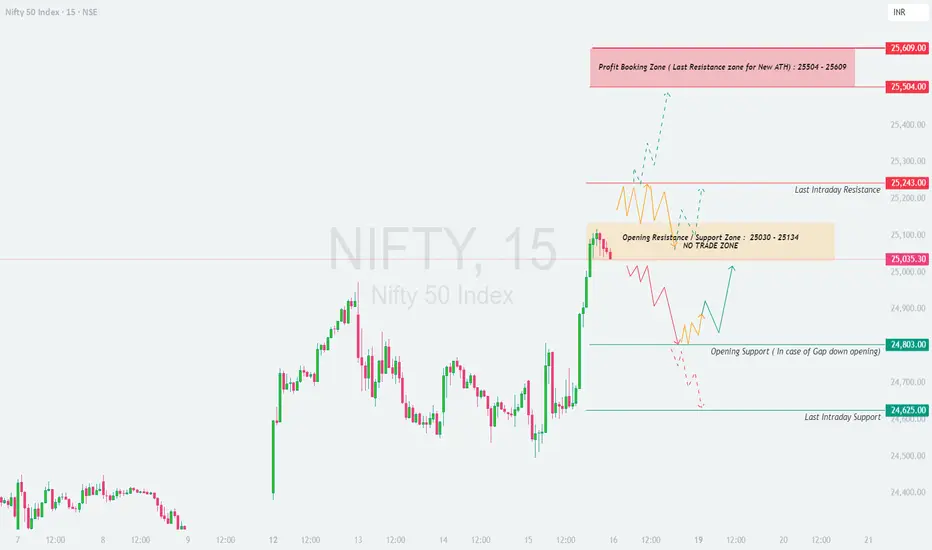

📘 NIFTY TRADING PLAN – 16th May 2025 (15-Min Structure Based)

📍 Nifty closed at 25,035.30 on 15-May-2025. Price is currently hovering around the Opening Resistance/Support Zone (25,030 – 25,134), which has been marked as a No Trade Zone due to potential whipsaws and lack of clear direction.

As per your rule, a Gap Opening is considered ±100 points or more from the previous close.

Let’s break down the strategy into three possible opening scenarios:

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,135)

(Gap-up of 100+ points)

📍 Nifty closed at 25,035.30 on 15-May-2025. Price is currently hovering around the Opening Resistance/Support Zone (25,030 – 25,134), which has been marked as a No Trade Zone due to potential whipsaws and lack of clear direction.

As per your rule, a Gap Opening is considered ±100 points or more from the previous close.

Let’s break down the strategy into three possible opening scenarios:

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,135)

(Gap-up of 100+ points)

- []If Nifty opens above 25,135, it will start trading near the Last Intraday Resistance zone at 25,243. This zone may act as a strong supply area initially.

[]Price action near 25,243 must be closely watched. If there’s rejection or failure to sustain, a quick pullback toward 25,134 – 25,030 is possible.

[]However, if Nifty shows strength and sustains above 25,243 on 15-min closing basis with bullish structure, fresh long entries can be considered.

[]Upside targets will be 25,504 and potentially 25,609, which is the Profit Booking / Last Resistance zone for a New All-Time High. - Risk increases if you chase long trades right at open without confirmation candles.

👉 📚 Tip: Prefer a breakout-retest strategy above 25,243 for cleaner long trades. Avoid buying at peak unless there’s strong momentum confirmation.

📊 SCENARIO 2: FLAT OPENING (Between 25,030 – 25,134)

(Flat to minor gap opening)- []This zone is marked as the Opening Resistance/Support Zone (25,030 – 25,134) and is a NO TRADE ZONE due to the likelihood of choppy moves and indecision.

[]Wait for a directional break — either above 25,243 for bullish trades or below 25,030 to consider bearish setups.

[]If price consolidates within this zone during the first 30 minutes, it’s best to stay patient and avoid noise trades.

[]A 15-min candle closing below 25,030 could trigger shorting opportunities with targets at 24,803 and then 24,625. - Above 25,134, longs should only be taken after a 15-min close above 25,243 to avoid being trapped.

👉 📚 Tip: This zone is not ideal for option buying as theta decay will hurt both sides. Let the direction become clear before entering.

🔻 SCENARIO 3: GAP-DOWN OPENING (Below 24,935)

(Gap-down of 100+ points)- []A gap-down below 24,935 pushes Nifty closer to Opening Support zone at 24,803, which has the potential to act as a bounce area.

[]If price bounces from 24,803 with a bullish 15-min candle, a quick recovery toward 25,030 can be expected.

[]However, if Nifty breaks below 24,803 decisively with volume and a follow-up 15-min candle close, further downside may continue toward 24,625 (Last Intraday Support).

[]This zone may provide scalping opportunities on both sides but demands high discipline and tight SLs. - Aggressive traders may also look for PE buying or bear put spreads below 24,803, targeting 24,625 and potentially further if global cues support weakness.

👉 📚 Tip: Watch for volume and structure at 24,803 — it's a decision point. If it cracks, ride the trend but be cautious near 24,625 as it may trigger a short-covering bounce.

🛡️ RISK MANAGEMENT & OPTIONS TRADING TIPS:- []⏰ Avoid trading within the first 15 minutes post-market open unless a clean breakout/breakdown is visible.

[]⚖️ Never trade both sides at once — choose the direction based on price structure and stick with it.

[]💼 Use ATM or ITM options to minimize theta impact during intraday trades.

[]📉 If the market consolidates, avoid buying options. Use spreads (Bull Call / Bear Put) or wait for V-shaped moves.

[]🔄 Exit OTM options by 2:45 PM unless holding momentum trades.

[]📊 Keep SL on candle close basis (15-min preferred) and don’t average your loss-making trades.

👉 💡 Bonus Tip: For momentum confirmation, look for confluence of volume spike + candle body closing beyond marked zone.

📌 SUMMARY & CONCLUSION:

🔸 Bullish Breakout Trigger: 25,243 → Targets: 25,504 / 25,609

🔸 Bearish Breakdown Trigger: Below 25,030 → Targets: 24,803 / 24,625

🔸 Flat Zone: 25,030 – 25,134 → Avoid trading until a clear breakout or breakdown

🔸 Critical Supports: 24,803 (Gap-down cushion), 24,625 (last support zone)

🔸 Risk Focus: Wait for structure confirmation, don’t get trapped in emotional trades

📈 Nifty is currently poised near a decision zone. A clean breakout or breakdown can set the tone for the day, but avoid premature entries in the No Trade Zone. Let price confirm its intent, and then follow with disciplined execution.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. This trading plan is shared strictly for educational and informational purposes only. Please conduct your own analysis or consult a registered advisor before initiating any trade. Trading carries risks – protect your capital at all times.

- []⏰ Avoid trading within the first 15 minutes post-market open unless a clean breakout/breakdown is visible.

- []A gap-down below 24,935 pushes Nifty closer to Opening Support zone at 24,803, which has the potential to act as a bounce area.

- []This zone is marked as the Opening Resistance/Support Zone (25,030 – 25,134) and is a NO TRADE ZONE due to the likelihood of choppy moves and indecision.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.