Gold bears prepare for another stunt as US inflation loomsGold Price again prods the 200-day Exponential Moving Average (EMA) support, after failing to break the same during late August, within a 2.5-month-old falling wedge bullish chart formation. The sluggish MACD signals and a downward-sloping RSI (14), not oversold, also favor the XAUUSD bears in breaking the 200-EMA support of around $1,910, which in turn will allow the precious metal to test the $1,900 threshold. However, the stated wedge’s bottom line of around $1,880 could challenge the commodity sellers afterward. In a case where the quote remains bearish past $1,880, the 78.6% Fibonacci retracement of its February-Mary upside, close to $1,860, will act as the final defense of the buyers before directing the prices toward the early 2023 low of around $1,805.

On the contrary, the Gold Price recovery will aim for the 100-EMA hurdle of surrounding $1,930. Following that, the aforementioned bullish chart pattern’s top line, close to $1,945, and the monthly high of near $1,953 could challenge the XAUUSD buyers. In a case where the bullion remains firmer past the $1,953 hurdle, the odds of witnessing a rally towards July’s peak of $1,987 and then to the theoretical target of the wedge formation, close to $2,045, can’t be ruled out. It’s worth noting that the $2,000 psychological magnet acts as an extra filter toward the north.

Overall, the Gold Price appears to decline further but the downside room seems limited unless the US CPI offers an extremely strong figure for August month.

Fed

GBPUSD recovery hopes to stay valid beyond 1.2430GBPUSD consolidates losses made in the last three consecutive weeks ahead of the UK’s employment report. Adding strength to the recovery momentum is the RSI (14) line’s rebound from the oversold territory, as well as a six-week-old falling wedge bullish chart formation, which in turn suggests an immediate run-up to cross the 1.2600 round figure. However, the upward trajectory needs validation from the stated wedge’s top line, close to 1.2640 by the press time, to highlight the theoretical target of around 1.3190. During the theoretical run-up, the 50-SMA level of around 1.2750, June’s high surrounding 1.2850 and the 1.3000 psychological magnet will act as intermediate halts.

Meanwhile, the 50.0% Fibonacci retracement of the pair’s March-July upside, near 1.2470, limits the immediate downside of the GBPUSD pair. That said, a convergence of the 200-SMA and the wedge’s bottom line, close to 1.2430, appears a tough nut to crack for the Cable pair sellers. It’s worth noting that a clear downside break of the 1.2430 support confluence won’t hesitate to quickly drag the Pound Sterling to the 61.8% Fibonacci retracement level surrounding 1.2315 before testing the mid-March swing high of around 1.2200.

Overall, GBPUSD buyers are in the driver’s seat ahead of the UK employment data.

Rising wedge lures USDJPY sellers amid hawkish BoJ concernsUSDJPY begins the week on a negative note while extending a downside gap during the early hours of Monday. Adding strength to the bearish bias about the Yen pair are the concerns about the Bank of Japan’s (BoJ) exit from the ultra-loose monetary policy easing and a five-week-old rising wedge bearish chart pattern. It should be noted, however, that multiple supports stand tall to test the pair sellers on their way to the theoretical target of the rising wedge confirmation, around 139.20. That said, the stated wedge’s bottom line of around 145.60 acts as an immediate challenge for the bears to retake control. Following that, the 200-SMA and an ascending trend line from mid-July, close to 144.70 and 143.40 in that order, will precede the 140.00 round figure to also check the pair’s downside momentum ahead of highlighting the 139.20 mark.

On the contrary, another rejection from the BoJ policymakers to the hawkish bias and strong US Consumer Price Index (CPI), scheduled for Wednesday, could renew the upside bias about the USDJPY pair. In that case, the tops marked since last Tuesday around 147.90 will provide headwinds to the Yen pair’s recovery. It should be noted that the stated wedge’s top line, around 148.10 by the press time, holds the key to the buyer’s entry. In that case, the north run will aim for the 150.00 psychological magnet ahead of targeting the previous yearly high surrounding 151.95, as well as the 152.00 threshold.

To sum up, USDJPY bulls appear to run out of steam but the bears need validation from 145.60, BoJ officials and the US inflation to retake control.

Gold has limited downside room unless it breaks $1,900Gold price appears well set to print the first weekly loss in three as it defends the previous Friday’s U-turn from a key resistance line below the important Exponential Moving Averages (EMAs). However, the 50-EMA pierces the 200-EMA from below and prints a “Golden Cross” bullish moving average crossover suggesting a corrective bounce in prices. Additionally, the RSI (14) also rebounds from the oversold territory and hence increases the odds of witnessing a corrective bounce towards the EMA convergence surrounding $1,930. Following that, the 50% Fibonacci retracement of the July-August downturn, near $1,937, may please the XAUUSD buyers before testing them with a seven-week-old descending resistance line surrounding $1,950. Adding strength to the stated trend line resistance is the 61.8% Fibonacci retracement, also known as the “Golden Fibonacci Ratio”.

Meanwhile, the Gold buyer’s failure to defend Thursday’s corrective bounce needs to break $1,915 support to recall the sellers. Even so, a horizontal area comprising multiple levels marked since late June, close to $1,900, appears a tough nut to crack for the XAUUSD bears afterward. It should be observed, though, that a clear downside break of $1,900 won’t hesitate to challenge the previous monthly low of around $1,884 while targeting the early March swing high of around $1,858 and then to the yearly bottom of $1,804, quickly followed by the $1,800 round figure.

To sum up, the Gold price remains on the bear’s radar despite the latest recovery.

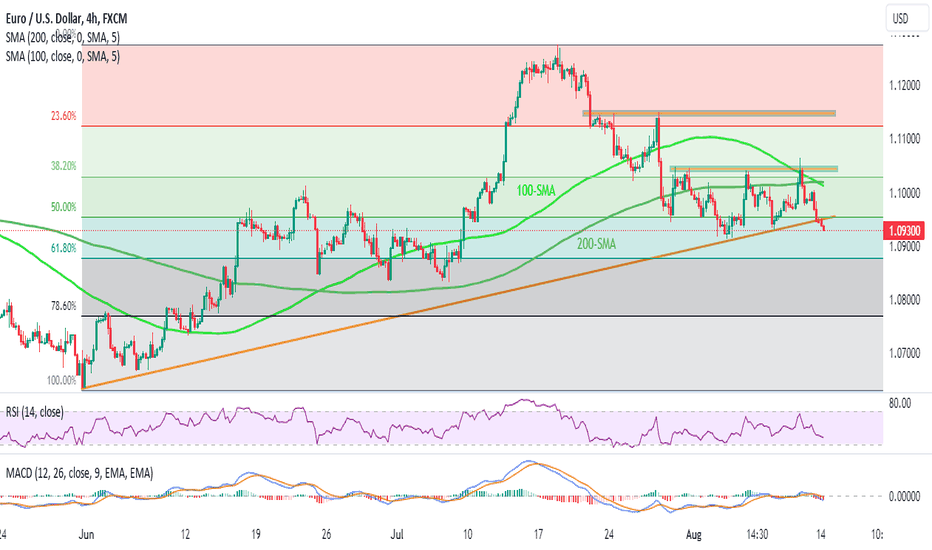

EURUSD remains on the back foot within bearish channelEURUSD braces for the eighth consecutive weekly loss despite the latest hesitance of the bears surrounding the bottom line of the 1.5-month-old descending trend channel. It’s worth noting that the nearly oversold RSI line and sluggish MACD signals suggest a corrective bounce of the Euro pair, which in turn highlights the previous support line stretched from late June, close to 1.0750 by the press time. In a case where the quote remains firmer past 1.0750, September’s peak of around 1.0885 and the aforementioned channel’s top line surrounding 1.0900 will lure the pair buyers. It should be observed, however, that the bullish bias remains elusive unless the quote stays below the 200-SMA hurdle of 1.0925, a break of which could challenge July’s peak of 1.1275 gradually.

Meanwhile, the EURUSD pair’s weakness might dwindle around the stated bearish channel’s bottom line, close to 1.0695 by the press time. Following that, the lows marked in May and March, respectively near 1.0635 and 1.0515 could lure the Euro sellers. Should the pair bears remain in control past 1.0515, the yearly bottom of around 1.0480 will act as the final battle point for the buyers before giving the throne to the sellers.

Overall, EURUSD is likely to remain bearish but a corrective bounce can’t be ruled out.

USDCAD bulls jostle with 1.3640-50 crucial resistance on BoC DayUSDCAD bulls struggle to keep the reins at a five-month high as markets await the all-important Bank of Canada (BoC) Interest Rate Decision and the US ISM Services PMI for August. That said, the nearly overbought RSI and impending bear cross on the MACD checks buyers as they attack a convergence of an 11-month-old descending resistance line and a horizontal region comprising multiple levels marked since late April, close to 1.3640-50. As a result, the pair’s upside appears difficult and hence needs a strong boost from the BoC, as well as US data, to cross the stated hurdle, which in turn could propel prices towards the yearly high marked in March around 1.3865. Following that, the late 2022 peak of 1.3980 and the 1.4000 psychological magnet will gain the market’s attention.

Meanwhile, the USDCAD pullback may initially aim for the 38.2% Fibonacci retracement of August-October 2022 upside, near 1.3500, ahead of retesting the 200-DMA support of 1.3465. In a case where the Loonie pair remains bearish past 1.3465, the early July swing high of 1.3385 and the 61.8% Fibonacci retracement surrounding 1.3200, also known as the Golden Fibonacci ratio, will be on the seller’s radar. Finally, the yearly low marked in July around 1.3090 acts as the last battle point for the buyers, a break of which won’t hesitate to drag the pair below the 1.3000 psychological magnet.

Overall, USDCAD remains bullish but may witness a pullback before the further upside, unless the BoC and US data offer surprises.

AUDUSD bears flex muscles on RBA DayAUDUSD bulls struggle to hold the forte after posting the first weekly gain in seven on the Reserve Bank of Australia (RBA) Interest Rate Decision Day. That said, the Aussie pair trades within a three-week-old bearish triangle, staying below the convergence of the 100-SMA and 50-SMA surrounding 0.6450 on the key day. It’s worth noting that the steady RSI and bearish MACD signals lure the sellers to sneak in and break the stated bearish triangle’s bottom line, close to 0.6420 at the latest. In a case where the risk-barometer pair remains weak past 0.6420, it confirms the bearish chart pattern and can well refresh the yearly low, currently the August 13 bottom of around 0.6360.

On the other hand, an upside clearance of the previously stated triangle’s top line, near 0.6530, could unleash the AUDUSD buyers. Following that, a downward-sloping resistance line from mid-July around 0.6600 will precede a five-week-old horizontal resistance zone surrounding 0.6625 to test the upside momentum. In a case where the Aussie pair buyers keep the reins, backed by the hawkish RBA actions or signals, the odds of witnessing a run-up toward July’s peak of around 0.6900 can’t be ruled out.

Overall, AUDUSD bulls run out of steam but the bears need approval from the RBA and the triangle breakdown.

GBPUSD buyers remain hopeful despite latest disappointmentGBPUSD managed to confuse pair sellers last week by defending a one-month-long falling wedge bullish chart pattern despite declining in the later days. Also challenging the Cable pair’s downside is a weeklong rising support line, as well as a nearly oversold RSI (14) line. It’s worth noting, however, that the MACD still flashes the bearish signals and hence the Pound Sterling buyers need to wait for a clear upside break of the stated wedge’s top line surrounding 1.2720, as well as the 200-SMA of near 1.2755, to retake control. That said, a horizontal support-turned-resistance stretched from early August, close to 1.2620, guards the pair’s immediate recovery whereas a clear break of 200-SMA will enable the quote to challenge the yearly top marked in July around 1.3145, with a likely pause in the run-up around the 1.3000 round figure.

Meanwhile, a downside break of the immediate one-week-old rising support line surrounding 1.2580 could convince GBPUSD bears to test the falling wedge bullish formation. In doing so, the quote will poke the wedge’s bottom line of around 1.2530. Should the Cable pair sellers dominate past 1.2530, the odds of witnessing a gradual downside toward May’s bottom near 1.2300 can’t be ruled out.

Overall, GBPUSD bears run out of steam but the recovery needs validation from 1.2755, as well as this week’s key data/events.

Gold buyers remain hopeful on NFP day, focus on $1,955Gold braces for the second consecutive weekly gain as it confronts the key resistances on the US Nonfarm Payrolls (NFP) day. Among them, the four-month-old descending trend line is the immediate challenge for the XAUUSD bulls around $1,945 ahead of the $1,955 crucial hurdle comprising the 100-SMA and the previous support line from late 2022. It’s worth noting that the quote’s successful rebound from the 50% Fibonacci retracement of its November 2022 to May 2023 rise joins the bullish MACD signals to favor the upside bias for the metal price. However, the RSI line speedily approaches the overbought territory and hence suggests the limited room towards the north for the metal, which in turn highlights the $1,955 level as a tough nut to crack for the bulls. In a case where the commodity remains firmer past $1,955, the odds of witnessing a quick rally towards the 23.6% Fibonacci ratio of around $1,987 can’t be ruled out whereas the $2,000 threshold could check the run-up afterward.

On the flip side, the $1,900 round figure will precede the 50% Fibonacci retracement level of around $1,898 to restrict the near-term downside of the Gold Price. Following that, the lows marked in June and August, respectively near $1,893 and $1,885 will be in the spotlight for the sellers. Should the XAUUSD remain weak past $1,885, its fall toward the 61.8% Fibonacci retracement of near $1,858, also known as the Golden Fibonacci Ratio, becomes imminent.

Overall, the Gold price approaches the interesting resistance territory as markets await the US employment report for August.

EURUSD recovery remains unconvincing below 1.1040EURUSD extends recovery from the 200-DMA, as well as an upside break of a fortnight-old descending resistance line, as markets await the Eurozone inflation data and the Fed’s favorite inflation gauge, namely the US Core PCE Price Index. That said, the looming bull cross on the MACD and upbeat RSI (14), not overbought, also keep the Euro buyers hopeful. However, a clear run-up beyond the previous support line stretched from October 2022, now resistance around 1.1040, becomes necessary to confirm the bullish trend. Following that, the yearly high of 1.1275, marked earlier in the month, will be in the spotlight.

On the contrary, the two-week-long resistance-turned-support of around 1.0880 restricts the immediate downside of the EURUSD pair ahead of the 200-DMA level of 1.0810. In a case where the Euro pair drops below 1.0810, and also breaks the 1.0800 round figure, sellers can aim for May’s bottom of 1.0635 before targeting the yearly low marked in January surrounding 1.0480. It’s worth noting that the downside moves need strongly disappointing Eurozone HICP and CPI numbers, as well as an extremely positive US Core PCE Price Index, to reverse the latest uptrend.

Overall, EURUSD remains in the recovery mode as the key Eurozone and the US data loom.

GBPUSD appears ready for further downside towards 200-SMAGBPUSD remains on the back foot while justifying a downside break of a 5.5-month-old rising support line and the 100-SMA. Also keeping the Cable bears hopeful are the bearish MACD signals. However, the nearly oversold RSI conditions suggest limited room towards the south, which in turn highlights the 200-SMA level of around 1.2400 as the key support. It’s worth noting that the 50% Fibonacci retracement of the March-July fall, close to 1.2470, acts as an immediate check of the sellers while the 61.8% Fibonacci retracement of near 1.2310, also known as the golden ratio, will challenge the sellers past 200-SMA.

On the contrary, the GBPUSD pair’s corrective bounce needs validation from the 100-SMA hurdle of 1.2645. Following that, a convergence of the 21-SMA and the previous support line from mid-March, surrounding 1.2700, appears a tough nut to crack for the Cable buyers. In a case where the Pound Sterling remains firmer past 1.2700, the gradual upside toward June’s peak of 1.2848 can’t be ruled out.

Overall, GBPUSD appears well set for further downside even if the road towards the south appears bumpy.

USDJPY bulls run out of steam around mid-146.00sUSDJPY again flirts with the 78.6% Fibonacci retracement of the October 2022 to January 2023 downturn within a five-month-long bullish channel. Though, the overbought RSI (14) and looming bear cross on the MACD signal pullback of the Yen pair. That said, the tops marked in late June and early July join the 21-DMA to highlight the 144.60-50 zone as a short-term key support. In a case where the risk-barometer pair drops below 144.50, the late July swing high around 142.00 might stop the sellers before challenging them with the 140.00 support confluence comprising 100-DMA and the bottom line of the stated channel.

Meanwhile, a daily closing beyond the 78.6% Fibonacci retracement level of around 146.50 will direct the USDJPY buyers toward the November 2022 peak of around 148.85 and then to the 149.00 round figure. Following that, the 150.00 round figure might test the Yen pair’s upside before highlighting the previous yearly high of around 152.00.

To sum up, the USDJPY pair’s pullback appears overdue but the downtrend appears off the table beyond 140.00.

23-week-old support line challenges AUDUSD bearsAUDUSD bears ran out of steam during the sixth week of the downtrend by positing the slimmest losses since mid-July. Even so, the Aussie pair faded bounce off a downward-sloping support line from early March, not to forget staying beneath a six-week-long descending resistance line. It’s worth noting that the nearly oversold RSI and the impending bull cross on the MACD challenge the pair sellers, suggesting another bounce off the stated multi-week-old support line, close to 0.6450 by the press time. In a case where the bears manage to conquer the 0.6450 support, last November’s bottom of around 0.6270 will be in the spotlight. Following that, the previous yearly low of near 0.6170 could lure the offers.

On the flip side, a corrective bounce needs validation from the downward-sloping resistance line from mid-July, close to 0.6435 at the latest. Also acting as the short-term upside AUDUSD hurdle is the 21-DMA of around 0.6505. Should the Aussie bulls manage to keep the reins past 0.6505, the lows marked in late June and early July around 0.6600 will give the final fight to the bulls before giving them control. It should be observed that the double tops marked in June and July surrounding 0.6900 appear a tough nut to crack for the buyers afterward.

Overall, AUDUSD remains bearish but the downside room appears limited, which in turn suggests a corrective bounce before the fresh leg towards the south.

EURUSD drops within bearish channel with eyes on Jackson HoleEURUSD prepares for the sixth consecutive weekly fall as ECB and Federal Reserve bosses prepare for the annual showdown at the Jackson Hole Symposium. That said, the Euro pair remains pressured within a one-month-old descending trend channel amid downbeat RSI and MACD conditions, which in turn suggest less downside room and highlights the stated channel’s bottom line of around 1.0785 as the key support. In a case where the sellers dominate past 1.0790, the 78.6% Fibonacci retracement of May-July upside, near 1.0770, will act as the final defense of the buyers, a break of which will direct the prices toward May’s bottom of 1.0635.

On the contrary, a fortnight-long falling resistance line, close to 1.0880 at the latest, guards immediate EURUSD recovery within the bearish channel formation. Following that, the mentioned channel’s top line of near 1.0980 and the 200-SMA surrounding 1.1015-20 could test the Euro buyers before giving them a charge. In that case, the monthly high of 1.1065 and the late July peak of 1.1150 may check the upside moves ahead of directing the quote to the yearly top of 1.1275.

Overall, EURUSD bears appear running out of steam but the buyers need strong reasons to retake control, which in turn highlights the central bankers’ speeches at the key event for the pair traders to watch.

AUDUSD forms falling wedge but bulls need more to returnAUDUSD bears take a breather after a five-week downtrend, portraying a falling wedge bullish chart pattern around the yearly low. Adding strength to the hopes of recovery is an upward-sloping RSI line, not overbought, as well as the bullish MACD signals. However, an area comprising multiple lows marked since late May, around 0.6460-70, restricts the short-term upside of the Aussie pair. Following that, a three-month-old horizontal area and the 200-SMA, respectively near 0.6580-6600 and 0.6635, will challenge the buyers before giving them control.

On the contrary, a one-week-long rising support line surrounding 0.6390 limits the immediate downside of the AUDUSD pair ahead of the stated wedge’s bottom line, close to 0.6350. In a case where the Aussie pair remains bearish past 0.6350, the November 2022 low near 0.6270 and the previous yearly bottom of around 0.6170 will be in the spotlight.

Overall, AUDUSD bears run out of steam and hence suggest a corrective bounce in the pair’s price. However, the downward trend established since mid-July is more likely to prevail unless witnessing strong Aussie data and/or downbeat US statistics, as well as the dovish Fed talks and the risk-on mood.

GBPUSD eyes further upside, 1.2830 challenges buyersGBPUSD gained buyer’s attention after snapping a four-week downtrend the last week. Adding strength to the upside bias is the Cable pair’s confirmation of the descending triangle bullish chart pattern. However, a clear upside break of the stated triangle’s upper line, close to 1.2740 by the press time, as well as successful trading beyond the 200-SMA hurdle of 1.2830 becomes necessary for the Pound Sterling bulls to retake control. Following that, the late July swing high of around the 1.3000 psychological magnet will act as a buffer during an expected ride towards challenging the yearly top marked the last month near 1.3145.

On the contrary, multiple supports around 1.2700 and 1.2650 restrict the short-term downside of the GBPUSD pair. However, the Cable’s bearish bias remains elusive unless witnessing a clear break of the previously stated triangle’s bottom line, close to 1.2625 by the press time. It’s worth noting that the Pound Sterling’s sustained weakness beneath 1.2625 may seek confirmation from the late June swing low of around 1.2590 before targeting May’s bottom of 1.2310.

Overall, GBPUSD lures buyers but the upside needs validation from 1.2830.

USDJPY portrays bullish consolidation beyond 200-SMAUSDJPY posted a three-week winning streak but ended Thursday on a negative note. That said, a convergence of 50-SMA and a seven-week-old horizontal area surrounding 145.00-145.10 restricts the immediate downside of the Yen pair. Following that, the early-month high of around 143.90 and the 200-SMA level of around 142.15 will act as the final defense of the buyers. In a case where the quote remains bearish past 142.15, as well as breaks the 142.00 round figure, the odds of witnessing a slump towards the 140.00 round figure and then to the late July swing of near 138.00 can’t be ruled out.

Alternatively, a corrective bounce in the USDJPY price could challenge the latest multi-month peak of around 146.60 before trying to restore the bull’s confidence by poking the previous support line stretched from July 28, around 146.80. In a case where the Yen buyers remain dominant past 146.80, the 150.00 round figure will be crucial to watch as the key upside hurdle, a break of which could allow the upside to aim for the previous yearly top surrounding 152.00.

Overall, the USDJPY buyers are taking a breather but not off the table as the key supports hold.

AUDUSD remains vulnerable to refresh yearly low past 0.6400A daily closing beneath a nine-month-old rising support line, now resistance around 0.6480, keeps the AUDUSD bears hopeful of witnessing further downside even as the oversold RSI conditions prod the immediate declines. That said, the 78.6% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6380, checks the bears while the last November’s bottom of around 0.6270 can challenge the Aussie pair’s downside afterward. In a case where the quote remains weak past 0.6270, the previously yearly low marked in October around 0.6170 will be in the spotlight.

On the contrary, AUDUSD recovery needs validation from the multi-day-old previous support line, close to 0.6480. Even so, the 10-DMA level surrounding 0.6515 can challenge the buyers before directing them to the lows marked in late June and early July around 0.6600. It’s worth noting that the Aussie pair’s successful trading beyond 0.6600 enables it to aim for the 50% Fibonacci retracement level of near 0.6670 ahead of targeting May’s peak of near 0.6820. Above all, AUDUSD stays on the bear’s radar unless crossing the double tops marked in July close to 0.6900.

Overall, AUDUSD is less likely to return to the buyer’s radar any time soon.

Falling wedge, oversold RSI tease NZDUSD buyers on RBNZ dayNZDUSD bears appear running out of steam after a four-week downtrend as the Kiwi pair portrays a one-month-old falling wedge bullish chart formation at the yearly low amid the oversold RSI (14) line. That said, the 10-DMA surrounding 0.6045 guards immediate recovery of the quote ahead of the key 0.6060 resistance comprising the top line of the stated wedge. In a case where the bulls manage to keep control after crossing the 0.6060 hurdle, June’s high of around 0.6250 and a six-month-long horizontal area near 0.6380-90 can test the upside momentum before the falling wedge’s theoretical target of 0.6535. It’s worth noting that the said 0.6535 level coincides with the yearly peak marked in February and hence becomes the key hurdle for the buyers to watch afterward.

On the contrary, the aforementioned wedge’s lower line restricts the immediate downside of the NZDUSD pair around 0.5920, a break of which will defy the bullish chart pattern. However, the 0.5900 round figure and a downward-sloping support line from early March, close to 0.5880, could challenge the bears afterward. In a case where the Kiwi sellers refrain from stepping back past 0.5880, the 78.6% Fibonacci retracement of October 2022 to February 2023 upside, around 0.5730, will act as the last defense of the buyers before directing the quote to the previous yearly low of near 0.5515.

Overall, NZDUSD is likely to witness recovery as the RBNZ managed to lure Kiwi buyers without doing much. However, Fed Minutes will be crucial to watch for clear directions.

GBPUSD closing in key support ahead of UK employment dataGBPUSD remains on the back foot as the Cable bears attack the bottom line of a six-week-old bullish triangle after staying successfully beneath an ascending support line from early March, now resistance around 1.2830. That said, the bearish MACD signals keep the Cable sellers hopeful. However, the below 50.0 conditions of the RSI (14) line join a convergence of the 100-DMA and bottom of the stated triangle, around 1.2610, quickly followed by the 1.2600 round figure, to challenge the Pound Sterling’s downside. In a case where the quote remains bearish past 1.2600, the odds of witnessing a slump toward the 200-DMA support of around 1.2350 can’t be ruled out.

On the contrary, an upside break of the stated triangle confirms the GBPUSD pair’s bullish breakout and theoretically suggests a run-up towards 1.3700. However, the multi-day-old support-turned-resistance around 1.2830 and the late July swing high around the 1.3000 psychological magnet can test the Pound Sterling bulls. Also acting as an upside hurdle is the yearly high of around 1.3145.

Overall, GBPUSD bears approach the short-term key support confluence surrounding the 1.2600 round figure as the UK employment data looms. It’s worth noting, however, that the downbeat prints of the British jobs report may allow the bears to keep the reins and prod the 200-DMA support while the road towards the north appears bumpy in case the scheduled data offers a positive surprise.

EURUSD sellers tighten grips ahead of a busy weekIn addition to posting the fourth consecutive weekly losses, the EURUSD also ended the week on a negative note while piercing a 10-week-old rising support line, now immediate resistance around 1.0950. Also keeping the Euro sellers hopeful are the bearish MACD signals. However, the RSI (14) line is below 50.0 and suggests bottom-picking, which in turn highlights the monthly low of around 1.0910 as short-term key support. Following that, July’s bottom surrounding 1.0830 and the 78.6% Fibonacci retracement of May-July upside, near 1.0770, can check the downside moves targeting May’s trough close to 1.0635.

Meanwhile, a corrective bounce needs to cross a convergence of the 100-SMA and the 200-SMA to convince the intraday buyers of the EURUSD pair. Even so, a fortnight-old horizontal resistance area surrounding 1.1045-50 could test the bulls before giving them control. Even so, the tops marked during late July may offer breathing space to the buyers near 1.1150. In a case where the Euro pair remains firmer past 1.1150, the odds of witnessing a run-up towards challenging the yearly top marked in July around 1.1275 can’t be ruled out.

Overall, EURUSD is on the bear’s radar as traders await more details of EU/US growth and inflation.

GBPUSD bulls need 1.2870 breakout and strong UK GDPA bullish triangle joins Thursday’s rebound to lure GBPUSD buyers as markets await the first estimates of the UK Q2 GDP. However, fears of recession and the 1.2815-25 resistance confluence restrict Cable prices. That said, a convergence of the 100-SMA and top line of a six-week-old descending triangle together constitute the 1.2800-05 key hurdle for the buyers. Even if the Pound Sterling bulls manage to cross the 1.2805 resistance, the 200-SMA level of near 1.2825 and previous support line stretched from late May, close to 1.2870 will act as the final defenses of the sellers.

On the contrary, a softer UK GDP outcome could quickly fetch the GBPUSD price towards the one-week-old horizontal support of around 1.2680. Following that, a broad support zone comprising multiple levels marked since late June, around 1.2620-2590, will be a tough nut to crack for the Cable bears. In a case where the Pound Sterling keeps the reins past 1.2590, the 1.2500 round figure and late May’s swing high near 1.2480 will be buffers during the south run towards May’s low of 1.2308.

Overall, GBPUSD teases buyers but they have a tough task on hand to retake control.

EURUSD sellers prepare for entry, 1.0930 and US inflation eyedEURUSD bears appear running out of steam during the fourth weekly loss as it grinds near the key support confluence within a five-month-old bullish channel ahead of the US inflation. In doing so, the Euro pair seesaws between a three-week-old falling resistance line and a confluence of the 100-DMA and a rising support line from November 2022, respectively near 1.0970 and 1.0930. It’s worth noting that the MACD and RSI signal the return of the buyers but a clear downside break of 1.0930 could quickly challenge the bullish channel by poking the 1.0760 mark comprising the stated channel’s support line. In a case where the Euro bears ignore oscillators and break the 1.0760 support, May’s low of 1.0688 may act as an intermediate halt before dragging the quote toward the lows marked in February and January of 2023, close to 1.0515 and 1.0480 in that order.

On the flip side, a clear upside break of the aforementioned three-week-old descending resistance line, close to 1.0970 at the latest, becomes necessary for the EURUSD bull’s return. Following that, the tops marked in February and April, near 1.1035 and 1.1095 in that order will gain the market’s attention. In a case where the Euro buyers dominate past 1.1095, the yearly high marked in July around 1.1275 and the previously stated bullish channel’s top line, close to 1.1285, should lure the bids.

Overall, EURUSD is hitting strong support ahead of the key event that’s likely to underpin the US Dollar pullback, which in turn requires sellers to remain cautious before taking a fresh short position.