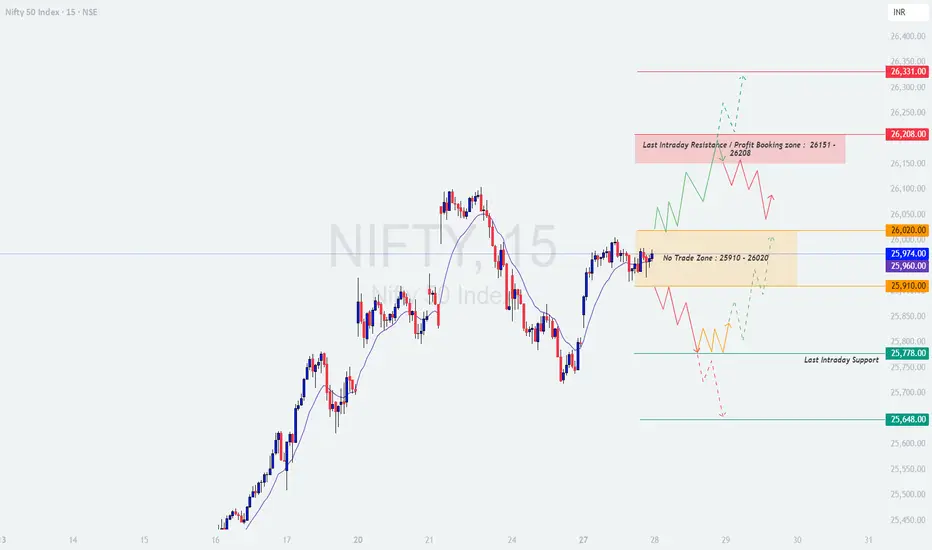

NIFTY TRADING PLAN – 28-Oct-2025

📊 Nifty closed around 25,974, hovering within the No Trade Zone (25,910 – 26,020) after a choppy session. The index is showing signs of indecision as buyers defend lower supports near 25,778, while sellers remain active near the upper resistance zone around 26,151 – 26,208. Tomorrow’s move will largely depend on the opening tone and how prices react to the key levels outlined below.

🟩 SCENARIO 1: GAP-UP OPENING (100+ Points Above 26,020)

If Nifty opens above 26,020, it will immediately enter the Last Intraday Resistance / Profit Booking Zone (26,151 – 26,208).

🧠 Educational Insight:

Gap-ups often reflect overnight optimism, but smart traders wait for confirmation candles before chasing prices. The first 15–30 minutes are crucial to determine if the opening gap will sustain or fade.

⚙️ Plan of Action:

→ Let the first candle close; if Nifty holds above 26,151, long entries can be considered with targets toward 26,331 and stop-loss below 26,020.

🟨 SCENARIO 2: FLAT OPENING (Between 25,910 – 26,020)

A flat start within the No Trade Zone may lead to range-bound and confusing price action early in the session.

🧠 Educational Insight:

When markets open flat within a “No Trade Zone,” patience is key. Many traders lose money trying to predict breakouts that never confirm. Let the price show strength before taking a stance.

⚙️ Plan of Action:

→ Wait for a decisive hourly close beyond 26,020 (for long) or below 25,910 (for short). Trade only post-confirmation with strict stop-loss rules.

🟥 SCENARIO 3: GAP-DOWN OPENING (100+ Points Below 25,910)

If Nifty opens below 25,910, it will shift short-term sentiment bearish, especially if opening occurs near 25,778 or below.

🧠 Educational Insight:

Gap-down openings often test traders’ emotions — avoid panic selling at open. Reversal candles around 25,778 can provide high R:R setups for quick intraday longs.

⚙️ Plan of Action:

→ Consider short positions below 25,778 with stop-loss above 25,910. For a safer play, wait for rejection candles near 25,910 before entering any directional trade.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📘 SUMMARY & CONCLUSION

🔹 The bias remains neutral within the range, but momentum can quickly shift beyond 26,020 or below 25,910.

🔹 Buy on dips near 25,778 if support holds, and sell on rises near 26,208 if rejection patterns appear.

🔹 Stay flexible — the trend confirmation will only emerge after a decisive breakout beyond the defined zones.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational and informational purposes. Please do your own research or consult a certified financial advisor before taking any trading decision.

📊 Nifty closed around 25,974, hovering within the No Trade Zone (25,910 – 26,020) after a choppy session. The index is showing signs of indecision as buyers defend lower supports near 25,778, while sellers remain active near the upper resistance zone around 26,151 – 26,208. Tomorrow’s move will largely depend on the opening tone and how prices react to the key levels outlined below.

🟩 SCENARIO 1: GAP-UP OPENING (100+ Points Above 26,020)

If Nifty opens above 26,020, it will immediately enter the Last Intraday Resistance / Profit Booking Zone (26,151 – 26,208).

- [] Watch for quick momentum toward 26,151 — this is a critical intraday level where profit booking can emerge.

[] Sustaining above 26,208 may trigger fresh long entries, extending the move toward 26,331.

[] Failure to hold above 26,151 could bring the index back to retest the 26,020 breakout level — a healthy pullback zone for intraday traders.

[] A sustained break below 26,020 will indicate a failed gap-up breakout, turning bias neutral to mildly bearish.

🧠 Educational Insight:

Gap-ups often reflect overnight optimism, but smart traders wait for confirmation candles before chasing prices. The first 15–30 minutes are crucial to determine if the opening gap will sustain or fade.

⚙️ Plan of Action:

→ Let the first candle close; if Nifty holds above 26,151, long entries can be considered with targets toward 26,331 and stop-loss below 26,020.

🟨 SCENARIO 2: FLAT OPENING (Between 25,910 – 26,020)

A flat start within the No Trade Zone may lead to range-bound and confusing price action early in the session.

- [] Bulls need a clean breakout above 26,020 to shift momentum back toward 26,151 – 26,208.

[] Bears will regain short-term control if prices slip below 25,910, potentially driving the index toward 25,778. - Avoid trading within this zone as whipsaws are likely due to equal buying and selling pressure.

🧠 Educational Insight:

When markets open flat within a “No Trade Zone,” patience is key. Many traders lose money trying to predict breakouts that never confirm. Let the price show strength before taking a stance.

⚙️ Plan of Action:

→ Wait for a decisive hourly close beyond 26,020 (for long) or below 25,910 (for short). Trade only post-confirmation with strict stop-loss rules.

🟥 SCENARIO 3: GAP-DOWN OPENING (100+ Points Below 25,910)

If Nifty opens below 25,910, it will shift short-term sentiment bearish, especially if opening occurs near 25,778 or below.

- [] The first support zone lies around 25,778 — expect a possible technical bounce here.

[] If this support fails, the next target for sellers will be 25,648, where a temporary base could form. - Only a recovery and sustained close above 25,910 would negate the bearish pressure.

🧠 Educational Insight:

Gap-down openings often test traders’ emotions — avoid panic selling at open. Reversal candles around 25,778 can provide high R:R setups for quick intraday longs.

⚙️ Plan of Action:

→ Consider short positions below 25,778 with stop-loss above 25,910. For a safer play, wait for rejection candles near 25,910 before entering any directional trade.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

- [] Avoid entering during the first 15–30 minutes after market opens — let volatility settle.

[] Always define your stop-loss — never risk more than 1–2% of total capital in a single trade.

[] Prefer deep ITM options for directional plays to reduce time decay.

[] Avoid trading when price remains in the “No Trade Zone”; capital preservation is priority. - Trail profits dynamically — once your trade achieves 1:1 R:R, secure partial gains.

📘 SUMMARY & CONCLUSION

- [] Key Resistance Levels: 26,020 → 26,151 → 26,208 → 26,331

[] Key Support Levels: 25,910 → 25,778 → 25,648 - No Trade Zone: 25,910 – 26,020

🔹 The bias remains neutral within the range, but momentum can quickly shift beyond 26,020 or below 25,910.

🔹 Buy on dips near 25,778 if support holds, and sell on rises near 26,208 if rejection patterns appear.

🔹 Stay flexible — the trend confirmation will only emerge after a decisive breakout beyond the defined zones.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational and informational purposes. Please do your own research or consult a certified financial advisor before taking any trading decision.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.