🔹 Intro / Overview

____________________________________________________________

📖 How to Identify

____________________________________________________________

📖 Key Points of Pattern

____________________________________________________________

🎯 Trading Plan (Educational Only)

____________________________________________________________

📊 Chart Explanation

____________________________________________________________

👀 Observations

____________________________________________________________

❗ Why It Matters

____________________________________________________________

🎯 Conclusion

____________________________________________________________

⚠️ Disclaimer

☕ The Cup and Handle is a 📈 bullish continuation pattern often studied in technical analysis.

⚔️ It forms when there is a fight between bulls 🐂 and bears 🐻 — the Cup develops as both remain strong.

📉 During the Handle, sellers 🛑 temporarily gain strength.

📈 But when price closes above the Validation Line, buyers regain control 💪 and bullish momentum dominates.

____________________________________________________________

📖 How to Identify

- ✅ Validation → The pattern is valid if price closes above the Validation Line.

- ❌ Devalidation → The pattern is invalid if price closes below the Devalidation Line(before Validation).

- 📉 Retracement Rule →The pattern is only confirmed if the price closes below the Retracement Line during the Handle formation.

- This ensures a proper pullback forms before breakout.

____________________________________________________________

📖 Key Points of Pattern

- ✅ A valid Cup requires the retracement condition — confirmation occurs only if price closes below the Retracement Line.

- ⚖️ Balanced Highs → Point A (left peak) and Point C (right peak) should be relatively close in price, ensuring a proper Cup shape 🍵.

- 🔒 The Handle must not break the structural integrity of the Cup.(No Close Below Devalidation Lines)

____________________________________________________________

🎯 Trading Plan (Educational Only)

- 📌 Entry → Considered only after confirmation when price closes above the Validation Line.

- 🛡️ Stop-Loss (SL) → After validation, the Devalidation Line may act as an SL.

- 🎯 Target (TP) →

- First Target → 1R (equal to the risk defined by Entry–SL distance).

- Remaining Lots → Trail using ATR, Fibonacci levels, Box Trailing, or structure-based stops.

____________________________________________________________

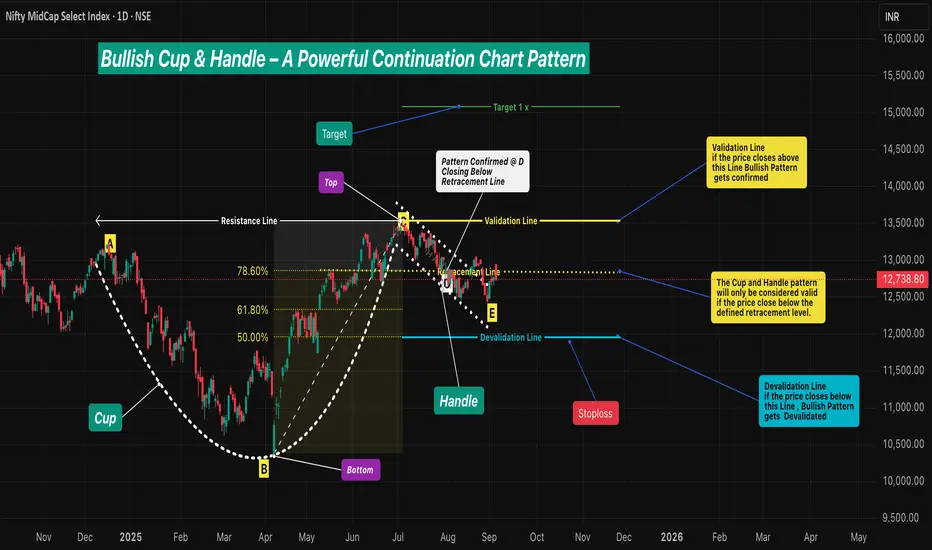

📊 Chart Explanation

- 🍵 The Cup forms with a rounded base Point B and two balanced tops: Point A (left peak) & Point C (right peak) - The marginal price difference should be small to ensure a reliable Cup.

- 📈 The Retracement Line (Point D) confirms the pattern only if price closes below the Fibonacci Level of 78.60% and above the 50.00% .

- 📉 The Handle develops as price pulls back, with Point E marking the Handle low. and Good Handle of Cup is Formed (this low should not go below 50.00% Level)

- 📏 The Fibonacci retracement levels are drawn from Point B (Cup base) to Point C (right peak). These levels provide a reference framework to observe Retracement (minimum 78.60%), Validation (100.00%), and Devalidation (50.00%) areas for educational study of the structure.

____________________________________________________________

👀 Observations

- ✨ Works best after a strong uptrend 🚀 or at major support–resistance zones 🧱.

- ⚖️ A balanced Cup (Top Right ≈ Top Left) improves reliability.

- 📏 Handle Formation

- The Handle should be shorter than the Cup depth — and should also be longer than the required minimum depth for proper structure.

- If the Handle is too deep, it weakens the setup — and also if it is too short, the formation loses reliability.

____________________________________________________________

❗ Why It Matters

- 🔍 Shows the market battle between buyers and sellers.

- 💪 Highlights how buyers regain dominance after retracement validation.

- ⚖️ Balanced structure + strict rules = better filtering of weak setups.

- 📝 Provides clarity on entry, SL, and TP with a structured framework.

____________________________________________________________

🎯 Conclusion

The Cup and Handle pattern, when validated through Fibonacci retracement rules 📉, balanced highs ⚖️, and proper Handle structure 🔒, offers a disciplined framework for studying bullish continuation setups.

🔥 Patterns don’t predict. Rules protect.

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.