Symbol - MEWUSDT MEWUSDT pair is currently in the distribution phase, testing a significant resistance and liquidity zone, where it has exhibited a false breakout. In light of the current market conditions, it is crucial to monitor several key levels, including both support and resistance. A potential retest of the 0.00300 - 0.00312 range is likely, with the...

Symbol - LAYERUSDT CMP - 1.4200 LAYERUSDT is currently exhibiting a consolidation phase within an ongoing uptrend. The asset is outperforming the broader market; however, the initial reaction to the significant resistance at 1.4200 may result in a false breakout, followed by a retracement towards 1.275 or the 0.5 Fibonacci level. Since the start of the session,...

Symbol - XAUUSD CMP - 3018 Gold is currently undergoing a corrective phase, having broken through channel resistance and is now consolidating above the downtrend line. Market participants are awaiting key economic data and potential developments in the ongoing tariff dispute. President Trump has confirmed plans to implement retaliatory tariffs on April 2, with...

Symbol - EURAUD The EURAUD pair is currently testing a key resistance level on the weekly chart. A false breakout has occurred following a liquidity sweep, with no apparent continuation of the bullish trend. Additionally, the chart is displaying a familiar pin-bar reversal pattern. After the price exited the consolidation range, which was capped by the 1.6787...

Symbol - IPUSDT CMP - 5.5500 IPUSDT is currently establishing favorable conditions for potential growth. Bitcoin has provided a modest boost to the market following positive developments regarding the SEC and XRP, a factor that has not gone unnoticed within the crypto community. The IPUSDT coin has experienced an extended period of consolidation, forming a...

Symbol - GBPUSD CMP - 1.2937 The GBPUSD pair has shown impressive bullish strength recently, continuing its upward move against the US dollar. This strength can be attributed to aggressive sell-off of the US dollar, which has created a favorable environment for the British pound. The pair is currently trading in a critical zone, with consolidation at the 1.2920...

Symbol - NIFTY50 CMP - 23350.40 The Nifty50 is still trading within a bearish technical structure. As of now, the index is currently trading at 23350 after a strong up move. Given the ongoing downtrend and resistance levels, there is a strong possibility that Nifty may experience a pullback from these levels. I had shared a trading idea on Nifty50 when it was...

Symbol - EURJPY CMP - 161.95 EURJPY is currently exhibiting a false breakdown of resistance, which signals the formation of a reversal pattern near the upper boundary of the descending price channel. Additionally, market pressure, influenced by the correction of the U.S. dollar, is contributing to this development. On the daily chart, the overall structure...

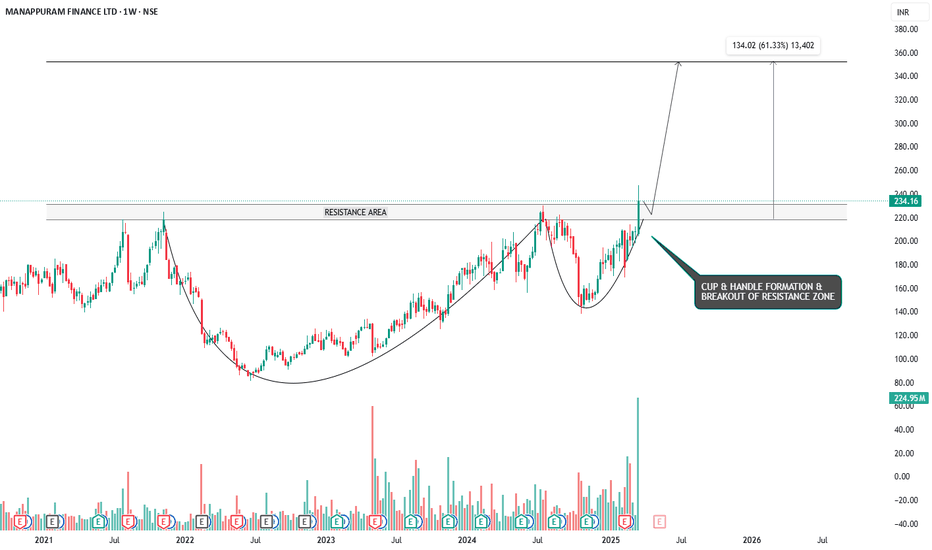

Symbol - MANAPPURAM CMP - 234.16 Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC. Manappuram Finance Ltd. has recently demonstrated a significant bullish breakout,...

Symbol - OMUSDT CMP - 6.8800 OMUSDT demonstrates greater strength compared to the broader market. Following a significant rally, a corrective phase has formed in the shape of a bearish wedge. Subsequently, the price has broken through resistance and is attempting to establish a consolidation above a key support level. In the context of a generally weak market,...

Symbol - DEGOUSDT CMP - 1.970 DEGOUSDT attempted to break its prevailing trend but encountered significant resistance and was further impacted by a weak cryptocurrency market. The downward movement may persist. Following the breakout from the descending channel's resistance, a bullish momentum of 45% was established. However, the price faced strong resistance...

Symbol - AUDUSD CMP - 0.6302 AUDUSD pair, supported by a decline in the US dollar, holds significant potential for continued growth. However, given the upcoming NFP release today, Friday, the associated risks are heightened. Currently, the currency pair is establishing a local uptrend, and in conjunction with the weakening dollar, the Australian dollar may...

Symbol - NZDJPY CMP - 85.40 NZDJPY currency pair is attempting to reverse its downtrend by breaking through the channel resistance. With the recent strengthening of the U.S. dollar, the pair has strong potential to advance. From a technical perspective, buyers are gaining momentum and providing market support, as evidenced by the rising local lows, which are...

Symbol - BTCUSD CMP - 84540 BTCUSD continues to exhibit a bearish trend after breaking the bullish structure on the weekly timeframe. There are no discernible bullish drivers at present, and from a technical standpoint, the price is poised to approach the imbalance zone between 75K and 73K. Recent events, such as the crypto summit and discussions surrounding...

Symbol - USDJPY CMP - 147.82 Following a significant decline in USDJPY, The price is approaching a strong support zone which is held since July 2024. The fundamental environment has been volatile recently, with a predominant influence from Trump's tariffs & US economic factors. Given the recent price action near support zone 148.00 - 147.00, there is a...

Symbol - QUICKUSDT CMP - 0.0290 QUICKUSDT is currently exhibiting a counter-trend move toward the resistance level within the range of 0.0295, A false breakdown of this key level has occurred amidst the prevailing downtrend. The cryptocurrency market is undergoing a period of significant challenges. While Bitcoin is testing new lows around 77K, altcoins are...

Symbol - XAUUSD CMP - 2913 Gold continues to strengthen amidst escalating economic uncertainties and the aggressive sell-off in the US dollar. The metal is currently encountering resistance at the 2921 level and appears poised for further upward movement. The US dollar has broken its bullish structure following comments from the US Department of the Treasury...

Symbol - XAUUSD CMP - 2907 Gold is currently consolidating and trading sideways within a defined support zone of 2892 and resistance at 2921. The metal is showing no signs of further growth as it remains stuck within this range. While there has been an aggressive sell-off in the US dollar, a typical scenario that would support gold, the precious metal has failed...