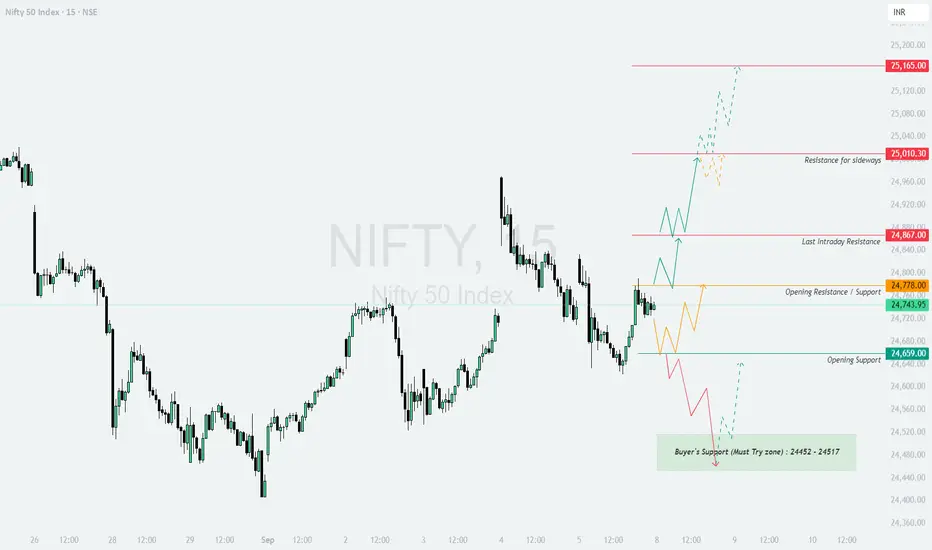

NIFTY TRADING PLAN – 08-Sep-2025

📌 Key Levels to Watch:

Resistance for sideways: 25,010

Major Resistance: 25,165

Last Intraday Resistance: 24,867

Opening Resistance / Support: 24,778

Opening Support: 24,659

Buyer’s Support (Must Try Zone): 24,452 – 24,517

The market is trading near an inflection zone. The price reaction at these levels will guide the intraday trend.

🔼 1. Gap-Up Opening (100+ points above 24,867)

If Nifty opens strongly above 24,867, bulls will attempt to extend gains towards higher resistances.

📌 Plan of Action:

👉 Educational Note: Gap-ups near major resistances require confirmation. Always wait for a retest or sustained move before entering long positions.

➖ 2. Flat Opening (Around 24,720 – 24,780)

A flat start near 24,743 – 24,778 indicates indecision, with equal chances for bulls and bears.

📌 Plan of Action:

👉 Educational Note: Flat openings provide clarity after the first 30 minutes. Observe how price reacts around the opening resistance/support zone before taking trades.

🔽 3. Gap-Down Opening (100+ points below 24,640)

If Nifty opens with weakness below 24,640, sellers will try to dominate.

📌 Plan of Action:

👉 Educational Note: Gap-downs often trigger panic selling. Instead of chasing the fall, wait for a retest of supports to catch a safer entry.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 24,867 → Bullish bias towards 25,010 & 25,165.

🟧 Flat Opening → Watch 24,778 for breakout; above bullish, below weak.

🔴 Below 24,640 → Weakness towards 24,517 & 24,452 buyer’s support zone.

⚠️ Critical Zone: 24,452 – 24,517 (Buyer’s Support). A rebound here is highly probable, but if broken, weakness can accelerate.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only and should not be considered as financial advice. Please consult your financial advisor before trading.

📌 Key Levels to Watch:

Resistance for sideways: 25,010

Major Resistance: 25,165

Last Intraday Resistance: 24,867

Opening Resistance / Support: 24,778

Opening Support: 24,659

Buyer’s Support (Must Try Zone): 24,452 – 24,517

The market is trading near an inflection zone. The price reaction at these levels will guide the intraday trend.

🔼 1. Gap-Up Opening (100+ points above 24,867)

If Nifty opens strongly above 24,867, bulls will attempt to extend gains towards higher resistances.

📌 Plan of Action:

- [] Sustaining above 24,867 will shift momentum towards 25,010.

[] A sideways consolidation can occur near 25,010, as it’s a critical resistance. - If Nifty manages to sustain above 25,010, the next big target is 25,165.

👉 Educational Note: Gap-ups near major resistances require confirmation. Always wait for a retest or sustained move before entering long positions.

➖ 2. Flat Opening (Around 24,720 – 24,780)

A flat start near 24,743 – 24,778 indicates indecision, with equal chances for bulls and bears.

📌 Plan of Action:

- [] If Nifty sustains above 24,778, it can push towards 24,867.

[] A breakout above 24,867 strengthens the bullish momentum towards 25,010. - Failure to hold above 24,743 can drag Nifty back to 24,659 (opening support).

👉 Educational Note: Flat openings provide clarity after the first 30 minutes. Observe how price reacts around the opening resistance/support zone before taking trades.

🔽 3. Gap-Down Opening (100+ points below 24,640)

If Nifty opens with weakness below 24,640, sellers will try to dominate.

📌 Plan of Action:

- [] Immediate test will be at 24,659; if broken, price may fall towards the buyer’s support zone 24,452 – 24,517.

[] A strong rebound is likely from this buyer’s support zone, as it is marked as a “must-try” level for bulls. - Sustaining below 24,452 will open deeper downside possibilities, turning the sentiment weak.

👉 Educational Note: Gap-downs often trigger panic selling. Instead of chasing the fall, wait for a retest of supports to catch a safer entry.

🛡️ Risk Management Tips for Options Traders

- [] Always define a stop-loss based on hourly close to avoid getting trapped in volatility.

[] Keep position sizing small (1–2% of capital) in uncertain zones.

[] For gap-up/gap-down days, prefer directional option buying only after confirmation.

[] Use hedged strategies (like spreads) if trading near major support/resistance zones. - Book partial profits at intermediate levels to lock in gains.

📌 Summary & Conclusion

🟢 Above 24,867 → Bullish bias towards 25,010 & 25,165.

🟧 Flat Opening → Watch 24,778 for breakout; above bullish, below weak.

🔴 Below 24,640 → Weakness towards 24,517 & 24,452 buyer’s support zone.

⚠️ Critical Zone: 24,452 – 24,517 (Buyer’s Support). A rebound here is highly probable, but if broken, weakness can accelerate.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only and should not be considered as financial advice. Please consult your financial advisor before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.