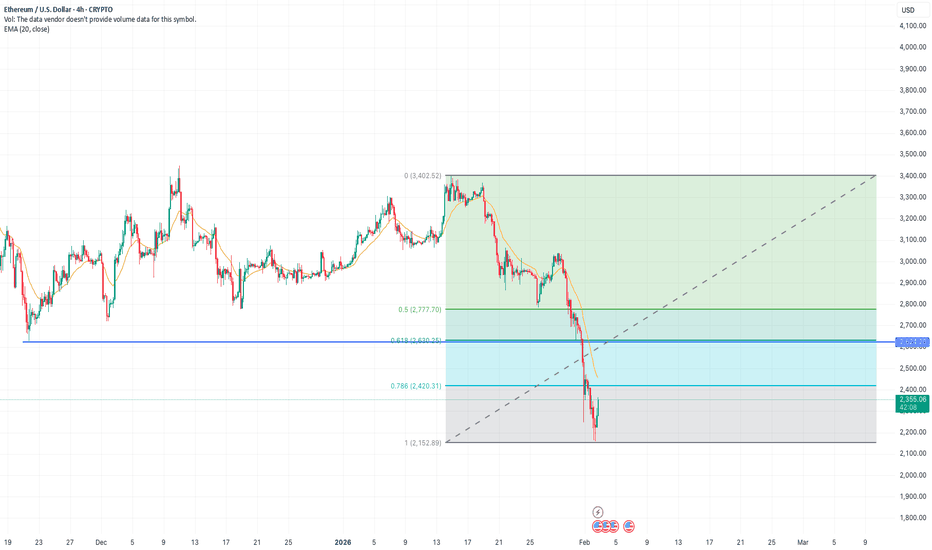

ETH/USD Daily — Support Bounce Setup in a Strong Downtrend

Chart Analysis:

Market Structure:

ETH is clearly in a bearish trend on the daily timeframe. Lower highs and lower lows are intact after a sharp rejection from the major supply zone around 3,300–3,400 (yellow zone).

Impulsive Sell-Off:

The recent move down is strong and aggressive, suggesting capi

Key stats

About Ethereum

Ethereum — the world’s second-most famous blockchain network — is a platform for creating decentralized applications based on blockchain and smart contract technology (a command that automatically enforces the terms of the agreement based on a given algorithm). It's the chain that birthed DeFi (decentralized finance) and started the NFT craze which saw billions of dollars pour into cryptocurrency. Safe to say, it's one of the big dogs.

Related coins

ETHUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARDETHUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the mark

The Bearish take on EthereumETH’s price action isn’t resilience — it’s structural weakness.

• ETH failed to lead while BTC stabilized

• No rotation narrative — capital isn’t choosing ETH

• Underperformance is a signal, not noise

Ethereum doesn’t benefit from “digital scarcity.”

• Supply is policy-driven, not fixed

• Monetar

ETH Reversal or just a pullback?CRYPTO:ETHUSD

Looking at the 4hr TF of ETH. it looks taking a minor pullback from the downward trend.

Yet it has to close Above $2620 to break the character of the current downtrend.

Highly likely it will chase this number successfully as more people are coming in with sentiment of buying the

Indicators & Oscillators (Technical Analysis) – Complete GuideIntroduction

In technical analysis, Indicators and Oscillators are mathematical tools derived from price, volume, or open interest data. Traders use them to analyze market behavior, identify trends, measure momentum, spot reversals, and improve trade timing.

While price action shows what the marke

Will it rhyme again?What do you think would happen?

This indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from th

#ETH Risker than beforeWatch for these levels. ETH can head back to $900 to $1000 again.

This chart/indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible

Part 1 Intraday Institutional Trading Who Should Trade Options?

People who:

- Understand options and risks.

- Have experience trading stocks/derivatives.

- Want to hedge existing positions.

- Are comfortable with potential losses.

Not suitable for:

- Beginners without knowledge.

- Risk-averse investors.

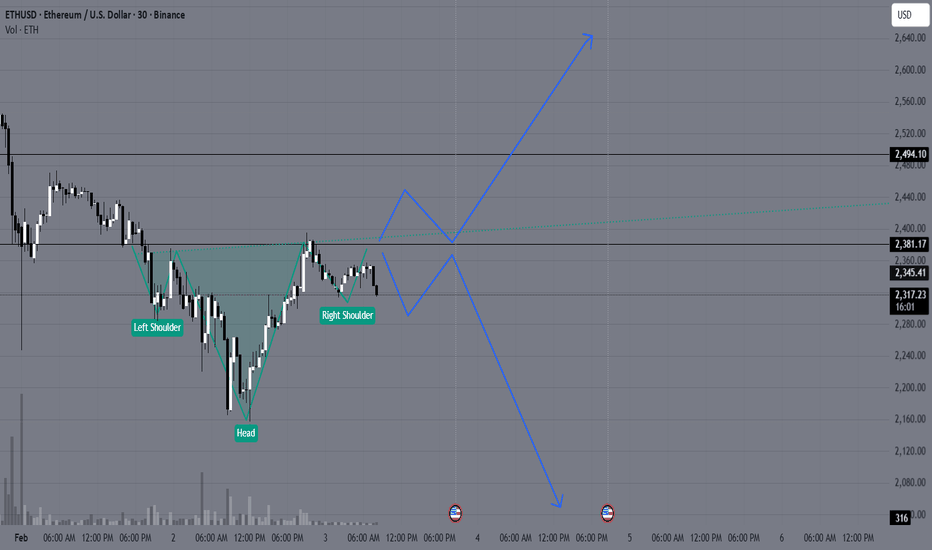

ETHUSD at a crucial support Forming Head and shoulder pattern✅ Pattern Forming: Inverse Head & Shoulders (Early Stage)

Look closely:

Left Shoulder → ~2300

Head (lowest point) → ~2180–2200

Right Shoulder → ~2250–2270

Price now pushing upward again

This is a classic bullish reversal structure.

✅ Key Resistance / Neckline Zone

Marked level around:

2380–

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Discover funds exposed to Ethereum and find the best way to access the coin.

Frequently Asked Questions

The current price of Ethereum (ETH) is 1,935.6 USD — it has fallen −4.19% in the past 24 hours. Try placing this info into the context by checking out what coins are also gaining and losing at the moment and seeing ETH price chart.

The current market capitalization of Ethereum (ETH) is 233.61 B USD. To see this number in a context check out our list of crypto coins ranked by their market caps or see crypto market cap charts.

Ethereum (ETH) trading volume in 24 hours is 24.32 B USD. See how often other coins are traded in this list.

Ethereum price has fallen by −14.05% over the last week, its month performance shows a −34.59% decrease, and as for the last year, Ethereum has decreased by −27.28%. See more dynamics on ETH price chart.

Keep track of coins' changes with our Crypto Coins Heatmap.

Keep track of coins' changes with our Crypto Coins Heatmap.

Ethereum (ETH) reached its highest price on Aug 24, 2025 — it amounted to 4,955.3 USD. Find more insights on the ETH price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

Ethereum (ETH) reached the lowest price of 0.4 USD on Oct 22, 2015. View more Ethereum dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The current circulating supply of Ethereum (ETH) is 120.69 M USD. To get a wider picture you can check out our list of coins with the highest circulating supply, as well as the ones with the lowest number of tokens in circulation.

The safest choice when buying ETH is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade ETH right from TradingView charts — just choose a broker and connect to your account.

Crypto markets are famous for their volatility, so one should study all the available stats before adding crypto assets to their portfolio. Very often it's technical analysis that comes in handy. We prepared technical ratings for Ethereum (ETH): today its technical analysis shows the strong sell signal, and according to the 1 week rating ETH shows the strong sell signal. And you'd better dig deeper and study 1 month rating too — it's sell. Find inspiration in Ethereum trading ideas and keep track of what's moving crypto markets with our crypto news feed.

Ethereum (ETH) is just as reliable as any other crypto asset — this corner of the world market is highly volatile. Today, for instance, Ethereum is estimated as 5.16% volatile. The only thing it means is that you must prepare and examine all available information before making a decision. And if you're not sure about Ethereum, you can find more inspiration in our curated watchlists.

You can discuss Ethereum (ETH) with other users in our public chats, Minds or in the comments to Ideas.