BEL - STWP Equity Snapshot📊 STWP Equity Snapshot – Bharat Electronics Ltd (BEL)

(Educational | Chart-Based Interpretation)

Market Structure

BEL continues to trade in a structurally strong uptrend, characterized by higher highs and higher lows on the daily timeframe. Recent price action reflects consolidation after a sharp upward expansion, suggesting digestion of gains rather than distribution. The broader structure remains constructive, with price holding above key support zones and maintaining bullish alignment.

Demand–Supply Structure

Price has respected a well-defined demand zone in the 402–397 region, where buyers have consistently defended declines. The recent bullish reaction from this area indicates demand absorption and willingness to support price at higher value levels. Overhead supply is visible near recent highs, but selling pressure appears controlled, indicating healthy supply management rather than aggressive profit booking.

Key Levels – Daily Timeframe

Primary demand zones are placed near 409, followed by deeper structural support around 402–397. These zones represent areas where buyers have previously stepped in with conviction. On the upside, resistance and reaction zones are located near 421, 426, and 434, which may act as pause or acceptance areas during further upside attempts.

What the Chart is Saying

Momentum remains supportive, with RSI holding near 57–58, reflecting healthy strength without signs of exhaustion. Price continues to trade above key moving averages, reinforcing trend integrity. Volume participation remains above average during bullish candles, suggesting continuation interest rather than speculative activity.

CPR Impact

BEL is trading above the CPR pivot with a relatively narrow CPR structure, which generally supports directional continuation rather than range-bound behavior. Acceptance above the CPR zone indicates short-term bullish control. However, the projected CPR ahead appears wider, hinting at the possibility of brief consolidation before the next directional phase.

Additional Structure Observations

Recent pullbacks have been shallow and followed by strong recovery attempts, indicating dip-buying behavior. Short-term moving averages remain positively aligned, while the longer-term structure continues to slope upward. The absence of heavy selling volume during declines suggests effective absorption of supply. Overall, the structure supports continuation, subject to normal consolidation and acceptance checks.

Intraday Reference Levels (Structure-Based)

The 418 zone acts as the near-term balance area and remains the key intraday reference. Sustained holding above 418 keeps the structure stable and supports upside testing toward the 436–449 zone, which represents upside reaction areas where price may pause or require acceptance. On the downside, weakness below 418 increases risk toward the 402–397 demand zone, where intraday structure would be reassessed. These levels define intraday risk versus opportunity, not directional certainty.

Swing Reference Levels (Hybrid Model | 2–5 Days)

From a short-term swing perspective, BEL remains within a positive structural framework as long as price holds above the 402–397 primary demand zone. If strength sustains, the 449–473 zone emerges as a higher range-expansion reference area over the coming sessions. Conversely, sustained acceptance below 397 would elevate downside risk and indicate a shift from consolidation toward deeper corrective behavior. Until such failure occurs, consolidation above demand should be viewed as constructive.

Final Outlook (Condition-Based)

Momentum remains strong and supportive of the prevailing structure. The trend is clearly up, with buyers maintaining control above key demand zones. Risk remains elevated due to proximity to resistance and recent price expansion, while volume stays moderate and healthy, supporting continuation rather than exhaustion.

💡 STWP Learning Note

Strong trends often pause through consolidation, not reversal.

Respect structure and let price confirm continuation.

📘 STWP Approach

Observe price. Respect risk.

Trade structure, not prediction.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Chart Patterns

ZOTA - STWP Equity Snapshot📊 STWP Equity Snapshot – Zota Health Care Ltd

(Educational | Chart-Based Interpretation)

Market Structure

ZOTA witnessed a sharp corrective phase from higher levels, followed by a strong rebound from a well-defined demand zone. The recent candle stands out as a decisive bullish reaction, indicating aggressive buying interest after prolonged selling pressure. Despite the strength of the bounce, price is still trading within a broader range, and the larger trend structure has not yet shifted into a clear uptrend.

Demand–Supply Structure

Price moved deeply into a historical demand zone where buyers stepped in with conviction. The strong bullish candle suggests absorption of selling pressure and short-term buyer dominance. However, overhead supply zones remain active, meaning the current move should be viewed as a recovery from demand rather than a confirmed breakout. Sustained strength is required for further range expansion.

Key Levels – Daily Timeframe

Immediate demand zones are placed near 1376, followed by lower structural supports around 1290 and 1250. These are areas where buyers have previously defended price. On the upside, resistance zones are visible near 1451, 1526, and 1652, where selling pressure has historically emerged. These levels act as reaction zones and help define the current range.

What the Chart is Saying

Momentum has improved significantly after the recent bullish expansion, supported by strong volume participation. RSI is recovering from lower levels, indicating improving internal strength, but it is still not in a trending zone. The structure remains range-bound, suggesting that price may consolidate or oscillate between demand and supply zones before showing directional clarity.

CPR Impact

ZOTA is currently interacting with a wide CPR structure, which typically signals indecision and range-bound behavior. Earlier price action stayed below CPR resistance, reinforcing the lack of strong directional bias. For any sustained bullish shift, price would need to show acceptance above the CPR pivot with follow-through. Until then, the CPR structure supports a cautious, range-based view.

Additional Structure Observations

The rebound candle carries added significance as it formed with an open equal to the low, indicating immediate buyer control and minimal intraday selling pressure. This move was supported by clear volume expansion, suggesting participation beyond short-term traders and pointing toward stronger hands absorbing supply near demand. Short-term moving averages are attempting to turn up, reflecting improving momentum, while price remains below longer-term averages, keeping the broader structure neutral. RSI has recovered from lower levels but is still below bullish expansion zones, indicating support without trend confirmation. Additionally, the projected wide CPR for the next session reinforces the probability of consolidation or two-sided activity rather than immediate directional continuation. Overall, the move reflects strength from demand, but structural acceptance above nearby supply is still required for confirmation.

Intraday Reference Levels (Structure-Based)

The reference price zone near 1400 acts as a short-term decision area. Weakness below this zone may expose price toward lower demand regions around 1290. On the upside, reaction zones near 1450 and above are areas where price may pause or face selling pressure. These are observational levels, not predictions.

Swing Reference Levels (Hybrid Model | 2–5 Days)

For the short swing perspective, the 1400 zone remains the structural reference. Failure to hold demand increases downside risk toward deeper support zones. If strength sustains, higher range-expansion zones above previous resistance come into focus, but only as conditional possibilities within the broader range.

Final Outlook (Condition-Based)

Momentum is strong in the short term, supported by volume expansion. The trend remains range-bound, with no confirmed directional control yet. Risk remains high due to the counter-trend nature of the recovery and nearby supply zones. Volume is elevated, indicating participation, but structure confirmation is still pending.

💡 STWP Learning Note

Strong rebounds from demand show intent — not confirmation.

Let structure and acceptance guide bias, not candle size.

📘 STWP Approach

Observe price. Respect risk.

Trade structure, not excitement.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

BTCUSD at Key Demand Zone, price seeks stability after pullbackBTCUSD displays a clear change in market behavior after completing a strong bullish phase that pushed price toward all-time highs. Following this peak, momentum weakened and price entered a corrective decline, forming lower highs and lower lows that define a short-term bearish structure. This pullback appears corrective rather than impulsive, suggesting the broader market context remains balanced rather than fully bearish.

Price is now testing a well-defined demand zone around 89,000–88,500. This area previously acted as a base for strong upside expansion and represents a key support region where buyers may re-enter the market. A stable reaction from this zone could signal absorption of selling pressure and the beginning of a recovery phase. Holding above demand keeps the downside controlled and preserves the possibility of a bullish response.

On the upside, the first major resistance is located near 93,000–94,000. This zone marks prior selling activity and is expected to act as a barrier during any rebound. A clean break and acceptance above this resistance would indicate improving momentum and increase the probability of a broader trend shift. Until then, upside moves may remain corrective.

If demand fails, price could extend lower and confirm bearish continuation. Overall, BTCUSD is at a decision area where structure, demand, and resistance will guide the next directional move

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

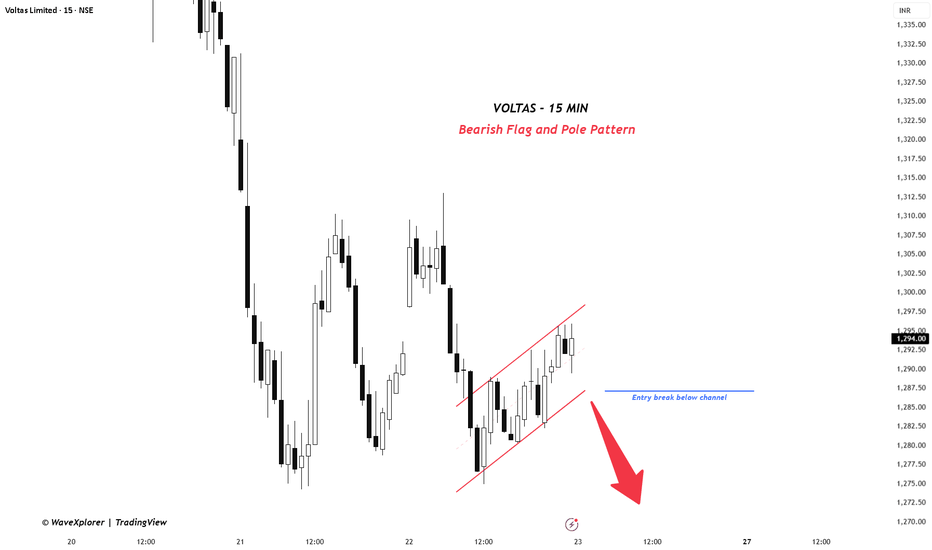

VOLTAS (15-Min) – Bearish Flag in PlayVOLTAS is forming a classic bearish flag & pole on the 15-minute timeframe. The sharp decline marks strong selling pressure, followed by a slow, overlapping upward channel, which is corrective in nature.

As long as price remains within this rising flag, the structure stays intact. A breakdown below the channel is the trigger, opening the door for continuation on the downside.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

HAL Weekly Chart suggest BO above 4680 ... 20% upside Possible.HAL Weekly Chart suggest BO above 4680 ... 20% upside Possible.

HAL looks breaking out from Earlier tops of 4680 after long time. Expect momentum to continue for 20% upside soon.

We can see multiple patterns on chart ... Daily CUP / Weekly CUP / DEC 24 Top Breakout.

LTP - 4736

SL - 4650

Targets - 5680+

timeframe - 10-12 weeks.

Happy Investing.

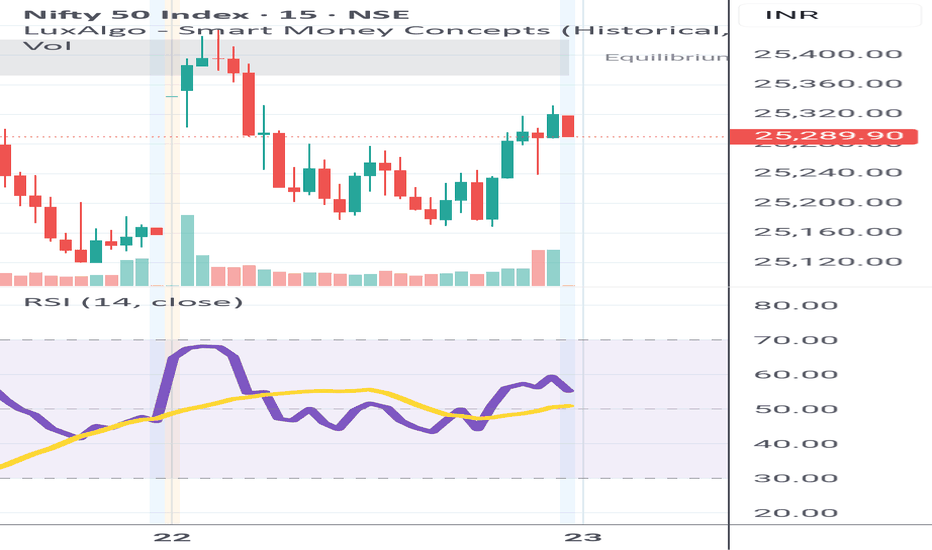

Lets Talk about Nifty I make educational content videos on Trading - Swing Trading in Indian markets especially

In this video I am talking about Nifty in general as a index nothing else - no direction - no predication - I am a setup and data backed trader and follow my setups and not general trends or bias shared commonly .

What"s next for IBKR ?Stock has been testing the 52 wk high resistance zone for quite a few times . After the earning boost , stock is poised to give a new ATH in the next 3-6 months depending upon macro and global uncertainities. Next stock target from current price is 86-90 $ per share translating into a return of almost 10 % from the current levels .

$SAND MACRO SETUP | 7,800%+ CYCLE EXPANSION IF HTF DEMAND HOLDSCSE:SAND Is Trading At A Major HTF Accumulation Zone After A ~99% Decline From ATH, Forming A Long-Term Base Inside A Multi-Year Descending Channel.

Technical Structure:

• Strong Demand Holding At $0.14 – $0.11

• Price Reacting From HTF Trendline Support

• Structure Remains Valid Above $0.10 (HTF Close)

• Break Above $0.22 – $0.26 Required For Bullish Continuation

Expansion Targets (HTF): $0.65 → $1.50 → $3.50 → $8.48+ (ATH Zone)

This Remains A High R:R Macro Setup If HTF Demand Holds And Price Breaks The Descending Channel.

Invalidation:

HTF Close Below $0.10 Opens Downside Toward $0.05 – $0.035, The Last Major Bullish Order Block.

TA Only. Not Financial Advice. DYOR.

XAUUSD (Gold) | Technical Outlook | 22nd Jan'2026Gold continues to trade near 4,831, maintaining a strong bullish structure across all major timeframes. Price remains firmly above key moving averages (20/50/100/200), signaling sustained buyer control and trend continuation.

Momentum indicators support the upside, with RSI in bullish territory, MACD positive, and ADX above 35, confirming strong trend strength. Volatility remains elevated, suggesting sharp and directional price moves.

Key Levels to Watch

Support: 4,800–4,790 | 4,770–4,760 | 4,740–4,730

Resistance: 4,838–4,845 | 4,870–4,888

Major Breakout: Above 4,900

Bullish Bias

As long as Gold holds above 4,770–4,780, the trend remains bullish. A break and close above 4,845 could trigger momentum buying toward 4,870 → 4,900+. Pullbacks are expected to remain corrective.

Bearish / Correction

Bearish pressure emerges only below 4,770, with downside levels at 4,740 → 4,700 → 4,660. Trend reversal only if 4,630 breaks on a daily close.

Trading Focus

Buy on dips near 4,800–4,790

Sell only on breakdown below 4,770

Watch US PMI, GDP, Jobless Claims, Fed commentary & DXY for volatility

Conclusion

Gold remains firmly bullish, with the path of least resistance pointing higher unless key supports fail.

Part 11 Trading Master Class With Experts Time Decay (Theta)

Theta represents how much value option will lose per day even if price doesn’t move.

Sellers LOVE Theta

Buyers FEAR Theta

Near expiry:

A ₹200 premium may fall to ₹20 even with little change in spot.

This is how sellers make money consistently.

NIFTY – Short-term & Long-term Outlook from Demand ZoneNifty has shown a strong rejection from the 24,900–24,500 historical demand zone.

On the 4H chart:

Long lower wick near 24,900 indicates aggressive buyer participation.

RSI exhaustion and reversal suggests selling pressure has weakened.

Trendline and EMAs remain intact.

Short-term View:

Above 24,900 → upside possible towards 25,600 – 25,900

Below 24,900 (sustained) → downside towards 24,500

Long-term View:

24,500 is the major invalidation level.

Above 24,700–24,900, bias remains bullish on dips.

Upside targets: 26,000 – 26,400+

Disclaimer:

I am not a SEBI registered advisor. This analysis is for educational purposes only. Please do your own research before taking any trades.

Part 12 Trading Master Class With Experts Why Traders Use Options

Options allow traders to benefit from multiple market views:

Directional trading (up or down)

Non-directional trading (markets stay range-bound)

Volatility trading (IV expansion/contraction)

Hedging (protect portfolios)

Income generation (selling options)

This flexibility makes options superior to normal equity trading.

Part 5 Advance Trading Knowledge Introduction to Option Trading

Option trading is a sophisticated financial market activity that allows traders and investors to manage risk, speculate on price movements, and generate income using derivative instruments known as options. Unlike traditional equity trading—where an investor buys or sells shares outright—options derive their value from an underlying asset such as stocks, indices, commodities, currencies, or cryptocurrencies.

An option contract gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. The seller (writer) of the option, on the other hand, has the obligation to fulfill the contract if the buyer chooses to exercise it.

Option trading is widely used in global financial markets due to its flexibility, leverage, and ability to profit in rising, falling, or even sideways markets.

BANK Of India weekly chart1. Pattern identification: The weekly Bank of India chart shows a rounding bottom marked with a white arc, indicating a potential long‑term reversal from downtrend to uptrend.

2. Current price action:

Price is ₹166.75 (close) with a 5.98% gain.

The stock is approaching the rim of the saucer near ₹170.

3. Breakout analysis:

A clean break above ₹170 on strong volume will confirm the rounding‑bottom completion and trigger a bullish move.

Target can be estimated by measuring the depth of the saucer, rise from bottom to rim.

4. Volume & momentum:

Volume spikes are seen during the bottom formation and recent rise, supporting accumulation.

5. The View :

Initiate a long position on a decisive breakout above ₹170 with a noticeable volume surge (preferably > average volume).

Stop‑loss: Place a protective stop below the lower support, around ₹160, to limit loss if the pattern fails.

The pattern suggests buyers are gaining control; risk‑reward is favorable if the breakout holds.

Bitcoin Bybit chart analysis JENUARY 21Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

The Nasdaq has been acting up lately.

As the Nasdaq is undergoing forced coupling,

please pay close attention to its movements.

*Long Position Strategy:

1. Confirm the touch of the purple finger at the top,

and then switch to a long position at $88,784 at the red finger at the bottom.

/ If the purple support line is broken, set a stop loss.

2. $91,612.7 long position initial target -> Top, then Good in that order.

If the strategy is successful, $90,566.3 is the long position re-entry point.

If the upper level falls immediately without touching the first point,

wait for a final long position at point 2. / If the green support line is broken, set a stop loss.

Today's bottom -> $86,977.3

is a major rebound point on the daily Bollinger Band chart.

Also, the orange resistance line at the top is the center line of the 4-hour Bollinger Band chart.

A strong breakout of this area is necessary for a true rebound.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

MedPlus: Rising Channel Accumulation – Swing Opportunity StudyOn the daily chart, MedPlus Health Services is trading within a well-defined rising channel, indicating controlled accumulation after a prior decline. Price action shows higher lows and stable demand, while upside progress remains capped by a major resistance band.

🔸 Key Support Levels

₹740–760 → Primary channel support & accumulation zone

₹780–800 → Mid-channel support / short-term decision area

Holding above these zones keeps the bullish swing structure intact.

🔸 Key Resistance Levels

₹845–850 → Major horizontal resistance & breakout trigger

₹880–900 → First expansion zone after breakout

₹940–960 → Upper swing projection / prior rejection area

A decisive daily close above ₹850 with volume would indicate trend continuation, while failure to hold channel support would weaken the structure.

🔸 Invalidation Level (Structure Failure)

Below ₹740 (daily close)

Channel breakdown would invalidate the current swing thesis and suggest further consolidation or downside.

🔹 Swing Study Summary

Structure: Higher lows inside rising channel

Bias: Neutral-to-positive while above ₹740

Decision zone: ₹845–850

⚠️ Note

This analysis is for educational and chart-study purposes only.

It is not a buy/sell recommendation.

Decisive Zone in NAUKRI around 1345NAUKRI is currently sitting at a critical technical juncture. After a period of volatile price action, the stock has returned to a well-defined Decisive Zone (approx. 1,332 – 1,354). Historically, this area has acted as a significant ceiling (resistance), and how the price reacts here will likely dictate the trend for the coming sessions.

Success in this zone depends entirely on Volume Confirmation.

🚀 Bullish Scenario: If the price breaks above the zone with a high-volume spike, it confirms that buyers have overwhelmed the sellers. Action: Look for long opportunities on a candle close above resistance. Target 1400

📉 Bearish Scenario: If the price faces rejection at these levels (forming long upper wicks) and breaks back below the immediate support, the historical resistance remains intact. Action: Look for short opportunities or wait for a better base to form. Target 1290

Sensex – Short Term & Long Term Levels (Educational View)

Key Structural Levels:

Immediate Support (Short Term): 81,800

Major Positional Support (Long Term): 81,500

Short Term View (1–2 Days)

As long as 81,800 holds, pullback buys are possible with:

SL: Below 81,800 (sustained break)

Upside Targets:

82,900

83,300 – 83,500

If price breaks today’s high and holds above 82,300,

a move toward 83k–83.5k zone is likely.

If 81,800 breaks and sustains, short-term trend turns bearish

with downside toward 81,500.

Long Term / Positional View

As long as 81,500 holds on higher timeframe,

long-term structure remains intact with upside potential toward:

85,500 – 86,000

If 81,500 breaks and sustains on 4H/Daily,

positional structure turns bearish with further downside expected.

Disclaimer: I am not a SEBI registered advisor/trader.

This view is shared only for educational and learning purposes.

Please do your own analysis before taking any trade.