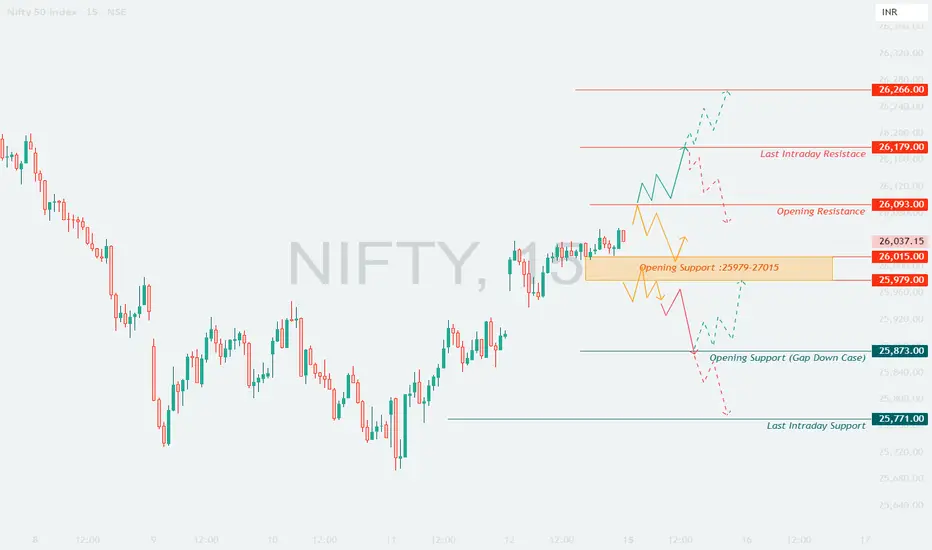

📊 NIFTY – TRADING PLAN FOR 15 DEC 2025

Nifty closed near 26,037, just above a key support band (Opening Support: 25,979–26,015) and below a series of overhead resistances.

The session will heavily depend on how price reacts at:

Opening Support Zone: 25,979 – 26,015

Opening Resistance: 26,093

Last Intraday Resistance: 26,179

Major Upside Target: 26,266

Opening Support (Gap-down case): 25,873

Last Intraday Support: 25,771

Let’s break down every opening scenario.

🚀 1. GAP–UP OPENING (100+ points)

A gap-up above 26,130–26,150 shows strong bullish intent.

⚖ 2. FLAT OPENING (near 25,980–26,030)

A flat open near support allows clearer early structure.

📉 3. GAP–DOWN OPENING (100+ points)

Expected gap-down region: 25,930–25,850.

🛡 RISK MANAGEMENT GUIDELINES FOR OPTIONS TRADERS

📌 SUMMARY & CONCLUSION

• Bullish bias only above 26,093, with confirmation above 26,179.

• Upside target zone: up to 26,266.

• Neutral/choppy zone: 25,979–26,093. Confirm structure before entering.

• Downside risk: Below 25,979, real weakness begins.

• Major supports for reversal: 25,873 and 25,771.

Stay patient, avoid emotional trades, and trade only on confirmation.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This trading plan is for educational purposes only and should not be treated as investment advice.

Always conduct your own analysis and follow strict risk management.

Nifty closed near 26,037, just above a key support band (Opening Support: 25,979–26,015) and below a series of overhead resistances.

The session will heavily depend on how price reacts at:

Opening Support Zone: 25,979 – 26,015

Opening Resistance: 26,093

Last Intraday Resistance: 26,179

Major Upside Target: 26,266

Opening Support (Gap-down case): 25,873

Last Intraday Support: 25,771

Let’s break down every opening scenario.

🚀 1. GAP–UP OPENING (100+ points)

A gap-up above 26,130–26,150 shows strong bullish intent.

1. If Nifty opens above 26,093 but below 26,179

• Market opens directly inside resistance.

• Do NOT chase long immediately.

• Wait for either:

– Breakout above 26,179, followed by retest → Long toward 26,266.

– Rejection at 26,179, falling back under 26,093 → Short toward 26,015.

2. If Nifty opens above 26,179

• Strong bullish continuation.

• On a retest of 26,179, a long becomes high-probability.

• Targets: 26,220 → 26,266.

• Book partial profits in the final target zone.

3. If gap-up is between 26,015–26,093

• Price opens slightly above support and may retest the zone.

• If 26,015–25,979 holds → Long toward 26,093 → 26,179.

• If 26,015 breaks with momentum, move to caution; market becomes vulnerable to deeper pullbacks.

⚖ 2. FLAT OPENING (near 25,980–26,030)

A flat open near support allows clearer early structure.

1. If 25,979–26,015 holds as strong support

• Watch for bullish rejection candles or higher lows.

• Long setups valid toward 26,093 → 26,179.

2. Break above 26,093 with a retest

• Confirms directional strength.

• Target becomes 26,179 → 26,266.

3. If price rejects 26,093 early and falls back

• Sideways consolidation may form inside the orange zone.

• Only short when 25,979 breaks convincingly.

• Downside targets: 25,873 → 25,771.

📉 3. GAP–DOWN OPENING (100+ points)

Expected gap-down region: 25,930–25,850.

1. If opening is near 25,873 (Gap-down Support)

• Avoid shorting blindly; it’s a strong demand zone.

• Look for reversal patterns (wick rejections, CHoCH).

• If confirmed → Long toward 25,979 → 26,015.

2. If opening falls below 25,873

• Market enters weak territory.

• Next support is 25,771 (Last Intraday Support).

• A retest of 25,873 after breakdown → Short toward 25,771.

3. If 25,771 also breaks

• Trend turns bearish for the session.

• Expect extended downside movement; avoid bottom fishing.

• Trail SL aggressively if short.

🛡 RISK MANAGEMENT GUIDELINES FOR OPTIONS TRADERS

1. Avoid trading first 3–5 minutes, especially on gap days (IV distortion).

2. Keep SL based on spot levels, not premium fluctuation alone.

3. Prefer ATM/ITM options for directional trades — better risk control.

4. Do NOT average losing positions — cut losers quickly.

5. Avoid deep OTM options unless using them for hedging.

6. Book partial profits at intermediate levels to lock in gains.

7. If VIX rises sharply → favor option selling with hedges.

8. Maximum daily loss limit = 1–2% of capital. Stop trading once hit.

📌 SUMMARY & CONCLUSION

• Bullish bias only above 26,093, with confirmation above 26,179.

• Upside target zone: up to 26,266.

• Neutral/choppy zone: 25,979–26,093. Confirm structure before entering.

• Downside risk: Below 25,979, real weakness begins.

• Major supports for reversal: 25,873 and 25,771.

Stay patient, avoid emotional trades, and trade only on confirmation.

⚠ DISCLAIMER

I am not a SEBI-registered analyst.

This trading plan is for educational purposes only and should not be treated as investment advice.

Always conduct your own analysis and follow strict risk management.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.