Axis Bank | Intraday Price Behavior Near Square-Based LevelsDisclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Educational Case Study | 8 April 2024

This idea documents an educational intraday case study on Axis Bank, focusing on how price–degree alignment and time awareness were observed using square-based geometric methods commonly referenced in classical market studies.

The purpose of this post is to study chart behavior, not to suggest or validate trades.

📊 Chart Context

Instrument: Axis Bank Ltd. (NSE)

Date: 8 April 2024

Timeframe: 15-minute (Intraday)

During the session, Axis Bank showed early upward momentum. A structured geometric framework was applied to observe how price behaved relative to predefined reference levels throughout the day.

🔍 Methodology (Observational Framework)

The session low was treated as a reference point for structure

From this reference, square-based projections were observed

A level near 1079 aligned with a 45-degree projection, often associated with normal intraday price reach in historical studies

Higher projections were noted only as contextual markers, not expectations

All levels were treated as potential reaction zones, not fixed barriers.

📈 Observed Intraday Behavior

Price approached the projected zone during mid-session

Near this area, the market showed temporary pressure and difficulty sustaining above the level

The broader intraday range remained contained within the projected boundary

This behavior aligned with previously observed historical responses around similar geometric zones

No execution, trade direction, or outcome is implied.

📘 Educational Takeaways

Square-based geometry can help define logical intraday price boundaries

Certain angles may act as areas of interest, depending on market context

Time awareness adds structure when observing intraday movement

This approach emphasizes price structure over indicators or signals

All insights are derived from historical chart observation only.

📌 Important Note

This case study is shared solely for learning and research purposes.

Geometric levels do not guarantee outcomes and should always be used as contextual tools.

Market behavior may include:

Temporary pauses

Short-term pressure

Range expansion or contraction depending on conditions

🚀 Summary

This intraday case study highlights how price geometry and time alignment can be used to observe market behavior in a structured and objective manner.

More educational chart studies will follow.

Beyond Technical Analysis

Natural Gas | When Volatility Gives Way to StructureNatural Gas has transitioned from extreme volatility into a clearly defined rising channel, signaling a shift from emotional price action to structured participation.

After forming a long-term base, price has respected both the upper and lower boundaries multiple times — confirming this as an active trend, not random movement.

The recent sharp move reflects momentum expansion, but what matters now is how price behaves within the channel, not the spike itself.

From here, two outcomes remain valid:

• Acceptance above the mid/upper channel keeps the trend healthy

• Rejection leads to rotation back toward channel support

No forecasts, no headlines — structure defines risk, and reaction defines opportunity.

In commodities, volatility attracts attention — but structure pays.

Chambhal Fertlizer - looks good for long termThe stock hit 700 levels in May 2025, currently trading around 430 with a fall of more than 40%, last few week the stock taking support around 420 levels, fundamentals are better. Technically, stock looks weak. Long term investors can focus the stock between 385-430.

Ascending Triangle vs Head & Shoulders — A Battle of StructuresThis chart is not about a single pattern — it’s about overlapping structures, which is why this zone matters.

On one hand, price has formed a Head & Shoulders pattern, signaling distribution near the top and warning that momentum has slowed after the prior up-move.

At the same time, the market is also forming an Ascending Triangle, with higher lows pressing against a common resistance, showing that buyers are still active and unwilling to give up ground easily.

This creates a high-importance decision zone:

• If price accepts above the resistance, the Head & Shoulders loses relevance and the ascending triangle resolves to the upside.

• If price breaks and holds below the rising trendline, the triangle fails and the Head & Shoulders structure activates, opening the door for deeper retracement.

This is not a prediction setup — it’s a reaction setup.

The market is compressing energy, and only price acceptance will decide which structure survives.

In such zones, patience and discipline matter more than anticipation.

Cross-Market ArbitrageConcept and Rationale

In an ideal and perfectly efficient market, the price of an identical asset should be the same everywhere once adjusted for factors such as transaction costs, taxes, and exchange rates. This principle is often referred to as the law of one price. However, in real-world markets, temporary deviations occur due to differences in liquidity, information flow, trading hours, capital controls, regulatory frameworks, and investor behavior. Cross-market arbitrage aims to capitalize on these deviations before prices converge again.

The strategy plays a critical role in maintaining market efficiency. Arbitrageurs, by acting on price discrepancies, help align prices across markets. As more traders exploit an arbitrage opportunity, buying pressure in the cheaper market and selling pressure in the expensive market gradually eliminate the price gap.

Types of Cross-Market Arbitrage

One of the most common forms is geographical arbitrage, where the same asset trades on exchanges in different countries. For example, a stock listed on both the Indian market and a foreign exchange may trade at slightly different prices due to currency movements or local demand-supply dynamics.

Another major form is exchange-based arbitrage, where price differences exist between two domestic exchanges trading the same instrument. In equity markets, this can occur when a stock is listed on multiple exchanges and short-term inefficiencies arise.

Currency-based cross-market arbitrage involves exploiting mispricing between currency pairs across different forex markets or between the spot and offshore markets. This often overlaps with triangular arbitrage, where inconsistencies between three currency exchange rates create profit opportunities.

Derivative-based arbitrage is also significant. Here, traders exploit price differences between a cash market instrument and its derivative, such as an index and its futures contract traded on different exchanges or jurisdictions.

Mechanics of Execution

Successful cross-market arbitrage requires simultaneous execution of buy and sell orders to eliminate directional market risk. Speed and precision are essential, as arbitrage windows are often extremely short-lived. Institutional traders typically rely on algorithmic trading systems and direct market access to identify and execute opportunities in milliseconds.

For example, if a stock is trading lower on one exchange compared to another after accounting for currency conversion and transaction costs, an arbitrageur would buy the stock in the cheaper market and sell it in the higher-priced market at the same time. The profit is realized once the positions are settled, assuming the price gap closes as expected.

Role of Technology

Technology is a decisive factor in cross-market arbitrage. Modern arbitrage strategies heavily depend on real-time data feeds, low-latency infrastructure, co-location services, and automated execution systems. Without these, price discrepancies are likely to disappear before a trade can be completed.

High-frequency trading firms dominate this space because they can react faster than manual traders. However, longer-duration arbitrage opportunities may still exist in less liquid markets or during periods of high volatility, regulatory changes, or market stress.

Risk Factors

Although cross-market arbitrage is often perceived as low risk, it is not risk-free. Execution risk is one of the most significant concerns. If one leg of the trade is executed while the other fails or is delayed, the trader may be exposed to market movements.

Currency risk arises when trades involve assets priced in different currencies. Even small exchange rate fluctuations can impact profitability if not properly hedged.

Liquidity risk is another challenge, especially in emerging markets. A lack of sufficient volume may prevent traders from executing large orders at expected prices.

Regulatory and settlement risk also play a role. Different markets have varying settlement cycles, taxation rules, and capital restrictions, which can complicate arbitrage trades and increase costs.

Costs and Constraints

Transaction costs such as brokerage fees, exchange fees, taxes, and bid-ask spreads significantly influence the viability of cross-market arbitrage. Even a seemingly attractive price difference can become unprofitable once these costs are considered.

Additionally, capital requirements can be high, as traders must maintain positions in multiple markets simultaneously. Margin rules and leverage limits may further constrain strategy implementation.

Market Impact and Importance

Cross-market arbitrage contributes to price discovery and market integration. By narrowing price differences across markets, arbitrageurs enhance transparency and efficiency. This is particularly important in globalized financial systems where capital flows freely across borders.

During periods of market stress, arbitrage opportunities may widen due to panic selling, liquidity shortages, or regulatory disruptions. While this increases potential returns, it also raises risks, making risk management and capital discipline crucial.

Conclusion

Cross-market arbitrage is a sophisticated trading strategy rooted in the fundamental principle of price convergence across markets. While the theoretical concept is straightforward, practical execution requires advanced technology, deep market understanding, and robust risk controls. As global markets continue to integrate and trading becomes increasingly automated, cross-market arbitrage remains a vital mechanism for maintaining efficiency, though opportunities are often fleeting and highly competitive. For skilled traders and institutions, it offers a compelling blend of analytical rigor, speed, and strategic precision.

Antony Waste Handling Cell Ltd – Weekly Chart ViewPrice reacting from deep discount zone with volume support.

🔹 Stock respected 0.786–0.886 Fibonacci retracement zone

🔹 Strong bullish candles emerging from ~428–445 demand area

🔹 Noticeable volume expansion, indicating institutional participation

🔹 Price currently testing the descending trendline resistance

Key Levels to Watch

Immediate Resistance: 570–580

Major Supply / Gap Zone: 733–780

Support Zone: 445–428

Invalidation: Weekly close below 427

Expectation (Not Prediction)

Acceptance above trendline → scope for mean reversion towards gap zone

Rejection from trendline → range continuation with higher lows

📌 No indicators. No noise.

Structure + Levels + Volume = Clarity

Note: Educational view only. Not investment advice.

Regards

Bull Man

#PriceAction

#TechnicalAnalysis

#SwingTrading

#IndianStocks

#WeeklyChart

#SupportAndResistance

#FibonacciRetracement

#VolumeAnalysis

#Trendline

#TradingEducation

Axis Bank | Intraday Price-Time Observation Using Square-Based GDisclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Educational Case Study | 21 October 2024

This idea presents an educational intraday case study on Axis Bank, focusing on how price–degree alignment and time awareness can be observed using square-based geometric methods commonly discussed in classical market studies.

The purpose of this post is to study chart behavior, not to suggest or validate trades.

📊 Chart Context

Instrument: Axis Bank (NSE)

Date: 21 October 2024

Timeframe: 15-minute (Intraday)

During the session, price showed a shift in momentum after reaching a higher price region. As the move developed, a structured geometric framework was used to observe how price behaved relative to predefined reference points.

🔍 Methodology Used (Observational)

A reference point was marked near 1214, from where price began to decline

From this reference, a 45-degree projection was observed using a square-based calculation method

The derived level appeared near 1197, representing a potential intraday reaction zone

Time was observed as an additional context factor, particularly how price behaved before later session hours

These levels were treated as areas of observation, not certainty points.

📈 Observed Market Behavior

Price approached the projected zone during the intraday session

Near this level, the market showed temporary pressure followed by a short-term response

The behavior aligned with historical observations where price interacts with similar geometric zones

The reaction highlighted how price and time together can influence intraday movement

No trade execution or outcome is implied.

📘 Key Educational Insights

Square-based geometry can help define normal intraday price reach

Certain angles may act as potential reaction areas, depending on context

Time awareness can add structure to intraday observation

This approach emphasizes market structure over indicators

All points are based on historical chart study, not forecasting.

📌 Educational Note

This case study is shared solely for learning and research purposes.

Geometric levels do not guarantee outcomes and should always be treated as contextual tools.

Market responses may vary based on:

Volatility

Liquidity

Broader market structure

🚀 Summary

This intraday case study demonstrates how price geometry and time awareness can be used to observe market behavior in a structured and disciplined way.

More educational observations will follow.

NIFTY 50 | Time-Cycle Observation Using Gann-Based MethodsDisclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Educational Case Study | March–April 2023

This idea shares an educational case study highlighting how time-cycle concepts, often discussed in classical Gann literature, were observed on the NIFTY 50 index during March–April 2023.

The focus of this post is to study how time completion and price behavior interacted, rather than to present a forecast or trading outcome.

📊 Background of the Observation

On 13 March 2023, NIFTY 50 was trading near a time–price balance area identified through time-based analysis methods.

Rather than relying on indicators or news flow, the study examined how time progression aligned with subsequent price behavior — an approach commonly referenced as time leading price in classical analysis.

A 9-day time window was identified as an area of interest, with 24 March 2023 marking a notable time point for observation.

🔍 Market Behavior After Time Completion

Following the completion of the identified time window:

The index began showing positive momentum

Price expanded upward over the subsequent sessions

Part of the observed movement unfolded shortly after the time cycle completed

Additional price expansion continued as the broader structure evolved

This sequence provided an example of how price activity may increase after time completion, depending on market conditions.

📘 Key Educational Takeaways

Market expansion is often observed after time completion, rather than at obvious price levels

Time analysis can help identify periods of potential expansion or contraction

Studying time reduces emotional bias and improves patience

Gann-based methods focus on structure and rhythm, not precise prediction

All observations are based on historical chart behavior, not future expectations.

📌 Important Clarification

This post is shared only for study and research purposes.

No directional advice, trade execution, or performance guarantee is implied.

Time-based zones should be treated as:

Areas of observation

Potential reaction windows

Not fixed outcomes

📚 Additional Learning Resource

For readers interested in a detailed educational explanation of time-cycle concepts used in this chart study, a longer learning resource is available below:

nirajmsuratwala.in

(Shared strictly for educational reference)

🚀 Summary

This case study demonstrates how time-cycle observation, when combined with structure, can help traders study market rhythm objectively.

More educational case studies will follow.

Axis Bank | Observed Price Reaction Near a 45° LevelCase Study – 8 November 2024

This idea presents an educational case study focused on intraday price behavior near a geometric level, specifically a 45° projection, observed on Axis Bank on 8 November 2024.

The study is shared to understand how price, time, and structure may interact around predefined geometric zones — without any predictive or advisory intent.

📊 Chart Observation

On 8 November 2024, Axis Bank moved toward a projected level derived from a 45° calculation, originating from an intraday reference point using Square-of-9–based methodology.

The projected zone appeared near 1168

During the afternoon session, price showed temporary pressure and rejection around this area

The behavior aligned with previously observed reactions near similar geometric levels

This observation highlights how markets may respond near certain structural zones, depending on context and timing.

🔍 What This Case Study Illustrates

Identifying a 0° reference from an intraday extreme

Observing price movement capacity along a 45° path

Noting time sensitivity, where reactions often occur near specific time windows

Understanding how a geometric zone can act as a potential reaction area, rather than a fixed resistance

These observations are intended to support chart study and market behavior analysis, not decision-making shortcuts.

📌 Educational Note

This post discusses observed historical behavior on charts.

Geometric levels and angles represent areas of interest, not guaranteed outcomes.

Market behavior may include:

Temporary pauses

Short-term pressure

Expansion or continuation depending on broader structure

No trade direction or execution guidance is provided.

🚀 Conclusion

This case study demonstrates how combining geometry, structure, and time can add clarity to intraday chart analysis when used objectively.

More such educational observations will follow.

Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

USD/CHF Approaching Breakdown from RangeUSD/CHF is moving in a sideways corrective pattern, not a strong trend. The price is forming an A-B-C-D-E structure, which usually happens before the market makes a bigger move. Right now, price is in the last part of this pattern (wave E) and is sitting near a resistance area, where it has failed to move higher and has started to turn down. This behavior often means sellers are becoming stronger. As long as the price stays below 0.795–0.798 , the outlook remains bearish, and the market is expected to move lower toward the 0.782–0.775 support area. If this move happens, it would complete the corrective pattern after a short pause, and then the market can decide its next big direction.

Stay tuned!

@Money_Dictators

Thank you :)

BAJAJCON - This Is What 100 Charts Have Taught MeThis idea is special to me — it marks my 100th idea shared on TradingView.

Over time, charts have taught me one simple truth: price respects structure more than opinions.

BAJAJCON is trading within a well-defined rising channel, a structure that has been respected across multiple market cycles. Each pullback into demand has been followed by recovery, showing controlled participation rather than emotional moves.

The recent move is not random strength. It’s a reaction from the lower trendline, followed by acceptance toward the upper boundary — exactly how healthy trends behave.

This chart reflects my journey as well: fewer predictions, more patience; fewer indicators, more clarity.

Whether price pauses here or expands further, the structure remains intact, and that is what matters most.

BTCUSD – Let the Structure DecidePrice is currently trading inside a well-defined rising channel, where both demand and supply are clearly respected.

This is not random volatility — it’s organized price movement.

After a strong impulsive move, Bitcoin has shifted into a controlled consolidation, allowing the market to absorb supply and reset sentiment. Such phases are essential for any sustainable trend.

At this stage, two scenarios matter:

If price holds the lower channel support, it keeps the structure intact and opens the door for a continuation toward the upper trendline.

If support fails decisively, the next logical area lies at the broader horizontal demand zone below, where higher-timeframe buyers previously stepped in.

This is a wait-and-watch zone, where price behavior near support will decide the next leg — not opinions, news, or emotions.

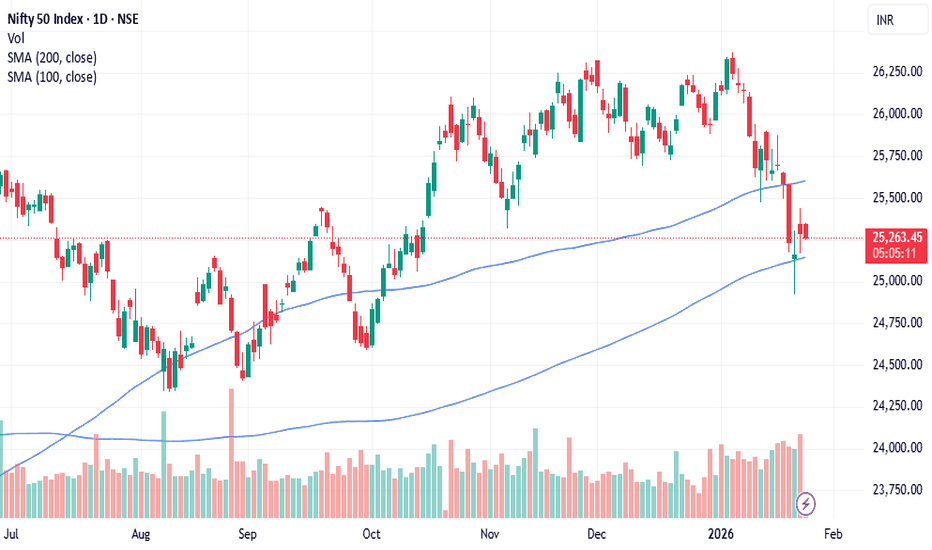

Nifty expected to consolidate between 200DMA and 100DMANifty after falling below 25000 has been on a consolidation mode expected to consolidate and stay with negative bias as long as holds between its 200DMA of 25133 and 100DMA of 25600. As per FIIs positions they have added both fresh longs and shorts yesterday Jan 22nd 2026, but fresh shorts are higher than longs, Nifty may consolidate with negative bias.

GIFTNIFTY Feb 2026 Fut Roll-Over Swing Levels For 23rd JAN 2026Roll-Over: GIFTNIFTY Feb 2026 Fut ntraSwing Levels For 23rd JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

🚀Follow GIFTNIFTY Post for NF levels

Sometime Opposite Direction Found in NIFTY Spot, NIFTY Jan EXO & NIFTY FEB Exp. better tp long at that juncture.

^^^^^^^^^^^^_______________^^^^^^^^^^^^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

SILVER (XAGUSD) 1HRsWING TRADE

- EARN WITH ME DAILY 10K-20K –

SILVER (XAGUSD) Looking good for upside..

When it break level 93053 and sustain.. it will go upside...

BUY@ 93053

Target

1st 96004

2nd 98886

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome to join the ride ..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

GIFTNIFTY IntraSwing Levels for 23rd JAN 2026GIFTNIFTY IntraSwing Levels for 23rd JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

____________^^^^^^^^^^^^________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Nifty may once again test 25100-25000 rangeIf Nifty fails to move and holds above 25400-25450 range then it can once again slip towards 25100-25000 range. FIIs have added both long and short positions, but fresh short positions are 3 times higher than fresh long positions indicating volatility with negative bias.

Gold loses its power for 3 days ! Do you feel the same?Friends, I think that whenever the Moon is conjunct with Rahu and Ketu, that is, whenever the Moon is on the Rahu-Ketu axis, we see some kind of disturbance in the price of gold. I've observed this happening most of the time. Do you guys feel the same way?

Are You a Market Student? That’s Exactly Who This Is ForDisclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Most traders spend years searching for consistency, clarity, and a better way to interpret price behavior.

If your interest goes beyond indicators and focuses on how price and time interact structurally, then this series is meant for you.

This idea marks the beginning of a study-based series focused on classical market observation methods inspired by W.D. Gann principles — strictly from an educational and analytical perspective.

🔎 Purpose of This Series

Markets often display repetitive behavior when observed through time, price, and structure.

In this series, we will study how historical market behavior has shown:

Time and price relationships

Cyclical tendencies

Geometric price movement

Structural behavior on charts

Reactions around specific angles and zones

The objective is not prediction, but observation and understanding.

📘 What You’ll See in Upcoming Ideas

Future posts may include:

Chart-based observations

Explanation of classical concepts

Historical examples from charts

Study of time, price, and structure interaction

How older analytical methods can still be observed in modern markets

All examples are shared to study market behavior, not to suggest trades.

📌 Important Note

This is not a trading call and not a strategy recommendation.

Zones, angles, and levels discussed represent areas where markets have historically shown reactions, not guaranteed outcomes.

Markets may additionally show:

Temporary pressure

Pauses in momentum

Expansion or contraction depending on context

🚀 Moving Forward

This post serves as an introduction only.

If you are curious about cycle studies, structural analysis, and classical market observation, stay connected for future ideas.

Let’s study the market logically, objectively, and step by step.