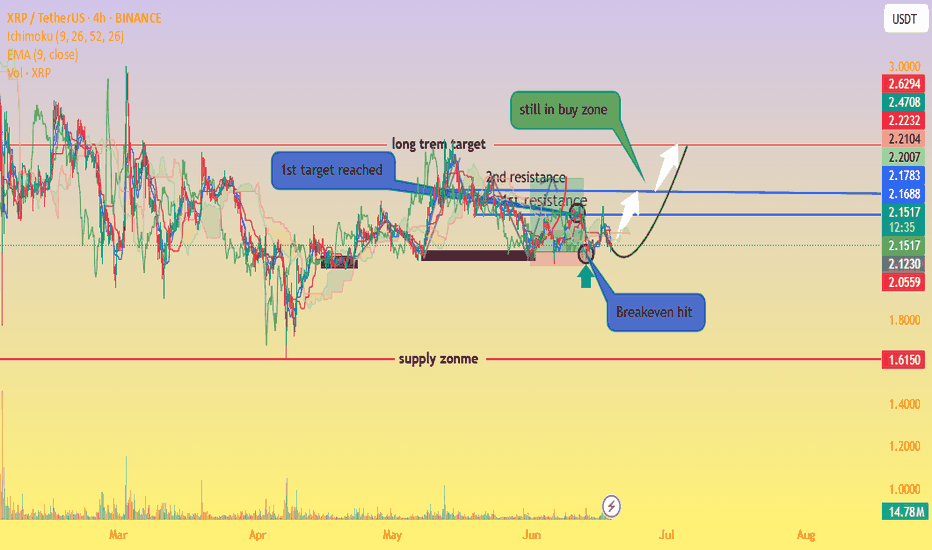

XRP Still in Buy Zone – Eyes on $2.50+our chart clearly marks that XRP has bounced off a strong buy zone (around the $2.10–$2.15 range), aligning well with a classic setup: price hitting support, creating a small base, and starting an upward rotation. 👇

Support area respected – The highlighted circle shows XRP revisiting the demand zone and quickly rebounding, very bullish behavior.

Lower wicks & volume spike – Indicate absorption of selling pressure and possible institutional interest.

Green arrow projection – Suggests a break above the immediate resistance (~$2.17 EMA/Ichimoku levels) could trigger a rally toward the next resistances around $2.22, $2.47, and potentially $2.63.

“Still in buy zone” annotation – Absolutely valid: as long as XRP stays above that key base ($≈$2.10), the bullish case holds.

🔍 Market Context

Range consolidation between ~$2.10–$2.30 has been the dominant theme, awaiting a breakout catalyst (e.g., ETF approvals or legal clarity)

thecryptobasic.com

+14

fxempire.com

+14

crypto.news

+14

.

Analysts highlight a falling wedge and support zone between $2.00–$2.20—if price holds, a move toward $3–$4 is plausible .

A range-bound weekly outlook anticipates a push toward $2.50 resistance before exploring higher targets .

✔️ Summary

Buy zone holding: Bullish pattern confirmed with rebound from support.

Key resistance levels: Watch for a breakout above $2.17/EMA and then $2.22–$2.30/$2.50.

Ideal strategy: Maintain position above support; add on breakout, targeting $2.50–$3.00.

Risk points: A drop below $2.10 could test $2.00 or even $1.85 support.

XRP Breakout Watch — Will June 16 Trigger a Bull Run?🚨 XRP Breakout Watch — Will June 16 Trigger a Bull Run? 🚨

CRYPTOCAP:XRP is holding above the key $2 support.

👉 A breakout above $2.65 → $3.00 is in play.

👉 Whale accumulation rising. Volume tightening.

👉 Ripple vs SEC ruling expected soon.

Targets if bullish: $3 → $8 → $13 🚀

Downside risk: Below $2 → $1.50 or lower.

Note: NFA & DYOR

XRP/USDT 4H — Major Breakout Alert! 🔥 XRPUSDT 4H — Major Breakout Alert! 🔥

Here’s what I’m seeing right now on the XRP 4H chart:

✅ Bullish CHoCH + BOS → trendline broken → market flipped bullish.

✅ Testing $2.29 FVG → buyers pushing strong.

✅ Volume confirms true breakout.

🎯 Next upside targets → $2.36 → $2.42 (supply zone).

Best buy zone on pullback → $2.17-$2.14 (confluence of FVG + 0.618 Fib + demand).

Bias: Bullish → Only flips neutral if $2.14 breaks down.

Pro Tip: Wait for pullback if not in yet → better R:R at $2.17-$2.14 zone.

What’s your target for CRYPTOCAP:XRP this week? Comment below! 🚀

XRPUSDT BUY ZONEXRPUSDT BUY ZONE

Buy signal for XRP, targeting a rise to the $5-7 range.

Wait to buy around $1.6-$1.8, or higher depending on capital conditions.

Wait for a weekly timeframe "has bottom" signal to enter.

This is a long-term signal following the monthly chart. Don’t expect immediate x3 or x5 profits within a few weeks—avoid rushing in.

Take profits when the "has peak" signal appears on the 1-month chart.

Most saw weakness. I saw a fully-formed draw on liquidity.XRP just tapped the bottom of a 1D Fair Value Gap (FVG) — and with that, the stage is set.

The move down into 2.0758 wasn’t failure. It was function. That leg completed the imbalance left behind from May’s impulse, sweeping resting liquidity in the process. Classic Smart Money delivery — efficient and controlled.

Now price sits in discount.

The first bounce into 2.2027 was reactionary. But the next move through that level opens the door toward 2.3614 — the 1D OB and origin of the last major sell-side sequence. That's the draw. That’s where Smart Money is aiming.

Above it, we sit under a high-volume void, and a clean 0.382 retracement (2.4344). That’s where I'll be taking partials and re-evaluating.

If we reject from there? I’m ready for the rebalance. But I’m not assuming it — I’m following delivery.

Execution framework:

🔑 Entry: Reactive or confirmation entry from 2.0758–2.2027 zone

🎯 Target 1: 2.3614 (OB)

🎯 Target 2: 2.4344 (liquidity magnet)

❌ Invalidation: Full body closure below 1.9510 — invalidates structure and intent

I don’t trade the wick. I trade the imbalance behind it.

Precision isn’t about prediction. It’s about understanding the game.