🧠 COPPER — The Sleeping Giant Ready for a Supercycle 🌍⚡

Copper, the “metal of electrification,” is setting up for one of the biggest macro-bull markets we’ve ever seen. From EVs to renewable grids to AI data-center power demand, copper is literally the blood of the new industrial era. Let’s break it down step-by-step 👇

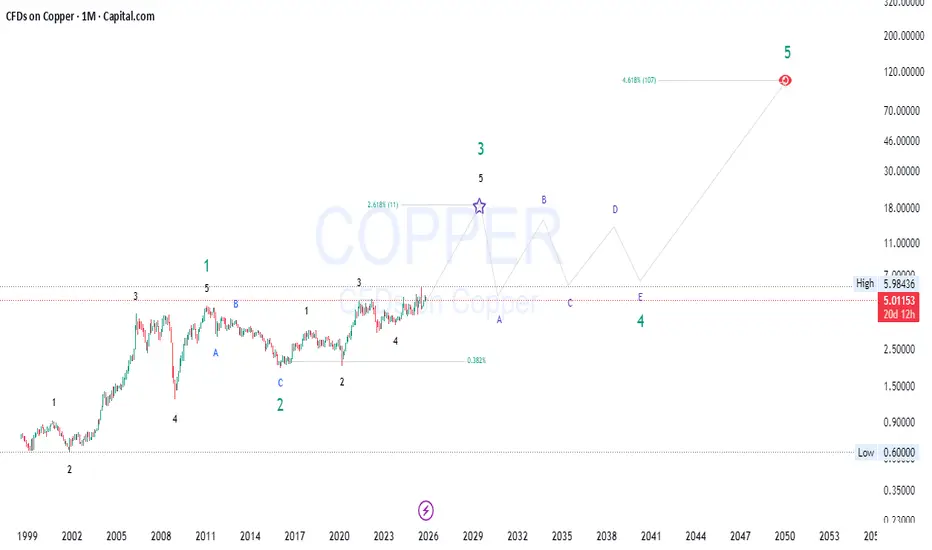

🔮 Wave Theory Confluence (Elliott + Fibonacci Extensions)

Zooming out to the monthly timeframe, we can clearly see Copper finishing its Wave 3 within a long-term 5-wave impulsive supercycle.

This aligns perfectly with historical commodity supercycles—massive runs followed by decades of consolidation before exponential growth again.

🧩 Smart Money Concepts (SMC) – Liquidity & Institutional Order Flow

Smart Money has been quietly accumulating since 2016 👀

Expect Wyckoff-style reaccumulation as price coils between $4–$6 before the breakout into the next expansion leg 🚀

🧭 Price Action & Market Structure

This PA structure mirrors textbook “smart accumulation > markup > distribution > reaccumulation” phases seen in previous copper supercycles.

💹 Fundamentals: The Perfect Storm

All fundamentals point to structural deficits by 2026-2030, aligning perfectly with Wave 3’s macro push.

🧮 Fibonacci Confluence & Cycle Timing

The time cycle between major waves (≈10–12 years) also aligns with commodity supercycles, putting Wave 5’s blow-off top around 2045-2050.

🔔 Conclusion: The Long Game

Copper isn’t just a trade — it’s a multi-decade macro opportunity.

While short-term volatility (Wave 4) will shake weak hands, the structural setup screams “supercycle incoming.”

🟢 Bias: Long-term bullish

🕰 Accumulation Zone: $4–$5

🎯 Targets:

⚡ “Commodities move slow… until they don’t.”

The smart money has already positioned. The rest will chase the breakout. Don’t be the last one in.

#Copper #ElliottWave #SmartMoneyConcepts #Commodities #MacroCycle #PriceAction #Fibonacci #TradingView #Investing #Metals

Copper, the “metal of electrification,” is setting up for one of the biggest macro-bull markets we’ve ever seen. From EVs to renewable grids to AI data-center power demand, copper is literally the blood of the new industrial era. Let’s break it down step-by-step 👇

🔮 Wave Theory Confluence (Elliott + Fibonacci Extensions)

Zooming out to the monthly timeframe, we can clearly see Copper finishing its Wave 3 within a long-term 5-wave impulsive supercycle.

- ✅ Wave 1 (2001-2008) fueled by China’s infrastructure boom.

- ✅ Wave 2 (2008-2016) a deep corrective phase, classic ABC zigzag.

- ⚡ Wave 3 (2016-2026) now unfolding with a 2.618 Fibonacci extension, targeting around $10–11 levels per pound by the late 2020s.

- 📉 After that, expect a macro Wave 4 correction—likely a complex ABCDE structure—before the final parabolic Wave 5 projection toward $100+ in the 2040s according to long-term fib confluence (4.618x extension).

This aligns perfectly with historical commodity supercycles—massive runs followed by decades of consolidation before exponential growth again.

🧩 Smart Money Concepts (SMC) – Liquidity & Institutional Order Flow

Smart Money has been quietly accumulating since 2016 👀

- Liquidity grab below the 2020 lows cleaned out retail longs, allowing institutions to build heavy long positions.

- The current structure shows higher highs (HHs) and higher lows (HLs) — the signature of a bullish market structure shift.

- Premium/Discount zones show Copper still trading in the discount range of the macro leg (below the 50% equilibrium), suggesting Smart Money accumulation continues.

Expect Wyckoff-style reaccumulation as price coils between $4–$6 before the breakout into the next expansion leg 🚀

🧭 Price Action & Market Structure

- Monthly BOS (Break of Structure) confirmed above $5, flipping long-term market structure bullish.

- Demand zones at $4.0–$4.5 act as strong re-entry levels.

- Liquidity pools above the $6 level (previous highs) likely to be taken out as price seeks expansion to the Wave 3 target zone.

- Look for a final shakeout into Wave 4 later in the decade before the next true parabolic move.

This PA structure mirrors textbook “smart accumulation > markup > distribution > reaccumulation” phases seen in previous copper supercycles.

💹 Fundamentals: The Perfect Storm

- ⚙️ Electrification Boom – Copper is the backbone of EVs, renewable grids, AI data centers, and defense manufacturing.

- 🔋 Supply Constraints – Global mine production growth slowing while demand from green tech surges.

- 🌎 Geopolitical Tensions – Supply concentration in Chile, Peru, and DRC adds a geopolitical risk premium.

- 💰 Inflation Hedge – Commodities entering a reflation cycle as central banks pivot back to stimulus.

All fundamentals point to structural deficits by 2026-2030, aligning perfectly with Wave 3’s macro push.

🧮 Fibonacci Confluence & Cycle Timing

- Wave 3 projection: 2.618 × Wave 1 = ~$10.7

- Wave 4 retracement: likely 0.382 fib (~$6–$7 zone)

- Wave 5 extension: 4.618 × Wave 1 = $100+

The time cycle between major waves (≈10–12 years) also aligns with commodity supercycles, putting Wave 5’s blow-off top around 2045-2050.

🔔 Conclusion: The Long Game

Copper isn’t just a trade — it’s a multi-decade macro opportunity.

While short-term volatility (Wave 4) will shake weak hands, the structural setup screams “supercycle incoming.”

🟢 Bias: Long-term bullish

🕰 Accumulation Zone: $4–$5

🎯 Targets:

- Mid-term (2026-2028): $10–11

- Long-term (2040s): $100+

⚡ “Commodities move slow… until they don’t.”

The smart money has already positioned. The rest will chase the breakout. Don’t be the last one in.

#Copper #ElliottWave #SmartMoneyConcepts #Commodities #MacroCycle #PriceAction #Fibonacci #TradingView #Investing #Metals

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.