Crude oil important levels to watch `Crudeoil important demand and supply zones are marked on the chart.

#Target on the upside after break of resistance is marked in red line.

#Target on the downside after break of support is marked in a green line.

What is demand zone?

In simple words, demand zone is the price area having highest buying potential.

What is supply zone?

In simple words supply zone is the price area having highest selling pressure.

Follow us for more such content and give us a like to motivate us.

Energy Commodities

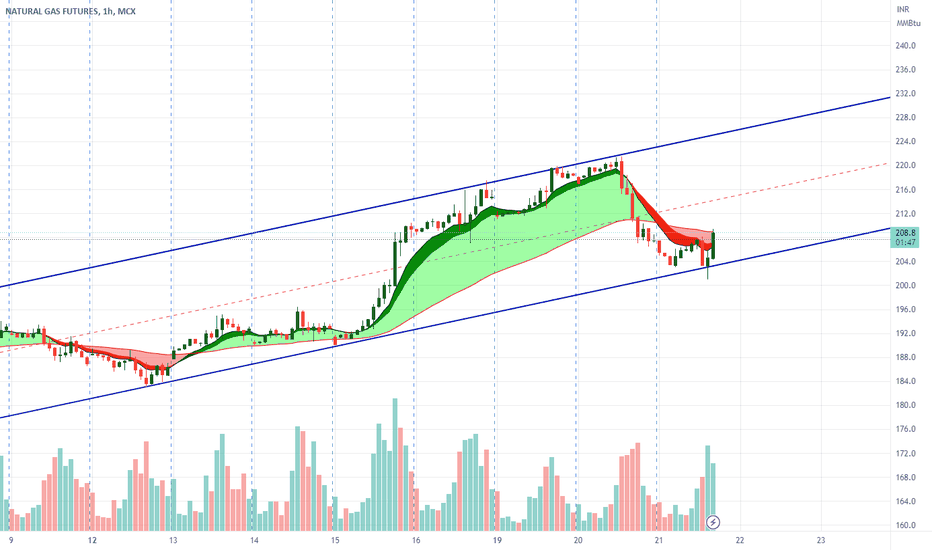

NATURALGAS Long for Wave 3/C UP!Attached: Natural Gas Mini Futures Hourly Chart Live

- Morning Star Candlestick Reversal Pattern activated

- Bounce off 200 DEMA (black line)

- Breakout from Wedge

- Price action can be Channelized suggestive that the Fall was a Corrective and not an Impulse

- So W3/ WC upside to play📈

1st Target on Upside = 223

2nd Target on Upside = 229

SL can be based on Morning Star Candlestick Pattern Low

Crude oil important levels to watch. CrudeOil important levels as per 15 minute time frame are as follows.

#Current Price: 5748

#Support: 5540

#Target on downside: Upon break of support expected ultimate target on downside can be 5300-5320 levels.

#Resistance: 5770

#targets on upside: Upon break of resistance, expected targets on upside are 5840, 5960.

trade only on trigger. Keep SL as per your risk appetite.

Please follow us for more such educational ideas, and give us a like if you like the information.

Bearish Harmonic Forming In Crude OilREAD CAREFULLY !!!

Crude Cmp - 5788

Bearish Bat PRZ - 5986/5991

SL - 6055

Target - 5830/5790

( It means Crude may move 200 points up from

here, so one can buy it with sl of 5724 )

Bearish Deep Crab PRZ - 6378

SL - 6431

Target - 6078/5990

( It means if crude breaks 6055 level it can

further move 320 points up )

CrudeOil Intraday Levels 26-06-2023Crude oil immediate demand and supply zones are marked on the chart.

#Support: 5650.

#Resistance: 5750.

expected targets on the upside after break of resistance are marked in red!!

and

Expected targets on downside after break of support are marked in green !!

Follow us for more such information and give it a like to boost our motivation.

A possible long trade in Natural GasNatural gas has been rallying over the last week and it has broken above some key pivot levels, in this video I discuss the key level and what the potential entry point can be for the commodity when it corrects further and the potential upside target. Coupled with the fact that this commodity is also below the long term mean prices mean that the long trade has a higher probability of being right. The trade has a potential 20% upside based on the charts and perhaps it will be easier if we as traders look at holding the mini lots. Of course every trader will make a different decision based on the capital in the account.

MCX Natural Gas – Impulsive Wave SetupA new impulsive structure has emerged from the low of 265.5 in natural gas. Price has accomplished wave (5) and started the zigzag correction at 801.

Currently, Natural gas is forming sub-wave 5 of impulsive wave C. Natural gas has also broken down 200 EMA and the base channel of 2 – 4 wave, which signals bearish momentum. It has faced strong support of 515 , but the price didn’t respect the level and ended up losing bullish momentum.

Wave C has traveled the same distance as wave A. Hence, Wave A = Wave C. If the price sustains below 516, traders can trade for the following targets: 486 – 462 – 440 .

I will update further information soon.

USOIL Crude oil possible Elliott wave counts on hourly chartHello Friends,

Here we had shared possible Elliott wave counts on hourly chart of USOIL CRUDE OIL, in which we can clearly see that after low of May 2023 Oil has done wave (1) & (2) of some degree and now we are unfolding wave (3) of same degree, Inside (3) also we had finished wave 1 & 2, and now possibly we had started wave 3 of (3) which may go $ 73 as an equality or $ 76 as an 161.8% of wave 1 of (3), and in wave 3 also we had started wave i and still wave ii is pending, so buy on dips funda will be worth full in this case with invalidation level of $66.77, so if price goes below $ 66.77 then our currently shared view will be invalidated, because wave 2 will never retrace more than 100% of wave 1.

Some referral snapshots are shared below, please go throughout, My studies are for educational purpose only. Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Overall wave structure looks bullish as of now

Price making lower low while indicator making higher low on completion of wave C of wave 2 of wave (3)

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Crude oil intraday levels !Crudeoil short below the support level for immediate target marked in green line on the chart.

if crude oil bounced back from the support region immediate target on upside is marked in the red line.

Trade cautiously. Allow candle to close above or below the level to initiate the trade on either side.

CrudeOil Intraday levels. Crude oil taking support in the same region marked in green for multiple times. for a decisive downside momentum from here crude oil needs to break the support region as per 15 minute candle closing basis.

However, if crude oil manages to break the trendline resistance, the immediate upward target is marked in the chart with a red dashed line. and further upside can be the selling zone from where crude oil rejected last time.

trade only on confirmation.

Disclaimer: This is just a view and only for educational purpose. follow your own trading setup before initiating any trade.

Crude Oil Important levels !After a sharp decline yesterday, crude oil managed to bounce back from the support zone.

currently, crude oil broken out from trendline resistance as per hourly chart and sustained above the supply zone.

Next immediate resistance or expected targets on the upside are marked in red line on the chart.

Disclaimer: This is just a view and only for educational purpose. follow your own trading setup before initiating any trade.

follow us for more such information.

Crude Oil intraday Levels !Currently crude oil is trading near its support zone.

a bounce back for the target marked in dashed line can be expected if it manages to close above the trendline resistance as per the 5 minute candle.

trade with caution. follow your trading setup before initiating any trade.

EXIDE INDUSTRIES BUY EXIDE INDUSTRIES NSE:EXIDEIND : Time Frame(TF) : Weekly , wait for the price to come @ 180 and then buy on 200 MA Support level .

Reason to buy : 1. Took a retest on fib retracement level of 23%

2. Supply level strong 200rs level , major confirmation after that .

3. Major battery companies showing momentum after a long time

4. Trend line Break and retest

5. EMA above 50 level .

Buy @180-185

SL @157 -160

Tgt1@200

Tgt2@235

Tgt3@275

Alert! Bearish Pattern Spotted!Bearish Pattern Alert!

📊 Pattern: Descending Triangle

📌 Symbol/Asset: Coal India

🔍 Description:

Stock Bearish If Support Level Breaks & Sustains Below Support

👉 Remember: Technical patterns are just one piece of the puzzle. Consider conducting further research, consulting with a financial advisor, and managing your risks appropriately.

Zig Zag corrective pattern and the Case study of Natural GasHello Friends,

Here we had shared some major points and characteristics of Zigzag Correction pattern of Elliott waves.

Also we had shared real example chart study of zigzag pattern as a case study of NaturalGas, in which their are some principles and guidelines, which are perfectly going through in chart of NaturalGas.

Principles and Guidelines of Zigzag correction pattern

1) Zigzag correction pattern is a 3 waves structure which is labelled as A-B-C

3) Subdivision of wave A and C is 5 waves, either impulse or diagonal

4) Wave B can be any corrective structure as 3 subdivisions

5) Zigzag is a 5-3-5 correction structure

Fibonacci measurements

Wave B is always contra trend which generally retraces near 50% or 61.8% of wave A, and can also retraces up to 85.4% to 90% of wave A

Wave C can generally be expected near 100% of wave A, but sometimes if it is extended then it can show 123.6%, 138.2% or up to 161.8% also.

Sometimes if wave C is truncated then it can be near 61.8% of wave A.

But ,If wave C is going more than 161.8% of wave A, then we should be cautious, because it can also be some kind of impulse wave instead of corrective wave.

Case Study of Natural Gas

Natural Gas almost done as expected till now as per zigzag corrective pattern, it would not be wonder if it looks to be doing a double correction higher in wave (ii) bounce & can see 2.786 level sometimes in next week before turning down as a wave (iii) of 5 of (C), On lower time frame if it doesn't crosses high of March 2023, then it can show some down moves to complete wave (iii), (iv) and (v) of 5 of bigger degree wave (C).

After big correction as zigzag pattern which had already reached extreme levels in wave (C) which is more then 123.6% of wave (A), so now anytime it can start fresh impulse moves towards north directions, so instead of finding selling opportunities, one should try to find buying opportunities only after confirmation, and confirmation is price crossing high of march 2023, once its crossed peak point of march 2023 then no selling is recommended, then its only buy on dips with invalidation levels of Low of April 2023 as a stoploss, because it must be ending the bigger correction from last year peak, and can be taken as fresh impulse is started.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.