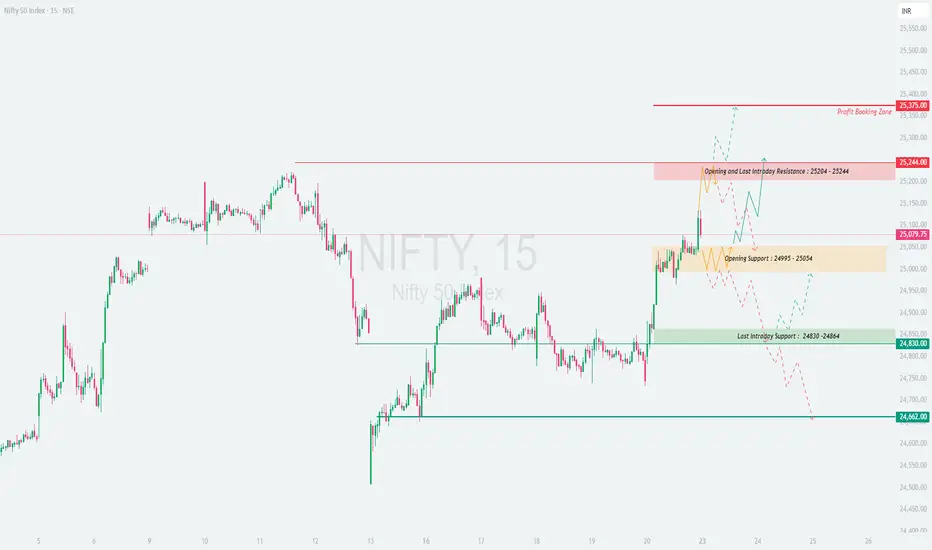

\📊 NIFTY TRADING PLAN – 21-Jun-2025\

📍 \Previous Close:\ 25,079.75

📏 \Gap Threshold:\ 100+ points

🕒 \Chart Reference:\ 15-minute timeframe

---

\

\[\*]\🚀 GAP-UP OPENING (Above 25,244):\

If Nifty opens above 25,244, it would break above the \Opening & Last Intraday Resistance zone (25,204 – 25,244)\, entering a profit-booking territory.

✅ \Plan of Action:\

• Wait for 15–30 minutes for confirmation candles.

• If sustained above 25,244, bullish continuation is likely toward the \Profit Booking Zone – 25,375+\.

• However, if the index shows rejection near 25,244, expect a retest of the previous resistance zone.

🎯 \Trade Setup:\

– Buy on a successful retest or breakout above 25,244

– Stop-loss: below 25,200

– Target: 25,350–25,375

📘 \Pro Tip:\ Avoid impulsive longs on big gap-ups. Let price digest the gap and give a clear entry.

\[\*]\📘 FLAT OPENING (Between 25,054 – 25,204):\

A flat opening places the index in a volatile consolidation zone between \Opening Support (24,995 – 25,054)\ and resistance.

✅ \Plan of Action:\

• Avoid trading inside the range of 25,054–25,204 due to fakeouts.

• Trade directional breakout from either side of this box:

– \Above 25,204\: Possible bullish breakout toward 25,350

– \Below 24,995\: Breakdown can push index to 24,864 or lower

🎯 \Trade Setup:\

– Buy above 25,204 or sell below 24,995 with confirmation

– Tight SL (20–30 pts) is necessary inside this choppy zone

📘 \Pro Tip:\ Avoid trading in the orange "Opening Support" zone unless a strong volume-based breakout or breakdown is seen.

\[\*]\📉 GAP-DOWN OPENING (Below 24,864):\

A gap-down opening below the \Last Intraday Support (24,864 – 24,830)\ signals early weakness in the market.

✅ \Plan of Action:\

• First support to watch: \24,662\

• If price bounces from 24,662 with strength, short-covering may lead to a test of 24,864

• A breakdown below 24,662 can open doors to 24,500–24,420 levels

🎯 \Trade Setup:\

– Short if price sustains below 24,830

– Stop-loss: above 24,880

– Buy only if sharp reversal seen at 24,662

📘 \Pro Tip:\ Avoid panic selling. Wait for price to stabilize post-gap down and then decide.

---

\🛡 RISK MANAGEMENT & OPTIONS TRADING TIPS:\

✅ \1. Never chase trades at market open – observe price structure first\

✅ \2. For gap-ups, prefer debit spreads instead of naked calls to limit risk\

✅ \3. Don’t hold OTM options during range-bound action – decay is rapid\

✅ \4. Trail profits – especially after a breakout move hits your first target\

✅ \5. Respect volatility – no trade is also a trade in indecision zones\

---

\📌 SUMMARY – LEVELS TO WATCH FOR 21-Jun-2025:\

• 🔴 \Resistance Zone:\ 25,204 – 25,244

• 🎯 \Profit Booking Zone:\ 25,375

• 🟠 \Opening Support Zone:\ 24,995 – 25,054

• 🟢 \Last Intraday Support:\ 24,864 – 24,830

• 🔻 \Breakdown Support:\ 24,662

💡 \Summary Recap:\

• 🔼 Above 25,244 = Bullish momentum resumes

• ⏸ Between 25,054–25,204 = Sideways chop, avoid trades

• 🔽 Below 24,864 = Watch for sell pressure and bounce from 24,662

---

\📢 DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is for educational and informational purposes only. Please consult your financial advisor before taking any market decisions. Trade safe and always manage your risk! ⚖️📉📈

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.