📈 NZD/USD "THE KIWI" Forex Money Looting Plan (Swing/Day Trade) 🥝💵

🛠️ Plan Overview

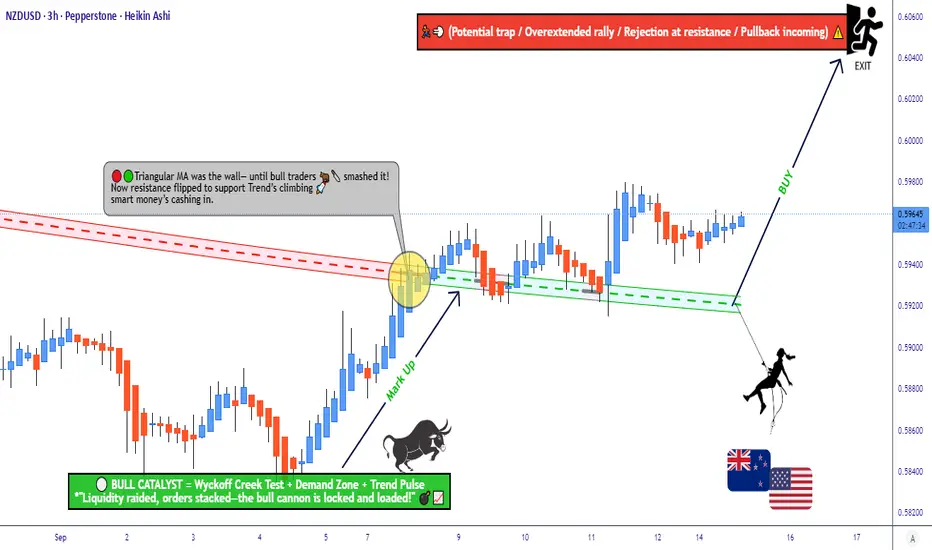

Bias: Bullish ✅

Reasoning: Demand Re-Test + Wyckoff Accumulation Phase (buyers confirmed their presence).

🎯 Entry Strategy (Thief Layer Style)

Our Thief Strategy = layered limit orders 🔑

Example buy layers:

0.59200

0.59300

0.59400

0.59500

(You can expand layers based on your risk appetite & market liquidity 📊).

⚡ This layered entry approach helps capture price dips while managing risk — OG Thief style!

🛡️ Stop Loss

Suggested SL: 0.59000 (below breakout structure).

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this SL is not a hard rule. Adjust it to match your own strategy & risk management.

🎯 Take Profit

Target zone: 0.60400 (strong resistance area).

Rationale: Price approaching overbought conditions + potential trap zone.

⚠️ Note: Exit is flexible — take profits on your own terms and protect your gains.

🔗 Related Pairs to Watch (Correlation Radar)

AUDUSD → Highly correlated (both AUD & NZD are commodity currencies 📦).

AUDUSD → Highly correlated (both AUD & NZD are commodity currencies 📦).

NZDJPY → Tracks Kiwi strength vs safe-haven flows 💴.

NZDJPY → Tracks Kiwi strength vs safe-haven flows 💴.

DXY (US Dollar Index) → Inverse correlation driver 💵.

DXY (US Dollar Index) → Inverse correlation driver 💵.

GBPNZD → Cross-check for Kiwi strength in broader FX spectrum.

GBPNZD → Cross-check for Kiwi strength in broader FX spectrum.

Watching these helps confirm if Kiwi momentum is real or just a false breakout!

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDUSD #Forex #Kiwi #SwingTrade #DayTrade #Wyckoff #FXTrading #TradingPlan #LayeringStrategy #AUDUSD #DXY

🛠️ Plan Overview

Bias: Bullish ✅

Reasoning: Demand Re-Test + Wyckoff Accumulation Phase (buyers confirmed their presence).

🎯 Entry Strategy (Thief Layer Style)

Our Thief Strategy = layered limit orders 🔑

Example buy layers:

0.59200

0.59300

0.59400

0.59500

(You can expand layers based on your risk appetite & market liquidity 📊).

⚡ This layered entry approach helps capture price dips while managing risk — OG Thief style!

🛡️ Stop Loss

Suggested SL: 0.59000 (below breakout structure).

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this SL is not a hard rule. Adjust it to match your own strategy & risk management.

🎯 Take Profit

Target zone: 0.60400 (strong resistance area).

Rationale: Price approaching overbought conditions + potential trap zone.

⚠️ Note: Exit is flexible — take profits on your own terms and protect your gains.

🔗 Related Pairs to Watch (Correlation Radar)

Watching these helps confirm if Kiwi momentum is real or just a false breakout!

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDUSD #Forex #Kiwi #SwingTrade #DayTrade #Wyckoff #FXTrading #TradingPlan #LayeringStrategy #AUDUSD #DXY

Trade active

Note

📊 NZD/USD Market Report - 18 September 2025💵 Real-Time Exchange Rate

NZD/USD: 0.5975 USD per 1 NZD

Daily Change: +0.0021 (+0.35%) 📈

Weekly Change: +0.85% 📈

Monthly Change: -0.52% 📉

😊 Investor Sentiment Outlook

Retail Traders:

Long (Bullish): 62% 😄

Short (Bearish): 38% 😟

Institutional Traders:

Long (Bullish): 45% 😐

Short (Bearish): 55% 😕

🧠 Overall Investor Mood

Mood: Neutral 😐

Retail traders show moderate optimism, driven by recent NZD strength.

Institutional traders lean cautious, reflecting global economic uncertainties.

😨 Fear & Greed Index

Score: 48/100 (Neutral Zone) ⚖️

Balanced sentiment with no extreme fear or greed.

Investors are cautious but not overly pessimistic.

📈 Fundamental & Macro Score Points

Fundamental Score: 52/100 🟡

New Zealand’s economy shows resilience with stable exports.

US Fed rate cut expectations (4.75% rate) pressure USD slightly.

Macro Score: 46/100 🟠

Global risk appetite is mixed due to US economic data and China’s trade slowdown.

NZD benefits from commodity price stability but faces headwinds from global uncertainty.

🐂 Overall Market Outlook

Outlook: Neutral with slight Bearish tilt 🐻

Short-term: Potential for NZD/USD to test lower levels due to institutional caution.

Long-term: Limited upside unless US data weakens further or NZ commodity exports surge.

🔑 Key Takeaways

NZD/USD slightly up today but underperforming monthly. 📉

Retail traders more bullish than institutions. 😄 vs 😕

Neutral investor mood and Fear & Greed Index suggest caution. ⚖️

Fundamentals and macro factors balanced, no strong directional bias. 🟡🟠

Market leans slightly bearish, watch US economic data for cues. 🐻

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.