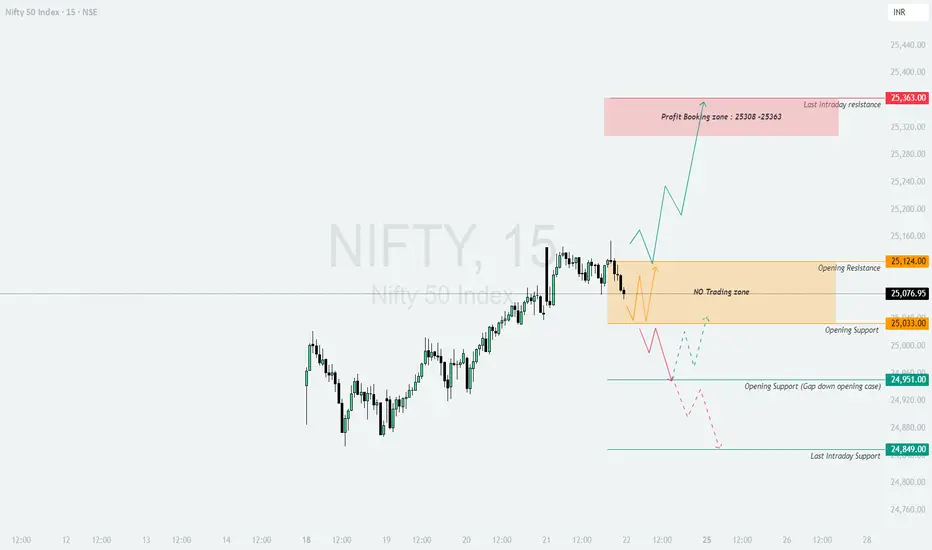

📌 Nifty Trading Plan for 22-Aug-2025

Key Levels from Chart:

Opening Resistance → 25,124

Opening Support → 25,033

Profit Booking Zone (Last Intraday Resistance) → 25,308 – 25,363

Opening Support in Gap Down Case → 24,951

Last Intraday Support → 24,849

Previous Close → 25,076.95

🚀 Scenario 1: Gap Up Opening (100+ points above previous close)

If Nifty opens above 25,175+, bullish sentiment will dominate the early session.

💡 Plan of Action: Look for long trades above 25,124 with confirmation, targeting 25,308–25,363. Trail stop-loss below 25,033. Book partials at resistance and avoid fresh longs if market looks tired near highs.

📊 Scenario 2: Flat Opening (within ±50–80 points of 25,077)

Flat openings often cause range-bound moves until a breakout.

💡 Plan of Action: Stay patient. Go long only above 25,124 or short below 25,033. Inside range, avoid overtrading and save capital for directional clarity.

⚠️ Scenario 3: Gap Down Opening (100+ points below previous close)

If Nifty opens near 24,950 or below, sellers will dominate.

💡 Plan of Action: Go short only if 24,951 breaks with volume, keeping stop-loss above 25,033. For scalpers, a bounce from 24,951 can be used for quick longs with strict SL.

📌 Risk Management Tips for Options Traders 💡

📝 Summary & Conclusion

Above 25,124, momentum can extend toward 25,308 – 25,363, where profit booking is expected 🚀.

Between 25,033 – 25,124, market is in a No Trading Zone ⚖️. Avoid traps.

Below 25,033, weakness toward 24,951, and if broken → 24,849 ⚠️.

👉 The day will be highly level-driven, and patience is key. Trade only at breakouts/breakdowns for clear setups.

⚠️ Disclaimer

I am not a SEBI registered analyst. This analysis is purely for educational purposes. Please consult your financial advisor before making any trading or investment decision.

Key Levels from Chart:

Opening Resistance → 25,124

Opening Support → 25,033

Profit Booking Zone (Last Intraday Resistance) → 25,308 – 25,363

Opening Support in Gap Down Case → 24,951

Last Intraday Support → 24,849

Previous Close → 25,076.95

🚀 Scenario 1: Gap Up Opening (100+ points above previous close)

If Nifty opens above 25,175+, bullish sentiment will dominate the early session.

- [] Immediate hurdle is 25,308 – 25,363 (Profit Booking Zone). Traders should expect selling pressure here as short-term players may book gains.

[] Sustaining above 25,363 can extend momentum further, but risk-reward weakens for fresh longs. - If rejection happens from 25,308–25,363, index could retest 25,124 support.

💡 Plan of Action: Look for long trades above 25,124 with confirmation, targeting 25,308–25,363. Trail stop-loss below 25,033. Book partials at resistance and avoid fresh longs if market looks tired near highs.

📊 Scenario 2: Flat Opening (within ±50–80 points of 25,077)

Flat openings often cause range-bound moves until a breakout.

- [] Price between 25,033 – 25,124 is a No Trading Zone. Avoid entering inside this range to prevent whipsaws.

[] Breakout above 25,124 can trigger a rally toward 25,308 – 25,363 zone. - Breakdown below 25,033 opens weakness toward 24,951.

💡 Plan of Action: Stay patient. Go long only above 25,124 or short below 25,033. Inside range, avoid overtrading and save capital for directional clarity.

⚠️ Scenario 3: Gap Down Opening (100+ points below previous close)

If Nifty opens near 24,950 or below, sellers will dominate.

- [] Support at 24,951 may attract intraday buying or short-covering bounce toward 25,033.

[] If 24,951 breaks decisively, expect further downside toward 24,849 (Last Intraday Support). - Failure to sustain below 24,951 can trap shorts, leading to a recovery back to 25,124 resistance zone.

💡 Plan of Action: Go short only if 24,951 breaks with volume, keeping stop-loss above 25,033. For scalpers, a bounce from 24,951 can be used for quick longs with strict SL.

📌 Risk Management Tips for Options Traders 💡

- [] Never chase option premiums after a big gap — premiums are inflated, wait for retracements.

[] Stick to defined-risk strategies (spreads, butterflies) instead of naked buying.

[] Always use stop-loss on options since time decay works against buyers.

[] Avoid over-leveraging — allocate not more than 2–3% capital per trade. - Book partial profits near key levels 🎯 and trail the rest.

📝 Summary & Conclusion

Above 25,124, momentum can extend toward 25,308 – 25,363, where profit booking is expected 🚀.

Between 25,033 – 25,124, market is in a No Trading Zone ⚖️. Avoid traps.

Below 25,033, weakness toward 24,951, and if broken → 24,849 ⚠️.

👉 The day will be highly level-driven, and patience is key. Trade only at breakouts/breakdowns for clear setups.

⚠️ Disclaimer

I am not a SEBI registered analyst. This analysis is purely for educational purposes. Please consult your financial advisor before making any trading or investment decision.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.