NIFTY TRADING PLAN – 03-Oct-2025

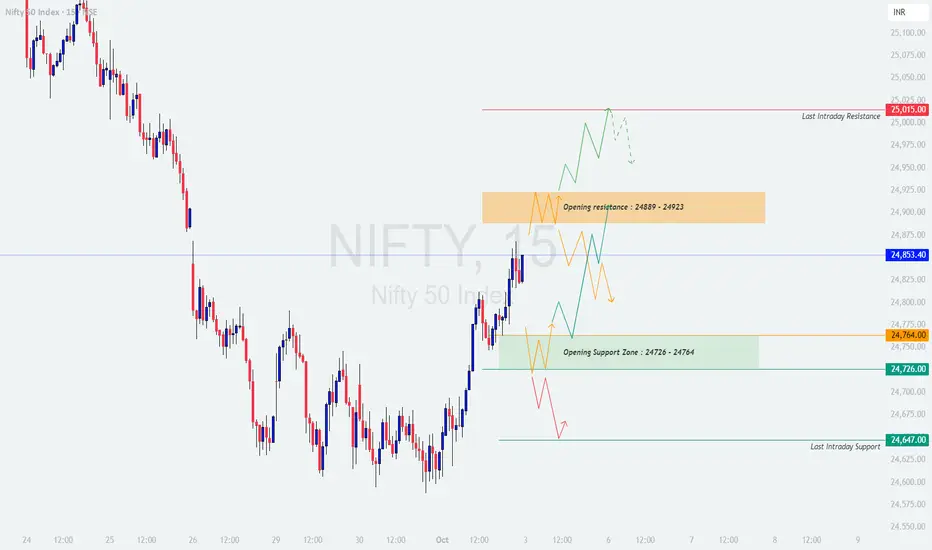

Nifty closed at 24,853.40, recovering from recent declines and now trading near crucial resistance and support zones. Tomorrow’s movement will largely depend on whether the index can break above 24,889 – 24,923 (Opening Resistance Zone) or hold below 24,726 – 24,764 (Opening Support Zone).

📌 Key Levels to Watch:

Opening Resistance Zone: 24,889 – 24,923

Last Intraday Resistance: 25,015

Opening Support Zone: 24,726 – 24,764

Last Intraday Support: 24,647

🚀 Scenario 1: Gap Up Opening (100+ points)

👉 Educational Note: Gap-up openings near resistance zones often trap impatient buyers. It is safer to wait for retests before committing capital.

⚖️ Scenario 2: Flat Opening (within ±100 points)

👉 Educational Note: Flat openings indicate market indecision. Traders should focus on range breakout opportunities rather than anticipating moves.

📉 Scenario 3: Gap Down Opening (100+ points)

👉 Educational Note: Gap-downs create panic. Disciplined traders wait for either breakdown confirmation or a sharp recovery signal to trade with better risk-reward.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

📊 Nifty is at a crucial juncture. Breakout above resistance can fuel bullish momentum, while breakdown below support may trigger renewed selling pressure. Traders should remain patient, disciplined, and trade only on confirmation of breakout/breakdown with volume.

⚠️ Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please do your own research or consult with a financial advisor before making trading decisions.

Nifty closed at 24,853.40, recovering from recent declines and now trading near crucial resistance and support zones. Tomorrow’s movement will largely depend on whether the index can break above 24,889 – 24,923 (Opening Resistance Zone) or hold below 24,726 – 24,764 (Opening Support Zone).

📌 Key Levels to Watch:

Opening Resistance Zone: 24,889 – 24,923

Last Intraday Resistance: 25,015

Opening Support Zone: 24,726 – 24,764

Last Intraday Support: 24,647

🚀 Scenario 1: Gap Up Opening (100+ points)

- [] If Nifty opens near or above 24,950 – 25,000, it will directly challenge the Last Intraday Resistance (25,015).

[] A sustained move above 25,015 could extend momentum towards 25,100+ levels, signaling strength.

[] However, if prices face rejection near 25,015, expect profit booking with pullback towards 24,900 – 24,850.

[] Traders should avoid chasing at higher openings and instead wait for confirmation of sustained breakout before entering fresh longs.

👉 Educational Note: Gap-up openings near resistance zones often trap impatient buyers. It is safer to wait for retests before committing capital.

⚖️ Scenario 2: Flat Opening (within ±100 points)

- [] A flat start near 24,800 – 24,850 will keep Nifty between its Opening Resistance Zone (24,889 – 24,923) and Opening Support Zone (24,726 – 24,764).

[] A decisive breakout above 24,923 may fuel momentum towards 25,015, with scope for extension to 25,100.

[] On the other hand, a breakdown below 24,726 could drag the index back to 24,647.

[] Expect sideways choppiness unless one side breaks decisively with volume confirmation.

👉 Educational Note: Flat openings indicate market indecision. Traders should focus on range breakout opportunities rather than anticipating moves.

📉 Scenario 3: Gap Down Opening (100+ points)

- [] If Nifty opens near 24,700 – 24,650, it will test the Opening Support Zone (24,726 – 24,764) and may even challenge the Last Intraday Support (24,647).

[] Breakdown below 24,647 could invite further weakness towards 24,550 – 24,500.

[] However, if the support zone holds, a rebound towards 24,800 – 24,850 is possible, triggering short covering.

[] Traders should wait for the first 15–30 mins to confirm whether supports sustain before taking trades.

👉 Educational Note: Gap-downs create panic. Disciplined traders wait for either breakdown confirmation or a sharp recovery signal to trade with better risk-reward.

🛡️ Risk Management Tips for Options Traders

- [] ⏳ Avoid trading aggressively in the first 15–30 minutes after opening.

[] 🛑 Always keep stop losses based on 15-min/hourly candle close.

[] 🎯 Use option spreads (Bull Call / Bear Put) to minimize premium decay risk.

[] 📉 Maintain a minimum 1:2 Risk-Reward ratio on every trade.

[] 💰 Book partial profits at key levels to protect gains.

[] 🧘 Never risk more than 2–3% of total capital on a single trade.

📌 Summary & Conclusion

- [] Bullish Bias: Above 24,923, targets 25,015 → 25,100.

[] Neutral Zone: Between 24,726 – 24,923, expect sideways consolidation. - Bearish Bias: Below 24,647, weakness towards 24,550 – 24,500 possible.

📊 Nifty is at a crucial juncture. Breakout above resistance can fuel bullish momentum, while breakdown below support may trigger renewed selling pressure. Traders should remain patient, disciplined, and trade only on confirmation of breakout/breakdown with volume.

⚠️ Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please do your own research or consult with a financial advisor before making trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.