📊 Market Overview

Gold experienced a sharp intraday drop during the Asian session, testing the 4,280 – 4,279 USD zone before quickly recovering. Despite short-term volatility, it continues to close the week in green for the ninth consecutive time — confirming the strength of the ongoing bullish cycle.

The broader fundamentals remain supportive:

💥 Persistent geopolitical tensions keep safe-haven demand high.

⚖️ US–China trade uncertainty and the risk of a prolonged US government shutdown weaken risk appetite.

💵 Fed rate-cut expectations and USD softness continue to favor gold upside.

In short — Smart Money remains positioned long, and every dip still looks like a liquidity grab for re-accumulation.

🧠 Technical Structure (MMFLOW View)

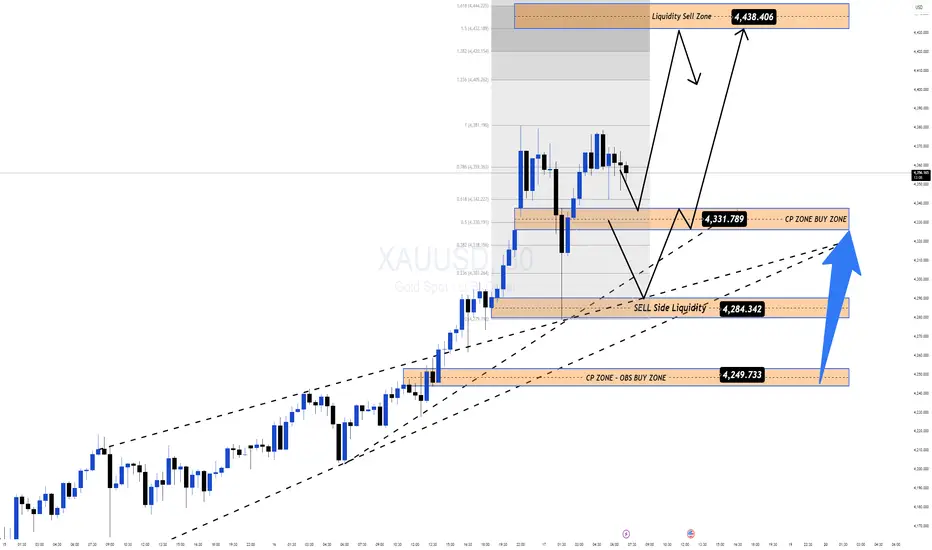

On the M30 timeframe, gold continues to respect an ascending channel, currently forming a liquidity trap and breakout setup around 4,280 – 4,330.

Price action suggests gold may be completing a short-term corrective wave (B) before resuming the larger bullish impulse.

The structure remains technically bullish, with all pullbacks showing strong rejections from demand zones.

🔑 Key Levels to Watch

🟢 BUY ZONE (Primary Setup)

Zone: 4,230 – 4,228

SL: 4,220

TP: 4,240 – 4,250 – 4,260 – 4,270 – ???

🔵 CP ZONE BUY (Secondary Support)

Zone: 4,284 – 4,285

SL: 4,275

TP: 4,300 – 4,315 – 4,330 – 4,340 – ???

🔴 SCALP SELL (Liquidity Reaction Zone)

Zone: 4,438 – 4,440

SL: 4,448

TP: 4,420 – 4,410 – 4,390 – ???

⚙️ MMFLOW Scenarios

1️⃣ Primary Bullish Scenario:

If gold holds above 4,280 – 4,284, expect continuation toward 4,380 – 4,438 (Liquidity Sell Zone).

The 4,284 level is the key control point where Smart Money may look to re-enter long positions.

2️⃣ Alternative Correction Scenario:

A clean break below 4,280 could drive price toward 4,249 – 4,243 (CP Buy Zone) before another bullish push higher.

This structure still aligns with a Healthy Correction Pattern within a broader uptrend.

⚡️ MMFLOW Insights

Gold remains in a mid-term expansion phase, with both macro and technical alignment favoring continued upside.

The 4,280 – 4,330 range acts as a Smart Money accumulation zone, preparing for a liquidity sweep higher.

Medium-term upside target: 4,438 – 4,445 USD/oz (Liquidity Sell Zone).

⚠️ Trading Notes

✅ Always use a protective Stop Loss — volatility can spike during liquidity hunts.

✅ Avoid chasing entries at highs; wait for reaction around BUY ZONES.

✅ Focus on liquidity confluence zones (Fibo + CP Zone + Order Block) for the highest-probability setups.

🧭 Quick Summary

Gold remains resilient despite early-session volatility.

Watch BUY ZONES at 4,230 – 4,228 and 4,284 – 4,285 for possible long re-entries.

Short-term target: 4,380 – 4,438 USD/oz.

Bias: Bullish – Buy the dips, not the breakouts.

Gold experienced a sharp intraday drop during the Asian session, testing the 4,280 – 4,279 USD zone before quickly recovering. Despite short-term volatility, it continues to close the week in green for the ninth consecutive time — confirming the strength of the ongoing bullish cycle.

The broader fundamentals remain supportive:

💥 Persistent geopolitical tensions keep safe-haven demand high.

⚖️ US–China trade uncertainty and the risk of a prolonged US government shutdown weaken risk appetite.

💵 Fed rate-cut expectations and USD softness continue to favor gold upside.

In short — Smart Money remains positioned long, and every dip still looks like a liquidity grab for re-accumulation.

🧠 Technical Structure (MMFLOW View)

On the M30 timeframe, gold continues to respect an ascending channel, currently forming a liquidity trap and breakout setup around 4,280 – 4,330.

Price action suggests gold may be completing a short-term corrective wave (B) before resuming the larger bullish impulse.

The structure remains technically bullish, with all pullbacks showing strong rejections from demand zones.

🔑 Key Levels to Watch

🟢 BUY ZONE (Primary Setup)

Zone: 4,230 – 4,228

SL: 4,220

TP: 4,240 – 4,250 – 4,260 – 4,270 – ???

🔵 CP ZONE BUY (Secondary Support)

Zone: 4,284 – 4,285

SL: 4,275

TP: 4,300 – 4,315 – 4,330 – 4,340 – ???

🔴 SCALP SELL (Liquidity Reaction Zone)

Zone: 4,438 – 4,440

SL: 4,448

TP: 4,420 – 4,410 – 4,390 – ???

⚙️ MMFLOW Scenarios

1️⃣ Primary Bullish Scenario:

If gold holds above 4,280 – 4,284, expect continuation toward 4,380 – 4,438 (Liquidity Sell Zone).

The 4,284 level is the key control point where Smart Money may look to re-enter long positions.

2️⃣ Alternative Correction Scenario:

A clean break below 4,280 could drive price toward 4,249 – 4,243 (CP Buy Zone) before another bullish push higher.

This structure still aligns with a Healthy Correction Pattern within a broader uptrend.

⚡️ MMFLOW Insights

Gold remains in a mid-term expansion phase, with both macro and technical alignment favoring continued upside.

The 4,280 – 4,330 range acts as a Smart Money accumulation zone, preparing for a liquidity sweep higher.

Medium-term upside target: 4,438 – 4,445 USD/oz (Liquidity Sell Zone).

⚠️ Trading Notes

✅ Always use a protective Stop Loss — volatility can spike during liquidity hunts.

✅ Avoid chasing entries at highs; wait for reaction around BUY ZONES.

✅ Focus on liquidity confluence zones (Fibo + CP Zone + Order Block) for the highest-probability setups.

🧭 Quick Summary

Gold remains resilient despite early-session volatility.

Watch BUY ZONES at 4,230 – 4,228 and 4,284 – 4,285 for possible long re-entries.

Short-term target: 4,380 – 4,438 USD/oz.

Bias: Bullish – Buy the dips, not the breakouts.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.