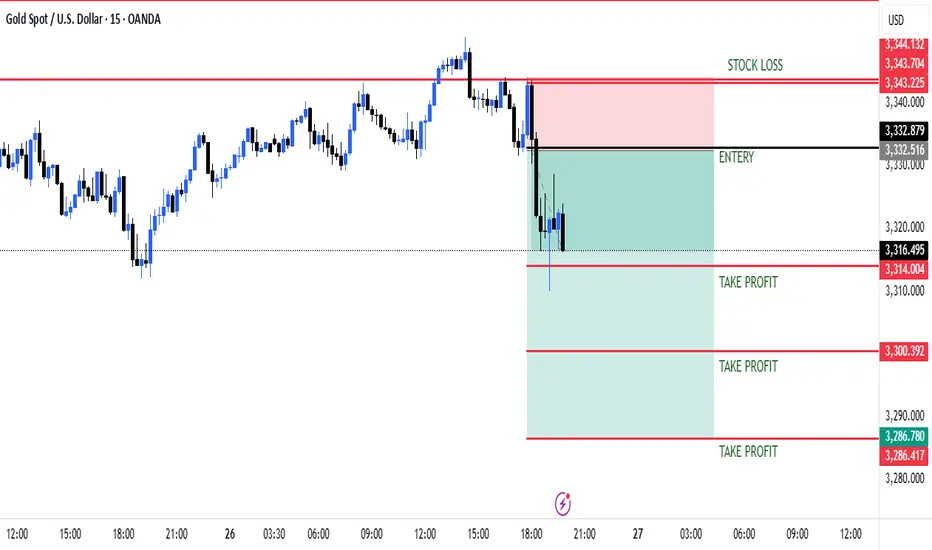

Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD), published by NaviPips on TradingView.com on June 26, 2025, at 19:52 UTC, here’s a suggested trading setup for a sell position:

Current Price and Trend: The current price is 3,318.835, with a slight decline of -3.610 (-0.11%). The chart shows a recent uptrend that appears to be exhausting near the current level, suggesting a potential reversal point.

Sell Entry: Enter a sell position at 3,332.879 (near the entry level marked), as it aligns with a resistance zone where the price has peaked and started to decline.

Stop Loss: Place a stop loss at 3,343.704, above the recent high, to protect against an upward breakout. This level is approximately 10.825 points above the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,314.004, a conservative target about 18.875 points below the entry.

Take Profit 2: 3,300.392, a mid-range target approximately 32.487 points below the entry.

Take Profit 3: 3,280.417, the furthest target, about 52.462 points below the entry, aligning with a strong support zone.

Price Action: The chart indicates a recent peak followed by a downward move, with the entry level near the resistance. The red and green zones suggest a bearish continuation from this point.

Risk-Reward Ratio: The distance to the stop loss (10.825 points) compared to the take profit levels (18.875 to 52.462 points) offers a favorable risk-reward ratio, ranging from approximately 1:1.7 to 1:4.8.

Conclusion

Enter a sell at 3,332.879, with a stop loss at 3,343.704 and take profit levels at 3,314.004, 3,300.392, and 3,280.417. Monitor the price action for confirmation of a continued downtrend, and be cautious of a potential reversal if the price breaks above the stop loss level.

Trade closed: target reached

DONE TARGETDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.