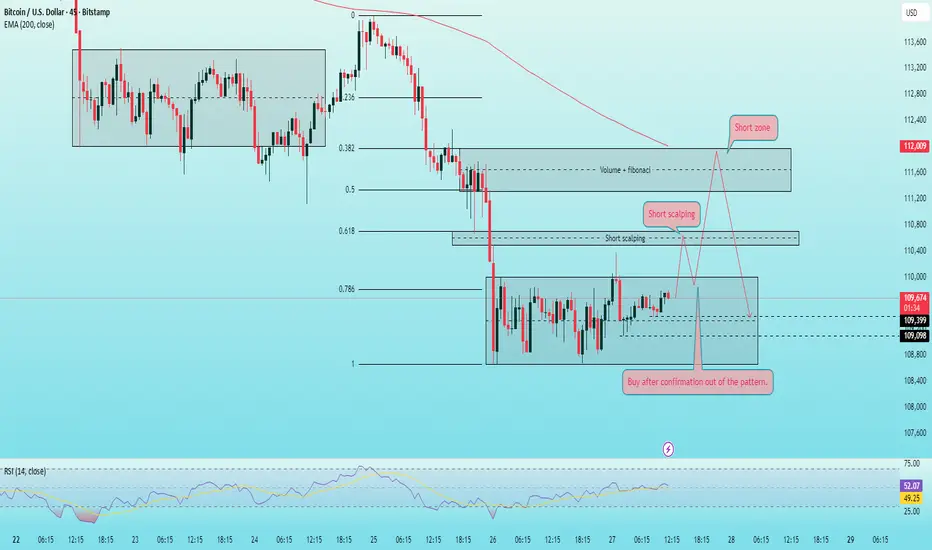

Technical Outlook

On the 45m chart, BTC has been consolidating in a rectangular range, showing a phase of accumulation before the next breakout. A decisive move outside this zone will confirm the short-term trend direction.

Recent lows suggest selling pressure is not very strong, increasing the probability of a rebound.

Still, we cannot rule out a fake downside move to sweep liquidity before resuming higher.

Around 110,000 remains a key level to look for long opportunities, but only after a confirmed breakout.

On the other side, 110,700 and 111,900 are potential short entry zones, aligning with Fibonacci retracement and Volume Profile resistance areas.

The RSI (14) is hovering around 52, reflecting a neutral momentum – another signal that we need a breakout confirmation before positioning strongly.

Trade Scenarios

Long: wait for a confirmed breakout, entry near 110,000, SL below the nearest swing low.

Short: around 110,700 and 111,900, SL ~400 points.

📌 Hopefully this setup helps you plan better trades. I usually share real-time signals in my private community so members can track the market more closely.

Free 🚀 XAUUSD Signals: 10/Day

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+PD74zGVOoWswMWQ1

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+PD74zGVOoWswMWQ1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free 🚀 XAUUSD Signals: 10/Day

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+PD74zGVOoWswMWQ1

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+PD74zGVOoWswMWQ1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.