SPX Rejection-Price Stalling Near Psychological Line-Short Mode🔍 Chart Context:

✅ Strong bullish trend earlier, supported by rising moving averages.

⚠️ A single Sell label has now appeared just under the 6400.28 marked resistance.

📏 Price is compressing after the impulse rally, forming potential lower highs.

🟧 Liquidity Control Box suggests recent supply presence in this zone.

🔽 Downside target is aligned with prior accumulation and untested support zones (around 6316.33).

🎯 Intraday Setup Summary:

Entry Bias: Bearish — only valid if price stays below the orange supply zone.

Stop Zone: Above 6400.28 structural resistance.

Target Zone: Testing the next demand cluster around 6316.33 for potential reaction.

🧠 Educational Insight:

This structure showcases how price often pauses or reverses near psychological levels (like 6400), especially when supply zones and exhaustion signals align. Useful for traders who combine momentum with structural bias.

⏱ Timeframe:

15-Minute (Intraday Setup)

Contains IO script

M&M Short Setup-Rejection from Supply Zone + Trend ConfirmationThis 2H chart on Mahindra & Mahindra Ltd. reflects a structure-aware short opportunity, based on price rejection from a key resistance zone and alignment with Leola Lens SignalPro logic.

🔎 Technical Structure Highlights:

🔴 SELL signal confirmed as price failed to sustain above recent supply clusters.

🟤 Multiple rejection blocks visible near ₹3,180 — now acting as resistance.

⚪ Price broke below the adaptive white base trendline, turning it into overhead pressure.

🟡 Prior yellow caution marker (trend shift risk) proved meaningful as momentum faded.

🟥 Defined invalidation level above ₹3,180.25.

🟢 Bearish targets align with previous demand zones near ₹3,025 and ₹2,919.

📌 Context Note:

Trend has shifted from congestion to downside acceleration. A clean break of recent structure suggests caution for longs. Watch for volatility around upcoming earnings.

📚 This is a technical case study — for educational use only.

Always trade with risk controls and your own judgment.

#M&M #Mahindra #NSEStocks #PriceAction #ShortSetup #StructureTrading #TechnicalAnalysis #SignalPro

TATAMOTORS Breakdown Watch-Structure Rejection & MomentumThis 1H chart on Tata Motors highlights a structure-aware short setup, guided by the Leola Lens SignalPro overlay.

🔍 Technical Breakdown:

🔴 A fresh SELL signal appeared after price lost the adaptive trendline and failed to reclaim the resistance block.

⚪ Price retested the liquidity rejection zone near ₹650–₹652 before continuing lower.

🟣 The white base trendline is now acting as overhead pressure.

🟥 The Liquidity Control Box serves as invalidation above ₹665.70.

🟢 Potential target zones extend toward the ₹620–₹580 region, aligning with prior demand clusters.

🧠 Context Note:

The setup follows a clear structure rejection after a failed bullish attempt. Momentum confirms the shift, but risk management remains essential due to volatility and earnings

📌 For educational purposes only.

Always manage risk and confirm with your own strategy.

#TataMotors #ShortSetup #StructureTrading #IndianStocks #NSE #PriceAction #TechnicalAnalysis

DXY Long Setup Forming After Structure Reclaim-101.567This intraday chart on DXY (U.S. Dollar Index) showcases a structure-aware long setup using Leola Lens SignalPro on the 1H timeframe.

⚙️ Key Technical Highlights:

🟢 Multiple BUY signals appeared near 99.98–100.00 zone after reclaiming short-term structure.

⚪ Price holds above the white adaptive base trendline — suggesting support strength.

🟥 Liquidity Control Box defines a clear invalidation zone under 99.98.

🔁 Prior SELL signals failed to follow through, indicating weakening bearish momentum.

📊 Target projection: 101.567 (based on structural extension and signal alignment).

📌 What to Monitor:

🔎 A decisive candle close above 100.10–100.15 can confirm bullish intent.

🎯 Reward-to-risk favored on clean setups post-breakout, aligning with momentum model.

📉 Invalid if structure re-breaks below base zone with volume.

⚠️ Educational use only. Not financial advice. Structure zones visualize behavior — not prediction.

🔐 Invite-only tool — access details in author bio.

ES1- Reversal After Extended SelloffPrice has experienced a clean, directional drop with consistent Sell signals and EMA slope confirmation.

Current Buy signal has appeared near potential support, offering a short-term reversal watch.

EMAs still show downward pressure, so caution is warranted until breakout confirmation occurs.

🔍 Educational Setup Observation:

Observed Entry Zone: Near 6,408.00

Stop Level: Below 6,399.25 (below structural low)

Potential Target Area: 6,442.75 — prior imbalance and reaction zone

🧠 SignalPro Highlights:

This is the first Buy signal after a strong sell sequence — often used as a potential momentum shift marker.

Short-term reversal setups like this often require clear candle confirmation above moving averages to validate direction.

⚠️ This chart and setup is for educational purposes only. It is not financial advice. Always conduct your own due diligence and apply proper risk management.

UK100-Short Setup After Supply Zone RejectionPrice rallied sharply from the lows after a Buy signal, showing strong momentum into resistance.

After the rally, a Sell signal has emerged near local highs and beneath a defined structure zone.

Price has started to reject from the zone, with EMAs flattening out — hinting at short-term weakness.

🔍 Educational Setup (Short Bias):

Observed Entry Area: Near 9,146.80

Stop Reference: Above 9,155.96 (supply invalidation point)

Target Zone: 9,092.29 — aligned with previous demand base and structural retest

🧠 SignalPro Observations:

Earlier Buy sequence led to momentum burst — now fading as price meets resistance

EMA behavior suggests potential for mean reversion or short-term correction

Liquidity cluster below may act as a draw in the near term

⚠️ This chart and analysis are for educational purposes only. This is not financial advice. Please conduct your own analysis and manage risk before making any trading decisions.

GBPJPY Short Setup- Momentum Rejection from ResistanceThis chart explores a potential short opportunity in GBPJPY on the 15-minute timeframe following a visible loss of bullish momentum near the upper structure.

🔍 Key Observations:

Sell Labels appeared after a strong upside move, near a key resistance zone.

A Caution Marker was triggered near the high — typically indicates a potential trend exhaustion.

Price lost support from short-term moving averages and began to trade below them.

A downside continuation setup is now active with price targeting prior demand levels.

🎯 Target Area:

A previous structure low and untested support zone around 197.699 is being monitored as a potential target, pending continued bearish momentum.

🧠 Educational Notes:

This idea highlights how momentum-based tools can help identify potential intraday turning points. The confluence of resistance rejection, caution labeling, and sell signals offers a clean example of short-term reversal structure.

⏱ Timeframe:

15-Minute (Intraday)

Nifty Financial Services Index-Reversal Set-Long Eyes ONLeolaLens SignalPro has triggered a fresh Buy indication on the 15-minute chart after a prolonged downtrend. This signal has emerged near a possible reversal zone, with defined risk and potential reward setup.

Entry: Around 26,660

Stop Loss: 26,599

🎯 Target 1: 26,880

🎯 Target 2: 27,040

🎯 Target 3 (Extended): 27,240

Key Observations:

Price attempting short-term EMA crossover

Favorable risk-reward ratio setup

Chart structure suggests potential for short-term reversal

🛑 Disclaimer:

This chart is shared strictly for educational purposes. This is not financial advice or a buy/sell recommendation. Please do your own research and consult a registered financial advisor before making any trading decisions.

DAX40 Recovery Setup-Potential Upside to 24552After a significant intraday selloff, DAX40 shows signs of a potential recovery as price reclaims the earlier support zone with strength.

🔍 Key Observations:

✅ Yellow box marks a cluster of bars after a strong downtrend, hinting at accumulation or exhaustion.

⚠️ Support retest held — recent candles show signs of rejection from the lower bound near 24,077.

📈 Leola Lens SignalPro structure suggests a potential shift in bias — upside projection mapped to 24,552 as the next key level.

📊 Clean invalidation zone below recent wick lows.

💡 Educational Insight:

This setup emphasizes the importance of price structure, volume balance zones, and trend exhaustion for anticipating reversals. Traders can study how institutional-style tools like SignalPro help highlight such shift moments with visual clarity.

ETHUSD Rejection Near Supply-Breakdown path to 3481ETH/USD shows signs of weakness after rallying into a short-term supply zone. The structure suggests a possible trend reversal as price begins to reject near key resistance.

🔍 Setup Highlights:

🟥 Red zone represents a clear supply area, where buyers were absorbed.

🟧 Yellow bar cluster from SignalPro shows early consolidation before the pump.

🔵 Breakdown trigger initiated as price lost the momentum and structure failed near 3,700.

🎯 Target zone at 3481, aligning with a previous demand imbalance zone.

📘 Educational Takeaway:

This chart helps illustrate how:

Supply rejection zones act as trend reversal points.

Visual tools like Leola Lens SignalPro guide traders on structure + sentiment.

Mapping invalidation clearly improves discipline and planning.

SPX Supply Rejection-Eyes on 6304SPX shows signs of potential weakness after testing a prior supply zone and failing to sustain higher levels. The current setup anticipates a downward move, supported by structural resistance and liquidity imbalances.

🔍 Chart Highlights:

🟥 Red zone marks supply rejection after a strong upward move.

📦 Liquidity Control Boxes from SignalPro show layered imbalance zones between 6,350–6,310.

🧊 Target marked at 6304, aligned with lower liquidity pocket and recent demand structure.

⚠️ Stop region defined above the rejection high, giving clear invalidation.

📘 Educational Focus:

This trade scenario highlights how to:

Identify potential exhaustion at supply zones

Map liquidity structures using institutional-style tools

Build trade ideas with defined risk-to-reward

Such planning reinforces disciplined trading, especially in high-volume indices like SPX.

BTCUSD-Eyes 120000 after Liquidity Sweep & Support RetestPrice action on the 15-min chart shows Bitcoin forming a potential bullish continuation after a liquidity sweep below short-term support. Here’s what stands out:

🔹 Triple Tap Support: Price respected a key zone multiple times, hinting at strong buyer interest.

🔹 Post-Sweep Reaction: Sharp recovery followed by consolidation suggests demand re-entered the market.

🔹 SignalPro Context: Leola Lens™ SignalPro highlighted key zones (yellow + orange), offering caution and trend context.

🔹 Projected Path: With price stabilizing above the reclaimed zone, potential upside target aligns with the 120000 region.

📌 Educational Note:

This setup highlights how liquidity collection below support and subsequent recovery can offer clues to short-term directional intent. Always manage risk based on volatility and session context.

USDCAD Bullish Setup-Shift from Accumulation to ExpansionPrice has broken above recent accumulation range marked by Liquidity Control Boxes.

SignalPro long setup activated with:

🔶 Smart accumulation zone breakout

🔁 Minor retest at 1.361 area holding

🎯 Targeting upper liquidity levels around 1.37139

Price structure shows a bullish microtrend reversal with risk capped below last demand block.

Key Elements on Chart:

📦 Leola Lens SignalPro's control zones provided context for consolidation and breakout

📈 Breakout aims toward untested supply zones above

⏳ Timeframe: 15-min

🧠 Educational Use Only – No financial advice.

Tool used: Leola Lens SignalPro

UNOMINDA – Daily Timeframe Breakout Idea (Resistance Zone Break)UNO MINDA LTD. has shown a breakout above a key horizontal resistance level on the daily chart, accompanied by a nearly 1.5 times volume surge near the breakout, as seen earlier, supported by strong momentum.

🔍 Breakout Context:

- Price might break above the ~₹1110 horizontal resistance, which had held for over 6 months.

- Breakout supported by more than average volume and just above average range near the resistance zone.

- The price is also trading above both the 50- and 100-day SMAs, indicating strong trend continuation.

- This aligns with a bullish continuation setup.

📉 Trade Plan:

- CMP: ₹1093

- Entry: Near ₹1112

- Target: ₹1188 (~7% upside from CMP)

- Stop-Loss: ₹1082

- Risk-Reward Ratio: ~1 : 2.0

📌 Note:

- Look for a confirmation candle to enter the trade.

- Avoid chasing the extended move unless confident in intraday momentum.

⚠️ Disclaimer: This post is for educational purposes only and not financial advice. Always do your research or consult a financial advisor before trading.

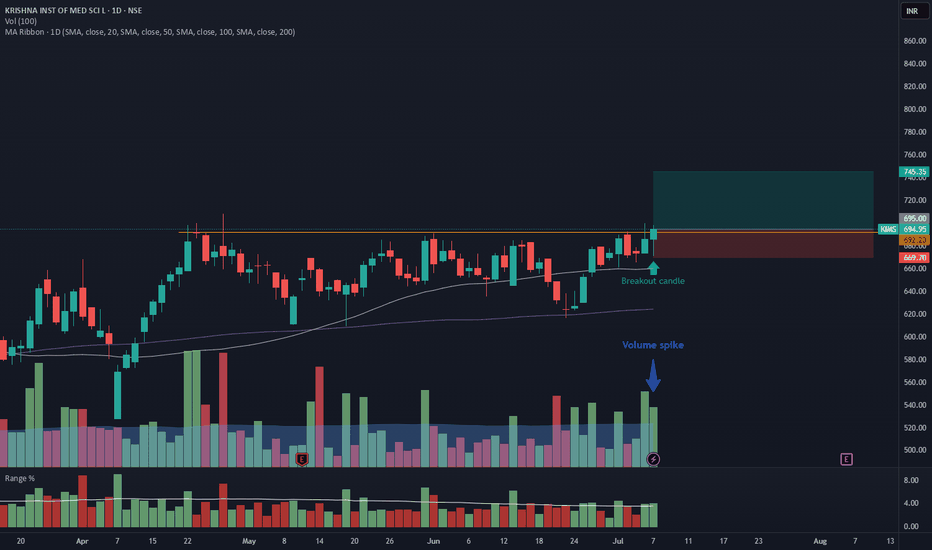

KIMS – Daily Timeframe Breakout Idea (Resistance Zone Break)

KRISHNA INSTITUTE OF MEDICAL SCIENCE has shown a breakout above a key horizontal resistance on the daily chart, accompanied by a ~2x volume surge, supported by strong momentum.

🔍 Breakout Context:

- Price broke above the ~692.20 horizontal resistance, which had held for over 2 months.

- Breakout supported by <2x average volume and just above average range on the breakout candle.

- The price is also trading above both the 50- and 100-day SMAs, indicating strong trend continuation.

- This aligns with a bullish continuation setup.

📉 Trade Plan:

- CMP: ₹694

- Entry: Near ₹695

- Target: ₹746 (~7.25% upside from CMP)

- Stop-Loss: ₹669

- Risk-Reward Ratio: ~1 : 2.0

📌 Note:

- Avoid chasing the extended move unless confident in intraday momentum.

⚠️ Disclaimer: This post is for educational purposes only and not financial advice. Always do your research or consult a financial advisor before trading.

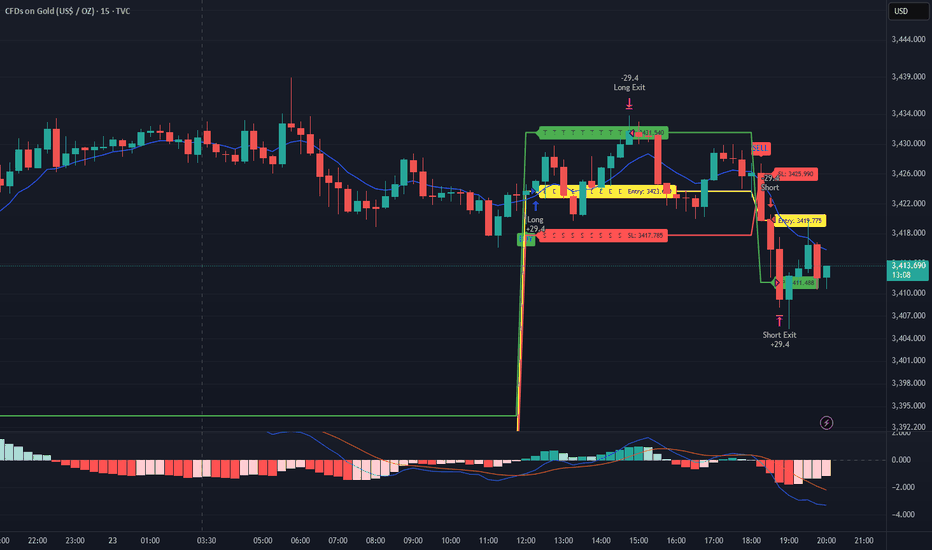

Perfect Short Setup Nailed – Again | 828 Pips Profit in XAUUSDHello Traders,

We’ve crafted a high-probability trading strategy designed specifically for XAUUSD. With over 65% accuracy and a 1:1.33 risk-reward ratio, Gold Sniper delivers reliable signals that traders can trust.

Our latest signal alone secured a profit of 828 pips.

📈 Ready to level up your trades?

DM now to get access and start using Gold Sniper on your charts.

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

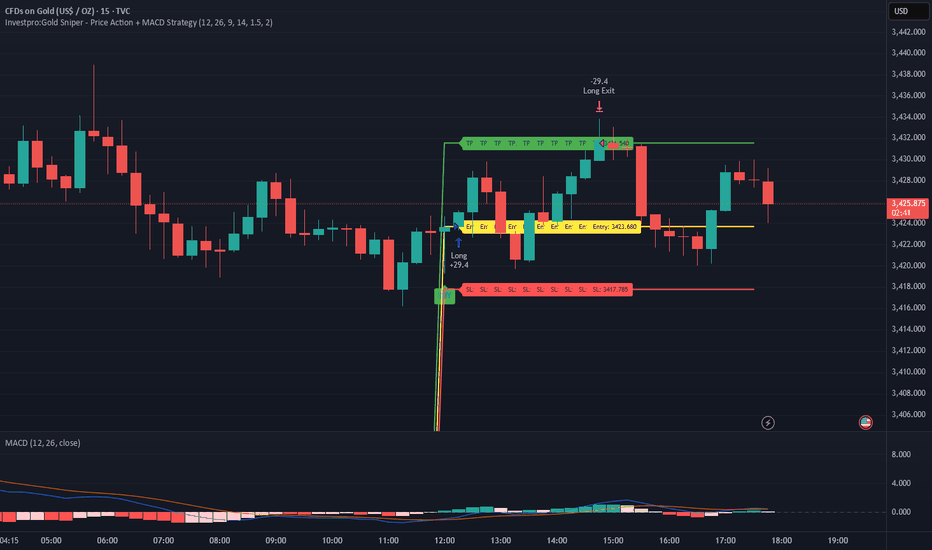

Introducing the Gold Sniper Strategy | Your Edge in the MarketHello Traders,

We’ve crafted a high-probability trading strategy designed specifically for XAUUSD. With over 65% accuracy and a 1:1.33 risk-reward ratio, Gold Sniper delivers reliable signals that traders can trust.

Our latest signal alone secured a profit of 786 pips.

📈 Ready to level up your trades?

DM now to get access and start using Gold Sniper on your charts.

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

HAVELLS Channel Breakout Setup with Earnings Ahead Havells is approaching a crucial resistance trendline within a well-defined downward sloping channel. Price currently tests mid-channel and historical supply zones, with multiple Leola Lens SignalPro yellow caution labels plotted—historically seen before directional reversals.

📌 Structure Highlights:

Clear channel formation since April

Multiple resistance rejections near 1580 zone

Buy interest seen near lower boundary with SignalPro confirmation

Breakout projection suggests target zone near 1680, aligning with prior volume gap

📅 Earnings event likely to be a catalyst. Monitor price behavior post-results for potential breakout confirmation above 1580.

🧠 Leola Lens™ SignalPro Notes:

Yellow caution labels have repeatedly appeared near key turning points within the channel, suggesting possible trend transition zones. These zones highlight moments of institutional activity, where smart money behavior often shifts.

The yellow caution markers indicate potential trend change zones, based on historical conditions where price has shown institutional interest or liquidity shifts. These zones are not direct buy/sell signals, but highlight areas to monitor closely for structural confirmation.

🧠 This chart is intended for educational and structural analysis only. No financial advice.

HAVELLS Pre-Result Reversal Watch I Holds for Potential 1600Chart Type: 15-minute | Tool Used: Leola Lens SignalPro

Price action has rebounded from a key liquidity zone (highlighted yellow) with visible accumulation below ₹1,520.

Key Observations:

Price retested prior demand zone (marked by SignalPro with structure and volume signals).

Potential bottom formation visible intraday with higher low attempt post 12 PM.

Rejection of downside wick near ₹1,514, aligning with earlier liquidity pockets.

Idea View:

If price sustains above ₹1,525–₹1,530, possible momentum expansion toward resistance zone at ₹1,600.60.

Clean structure break above previous order blocks may attract trend traders.

Result-based volatility expected — manage risk, especially with expected earnings post-market today.

Risk Reference Zone:

Invalid below ₹1,510 (red shaded zone)

This is not financial advice. Chart is for educational and structural reference only.

#HAVELLS #PriceAction #ChartAnalysis #MarketStructure #SignalPro #LiquidityZones #TechnicalAnalysis #TrendReversal #NSEStocks #EarningsSetup

Gold Daily Trend with Ascending Channel

MCX:GOLD1!

A gold daily time frame chart with an ascending channel is a technical analysis setup that shows the price movement of gold over a daily period, forming a pattern known as an ascending channel.

Key Features of an Ascending Channel:

- Trendline Connection: The channel is created by drawing two parallel trendlines:

- Lower Support Line: Connects the series of higher lows.

- Upper Resistance Line: Connects the series of higher highs.

- Price Action: The price of gold is moving upward within these two lines, bouncing between support and resistance.

- Trend Indication: Indicates a bullish trend, suggesting that the price is gradually increasing over time.

**Interpreting the Chart:

- Bullish Signal: As long as the price remains within the channel, the upward trend is considered intact.

- Trade Opportunities:

- Buy near support: When the price approaches the lower trendline.

- Sell near resistance: When the price nears the upper trendline.

- Breakouts:

- A move above the upper resistance line may signal strong bullish momentum.

- A break below the support line could indicate a trend reversal or correction.

Practical Use:

- Traders look for buying opportunities at the channel's support and be cautious if the price breaks out of the channel.

- Confirming other indicators or volume analysis can strengthen trading decisions.

Nifty 50 - Symmetrical Triangle Breakout WatchNifty is currently consolidating within a symmetrical triangle pattern on the 1-hour chart. Price is respecting both the rising support and descending resistance trendlines.

Key observations:

Clear higher lows indicate underlying bullish pressure.

Lower highs show selling pressure near resistance.

Expecting a possible pullback toward the lower trendline before a potential breakout to the upside.

Trade Plan (if breakout occurs):

📈 Bullish breakout above the upper trendline could lead to a sharp rally.

✅ Confirmation needed with strong volume and candle close above resistance.

Invalid if price breaks below the support trendline.

Stay alert for a breakout or breakdown — both scenarios possible, but current structure slightly favors bulls.

SWANENERGY - Daily Timeframe Breakout (Resistance Zone Break)SWAN ENERGY has shown a breakout above a key horizontal resistance level on the daily chart, accompanied by a nearly 2.5 times volume surge near the breakout zone, as seen earlier, supported by strong momentum.

🔍 Breakout Context:

- Price might break above the ~₹484 horizontal resistance, which had held for over 6 months.

The breakout zone has been supported by 2.5X volume and a range 3X of average near the resistance zone.

- The price is also trading above both the 50- and 100-day SMAs, indicating strong trend continuation.

- This aligns with a bullish continuation setup.

📉 Trade Plan:

- CMP: ₹485.2

- Entry: Near ₹484

- Target: ₹566 (~16.5% upside from CMP)

- Stop-Loss: ₹450

- Risk-Reward Ratio: ~ 1 : 2.3

📌 Note:

- Wait for the closing of this candle, enter the trade near 3:20 PM, or get confirmation on 75min/1Hr TF.

- Avoid chasing the extended move unless confident in intraday momentum.

⚠️ Disclaimer: This post is for educational purposes only and not financial advice. Always do your research or consult a financial advisor before trading.