#Banknifty 4 Hour #Banknifty on 4 hour chart seems to be doing a double three combination, as I understand from the EW theories from several sources that

Double three is a sideways combination of two corrective patterns including zigzag, flat, and triangle. When two of these corrective patterns are combined together, we get a double three.

It is possibly in last phase of its correction which seems to be triangle, any successful breakout would potentially invite upside targets as marked on the charts.

Elliotwaveanalysis

Axis bank case studyAxis bank spot cmp 985

Weekly time frame

Wolf wave + elliot wave study.

Elliot wave :- counter is trading in sub wave (v) of major wave 5 , where after motive phase gets terminated.

Price wise levels of 1015-1035 would act as a range where wave (v) could mature.

Ascending trend line resistance of wedge structure confluence around same levels.

Rsi in this last move have given bearish divergence.

Wolf wave :- on smaller time consideration wolf wave formation is being observed , which would mature around 1020-1040 levels.

around 2-3 major studies maturing around same range, on weekly time frame,

so going ahead counter would lots of selling pressure around this levels,

fresh long should only be considered above 1050 levels on weekly closing basis.

below that caution is required any time counter can slide to much lower levels.

Bulls keep caution ahead,,

ABFRL - Breakout & Retested NSE:ABFRL Elliott Wave Theory Suggests a New Uptrend

Description:

ABFRL stock has given a breakout and retested the breakout level. This is a bullish sign and suggests that the stock could be starting a new uptrend. According to the Elliott Wave Theory, if the stock breaks above 217, it could reach 241. A stoploss of 205.45 is recommended. Technical indicators such as RSI, MACD, and Chaikin Money Flow are all bullish. The price is also near the upper Bollinger band and trading above the Supertrend.

Here is a more detailed explanation of each technical indicator:

RSI (Relative Strength Index): The RSI is a momentum indicator that measures the speed and magnitude of price movements. A reading above 50 indicates that the stock is overbought, while a reading below 50 indicates that the stock is oversold. The RSI for ABFRL stock is currently above 50, which is a bullish sign.

MACD (Moving Average Convergence Divergence): The MACD is a trend-following indicator that shows the relationship between two moving averages. A positive MACD reading indicates that the moving averages are converging, which is a bullish sign. The MACD for ABFRL stock is currently positive, which is another bullish sign.

Chaikin Money Flow (CMF): The CMF is a volume-based indicator that measures the amount of money flowing into and out of a stock. A reading above 0 indicates that there is more money flowing into the stock than out of it, which is a bullish sign. The CMF for ABFRL stock is currently above 0, which is another bullish sign.

Bollinger Bands (Bollinger Bands): Bollinger Bands are a volatility indicator that show the standard deviation of a stock's price over a period of time. The bands are plotted above and below the moving average of the stock's price. When the price moves outside of the bands, it is considered to be a sign of volatility. The price of ABFRL stock is currently near the upper Bollinger band, which is a bullish sign.

Supertrend (Supertrend): The Supertrend is a trend-following indicator that uses a combination of moving averages and a volatility indicator to identify trends. The Supertrend for ABFRL stock is currently pointing upwards, which is a bullish sign.

Overall, the technical indicators suggest that ABFRL stock is in a bullish trend and could reach 241 if it breaks above 217. However, it is important to remember that technical indicators are not always accurate and should not be used as the sole basis for making investment decisions.

Larsen case studyLarsen spot cmp 2480

Weekly time frame

Elliot wave study

Counter is trading in last leg of motive phase which might mature around current levels.

v of 5 is in play,

Ascending wedge pattern indicate counter is overbought as its trading above structure.

RSI and MACD have bearish divergence with respect to price.

Last week counter made high of 2483 levels and today it made high around 2493 levels,

As per measured move wave 5 should mature around 2500 levels

so till counter does not give weekly close above 2500 levels , long should be cautious..

Counter have out performed rest of the counter in this last rally of over all market.

Now its time for counter to give away.

Keep watch, if this study pans out counter can give good fall going ahead.

Copper looks Bullish possible Elliott wave countsHello Friends,

Here we had shared possible Elliott wave counts on copper international chart.

Good thing is wave counts are aligned with each others in multi time frames, Over all it looks good to go long as per wave structure, whole scenario is shared in this video post, so please go through out this video post to understand the Analysis of copper as per Elliott waves theory.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Possible Elliott wave counts on hourly time frame of NiftyHello Friends

Here we had shared possible Elliott wave counts on hourly chart of NIFTY, in which we can clearly see that currently we are in impulse structure and as per counts we can say that after bottom of June 2022, we have started fresh impulse up move, in which we had completed wave (1) and (2) and now possibly we are in wave (3), which can be at least equality with wave (1) so estimated target may be 19748 where 5 of (3) may finish, currently we are in 3 of (3) and inside 3, we are in (v) of 3 of (3).

I am not sebi registered analyst. My studies are for educational purpose only. Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Some significant snapshots are shared below, please go throughout.

Thanks

RK💕

Overall wave structure since bottom of June 2022

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

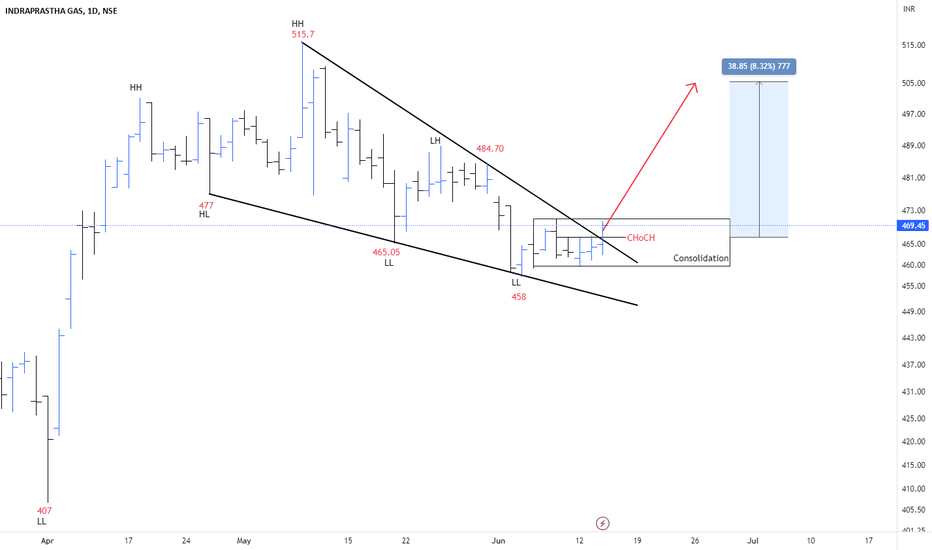

IGL: Bullish Falling Wedge Pattern IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs.

The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 .

Buyers have to break and stay above 504 to increase demand pressure.

Note: Do your own research / discuss it with your advisor

Banknifty spot heading to channel top...!!In above 30 min chart of banknifty we have given elliott wave count.

Banknifty made high near 44499 and when it made high that time macd and rsi both

shown negative diversgence which given a hint of coming correction in banknifty.

This correction is started in form of wave ABC which seems completed near channel support of 43345 where macd and rsi both given a positive divergence which giving hint of correction is completed on down side and soon may resume upside move.

Currently banknifty is paused near the middle of the channel which confluences with 200sma at

43887 and important fib ratios as shown in chart.

Banknifty moving above 200sma will give boost too bulls and doors will open up for channel top

44300.

NOTE : We are assuming that correction of Wave ABC completed at 43345 and impulsive wave 1-2-3-4-5 underway of which wave 2 is on .. once completed sharp wave 3 to start (crossing of 200sma will hint the same)

Banknifty future moving up after spotting positive diversionBanknifty future currently in broader range that is 43300 and 44100

and narrow range being 43500-44000

MACD and RSi given positive diversion.

POC is near 44000 which acting as magnetic level.

Shorters should stay cautious... as lower levels getting rejected till now

USOIL Crude oil possible Elliott wave counts on hourly chartHello Friends,

Here we had shared possible Elliott wave counts on hourly chart of USOIL CRUDE OIL, in which we can clearly see that after low of May 2023 Oil has done wave (1) & (2) of some degree and now we are unfolding wave (3) of same degree, Inside (3) also we had finished wave 1 & 2, and now possibly we had started wave 3 of (3) which may go $ 73 as an equality or $ 76 as an 161.8% of wave 1 of (3), and in wave 3 also we had started wave i and still wave ii is pending, so buy on dips funda will be worth full in this case with invalidation level of $66.77, so if price goes below $ 66.77 then our currently shared view will be invalidated, because wave 2 will never retrace more than 100% of wave 1.

Some referral snapshots are shared below, please go throughout, My studies are for educational purpose only. Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Overall wave structure looks bullish as of now

Price making lower low while indicator making higher low on completion of wave C of wave 2 of wave (3)

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Wave Pattern of BankNifty on 15M ChartBN has completed its ABC correction and looks like ready to go up higher. But unless it crosses 44500 level, it may hovering range-bound. Here the main concern is it has broken its prevous swing low of 43390 and hence its not clear what wave structure it is making.

So, stay away from it trading is a wise decision. If trading is unavoidable, then trade with strict SL

What is your view about BN. Please leave comments.

Interesting Chart Pattern of NiftyToday Nifty has shown high level of volatility, but failed to break its life-time high. I think Nifty is about to complete its major 3rd wave of the cycle. I though it would touch its upper band of the channel and reverse back from there. Clearly big players cleaverly resorted to profit booking.

Tomorror it may go up and break its LT high towards the upper band of the channel and fall from that level. What is your view? Please leave comments.

MFSL Breakout BUY!MFSL LONG SETUP

Attached: Daily Chart as of 21st June 2023

- Price has activated an Inverted Head & Shoulders/ Cup & Handle/ Bull Flag Breakout today on the back of High Volumes (Price Volume Pattern BO)

- Laggard from Insurance is finally joining in the Sectoral Rally (Sector Tailwinds)

- The previous Dip halted at 0.382, ABC corrective (Wave 3 or Wave C upside pending)

- Daily RSI crossed above 70 today

- Daily MACD gave a Buy Signal today

Upside Target= 785/ 807🎯📈

Stop Loss= Today's Low (< 710)

banknifty important hurdle near 44000-44100Banknifty key hurdle 44000--44100 as below

200sma :43970

poc: 44000

goden fib : 44036

prev. swing : 44083

support near 44350-400 being triple bottom in this zone

curve trendline support near 43200

market is range bound .. play support resistance untill decisive break of 44100

BANK NIFTY... BULL RUN??Today we witnessed a bear run resulting in a big red candle in bank nifty.

In smaller time frames one can notice the day's low was above yesterday's low level.

The last two day's price action can be fit into waves 1 & 2 of the next up trending wave.

In that case, we can expect a gap-up/positive opening in our markets (SGX is minus 50 points right now) and a continuous up move towards 44170, 44320 & 44560 levels. In this set up my stop loss will be below yesterday's low.

(If the market behaves negatively in the first 15 minutes tomorrow then today's fall may be downward wave 1 in Elliot waves and massive wave 3 on the downside can be witnessed. In my view, this fall is less likely and I have a strong bullish view of our markets)

Happy trading... Trade with an appropriate stop-loss.

Zig Zag corrective pattern and the Case study of Natural GasHello Friends,

Here we had shared some major points and characteristics of Zigzag Correction pattern of Elliott waves.

Also we had shared real example chart study of zigzag pattern as a case study of NaturalGas, in which their are some principles and guidelines, which are perfectly going through in chart of NaturalGas.

Principles and Guidelines of Zigzag correction pattern

1) Zigzag correction pattern is a 3 waves structure which is labelled as A-B-C

3) Subdivision of wave A and C is 5 waves, either impulse or diagonal

4) Wave B can be any corrective structure as 3 subdivisions

5) Zigzag is a 5-3-5 correction structure

Fibonacci measurements

Wave B is always contra trend which generally retraces near 50% or 61.8% of wave A, and can also retraces up to 85.4% to 90% of wave A

Wave C can generally be expected near 100% of wave A, but sometimes if it is extended then it can show 123.6%, 138.2% or up to 161.8% also.

Sometimes if wave C is truncated then it can be near 61.8% of wave A.

But ,If wave C is going more than 161.8% of wave A, then we should be cautious, because it can also be some kind of impulse wave instead of corrective wave.

Case Study of Natural Gas

Natural Gas almost done as expected till now as per zigzag corrective pattern, it would not be wonder if it looks to be doing a double correction higher in wave (ii) bounce & can see 2.786 level sometimes in next week before turning down as a wave (iii) of 5 of (C), On lower time frame if it doesn't crosses high of March 2023, then it can show some down moves to complete wave (iii), (iv) and (v) of 5 of bigger degree wave (C).

After big correction as zigzag pattern which had already reached extreme levels in wave (C) which is more then 123.6% of wave (A), so now anytime it can start fresh impulse moves towards north directions, so instead of finding selling opportunities, one should try to find buying opportunities only after confirmation, and confirmation is price crossing high of march 2023, once its crossed peak point of march 2023 then no selling is recommended, then its only buy on dips with invalidation levels of Low of April 2023 as a stoploss, because it must be ending the bigger correction from last year peak, and can be taken as fresh impulse is started.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

RNDR - Moving on Elliot Wave Pattern#RNDR 1-Day Chart Analysis

RNDR perfectly Moved as per Elliot Wave Theory and now its Correction wave starts, while first cycle of Correction wave is finished yet and movement start towards second upward direction wave and soon up to July in bearish zone time period, its again reach last lowest mark of 1.25 dollar approx.

Invest wisely and #DYOR always.

RLong

Ashok Leyland with 300% to 500% upside potentialAfter a long consolidation period stock is trying to come out of the range.

Chart is showing strength, keep an eye on the stock for long term

Levels & Logic mentioned on the chart

Wish You Happy & safe trading

Views are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

"Always Respect Risk"

Happy Trading

Jai Hind Jai Bharat

#Nifty Hourly Latest viewNifty after bottoming out in March end has been in clear uptrend with some minor pullbacks in between.

It is currently travelling in a parallel channel with a important support placed around 18190 which in last session acted as channel bottom trendline support as well as was May series avwap level.

Nifty bounced by more than 100+ points from that support.

In terms of wave marking as far as my understanding goes we may be possibility in (iii) of 5 and above 18360 we may see a momentum towards 18450 to 550 as per fibo projections.

From RSI side, yes there is a negative divergence (RSI is making HL) visible which is being talked about but at the same time RSI has not made a LL.

Same thing happened during larger wave 4, when Nifty 17850 to 17550 and eventually broke out upside.

This probably indicates that buying is emerging from lower levels and dips are being bought.

Depending upon How we see opening on Monday, as long as 18190 is safe, #Nifty may continue to move its upward journey.

Short term bullish structure / Invalidation level as I feel is only below 18030, or round number as 18K

The upside projection can be as marked on the charts as long as price continues to follow the channel and marked important levels.

Previous Nifty analysis are linked in related idea section

Suzlon - Traded Higher Ever Volume This MonthSUZLON (M) -

>It has completed the Falling Wedge pattern in the larger picture - ABC

>After completing the C Wave, it has formed the leading diagonal - Wave 1 & currently in Wave 2

>Go LONG above 12.2 on Weekly closing basis

>Volume - Highest ever since its inception

#Stocks #EW