12161, 12211, 12241 and 12270 are resistances on the upside. 12000 - 19976 - 11934 are support levels. Tomorrow being the weekly options settlement day, 12100-12200 should be the broad range.

Apollo Hospital is moving in a bullish channel, Sell near 1800, S.Loss 15 Rs. Target 1765. Buy following channel and central line,

Buy Bata at present levels for targets 1853 and 1906.

Jubilant Foods, Trade the bullish channel. It is near the top range, breakout is possible too. Buy 1870 - 75, Target 1921. Sloss 1818.

Buy the dips towards 515-518, for targets 537 - 550 - 564. S.Loss 503/-

12105-12146-12207 are major resistance levels, while 12040-11980-11932 are expected to act as major support levels. Nifty structure, global markets are indicating downward bias. Open Interest data, Option Chain and PCR indicate uptrend though.

SELL Below 1885 for targets 1847-1780. Stop Loss 1932 (short term / intraday) Stop Loss 1975 (positional) OTM calls exceeding above 1950 can be sold too, safe traders can buy Put if strike around 1850.

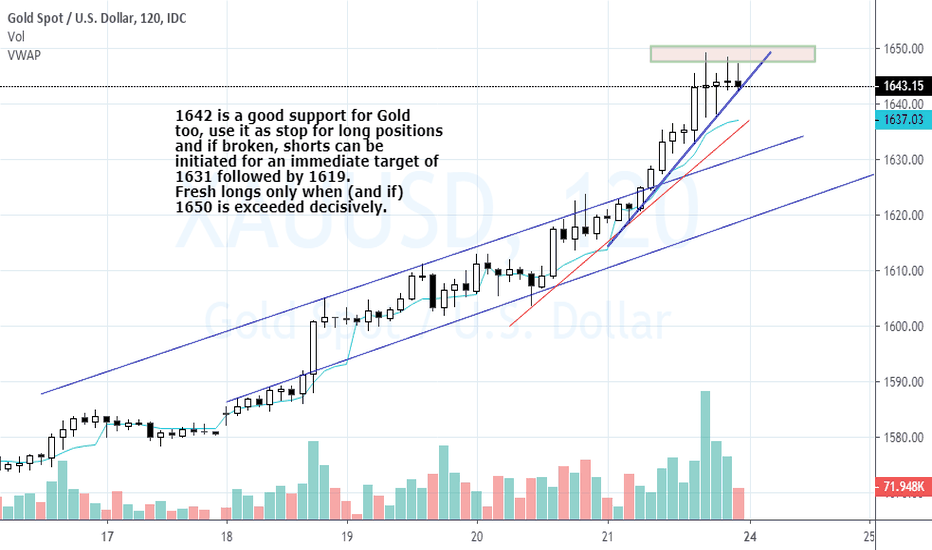

Gold or xauusd is moving in a bullish channel on weekly charts. Friday's top has touched this very line and closed a couple of dollars lower. Breakouts on weekly channels are not seen very often, a cautious approach is a must at these levels. I would wait for more SELL signals on other indicators before going short, 4-5 $ above the trendline will be the...

1642 is a good support for Gold too, use it as stop for long positions and if broken, shorts can be initiated for an immediate target of 1631 followed by 1619. 1650 can be used as stop. 1642's rupee equivalent would be 42300-350 level. Fresh longs only when (and if) 1650 is exceeded decisively.

It is wise to focus on quality midcap stocks , than the broader index. The Thursday correction has not impacted this index much, strong uptrend is intact.

Smart recovery from important Try to buy on dips, 1850-1870, with a S.loss of 1820. Target : 1945-1985-2000+

Sell at high with a stop loss of 633, for targets 568 - 552 - 508 - 492.

USD looking good, following major supporting trend lines. 72.10 - 72.4 can be expected going forward. 71.46 should be used as Stop.

PVR is consolidating outside am important resistance line, possibility of a breakout. Buy above 2114 with a stop loss of 2105, if 2105 is breached, short for a target of 2084-2061.

Voltas has moved out of a channel, two days back. Wait for a dip to 720-25 levels, buy for medium term - s.loss 700.

Granules closed at top line of a very interesting pattern. Once it breaches this pattern, it can move up faster. Something similar to what Gold and silver did yesterday, look at the charts I've shared yesterday. Buy above 188 and if you take it as a short term trading position keep a stop loss of 180. Otherwise, this is a good portfolio buy, one can hold it...

Gold has been in uptrend for some time, It has broken a major trendline some time back. Its recent high or 1610 USD or 41300 Rs. is likely to be exceeded soon.

Silver and gold have been running in positive territory for past one week, it gave a trendline breakout some time back. Uptrend can be expected as long as Coronavirus worries are impacting markets.