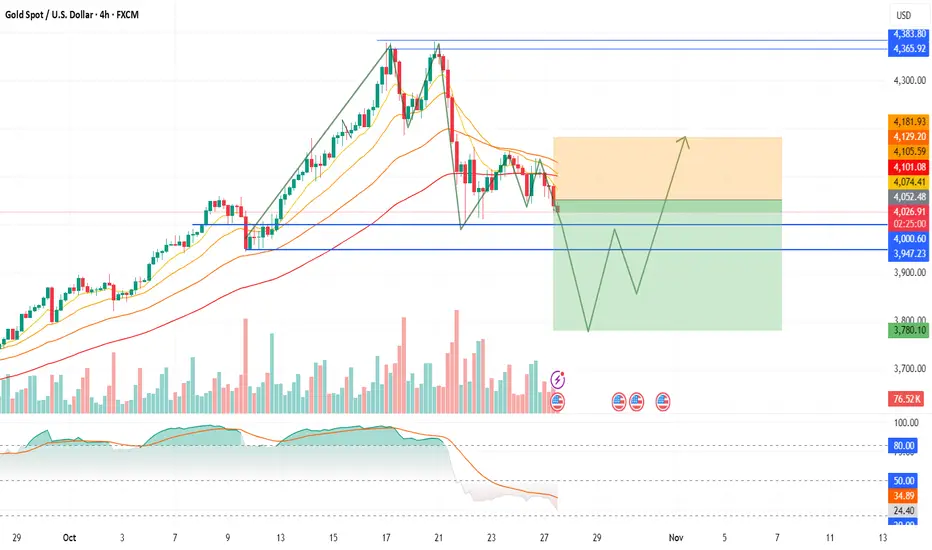

Gold is currently trading near $4,040, and my short-term outlook is bearish, followed by a strong bullish reversal in the coming sessions.

I expect prices to decline first toward the $3,800–$3,750 zone, which aligns with key support and previous demand levels. This correction phase would complete a healthy market reset before a potential major rally begins.

Once price stabilizes around $3,800, I anticipate a sharp reversal and breakout move toward $4,200+, possibly extending higher if momentum builds.

📊 My Plan:

Bias: Bearish first → then Bullish

Short-Term Target: $3,800–$3,750

Reversal Zone: Accumulate longs near $3,800

Upside Target: $4,200+

Invalidation: Below $3,740 (on 4H closing)

This setup favors patience and dual-phase trading — shorting the drop, then switching to long for the rebound.

I expect prices to decline first toward the $3,800–$3,750 zone, which aligns with key support and previous demand levels. This correction phase would complete a healthy market reset before a potential major rally begins.

Once price stabilizes around $3,800, I anticipate a sharp reversal and breakout move toward $4,200+, possibly extending higher if momentum builds.

📊 My Plan:

Bias: Bearish first → then Bullish

Short-Term Target: $3,800–$3,750

Reversal Zone: Accumulate longs near $3,800

Upside Target: $4,200+

Invalidation: Below $3,740 (on 4H closing)

This setup favors patience and dual-phase trading — shorting the drop, then switching to long for the rebound.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.