With gold prices rebounding after 8 months of sluggishness and stock getting bottom out. Expect it to first test Rs. 115 level and than 136 levels in the short term.

You can short reliance tomorrow if it goes below 2480 with target of 2380 and long if goes above 2500.

Nmdc has consolidated in the past few days around its 180 support and could propel towards 213 levels where next resistance lies. One can go long with stop loss of 178 with target of 210.

D-link has completed its 5 year time cycle i.e. from June 2016 to June 2021. As fall started in June 2016 which lead to its low of Rs. 49. Now, it has started the up trend backed by volumes growth and this is expected to take it first retracement level of 50% which is around 143 and than 180 levels. Buy d-link with one year time horizon and can earn around 50%...

IDBI is all set to touch rs 80 levels in one month time frame. IDBI was at around Rs 82 levels when PCA was taken against it by RBI with RBI now putting it out of PCA frame work. Its all set to give out big gains to the investors. Lets look at its financial conditions, which has shown significant improvement over the last one year period. 1. Life Insurance...

Based on Fibonacci retracement levels first resistance is around 427 level and once its broken can propel towards 492 levels. Looks good to hold for 1 year period with target of Rs 700. Major value unlocking event is when government lists yono app of SBI and it can command hefty valuations for the shareholders.

Tata motors have formed bull flag and have been in the range for quite some time. Today it took out resistance of 321 and if closed above it could go and test first 330 and than final resistance of 358. For short term traders 1. Buy 320 call for june series @ 24.65 with target of rs 30 first and than rs 45 if it reaches our 358 second target 2. also one can buy...

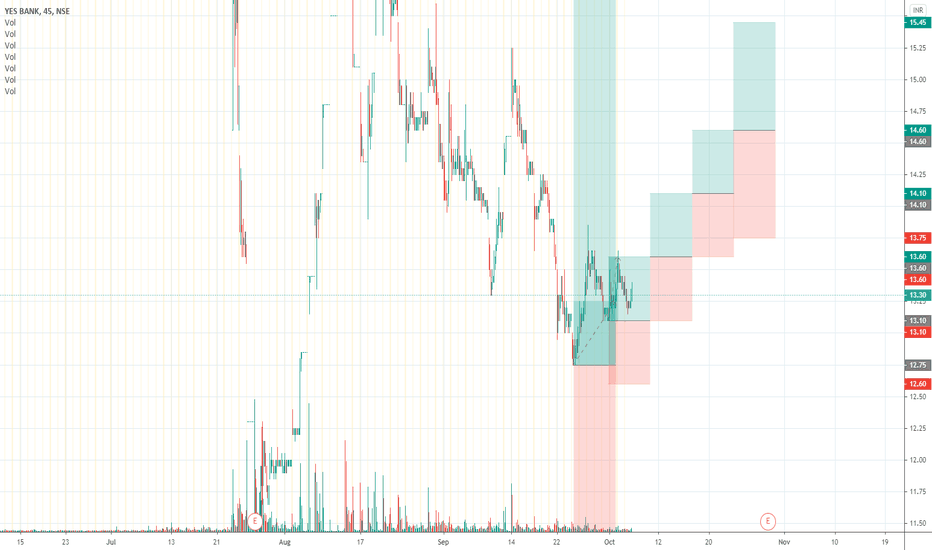

Yes bank has finally given a breakout and ready too launch towards Rs 15 target by month end. Volumes has increased over last couple of sessions. Buy yes bank at 13.30 with target of rs 15

Buy 10600 puts for july end with stoploss of 10600.. as there is strong resistance around 10560-10600 levels and once can see profit booking kicking in. Plus, market has rally pre-maturely which could led to significant correction as result kicks inn.

We are closer to the 50% retrenchment level and there is expected to be significant move.... the risk reward ratio is in favor of bear and we can see a fall towards 9800 level and 9500 levels.

Have seen significant rebound ,,,, one could easily get long covering around 9500 level which could see fall towards 9390 levels broken towards 9000 second target and final target 8600 over 2 weeks time period.

IT is trading below its 61.8% level which was around 2250 and it can go all the way down to its next support at 78.6% level which is around 1600.

The stock has encountered the resistance and expected to fall to 900 levels in the short run. So, buy put options on the stock or sell your existing stocks and buy back at lower price later on.

This stock has been falling and now close to cruical support of 3.90-4.25 ... one can look to enter this one with long & medium term horizon as it can run back to Rs 9 and than to Rs 21 level.

Nifty has fallen and have reached a strong support of 9944. Buy 9950 CE for month end with target of 10300.

We can buy 10600 call @ 140 with expectation nifty bouncing back above 10600 ... once above 10620 you can see bounce back to 10800 levels. Else downward stop loss @10550. Playing on first resistance

Based on fibonocci levels ... can fall towards 383 levels .. suggest buying put 390 for rs 8 with target of rs16. Stop loss of Rs 405. Also, market is looking negative which will further support downward movement.

We have seen great fall in nifty which should lead to short covering to above 11800 levels and than to 12000 levels. Buy calls of 11750 and 11700 with 6th feb expiry with possible upshoot in sight.