XRPUSDT – IS YOUR POSITIONING AND NAVIGATION SYSTEM CLEAR ENOUGHXRPUSDT – IS YOUR POSITIONING AND NAVIGATION SYSTEM CLEAR ENOUGH?

Let me share with you the core of the real-time price positioning and mapping system I often use. I’ve shared it widely on other signal channels, because platforms like TradingView have major limitations when it comes to expressing advanced ideas — you're mostly restricted to using standard indicators, and developing custom systems isn’t allowed. I’ve been banned a few times there, so... I’ve grown a bit lazy about posting.

To make a solid buy/sell decision on any coin, you need two things:

A navigation system (to guide you)

A price map (to know where you are)

Just like GPS + Google Maps.

You need to know where the current price is on the chart map, not just on the order book.

When you know where price is in the larger journey, you know whether to buy, sell, or stay flat.

Let’s take XRPUSDT as an example:

I called a buy signal for XRP long ago, when it dropped below $2 — that was shared in a TradingView post.

With our background systems and real-time chart map, it was clear:

There were two solid entry points at the base of XRP’s uptrend

Then, a reloading zone around $1.6 – $1.9

Followed by a push toward the weekly peak (W)

After that, a corrective phase and a new re-entry opportunity

It’s that clear — like looking at a 3D map.

You know where you are, where you’re heading, and what’s coming next.

Easy to make decisions, right?

Absolutely.

Because when the system is clear and the map is solid, there’s no room for hesitation or confusion.

If you don’t have a system like this yet, maybe it’s time to build your own financial GPS.

Trade ideas

$XRP – Elliott Wave 5th Wave Loading?

The setup looks primed for a bullish continuation!

We’re mid-cycle in a classic Elliott Wave structure:

(1) Impulsive launch

(2) Healthy retrace

(3) Aggressive rally with volume surge

(4) Controlled correction & consolidation

🔜 (5) Potential move towards 1.618 extension @ $3.67

Price currently sitting around $3.01 – near Wave (4) low.

📍 Bullish Confirmation Levels

✅ Holding above $2.85–2.90 (Wave 4 support)

✅ Higher low on RSI and bullish divergence

✅ Fib target for Wave 5 = $3.67 based on Wave 1 → 3 projection

🎯 Targets

Short-term: $3.40

Main target (Wave 5): $3.67

🚨 STOPLOSS : Below $2.80 for risk-managed setups

If momentum picks up, Wave 5 breakout could turn explosive — Watch volume and 4H candle structure closely!

BINANCE:XRPUSDT

XRP Chart"Lorem ipsum" is a placeholder text commonly used in graphic design, publishing, and web development. It is designed to mimic the appearance of real text without actually conveying any meaning. Its purpose is to allow designers to focus on the visual layout and presentation of a document without being distracted by the actual content.

$XRP just broke its all-time high: $3.66CRYPTOCAP:XRP just broke its all-time high: $3.66 — and this is just the beginning?

After years of waiting, XRP finally explodes past $2 and hits $3.66 this bull run. It’s not just a win for XRP holders — it’s a lesson in patience, conviction, and catching early setups before the hype.

Why it matters now:

🔹 While everyone’s chasing the latest meme coin, XRP silently did a clean 7x from $0.50.

🔹 Regulatory clarity is improving — XRP’s bullish narrative is finally unfolding.

🔹 Market rotation is real: old giants like XRP are moving again, and this signals strength in Layer 1 comeback plays.

Quick breakdown:

📌 First signal at $0.50 → 7x

📌 Second entry below $2 → already 2x

📌 Current price: $3.66 (ATH)

📌 Many ignored it, some mocked it — but price tells the truth.

Patience beats hype. Quality setups > chasing pumps.

Save-worthy takeaway:

If you ever feel FOMO, remember this:

The best trades aren’t loud. They’re early, quiet… and require conviction.

What’s your biggest “I told you so” moment in this bull run?👇

Let’s hear your favorite early calls — drop them in the replies!

xrpKey Analysis: Descending Triangle Pattern

As seen on the chart, XRP price has formed a very clear Descending Triangle pattern since late 2024. The pattern is characterized by:

Upper Trendline (Dynamic Resistance): A descending trendline connecting the lower highs. This indicates selling pressure every time the price tries to move up.

Lower Line (Horizontal Support): A strong horizontal support zone around the $1.52 - $1.85 level. This area has successfully held the price from falling further several times, indicating significant buying interest at this level.

The Descending Triangle pattern is often considered a bearish continuation pattern. However, if it breaks out to the upside (penetrating the dynamic resistance line), it could be a very strong reversal signal.

Trading Scenario and Plan

Based on the structure of this pattern, I see a long (buy) trading opportunity with a very attractive risk/reward ratio.

Entry Point: I see the $1.83 area as a potential entry point. This level is near the horizontal support zone, offering a relatively low price before a potential upside. Currently (early July 2025), the price is retesting this support area, providing an opportunity for accumulation.

Stop Loss: For risk management, I will place a Stop Loss below the key support zone, which is around $1.52. A daily candle close below this level will invalidate my bullish scenario.

Take Profit: My long-term target is at $5.04. This target is based on the psychological resistance level and the potential price movement after a breakout from the long consolidation pattern.

XRP/USDT Bullish Breakout Anticipatio XRP/USDT Bullish Breakout Anticipation 🚀

Technical Analysis:

The chart illustrates a potential bullish setup for XRP/USDT based on price structure, support/resistance levels, and harmonic movements.

🔍 Key Observations:

Rejection From Major Support Zone (1.95 - 2.00):

Price previously tested a strong demand zone (marked as “SUPPORT”) and showed significant rejection with bullish candlestick momentum.

Series of Higher Lows ✅:

The price structure shows consecutive higher lows (green arrows), indicating rising buying pressure and bullish intent.

Break of Intermediate Resistance (2.15 - 2.18):

A breakout from the neckline area confirms bullish continuation. Price is currently retesting this level, turning resistance into support.

Target Zone at 2.35 - 2.36 🟦:

A clean target area marked by historical resistance and previous high (red arrow).

Projection indicates a possible move toward 2.3512 USDT, aligning with the measured move from the breakout structure.

Bullish Harmonic Pattern Completion 🔼:

The chart also displays a harmonic pattern completion near the recent low, suggesting a reversal point aligning with market reaction.

🎯 Trading Plan:

Entry Zone: Current retest around 2.15 - 2.18 is favorable.

Target: 2.3512 (as per projection and prior resistance zone).

Invalidation: Break below 2.10 and especially under the key support (2.00) would invalidate the setup.

📌 XRP/USDT is showing bullish strength as long as it holds above the breakout level. A sustained move could trigger momentum towards the 2.35 target zone. 💪📊

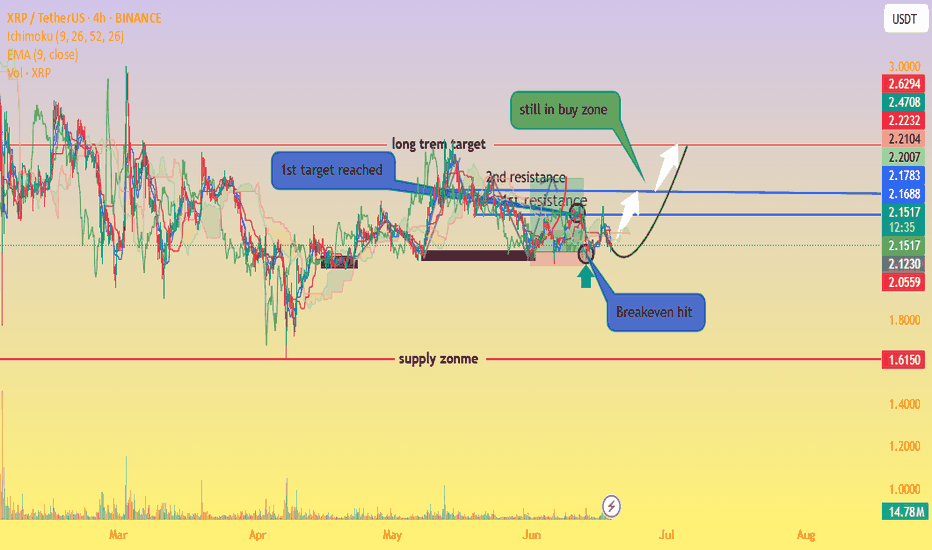

XRP Still in Buy Zone – Eyes on $2.50+our chart clearly marks that XRP has bounced off a strong buy zone (around the $2.10–$2.15 range), aligning well with a classic setup: price hitting support, creating a small base, and starting an upward rotation. 👇

Support area respected – The highlighted circle shows XRP revisiting the demand zone and quickly rebounding, very bullish behavior.

Lower wicks & volume spike – Indicate absorption of selling pressure and possible institutional interest.

Green arrow projection – Suggests a break above the immediate resistance (~$2.17 EMA/Ichimoku levels) could trigger a rally toward the next resistances around $2.22, $2.47, and potentially $2.63.

“Still in buy zone” annotation – Absolutely valid: as long as XRP stays above that key base ($≈$2.10), the bullish case holds.

🔍 Market Context

Range consolidation between ~$2.10–$2.30 has been the dominant theme, awaiting a breakout catalyst (e.g., ETF approvals or legal clarity)

thecryptobasic.com

+14

fxempire.com

+14

crypto.news

+14

.

Analysts highlight a falling wedge and support zone between $2.00–$2.20—if price holds, a move toward $3–$4 is plausible .

A range-bound weekly outlook anticipates a push toward $2.50 resistance before exploring higher targets .

✔️ Summary

Buy zone holding: Bullish pattern confirmed with rebound from support.

Key resistance levels: Watch for a breakout above $2.17/EMA and then $2.22–$2.30/$2.50.

Ideal strategy: Maintain position above support; add on breakout, targeting $2.50–$3.00.

Risk points: A drop below $2.10 could test $2.00 or even $1.85 support.

XRP Breakout Watch — Will June 16 Trigger a Bull Run?🚨 XRP Breakout Watch — Will June 16 Trigger a Bull Run? 🚨

CRYPTOCAP:XRP is holding above the key $2 support.

👉 A breakout above $2.65 → $3.00 is in play.

👉 Whale accumulation rising. Volume tightening.

👉 Ripple vs SEC ruling expected soon.

Targets if bullish: $3 → $8 → $13 🚀

Downside risk: Below $2 → $1.50 or lower.

Note: NFA & DYOR

XRP/USDT 4H — Major Breakout Alert! 🔥 XRPUSDT 4H — Major Breakout Alert! 🔥

Here’s what I’m seeing right now on the XRP 4H chart:

✅ Bullish CHoCH + BOS → trendline broken → market flipped bullish.

✅ Testing $2.29 FVG → buyers pushing strong.

✅ Volume confirms true breakout.

🎯 Next upside targets → $2.36 → $2.42 (supply zone).

Best buy zone on pullback → $2.17-$2.14 (confluence of FVG + 0.618 Fib + demand).

Bias: Bullish → Only flips neutral if $2.14 breaks down.

Pro Tip: Wait for pullback if not in yet → better R:R at $2.17-$2.14 zone.

What’s your target for CRYPTOCAP:XRP this week? Comment below! 🚀

XRPUSDT BUY ZONEXRPUSDT BUY ZONE

Buy signal for XRP, targeting a rise to the $5-7 range.

Wait to buy around $1.6-$1.8, or higher depending on capital conditions.

Wait for a weekly timeframe "has bottom" signal to enter.

This is a long-term signal following the monthly chart. Don’t expect immediate x3 or x5 profits within a few weeks—avoid rushing in.

Take profits when the "has peak" signal appears on the 1-month chart.

Most saw weakness. I saw a fully-formed draw on liquidity.XRP just tapped the bottom of a 1D Fair Value Gap (FVG) — and with that, the stage is set.

The move down into 2.0758 wasn’t failure. It was function. That leg completed the imbalance left behind from May’s impulse, sweeping resting liquidity in the process. Classic Smart Money delivery — efficient and controlled.

Now price sits in discount.

The first bounce into 2.2027 was reactionary. But the next move through that level opens the door toward 2.3614 — the 1D OB and origin of the last major sell-side sequence. That's the draw. That’s where Smart Money is aiming.

Above it, we sit under a high-volume void, and a clean 0.382 retracement (2.4344). That’s where I'll be taking partials and re-evaluating.

If we reject from there? I’m ready for the rebalance. But I’m not assuming it — I’m following delivery.

Execution framework:

🔑 Entry: Reactive or confirmation entry from 2.0758–2.2027 zone

🎯 Target 1: 2.3614 (OB)

🎯 Target 2: 2.4344 (liquidity magnet)

❌ Invalidation: Full body closure below 1.9510 — invalidates structure and intent

I don’t trade the wick. I trade the imbalance behind it.

Precision isn’t about prediction. It’s about understanding the game.

XRPUSDT 2025 EDITION #5XRPUSDT 2025 EDITION #5

Among the top 5 altcoins to invest in for significant profits in 2025, XRP ranks #5 on my list.

Why does XRP make the top?

For spot trading, we focus on the reliability of larger timeframes. XRP achieves this on the monthly (M) and quarterly (3M) charts, giving us a clear BUY signal.

Larger timeframes: No peak has been formed yet, meaning M and 3M have not reached a PEAK.

Current situation: As shown on the radar chart, M is in an uptrend, while W1 (weekly) and D1 (daily) are undergoing corrections. This indicates we should wait for W1 and D1 to form a bottom. Once a BOTTOM is confirmed, you’ll have the lowest point of the W1 correction.

What to do now?

Wait for both D1 and W1 to form a bottom and then BUY.

Alternatively, wait to buy at the $1.5 range or higher. If the correction is weak, the price may only drop to around $2 before resuming its upward trend.

Target price range: $5.5–$6.

2025.05.23 RIPPLE Short-term long positionWe are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

📈

Currently, Ripple is analyzed to have completed its B wave around the $2.20 level in the mid- to short-term wave count. Accordingly, the upcoming movement is likely to be an upward C wave or the beginning of a new bullish wave.

Based on the technical structure and wave theory, the short-term targets are as follows:

1st Target: 2.49

2nd Target: 2.51

3rd Target: 2.55

In the short term, whether previous highs are broken and the strength of buying pressure are key indicators to watch. If the rise continues with increased trading volume, the above targets are likely to be valid.

📌 Strategy Summary:

Pullback buying strategy is valid with proper risk management

Key support level is around $2.20

Position adjustment to follow based on future main scenario updates

Strategy based on the mid-term main outlook will be provided sequentially.

2025.05.18 RIPPLE Short-term long positionWe are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

📈 Ripple (XRP) Long Position Strategy

Currently, XRP appears to have completed a 5-wave structure with an ending diagonal pattern in the final wave. Notably, Wave 3 respected the 1.272 extension of Wave 1 with precision, adding confidence to the Elliott Wave count. This setup typically suggests a trend exhaustion, followed by a potential move higher after a corrective phase.

✅ Entry Strategy

Enter long after confirmation of support in the current correction zone.

Stop-loss should be placed tightly below the invalidation level of the structure.

🎯 Target Levels

1st Target: $2.42 — Breakout above the diagonal resistance

2nd Target: $2.47 — Retest of previous high resistance

3rd Target: $2.51 — Potential completion of the extended move

🔍 Technical Notes

MACD is attempting a bullish crossover after forming higher lows

RSI is recovering after exiting the overbought zone

Volume is tightening, suggesting a strong move may follow on breakout

2025.05.15 RIPPLE [XRP] Short-term long positionWe are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

The bullish Bat pattern has been fully confirmed.

A short-term upward move is anticipated, so please consider this in your strategy.

1st Target: 2.52

2nd Target: 2.57

As always, remain flexible and responsive to evolving market conditions.

XRP Up 28% From Our Support Call – What’s Next?XRP Up 28% From Our Support Call – What’s Next?

CRYPTOCAP:XRP perfectly respected the FVG 1 zone around $1.60, which we previously marked as a strong support. Since then, price has rebounded over 28% from that level.

Hope you didn’t get caught buying the $2.40–$2.50 zone — as warned, that area showed signs of exhaustion, and price has dropped 30% since.

What’s Next?

If bullish momentum continues, #XRP could revisit the $2.40–$2.50 resistance area. However, this zone may act as a rejection point once again.

From there, we could potentially see a pullback toward $1.30 and $1.00, which aligns with FVG support zones and the 0.5–0.618 Fib retracement levels — key areas where a strong bounce is likely.

🟢 Macro Bias: I remain bullish on XRP/USDT in this cycle and still expect a move toward $7–$10 in the broader bull market. Best entries will likely come during dips into major support zones.

❌ Invalidation Level: This chart setup gets invalidated on an HTF close above $2.50.

Keep it smart — entries on dips, not at tops. 👀

XRPUSDT - FACES PRESSURE - WILL SUPPORT HOLD OR BREAK?Symbol - XRPUSDT

CMP - 2.1850

XRPUSDT remains under pressure despite the release of relatively positive news. The asset, currently in a downtrend, continues to test a critical support level, with the likelihood of a breakdown increasing.

XRP is consistently testing a robust support zone on the weekly timeframe. In the medium term, two potential scenarios could unfold, contingent on the overall market sentiment. Should the current market conditions persist, the probability of a downside breakdown and further decline becomes significantly higher.

At present, attention is centered on the key support level at 2.0637, where retests are occurring. However, the response to these retests is progressively weaker, which raises the likelihood of a continued decline towards the 1.90 - 1.63 range.

Resistance levels: 2.2650, 2.3650, 2.5090

Support levels: 2.0637, 1.9000

The broader cryptocurrency market is facing challenging conditions, including the ongoing tariff war, high inflation, declining stock markets, and a sense of disillusionment within the crypto community due to unmet expectations. Until these macroeconomic factors show signs of improvement, the technical outlook for XRP remains negative, and further declines may occur after a brief correction.