Economic Cycles

BNF will continue to fall ?Hello All,

Please refer my previous related idea where it touched the 37700.

We are seeing continuous selling but at some point it has to breath and decides next movement. Market has been ending negative even if start with good momentum.

Falling channel with 2 Arcs or cycles where I have just plotted the second arc by cloning first one. If downside momentum continues we can see the exact replica which will end at 36300.

FII has sold 2700 cr and DII has bought for 2500 cr.

Please find the levels in the chart.

Always trade carefully with proper SL because it’s your hard earned money.

Please note this is just my observation and purely for educational purposes only. Consult with your financial advisor before taking any trade.

💎 PAYTM : 315% Profit Potential in Next 8 Months💣💣💣💣Finally After lots Criticism and Uncertainty Paytm has started it Bull run.

I believe tht the major drop on paytm stock was done intentionally.

First time Paytm Discovered Strong Demand Zone at 530rs Area.

Right now no one is talking abt this Gem, This is Perfect time to fill the bags silently and HOLD strong.

I am Expecting more than 300% returns in this Historic Upcoming rally.

BANK NIFTY Analysis / Observation 40000NSE:BANKNIFTY

I strongly believe this is not a breakout , and might be a fake one as NIFTY HASN’T BROKEOUT YET

If NIFTY BANK breaks and closes above the parallel channel, then i may re-think about my analysis

Here’s a link to my previous Analysis

I’m still thinking it may play out, keeping in mind of foreign markets.

Watch for breakout and close above the parallel channel and invalidation of H&S.

Share if you like it

PS: THOSE IS FOR EDUCATIONAL PURPOSE ONLY

VARROC BULLISHVARROC ENGINEERING STOCK is consolidating since past 4 months and currently it is near its resistance if candle sustains above it with good volume you can go long after doing your own analysis.

Targets, SL, Entry points has been given in the charts.

If took trade please do money management.

ONLY FOR EDUCATIOINAL PURPOSE..!

ES is in its final leg to bottom out around 4085-4075The S&P is in its 5th wave from the high of 4327, nearing the confluence target area of 4085-4075.

Ideally wait till the entire 5th wave is complete (all the subwaves) and wait for a reversal to take a low risk entry.

Targets can be the mid 4200s.

New idea will be updated there

ES emini wave analysis from 3693 lowThis whole rise has from 3693 low (yes, not the actual low at 3639. Refer: wave 5 truncation) has been a 3 wave move so far.

Wave 1/A has been a clear 5 wave followed by an extended 3/C wave with the iii of 3 extension.

The 3/C wave ended with wave 5 as an ending diagonal.

Now, the fall from the absolute high of 4327 has been impulsive so far with a series of 1-2-i-ii.

The first target post a completion of 5 waves up is the range of the 4th wave of lower degree. This comes at 4113-4080.

This level also coincides with the 0.382 retracement of the entire rise from 3723.

Given that the entire move from the top is impulsive, we can expect a minimum of a 5-3-5 correction. After that is done, we can evaluate if it evolves into a further decline, or pushes towards a new high.

Summary: Target - 4080. Further decline to be evaluated based on the evolving structure after that.

-ansible/entropy

Nifty wave counts from 15183This is one of the rare case where a 3 wave move up has a C wave extension greater than the regular 1.382/1.618.

In super-extended moves, we have seen C Waves extend to 2.0 and even 2.618 of wave A.

What determines the future move is the speed of reversal post completion of Wave C/3.

Another supporting evidence for it being a wave C and not wave 3 is that the initial moves prior to wave C was a clean Wave A i.e. a 3 wave move contained withing parallel lines, whose subwaves tended to equality.

A bull case could be made that - no it was a 1-2-i-ii and not an a-b-c within Wave A, but generally in 1-2-i-ii, the lower degree 1 is shorter than the length of the higher degree 1. Here, both waves tended to equality. Hence an argument for it being a wave A is stronger.

Now we will have to see how price behaves at prior wave 4s of lower degree. Immediate supports are offered in the range of 17150-17450, which is the range of the Wave 4 of lower degree. A corrective rise from there will confirm that we are going further lower.

Will revisit this developing idea once we are at 17150-200.

-ansible/entropy

Nifty Where does this heading July Contract Still Nifty showing corrective structure and we would be forced to change the view above 16200 levels.

Nifty retracing before its next fall. Nifty will be completing 61.8 retracement at 16116. If this area holds then we can expect a deeper fall towards 15200 and Below.

is BANKNIFTY ready for more.?BANKNIFTY did exactly as we analysed and has also successfully filled the gap taking the neckline as support now we can see BANKNIFTY resisting at 34400 as the gap has been filled and is an important closing hence if BANKNIFTY opens flat to negative we might see a good downside movement on the other hand if opens strong we might see 34400 acting as a good support and continuing its bull run

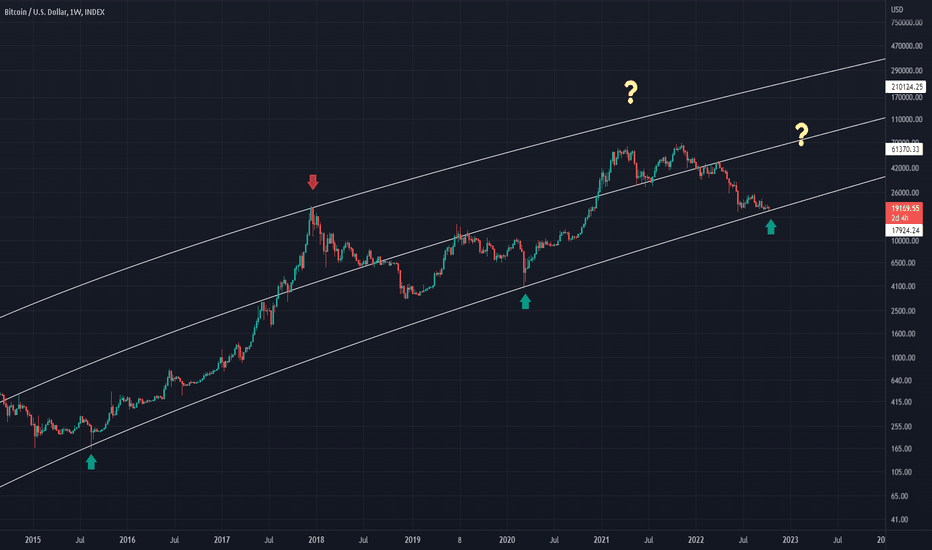

BTC Blood Path !!! But where is the BOTTOM ???Good day to everyone!

BTC enters the BOTTOM zone which is between 16-22k. Best buy zone is 16-18k .

We may rally to the resistance zone 48-50k after few months of bottom consolidation (July - October), and then continues the Bull Run breaking ATH.

Get ready for the next Bull Cycle..

~RPS

Important SUPPORT is still securedAs we analysed yesterday that the opening is very important and any flat to positive openeing could show strong upmove and we did saw that today but that upmove couldn’t sustain any longer and fell in the second half but still closed above our given support! this shows the same scenario as yesterday and same setup can be implied but continuous hitting on support is making rhe level weaker and hence as soon as the level is broken we can go short as this level will later act as resistance and one sided fall of 200 points can be seen in nifty

Bank Nifty:Bow Tie Diametric pattern.End of wave E.Go short.Rise in Bank nifty seems to have taken a form of Bow-Tie diametric pattern.We have seen completion of wave A,B,C,D,E.Currently it seems like we are in the middle of wave F.Wave F equality target of wave B is coming at 34608.Also it seems like wave F internally is forming a flat corrective pattern of which wave A and wave B is done and today after price retracing wave A by 80% (at 35958) wave C has commenced.Internally wave C target of 100% and 161% extention of wave A is coming at 35163 and 34672 respectively in this flat correction.

Bank nifty 15 day cycle has also passed it's 2/3rd topping time zone and is ending on 6th june,along with this we also had a top formed on no moon which is yet not taken out.

One can go short with a stop-loss of 36100 at cmp of 35550 for a target of 34700.

Disclaimer:This are just my view on index.Do not trade solely on its basis.Posting this just for my future reference.