Crude

Crude oil breakdownHi

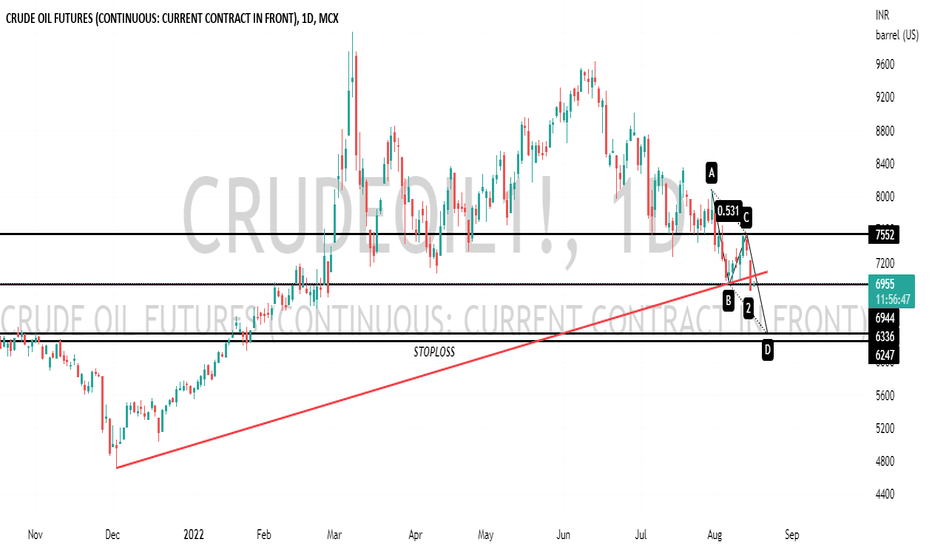

The PA suggests that the crude is good to short right now. I had missed the opportunity to short the previous breakdown (which you can see in the trailing chart).

I made the chart well before but kept sleeping on it. Nevertheless, currently I am short on a 15 min timeframe.

Will review it on one hour later.

RSI based Crude Oil StrategyRSI Based Strategy on commodity.

We can use RSI in two timeframe to identify Bullish and bearish sentiments.

5 & 15 Mins timeframe is best for intraday Trading.

Add two set of chart of RSI and make upper rsi band at 60 and lower rsi band at 40.

In 15 min timeframe, if upper band value greater than 60.it means we have to find out buy trade. And RSI lower band is less than 40, we have to find out sell trade.

Crude Oil - Lets Wait for a DirectionCrude Oil. Bearish Case :-

Narrow Weekly Bar. Weekly MA Resistance. Daily RSI Resistance Zone. Weekly TL Resistance

Bullish Case :

COT reports JUST Started turning Bullish. Bullish Daily and Weekly Momentum.

So overall scenario is still confusing.

Ideal case will be to attempt ONE more Leg down and then UP. But, that is not a necessity. So waiting for a concrete resolution of direction.

Daily Close above 81.25 may be helpful for bullish case

Crudeoil reversal zones 6-1-2023Note: Always try to find a good price action patterns or any candle stick patterns in marked zones in smaller timeframe to take entry with small stop loss. Or can take entry based on one 5 min candle close below or above the zone with SL previous candles high or low (*try to avoid big candles) .

(Color code for Support & Resistance zones: Red - Sell, Green - Buy, Price once cross above resistance it is obvious it will work as support, vis versa price cross below support zone ). If any doubt for take entry in price action patterns, please ask in comment box, i will try to help.

Disclaimer: Im not tip provider and this chart is not indented to take trade in my levels, It is shared here for learning purpose. Trading in this pattern is all your own risk.

Gail: Triangle Breakout Gail India

Return potential - 8-10% / 15-16.5%

Risk: 3-6%

Risk::Reward ratio is 1::3 / 1::2.5

- Rest Every thing mentioned in the chart. Use it to plan your trade accordingly...!!!

Do let me know if you find the analysis and insights helpful.

Like and Follow for more ideas like these...!!!

Take care & safe trading...!!!

Disclaimer

- The view expressed here is my personal view

- Past performance is not a guarantee for future predictions

- I have been wrong in the past and can be wrong again in future too

- Use this for educational purpose

- Any decision you take, you need to take responsibility for the same

- It's your hard earned money. Treat it wisely

- Trade / Invest keeping in mind your trading style, goals and objectives, time horizon & risk tolerance

- if trading in F&O, understand that F&O trading involves risk

- Do take proper risk management measures

- Do your own analysis and consult your financial adviser if need be

crude oil Demand and Supply For 14th November 2022For Crude Oil demand and supply zones are marked. If market rejects at demand zone , then a high probability buy trade can be initiated, rather in case of supply zone a sell trade. You must have a good candlestick knowledge in order

to utilize the zones at the best. You can even learn it from us. don't forget to look for PriceActionMonk.

WTIOCUSD(Crude) make or break levelCrude oil making a bearish pattern and still showing the sign of bullishness. Fight between Bull and Bears for the trend to continue. Which way will It go?

Crude respects the levels we analyzed In early posts, shows a good move over the period. The up-trend move after the breakout of the price mark of $87.894, was slowed down after the price tried to breach the overhead resistances of $90 that we suspected to be a major resistance zone. But moreover, there was a diversion which you can see in the picture created on 27/10/22 ( Diversion was found with the help of an indicator known as RSI).

When we see in the 1H chart, the price is showing bullish movement by making pin bars which can mean buyers are getting active around the $87.89 Price mark. But the price will be concerned bullish only when the price sustains above the $90 zone then we can say the view of the counter is bullish and look for buy on dips.

But on another side of the coin, you can see a bearish Head And Shoulder pattern and if the pattern is triggered then I believe Crude can be seen trading in the $83-$84 range shortly, and the view can be changed to sell on really. Until then you need to decide the strategy technics for trading this counter this is my view on the counter until I see the price breaching my analyzed levels

Crude Oil USOIL Elliott wave countsAs per Elliott wave structure and along with running trend sequence USOIL Crude oil is looking sell now or on rise (if any) with invalidation level of $ 90.17

Also RK's mass psychological cloud is suggesting to go short

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business. If you treat like a hobby, hobbies don't pay, they cost you...!

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Simple Trade Setup | Crude Oil | 04-07-2022 [INTRADAY]MCX:CRUDEOIL1!

Trade Setup for 04-07-2022

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.