Continuationpatterns

Trading an Inside Bar After a Triangle Breakout - ContinuationLong Above 236

Stop-loss 219

Target: 321

The Minimum Price target is 278. But that's not where we should exit. After an entry, hold the stock until the trialing stop-loss gets hit, or 1:5 RR is achieved. There are plenty of techniques and tools to trail the stop-loss. One can trail the stop according to his/her risk appetite. I'll update the idea about trailing stop-loss after an entry.

Apply money management, risk management, and position sizing before short term investing or trading in cash stocks.

Don't invest more than 5% of your capital in a single stock.

Buy the Consolidation Breakout - Risk-Reward 1:5Entry 283.25

Stop-loss 269

Target 253

Risk - Reward Ratio 1:5

LIC HOUSING FINANCE, from May 19th to Uptill June 17th, LICHSGFIN had a strong impulsive move. Since the 17th June top, price is in consolidation and remained above the 50% retracement level of the previous impulsive move. There is a high probability that an ongoing consolidation breakout may result in one more strong impulsive move.

Apply your money management before taking a trade, and trade management ones the trade is going in the anticipated direction.

How I set the target?

Target is equal to the range of the previous impulsive move, added to the breakout price.

Nothing is a sure shot in trading, each trade must have a pre-defined stop-loss.

How I set the Stop-loss?

Here come the stop-loss placing methods which are always debatable. Books guide us to place the stop-loss below the swing low or below the lower line of a chart pattern in a bullish breakout.

In this case, the Risk-Reward Ratio will be very poor because stop-loss will be 256 and the RR will be reduced to 1: 2.5 which I don't prefer in Positional Trading.

So kept stop-loss below the probable support zone in the lower time frame. The disadvantage in this method is that the stop-loss is tight and may get triggered if there is a high volatility or price fluctuation, but I'm ready to lose accuracy over high reward.

In trading, if you have 40 to 50% accuracy, it will be more then enough. With a good Risk to Reward ratio and 40 to 50% accuracy, is a winning combination.

Many claim 80% to 90% accuracy and still, they are not on the Frobs richest list.

If I get 80%-90% accuracy, "I will be The GOD OF TRADING".

In Trading High Accuracy is a MYTH.

Awaiting Falling Wedge Breakout - Risk/Reward 1:6Cadila Healthcare is in the uptrend in all time frames. Primary (Monthly), Weekly (Intermediate), and Daily (Short Term).

Trading Plans - An analysis without a proper trading plan is very much useless. It's trading that makes money, not fancy analysis.

Plan - A

On a daily chart, the price is trading in a rising channel, recent consolidation formed a falling wedge chart pattern.

Expecting price to breakout and continue its prior trend.

Entry - Above 338

Stop - 320

Target - 449

Risk-Reward 1:6

Plan - B

Take a long entry when price pullback to the prior resistance zone, which is a 290-300 price zone. I will update the trade accordingly if and when happens.

On a weekly chart, the price already broke a prolonged falling channel.

On a monthly chart, the Price went up in an impulsive wave after forming a double bottom and currently consolidating at 0.38% Retracement.

I will be updating this idea frequently as per the price behavior.

If you have any alternative analysis in Cadila Healthcare, do share in the comments.

Thank you,

EEz

Axisbank - Falling Wedge BreakoutHere's a falling wedge in the middle of an uptrend. Volume picks up on the breakout.

Price also taking support at the previous top. A classic case of Resistance becomes Support.

Long at 423 Stop at 400 Target 550.

Risk Reward 1:5

Using Covered Call.

Short Axis Bank 460 CE April @ 6.

Incase we hit Stop-loss in spot, Option will help in bringing down the cost of Stop-loss.

Remember we are in a counter-trend or rallies. So it's better to be cautious and should trail stop-loss once the position is in favor.

Bullish Pennant Breakout - Risk/Reward 1:4AMARAJABAT formed a bullish pennant on Daily chart . Waiting for a breakout to enter long.

Long above 781 | Stop-loss 755 | Pattern Price Target 850

Ideal target is 880, A strong resistance zone .

Risk/Reward 1:4

Bullish Flag Brakout : Continuation PatternMRF TYRE Buy on Pull back at 57150 With SL Below 56900 For Target 61000

Or

Buy the 1st 30 Min Range Breakout On April Fool's Day. Keeping SL as 30 Min Low or as per your Risk Management.

Falling Wedge in Formation ? And if formed and Breakout, It's time to touch 200 SMA.

The 200 simple moving average ( SMA ) is considered a key indicator by traders and market analysts for determining the overall long-term trend. The price level in a market that coincides with the 200 SMA is recognized as a major support when price is above the 200 SMA or resistance when price is below the 200 SMA level.

Why is the 200 SMA so common for traders and analysts?

200 SMA is Widely followed by everyone. Markets react strongly in relation to it partially just because so many traders and analysts attach so much importance to it.

Nothing to Explain more about it, because everyone knows about 200 Sma .

Let's Look at MRF price Action Around 200 SMA . There Are Many Wild Moves In MRF TYRE LTD Around 200 SMA .

MRF TYRE LIMITED From Low of 401 In 2001 To High of 81400 in 2018. 81400 ( up by 20300% in 17 Years)

"This Dude Is the Only One Who Knows How To Use Rubber, While We Just Use and Flush"

Let's Look at the Price & 200 Sma History Since 2000 to till date.

Descending Triangle Breakout - Bearish Continuation PatternIndusindbk Short below 1471

Stop-loss 1490

Target 1406

Risk 1.29% And Reward 4.42%

RR Ratio 1: 3.42

Bearish Continuation Pattern

Descending Triangles

In this “flat-bottom” triangle, the bottom trendline is horizontal and the top trendline slopes downward. The pattern illustrates lows occurring at a constant price level, with highs moving constantly lower.

Bearish Flag Breakout - Continuation Pattern - Risk Reward 1: 3Sell Pidilitind below 1101.85

Stop 1127.50

Target 1025

Risk 2.33% & Reward 7%

Riks Reward Ratio 1: 3

Bear flags are favored among technical traders because they almost always lead to large and predictable price moves. Like all continuation patterns, bear flags represent little more than a brief lull in a larger move lower. Indeed, in many cases, the flag pattern will actually take shape in the middle of the ultimate move lower.

KPIT TECH POLE FLAG BREAKOUT CONDITIONAL TRADE DEC FUTKPIT TECH POLE FLAG BREAKOUT CONDITIONAL TRADE

DEC FUT

BUY@230(229.85)

STOP@226

TARGET@237.5

LOT:2250

QTY:1

Descending Triangle Breakout - Continuation Pattern - RR 1: 4.3Relcapital Sell Below 221.60

Stop-loss 234

Target 168.40

Risk 5.57% & Reward 24%

RR Ratio 1: 4.30

Another Probability is, it can be turned out into triple bottoms as well but looking at the prolonged decline I personally prefer to sell descending triangle breakout rather buying triple bottoms.

Continuation Pattern

Descending Triangles

In this “flat-bottom” triangle, the bottom trendline is horizontal and the top trendline slopes downward. The pattern illustrates lows occurring at a constant price level, with highs moving constantly lower.

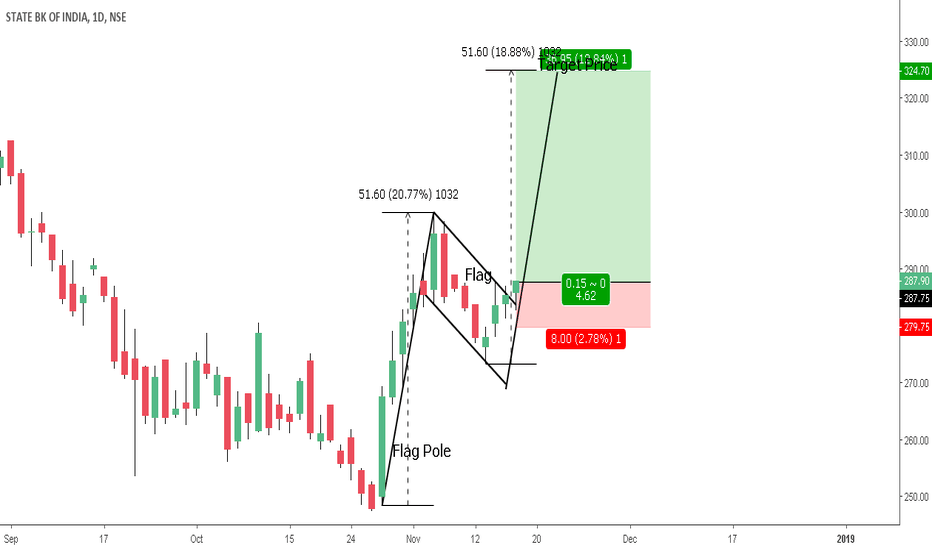

Bullish Flag Breakout - Continuation Pattern - RR Ratio 1: 4.6Long sbin Above 288

stop-loss - 279.75

Target 324.70

Risk 2.78 % & Reward 12.84%

RR Ratio - 1: 4.62

Continuation Pattern

Bullish Flag

Bullish Flag chart pattern represents consolidation. This means that it occurs after a large movement in price. As such it’s also a continuation pattern, which means that the market is likely to continue in the same direction once the pattern gives a breakout.

Rising Wedge Breakout - Continuation Pattern - Risk Reward 1: 3Short Bajajfinsv Below 5550

Stop-loss: 5745

Target 1: 5160

Target 2: 4955

Risk 3.50% & Reward 10.75 %

RR Ratio - 1: 3

RR is Calculated on 2nd Target.

Reversal or Continuation Pattern

Rising Wedge

Prices are moving upward, forming higher highs and higher lows, but the price is confined within two lines which get closer together to create a pattern. This indicates a slowing of momentum and it usually precedes a reversal to the downside. This means that you can look for potential selling opportunities.

RISING WEDGE PATTERN ( REVERSAL OR CONTINUATION )Reversal or Continuation Pattern

Rising Wedge

Prices are moving upward, forming higher highs and higher lows, but the price is confined within two lines which get closer together to create a pattern. This indicates a slowing of momentum and it usually precedes a reversal to the downside. This means that you can look for potential selling opportunities.

IDENTIFICATION GUIDELINES

1. The Shape of The Rising wedge – Two price trendlines both sloping upwards, the upper one following higher highs and the lower one following higher lows. Both trendlines must slope upwards and eventually intersect.

2. Formation of The Rising Wedge – Prices should rise to hit the upper trendline at least three highs(1-3-5), then fall away. Prices should fall to the lower trendline at least twice(2-4), then rise again before a final breakout. When you see less than 3 swing highs and 2 swing lows between the upsloping trendlines, be cautious about it.

3. Duration of The Rising wedge- The Rising Wedge has a minimum duration of 3 weeks and it rarely exceeds 3 or 4 months long. Anything less than 3 weeks of duration likely to be a pennant formation, not a rising wedge.

4. Volume inside The Rising Wedge – Volumes tends to be decreasing through the formation.

5. Pre-mature or False Breakout – Because volume is usually low in The Rising Wedge formation, it takes very little activity to bring about an erratic and false movement in price, talking the price outside of trendlines.

6. Breakout – Price closing below the lower rising trendline confirms the breakout.

HOW TO TRADE A RISING WEDGE

Trading Rules.

1. Entry – Sell short the stock day after Prices closing below the lower rising trendline. If you miss it, wait for the pullback then short when price resumes the breakout direction after the throwback completes. When you missed and, If you Don’t Get A pullback to the lower rising trendline then Don’t Chase The Stock Price for selling short.

2. Price Target – The technical target is the price which was a starting point of the lower rising trendline.

3. Taking Profit – For short-term traders, cover short when the price reaches near to the price which was a starting point for the lowe rising trendline. For intermediate and long-term traders, hold the stock as per your risk & capital management applied before entering into a trade.

4. Stoploss – usually, price closing above swing high or top is a stop-loss. But very often, The gap between swing high and breakout price is very high. So it won’t be suitable for a good risk-reward ratio. Without a Good Risk to Reward ratio in trading or investing can never create a wealth. Always Pay close attention to Risk-Reward Ratio. We must have RR above 1: 2.

DalmiaSug: Buy at 106-107: Ascending Triangle BreakoutDALMIASUG Buy at 106-107

Stop-loss: 93.85

Target: 138

Risk 11.50% & Reward 30%

RR Ratio 1 : 2.63

Ascending Triangle - Continuation Pattern

With its “flat-topped” shape, the ascending triangle indicates that buyers are more aggressive than sellers. The ascending triangle forms because of a supply of shares available at a fixed price. When the supply depletes, the shares quickly breakout from the flat-topped trendline and move higher.

IDENTIFICATION GUIDELINES

1. The Shape of The Triangle – Two price trendlines, upper one horizontal, and the bottom one rising upwards form a triangle pattern. The two lines join at the triangle apex.

2. Formation of The Triangle – Price Should rise to hit the upper horizontal trendline at least twice or two highs then fall away. Price should fall to the lower rising trendline at least twice or two lows then rise. The upper one, horizontal top trendline need not be completely horizontal but usually is.

3. Duration of The Triangle – The triangle is a relatively short-term pattern. It may take up to one month to form and it usually forms in less than three months.

4. Volume inside The Triangle – Volumes tends to be slightly higher on bounces and lighter on dips. Usually, the volume is low just before the breakout.

5. Pre-mature or False Breakout – Because volume is usually low just before the breakout or at the apex of the triangle formation, it takes very little activity to bring about an erratic and false movement in price, talking the price outside of triangles. Typically, a false move corrects itself within a week or so. The pattern immediately will be suspicious without an accompanying high volume breakout. If there’s no pick up in volume around the breakout, investors should be wary.

6. Breakout – Price closing above the horizontal line with high volumes confirms a breakout. Price will move up and away from the formation. Volume is heavy and continues to be heavy for several days.

HOW TO TRADE AN ASCENDING TRIANGLE

Trading Rules.

1. Entry – Buy the stock the day after a breakout. If you miss it, wait for the throwback then buy when price resumes the breakout direction after the throwback completes. When you missed and, If you Don’t Get A Throwback too then Don’t Chase The Stock Price, Believe Me, It Certainly Won’t Be The Last Ascending Triangle Ever Happened.

2. Price Target – The technical target is derived by computing the vertical height of the triangle at the start of a formation. Add the result to the price of the horizontal trendline. The Derived sum is the minimum price target.

3. Taking Profit – For short-term traders, sell when the price reaches near to the price target as computed above. For intermediate and long-term traders, hold the stock as per your risk & capital management applied before entering into a trade.

4. Stoploss – usually, price closing below rising lower trendline is a stop-loss. But very often, The gap between both Trendline is very high. So it won’t be suitable for a good risk-reward ratio. Without a Good Risk to Reward ratio in trading or investing can never create a wealth. Always pay close attention to RR ratio. It Must Be above 1:2.

HCC : Bullish Pennant : 32% Up side Potential HCC Entry 15.15 | Stop 13.95 | Target 20

8% Risk | 32% Reward

1: 4 RR

Continuation Pattern

Bullish Pennant

Price highs move slightly lower and price lows move slightly higher. Drawing a trend line connecting price highs and then another connecting price lows form two converging lines which are an identifying feature of the pennant.

IDENTIFICATION GUIDELINES

1. The Shape of The Bullish Pennants- Price bounded by two converging trendlines. Typically, in an uptrend the top of a bullish pennant is downsloping. This makes sense since, in an uptrend, profit taking will result in lower prices as traders sell stock.

2. Formation of The Bullish Pennants – Bullish pennants involve two distinct parts, a near vertical, high volume flagpole and the symmetrical triangle, low volume triangular consolidation comprised of four points and an upside breakout. The triangular consolidation during the formation of the pennant is very much like a symmetrical triangle and this implies that traders feel comfortable with the current price.

3. Duration of The Bullish Pennants – Pennants formation are short term, from a few days to 3 weeks. Formation longer than 3 weeks often fails.

4. Volume inside The Bullish Pennants – Volumes tends to be decreasing through the formation.

5. Pre-mature or False Breakout – Because volume is usually low throughout the formation, it takes very little activity to bring about an erratic and false movement in price, talking the price outside of trendlines.

6. Breakout – Price closing above the upper trendline confirms the breakout.

HOW TO TRADE THE BULLISH PENNANT

Trading Rules.

1. Entry – Buy the stock day after Prices closing above the upper trendline. If you miss, Wait for the pullback to the upper trendline and buy once price resumes in the breakout direction.

2. Price Target – The technical target is, measure the height of the flagpole, the start of the sharp straight up move, and add the hight of the pole to the upper trendline.

3. Taking Profit – For short-term traders, sell the stock when the price reaches near to the price target. For intermediate and long-term traders, hold the stock as per your risk & capital management applied before entering into a trade.

4. Stoploss – usually, price closing below the lower trendline is a stop-loss.

BAJAJ CROP LIMITED : SYMMETRICAL TRIANGLE ENTRY ABOVE : 424

STOP-LOSS CLOSING BELOW: 402

MINIMUM PRICE TARGET: 460

RISK TO REWARD RATIO : 1 : 1.64