Reliance: Big Stock, Big Structure, Slow DecisionsReliance Industries is trading within a well-defined long-term rising channel on the higher timeframe.

The recent decline looks like a pullback within structure, not a breakdown. Price is currently in the upper-to-mid part of the channel, leaving room for mean reversion toward the major rising trendline support.

This is not a fast-moving stock, and such moves usually take time and patience. The expectation is not an immediate fall, but a gradual drift or consolidation that may eventually bring price closer to the long-term support zone.

Until price reaches that zone, the chart remains a wait-and-watch setup. The real decision-making area lies near the lower trendline, where price reaction will matter more than prediction.

Beyond Technical Analysis

AUTO Sector vs Hero MotoCorp – Structure Test at a Crucial ZoneThis analysis combines sector context (AUTO Index) with stock-level structure (Hero MotoCorp) to understand the bigger picture.

AUTO Index:

The index has been moving inside a rising channel and is currently pulling back after a strong rally. Price is now approaching the lower half of the channel, where reactions become important. This looks more like cooling within structure, not a breakdown yet.

Hero MotoCorp:

On the stock level, price is reacting near a rising trendline support, which has acted as a demand zone in the past. The stock is holding structure while the sector is cooling — this relative behavior is worth observing.

Key takeaway:

When sector and stock both reach important structural zones together, reaction matters more than prediction. Strength here can lead to continuation; failure may open room for deeper consolidation.

No indicators, no forecasts — just price, structure, and patience.

LT: Vibration Stock (2-4 days) Intra- Positional - Swing Levels.LT: Vibration Stock (2-4 days): Intra- Positional - Swing Levels. EXp. View

💥Now @ 3841 - Near Gann Support Level / Zone @ 3840 -3848

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

SENSEX Analysis for 20th JAN 2026 IntraSwing Spot leveSENSEX @ 82853 (Data Delayed in Chart) Looks Good compare to NIFTY.

One can enter LONG Strategy Likr Bull Call spread, Protective PUT etc.

Screenshot of near CALL & PUT option shows Premium is more in Call side compare to PUT Side.

Screenshot of Bull Call spread LONG 82900 CE & SHORT 83200PE. Risk Max 130 points

🚀Follow & Compare NIFTY spot Post for Taking Trade

_______________^^^^^^^^^_________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

RBI Interest Rate Outlook and Liquidity Conditions1. Role of the RBI in Monetary Policy

The RBI operates under a flexible inflation targeting framework, with the primary objective of maintaining price stability while supporting economic growth. Inflation, measured by the Consumer Price Index (CPI), is targeted at 4% with a tolerance band of ±2%. Interest rate decisions and liquidity operations are aligned to this mandate.

The Monetary Policy Committee (MPC), comprising RBI officials and external members, meets periodically to assess macroeconomic conditions and decide on policy rates such as the repo rate, which is the benchmark for short-term interest rates in the economy.

2. Interest Rate Outlook: Key Drivers

The RBI’s interest rate outlook is shaped by a combination of domestic and global factors:

a. Inflation Dynamics

Inflation remains the most critical determinant of RBI’s policy stance. Key inflation drivers include:

Food inflation, especially cereals, pulses, vegetables, and edible oils

Fuel and energy prices, influenced by global crude oil trends

Core inflation, which reflects demand-side pressures

If inflation shows signs of persistence or risks breaching the tolerance band, the RBI tends to maintain a tight or cautious stance. Conversely, sustained disinflation creates room for policy easing.

b. Economic Growth

The RBI closely tracks GDP growth, industrial production, services activity, and consumption trends.

Strong growth with rising demand may warrant higher interest rates to prevent overheating.

Weak growth or slowing investment may push the RBI toward rate cuts to stimulate borrowing and spending.

The central bank typically aims for a balanced approach, avoiding aggressive rate moves unless macro conditions demand it.

c. Global Monetary Conditions

Global central banks—particularly the US Federal Reserve, ECB, and Bank of England—significantly influence RBI decisions.

Tight global liquidity or high global interest rates can lead to capital outflows from emerging markets like India.

To maintain currency stability and financial attractiveness, the RBI may delay or moderate rate cuts even if domestic conditions allow easing.

d. Exchange Rate and Capital Flows

Sharp volatility in the rupee or large capital flow movements can affect RBI’s rate outlook. Higher interest rates often help:

Support the currency

Attract foreign portfolio investment

Reduce imported inflation pressures

3. RBI’s Current Interest Rate Stance: A Broad Outlook

In the present environment, the RBI’s interest rate outlook can be described as cautious and data-dependent. Rather than committing to a fixed path of rate hikes or cuts, the central bank emphasizes:

Inflation sustainability over short-term growth boosts

Gradual policy normalization

Clear communication to avoid market shocks

This approach reflects RBI’s preference for stability and predictability, especially during periods of global uncertainty.

4. Understanding Liquidity Conditions

Liquidity refers to the availability of money in the banking system. Even with unchanged policy rates, liquidity conditions can significantly influence borrowing costs and financial market behavior.

The RBI manages liquidity primarily through:

Liquidity Adjustment Facility (LAF)

Repo and reverse repo operations

Standing Deposit Facility (SDF)

Open Market Operations (OMOs)

Variable Rate Repo (VRR) auctions

5. Liquidity Conditions in the Indian Banking System

Liquidity conditions fluctuate based on several factors:

a. Government Cash Balances

Large government tax collections or bond issuances can drain liquidity, while government spending injects liquidity into the system.

b. Currency in Circulation

Higher cash withdrawals during festive seasons or elections reduce system liquidity, while returns of cash to banks improve it.

c. Capital Flows

Foreign investment inflows add liquidity, while outflows tighten it.

d. RBI Operations

The RBI actively fine-tunes liquidity to ensure that overnight rates remain close to the policy rate.

6. RBI’s Liquidity Management Approach

The RBI follows a “neutral to calibrated liquidity” approach:

It avoids excessive surplus liquidity that could fuel inflation or asset bubbles.

It also prevents sharp liquidity shortages that could disrupt credit flow and financial markets.

By using variable rate auctions and short-term liquidity tools, the RBI ensures that:

Money market rates remain aligned with policy signals

Banks have adequate funds to meet credit demand

Financial stability risks are minimized

7. Interaction Between Interest Rates and Liquidity

Interest rates and liquidity work in tandem:

High rates + tight liquidity = strong anti-inflation stance

Low rates + surplus liquidity = growth-supportive environment

The RBI often prefers adjusting liquidity before changing rates, using liquidity as a flexible, short-term tool and rates as a more structural signal.

8. Impact on Banks, Borrowers, and Markets

a. Banking Sector

Stable liquidity conditions help banks:

Manage funding costs

Maintain credit growth

Improve transmission of policy rates to lending and deposit rates

b. Borrowers

Interest rate outlook directly affects:

Home loans

Corporate borrowing

MSME financing

A cautious RBI stance provides predictability, allowing borrowers to plan long-term investments.

c. Financial Markets

Bond yields, equity valuations, and currency movements respond to RBI signals on rates and liquidity. Clear communication helps reduce volatility and speculative excesses.

9. Risks and Challenges Ahead

Despite careful policy management, challenges remain:

Volatile food and energy prices

Geopolitical risks impacting global trade and oil prices

Climate-related supply disruptions

Sudden shifts in global capital flows

The RBI must continuously balance inflation control with growth support amid these uncertainties.

10. Conclusion

The RBI’s interest rate outlook and liquidity conditions reflect a measured, prudent, and forward-looking policy framework. By prioritizing inflation control, maintaining adequate liquidity, and responding flexibly to evolving data, the RBI aims to ensure macroeconomic stability while supporting sustainable economic growth.

For investors and market participants, the key takeaway is clear: RBI policy is unlikely to be impulsive. Instead, it will remain data-driven, cautious, and stability-oriented, with interest rates and liquidity tools working together to navigate India through both domestic challenges and global uncertainties.

HAL: Vibration Stock - Intraswing Levels.HAL: Vibration Stock - Intraswing Levels.

Looking good at this level @ 4435. Intra-Swing limited DN-Side with much more upside (i.e. Favourable RR)

🚀Follow & Compare NIFTY spot Post for Taking Trade

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

🚀Follow GIFTNIFTY Post for NF levels

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions..

GIFTNIFTY IntraSwing Levels for 20th JAN 2026GIFTNIFTY IntraSwing Levels for 20th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

________^^^^^^^____________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Reliance Industries Limited (RIL)Reliance is looking Good near 1380-1400 Rs support zone. RSI is also at oversold zone (26.70). Considering it for short term move with upside potential of 8 - 11 %.

1560 - 1575 Rs is a strong supply zone for it.

Target 1 : 1500-1510 RS

Target 2 : 1550 - 1560 Rs

Disclaimer : The Above shared Content is for information and education purposes only and should not be treated as investment or trading advice. Im not SEBI registered, Contact your financial advisor before any investment.

Aarti Drugs reversal trade and Fundamental Trigger is in placedReversal Trade in aarti Drugs :

For FY27: management believes mid-teens to 20% growth is feasible: “we can try for 15%-20% growth for next year” aided by stabilized pricing and new capacities—but explicitly contingent on salicylic acid ramp-up: “The key challenge will remain… ramp up of salicylic acid.”

NIFTY WEEKLY Level analysis from 19th - 23rd JAN 2026📊 NIFTY WEEKLY Level analysis from 19th - 23rd JAN 2026

🚀Follow & Compare NIFTY spot daily Postas well as

💥GIFTNIFTY Post for NF levelsfor Taking Trade

🚀Follow GIFTNIFTY Post for NF levels

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

NIFTY Analysis for 20th JAN 2026: Weekly Exp. IntraSwing levelsNIFTY Analysis for 20th JAN 2026: Weekly Exp. IntraSwing levels

🚀Follow GIFTNIFTY Post for NF levels

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

^^^^^^^^^^^______________^^^^^^^^^^^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

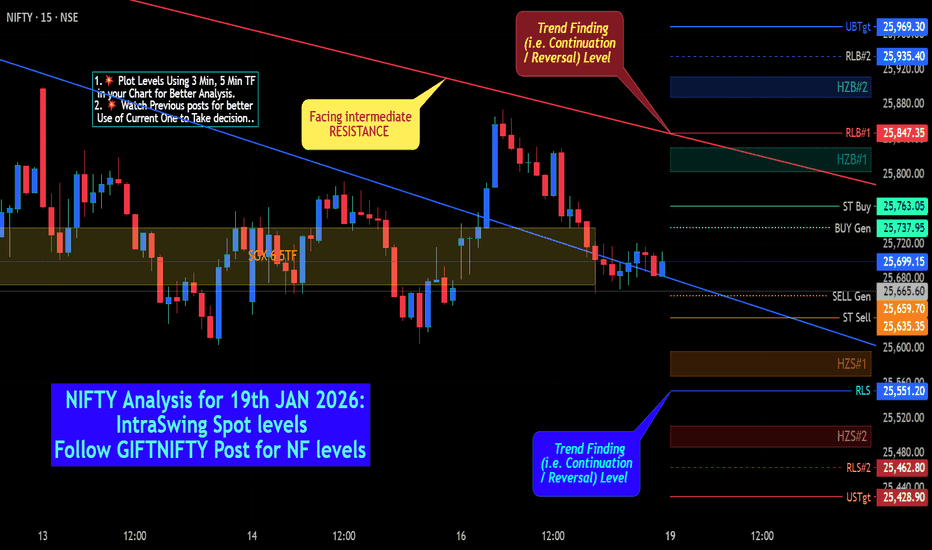

NIFTY Analysis for 19th JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 19th JAN 2026: IntraSwing Spot levels

🚀Follow GIFTNIFTY Post for NF levels

^^^___❇️❇️❇️❇️❇️❇️❇️❇️❇️___^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

POLICYBZR – Textbook Tweezer Bottom at Trendline SupportPOLICYBZR has formed a perfect Tweezer Bottom exactly at a rising demand / support trendline, indicating strong buying interest at lower levels. Sellers tried to push price below this zone but failed twice, which confirms absorption of supply.

This reaction is not random — it’s happening:

At a well-defined support trendline

After a controlled decline

With immediate bullish response, showing rejection of lower prices

What this means structurally:

As long as price holds above the tweezer low, downside risk remains limited

The first upside test will be the nearby supply zone / previous consolidation area

A sustained move above that zone can shift the structure back toward higher highs

This is a low-risk observation zone, where price action confirmation matters more than speed.

No indicators needed — pure price behavior is speaking.

COLPAL – Compression Near Lower Channel | Early Strength EmerginCOLPAL has been moving inside a long-term falling channel, respecting both the upper resistance and lower support trendlines. Recently, price has rebounded from the lower channel support, indicating demand at lower levels.

The structure shows gradual compression near the support zone, suggesting selling pressure is reducing. Today’s move signals early strength, but the trend is not confirmed yet.

As long as price holds above the lower trendline, the structure remains constructive.

A decisive breakout above the falling channel would be the real confirmation of trend reversal.

Until then, this remains a wait-and-watch zone, where price behavior matters more than prediction.

Simple chart. Clear structure. Patience required.

BAJFINANCE Weekly Level Analysis: PositionalSwing: 19th-23rd JANContinuation of early last night "Intraswing level" post

in early post mentioned Max level "UBTgt => 969" made high @ 969.95 i.e Hit all Levels.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

BAJFINANCE Nearer to Bottoming out-Intraswing Leve 19th JAN 2026BAJFINANCE Level Analysis: Intraswing for 19th JAN 2026

IS NEARER TO BOTTOMINGOUT?

🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔

👇🏼Screen shot of Daily Analysis

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Understanding Ownership, Value, and Investment in Stock MarketWhat Are Shares?

A share is a unit of ownership in a company. When a company needs capital to start, expand, or modernize its operations, it may choose to raise funds by issuing shares to the public or to private investors. Each share represents a small portion of the company’s ownership. Shareholders, therefore, become part-owners of the business.

For example, if a company issues one million shares and an investor owns ten thousand of them, that investor owns one percent of the company. Ownership through shares can entitle investors to certain rights, such as voting on major company decisions and receiving a portion of the company’s profits.

Why Companies Issue Shares

Companies issue shares primarily to raise capital without taking on debt. Unlike loans, the money raised through shares does not need to be repaid. Instead, shareholders share in the risks and rewards of the business. This capital can be used for various purposes such as launching new products, expanding into new markets, upgrading technology, or paying off existing liabilities.

Issuing shares also helps companies improve their credibility and visibility, especially when they are listed on a stock exchange. Publicly listed companies are often perceived as more transparent and reliable due to regulatory requirements and regular disclosures.

Types of Shares

Shares can be broadly classified into two main types: equity shares and preference shares.

Equity shares are the most common form of shares. Equity shareholders are the true owners of the company and have voting rights. They benefit from capital appreciation when the company grows and may receive dividends when profits are distributed. However, equity shareholders are last in line to receive assets if the company is liquidated, making these shares riskier.

Preference shares offer preferential treatment in terms of dividend payments and capital repayment during liquidation. Preference shareholders usually receive a fixed dividend, regardless of the company’s profitability, but they generally do not have voting rights. These shares are considered less risky than equity shares but offer limited growth potential.

How Share Prices Are Determined

The price of a share is determined by supply and demand in the stock market. When more investors want to buy a share than sell it, the price rises. Conversely, when more investors want to sell than buy, the price falls. Several factors influence this demand and supply dynamic, including company performance, earnings reports, industry trends, economic conditions, interest rates, and investor sentiment.

Fundamental factors such as revenue growth, profitability, management quality, and future prospects play a crucial role in determining a company’s intrinsic value. Technical factors, such as market trends and trading volumes, also influence short-term price movements.

Benefits of Investing in Shares

Investing in shares offers several advantages. One of the most important benefits is the potential for high returns over the long term. Historically, equities have outperformed many other asset classes such as fixed deposits and bonds, especially when investments are held for extended periods.

Shares also provide an opportunity to earn dividends, which can serve as a regular income stream. Additionally, investing in shares helps protect wealth against inflation, as growing companies tend to increase their revenues and profits over time, which is reflected in rising share prices.

Another key benefit is liquidity. Shares listed on stock exchanges can be easily bought and sold, allowing investors to convert their investments into cash relatively quickly.

Risks Associated with Shares

While shares offer attractive returns, they also come with risks. Market risk is the most common, where share prices fluctuate due to economic changes, political events, or global developments. Company-specific risks, such as poor management decisions, increased competition, or regulatory issues, can also negatively impact share prices.

Volatility is another risk, particularly in the short term. Share prices can rise or fall sharply, which may be unsettling for new investors. In extreme cases, if a company goes bankrupt, shareholders may lose their entire investment.

Role of Shares in Wealth Creation

Shares play a vital role in long-term wealth creation. By investing in fundamentally strong companies and holding shares over time, investors can benefit from compounding returns. Reinvesting dividends further enhances wealth accumulation.

Shares also contribute to economic growth by channeling savings into productive investments. The capital raised through shares enables companies to innovate, create jobs, and expand operations, which in turn supports overall economic development.

Shares and the Stock Market

The stock market acts as a platform where shares are issued, bought, and sold. Primary markets allow companies to issue new shares through initial public offerings (IPOs), while secondary markets enable investors to trade existing shares. Stock exchanges ensure transparency, liquidity, and fair pricing through regulated trading mechanisms.

Conclusion

Shares represent a powerful financial instrument that connects investors with businesses and economic growth. They offer ownership, the potential for high returns, and participation in a company’s success, while also carrying risks that require careful evaluation. Understanding shares—how they are issued, priced, and traded—helps investors make informed decisions and build long-term wealth. For anyone aiming to grow their financial knowledge or investment portfolio, shares remain a cornerstone of modern finance and an essential component of the global economic system.

GIFTNIFTY IntraSwing Levels for 19th JAN 2026GIFTNIFTY IntraSwing Levels for 19th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

__________________^^^^^^^^^______________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Screenshot (as of now at 9.56 am) of NIFTY spot Shows Consolidation at REVERSAL / TF level Near @ 25555. Witnessing RSI Bullish Divergence ib 5 min TF.

NEXT GOLD PEAK (XAUUSDFriends, this is the gold chart, and it's a monthly chart. Let's not beat around the bush and get straight to the point: when does gold reach its top and when does it hit its bottom? So, let me tell you.

The price of gold is highest when Jupiter is in a fire sign, that is, Aries, Leo, and Sagittarius. This surge in gold prices occurs when Jupiter transits through these fire signs. And at the same time, either Rahu or Ketu is in a water sign. If you look at the historical charts around the dates when these surges occurred, you will see this pattern.(Friends, this combination hasn't appeared since 2016. We will see this combination again in 2027, and in my opinion, that will be the next gold pick.)

Friends, astrology is a profound and complex subject (Gurumukhi), like the legal profession. It takes a lot of time to study and understand, and there are many aspects that can be quite confusing. So, I'll get straight to the point. Try to meet with an astrologer and try to understand it. Remember, nothing ever works 100 percent of the time.

HDFCBANK Level Analysis: Intraswing for 19th JAN 2026✈️ HDFCBANK Level Analysis: Intraswing for 19th JAN 2026

🚀Follow & Compare Daily Intraswing Post for Positioning much accurate level to Take Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.