Gold hits record 3,759 | Safe-haven flows surge back🟡 XAU/USD – 23/09 | Captain Vincent ⚓

🔎 Captain’s Log – Context & News

Today Gold surged nearly +2% , hitting a record $3,759/oz .

Geopolitical tensions : Israel launched missiles into Lebanon, killing 5 (including 4 US citizens) → safe-haven demand rushed back into Gold.

USD weakened , capital flowed out of stocks & bonds → strong support for precious metals.

ETFs & speculators : heavy buying amplified the rally.

Silver : jumped to its highest level in 14 years, reinforcing strength in the precious metals sector.

⏩ Captain’s Summary : Gold is fueled by geopolitics, macro factors, and safe-haven demand. But after a hot rally, the big question: continue breaking highs or face sharp swings if the FED shifts tone?

📈 Captain’s Chart – Technical Analysis (H45)

Storm Breaker (Resistance / Sell Zone)

3,771 – 3,787 (Fibo 0.5–0.618 confluence, ATH test zone)

Golden Harbor (Support / Buy Zone)

Near support: 3,740 (previous high turned support)

OB Dock: 3,717 – 3,723

Breakout Harbor: 3,689 – 3,691

Market Structure

Gold broke out to Higher High around 3,755 – 3,759.

Main trend remains bullish, but prone to volatility / pullback after a hot rally.

🎯 Captain’s Map – Trade Plan

✅ Buy (trend-follow priority)

Buy Zone 1 (OB)

Entry: 3,717 – 3,723

SL: 3,707

TP: 3,725 – 3,730 – 3,735 – 3,740 – 3,750

Buy Zone 2 (Breakout Retest)

Entry: 3,689 – 3,691

SL: 3,678

TP: 3,699 – 3,710 – 3,7xx

⚡ Sell (short-term scalp if overbought)

Sell Zone (ATH test)

Entry: 3,783 – 3,785

SL: 3,795

TP: 3,759 – 3,740 – 3,717

⚓ Captain’s Note

“The geopolitical storm pushed the Golden sails past 3,759. Golden Harbor 🏝️ (3,717 – 3,689) is the safe dock for sailors to board the northbound trend. Storm Breaker 🌊 (3,771 – 3,787) may raise heavy waves, suitable for short Quick Boarding 🚤 scalps. The main voyage remains bullish, but after a hot rally, sailors must keep a firm hand on the helm to avoid being thrown off by choppy swings.”

Federalreserve

Gold holds firm at 3,63x | Caution for Friday session🟡 XAU/USD – 19/09 | Captain Vincent ⚓

🔎 Captain’s Log – Market Context

FED : Probability of a 25bps cut in October is 91.9%, while holding rates is only 8.9% → almost certain FED will continue easing.

US News : No major data today, market remains quiet.

Gold : Sharp moves in Asia session, but support 3,632 – 3,630 held strong.

Yesterday’s Buy at 3,62x delivered 200 pips , confirming this zone as a “fortress” support.

Note : Today is Friday – end of the week session, unexpected volatility may occur before the weekly close → strict risk management required.

⏩ Captain’s Summary : Gold remains bullish, but caution is needed with end-of-week swings. Golden Harbor around 3,63x continues to be a solid anchor.

📈 Captain’s Chart – Technical Analysis

Storm Breaker (Resistance / Sell Zone)

3,661 – 3,663 (intraday resistance)

3,683 – 3,685 (strong OB, likely profit-taking zone)

Golden Harbor (Support / Buy Zone)

3,602 – 3,605 (FVG zone – deeper support if 3,63x breaks, waiting for strong demand)

Market Structure

After rebounding from 3,62x, Gold consolidated around 3,65x – 3,66x.

Main trend stays bullish, but needs support retest to confirm buyers’ strength.

3,66x is the pivot barrier:

• Breakout → targets 3,68x

• Rejection → retest 3,64x – 3,62x

🎯 Captain’s Map – Trade Plan

✅ Buy (priority)

Entry: 3,602 – 3,605

SL: 3,588

TP: 3,629 – 3,661 – 3,683

⚡ Sell (short scalp)

Entry: 3,683 – 3,685

SL: 3,695

TP: 3,665 – 3,645

⚓ Captain’s Note

“The 3,63x fortress continues to hold, keeping the Golden ship safe on its northward journey. Golden Harbor 🏝️ (3,602 – 3,605) remains the main dock for sailors to gather strength. Storm Breaker 🌊 (3,683 – 3,685) may raise waves, suitable for short Quick Boarding 🚤 . Today is Friday – the sea can shift unexpectedly, so keep the sails full but hands steady on the helm.”

FED slows down: Cuts 25bps, gold stays flat🟡 XAU/USD – 18/09 | Captain Vincent ⚓

🔎 Captain’s Log – News Context

FED : Cut rates by 25bps as expected, hinted at 2 more cuts this year → initially supported Gold to rebound around 3,65x.

Powell turned hawkish :

• “No need to move quickly on rate cuts.”

• “Today’s cut is mainly risk-management.”

This message signaled that the FED is not fully opening the easing door → Gold fluctuated and stalled its upside momentum.

Tonight: Awaiting Jobless Claims & Philly Fed for more clarity on the FED’s path.

⏩ Captain’s Summary

Gold is supported by the rate cut, but Powell’s “braking” caused volatility.

Zone 3,663 – 3,665 has become the pivot support to determine the next move.

📈 Captain’s Chart – Technical Analysis

Storm Breaker (Resistance / Sell Zone)

3,684 – 3,686 (strong OB)

3,717 – 3,719 (ATH Zone – very strong, likely heavy selling)

Golden Harbor (Support / Buy Zone)

Pivot Dock: 3,663 – 3,665 (new pivot support)

Main Harbor: 3,629 – 3,630 (BoS confluence & old sideway)

Market Structure

After breakout and profit-taking, Gold returned to test support.

3,663 – 3,665 : pivot support.

• If it holds → rebound to 3,684 – 3,717.

• If it breaks → deeper correction to 3,629.

🎯 Captain’s Map – Trade Plan

✅ Buy (priority)

Buy Zone 1

Entry: 3,663 – 3,666

SL: 3,655

TP: 3,684 – 3,717

Buy Zone 2

Entry: 3,629 – 3,630

SL: 3,618

TP: 3,663 – 3,684 – 3,717

⚡ Sell (only at resistance)

Sell Zone OB

Entry: 3,684 – 3,686

SL: 3,695

TP: 3,665 – 3,645

Sell Zone ATH NEW

Entry: 3,717 – 3,719

SL: 3,727

TP: 3,706 – 3,690 – 3,675

⚓ Captain’s Note

“The Golden sails caught wind as the FED cut rates, but Powell’s headwind slowed the advance. Golden Harbor 🏝️ (3,663 – 3,629) is the pivot dock to decide the next course. If it holds, the ship may rebound to test Storm Breaker 🌊 (3,684 – 3,719) . If it breaks, the ship will retreat deeper to gather strength. For now, Quick Boarding 🚤 should only be done at strong resistance, while the larger voyage still leans northward.”

FED shaken by politics | Gold eyes new ATH🟡 XAU/USD – 16/09 | Captain Vincent ⚓

🔎 Captain’s Log – News Context

FED & US Politics :

S. Miran elected to the FED Board but still serves as Trump’s economic advisor → concerns FED may face White House influence.

Michelle Mills elected with a narrow 48–47 margin.

Appeals Court blocked Trump from firing L. Cook, affirming FED’s independence, but raising the risk of a legal battle at the Supreme Court.

US Economy :

6:30 AM (US time): Retail Sales release – key consumer spending indicator.

Probability of a -50bps FED cut this week is down to 1.2% , nearly ruled out. FED is almost certain to deliver -25bps next week.

⏩ Captain’s Summary : Politics create noise, but the macro backdrop (FED easing + weak US data) remains the tailwind supporting Gold’s journey toward new ATH.

📈 Captain’s Chart – Technical Analysis

Storm Breaker (Resistance / Sell Zone) :

3706 – 3714 (Fibonacci resistance)

3722 – 3724 (Strong Sell Zone, potential ATH test)

Golden Harbor (Support / Buy Zone) :

FVG Dock: 3666 – 3668

OB Harbor: 3643 – 3645

Strong Low: 3611 (deep support)

Market Structure :

After a series of BoS , Gold broke out of sideways EqH/EqL and surged.

Preferred scenario: retrace to FVG 3666 , then bounce toward 3714 – 3722.

If 3722 breaks successfully → confirms new ATH and extends bullish momentum.

🎯 Captain’s Map – Trade Plan

✅ Buy (priority)

Buy 1 (FVG)

Entry: 3666 – 3668

SL: 3657

TP: 3690 – 3706 – 3714 – 372x

Buy 2 (OB)

Entry: 3643 – 3645

SL: 3632

TP: 3666 – 3700 – 3714 – 372x

⚡ Sell (short scalp at resistance)

Sell Zone

Entry: 3722 – 3724

SL: 3732

TP: 3714 – 3706 – 3690

⚓ Captain’s Note

“The Golden ship has broken free from sideways waters and is heading toward new peaks. Golden Harbor 🏝️ (3666 – 3643) is the safe dock for sailors to gather strength before sailing further. Storm Breaker 🌊 (3722 – 3724) is the big wave, suitable only for short Quick Boarding 🚤 . With dovish winds from the FED, the Golden sails are set toward new ATH.”

Gold faces early selling pressure | Main trend still Buy🟡 XAU/USD – 15/09 | Captain Vincent ⚓

🔎 Captain’s Log – News Context

FED rate cut probabilities this week :

-25bps : 96.4% (up from 89.1%).

-50bps : only 3.0% (down sharply from 10.9%).

Trump : Announced more sanctions on Russia, urged NATO to stop buying Russian oil; also emphasized “the possibility of significant FED rate cuts.”

Key event today : New York Manufacturing Index at 1:30 (US time).

⏩ Captain’s Summary : The sharp drop in -50bps expectations caused early selling pressure on Gold this morning. But overall, FED is still certain to cut rates and inflation is cooling → the bigger trend continues to favor Buy .

📈 Captain’s Chart – Technical Analysis

Storm Breaker (Resistance / Sell Zone) : 3665 – 3670 (Weak High & upper cap).

Golden Harbor (Support / Buy Zone) : 3623 – 3603 – 3587.

Market Structure :

On H1, Gold is moving within a tightening triangle with EqH and EqL .

Main trend stays bullish, but needs a retest of support before rallying toward 3665 – 3670.

🎯 Captain’s Map – Trade Plan

✅ Buy (priority)

Buy Zone 1

Entry: 3623 – 3625

SL: 3612

TP: 3640 – 3650 – 3660 – 3665+

Buy Zone 2 (FVG)

Entry: 3603 – 3605

SL: 3592

TP: 3620 – 3640 – 3655 – 3665

Deep Buy Zone

Entry: 3587 – 3590

SL: 3575

TP: 3610 – 3630 – 3650

⚡ Sell (short scalp at resistance)

Sell Zone

Entry: 3665 – 3670

SL: 3678

TP: 3655 – 3645 – 3635 – 36xx

⚓ Captain’s Note

“The Golden ship faces headwinds this morning as sailors reduce expectations for a -50bps cut. But the larger sail remains filled with dovish FED winds, steering the voyage north. Golden Harbor 🏝️ (3623 – 3603 – 3587) is the safe dock to gather strength. Storm Breaker 🌊 (3665 – 3670) may raise waves, suitable for short Quick Boarding 🚤 . The main journey still favors Buy , waiting for the FED to blow more tailwind into the Golden sails.”

Waiting for CPI & FED rate cut | Priority Buy at support🟡 XAU/USD – 11/09 | Captain Vincent ⚓

🔎 Captain’s Log – News Context

US PPI yesterday : Wholesale prices dropped sharply, below forecasts → strengthening expectations of a FED rate cut.

FED probabilities : 100% odds for a -25bps cut next week, and even 16% of investors bet on -50bps.

Today : US CPI & Jobless Claims – key data to assess inflation & labor, determining the specific cut.

⏩ Captain’s Summary : FED will certainly cut rates, so Gold remains supported in its bullish trend. Short-term fluctuations may occur due to sentiment or surprises (e.g., tariff news from Trump).

📈 Captain’s Chart – Technical Analysis

Storm Breaker (Resistance) :

Bearish OB: 3645 – 3650 (near-term resistance)

Weak High: 3674 (target if breakout succeeds)

Golden Harbor (Support) :

Near support: 3622

FVG Dock: 3603

Bullish OB: 3581 – 3585 (strong mid-term support)

Market Structure :

H1 shows a short-term bearish BoS, retesting support.

Main trend remains bullish → possible pullback to 3622 or 3603 before rallying toward 3670+.

🎯 Captain’s Map – Trade Plan

✅ Buy (priority with trend)

Entry 1 (FVG): 3603 – 3605

SL: 3592

TP: 3610 – 3615 – 3625 – 365x

Entry 2 (Bullish OB): 3581 – 3585

SL: 3572

TP: 3600 – 3620 – 3640

⚡ Sell (only short scalp at resistance)

Sell Zone: 3645 – 3650

SL: 3658

TP: 3635 – 3628 – 3622

⚓ Captain’s Note

“The Golden sails remain full of wind as the FED is almost certain to cut rates. Golden Harbor 🏝️ (3622 – 3603) and the deeper OB 3581 – 3585 are safe havens to follow the bullish tide. If the ship touches Storm Breaker 🌊 (3645 – 3650) , only Quick Boarding 🚤 short scalps are recommended. The larger voyage still heads north, steering Gold toward new highs at 367x.”

Gold Plan - Waiting for a pullback to Buy safely | New ATH ahead🟡 XAU/USD – 09/09 | Captain Vincent ⚓

🔎 Captain’s Log – News Context

FED : The probability of a September rate cut is now almost certain, reinforcing confidence that flows will continue moving into Gold.

Dollar : Dropped to a 7-week low due to FED rate cut expectations, adding further support for Gold.

US Economic Data : No major news today, the market focus remains on interest rates.

⏩ Captain’s Summary: Gold remains in a strong uptrend. However, Vincent advises waiting for a pullback into support to Buy safely , avoiding chasing price at higher levels.

📈 Captain’s Chart – Technical Analysis

Storm Breaker (Resistance / Sell Zone) :

Quick Boarding: 3654 – 3656 (Short-term Sell scalp)

Storm Breaker Peak: 3673 – 3675 (Sell zone – potential new ATH)

Golden Harbor (Support / Buy Zone) :

Buy Scalp Dock: 3615 – 3617

Main Golden Harbor: 3597 – 3599 (Strong support)

Price structure remains bullish after multiple BOS – Break of Structure. Current highs may trigger short-term profit-taking waves before Gold pulls back to Golden Harbor and then rallies toward ATH 367x .

🎯 Captain’s Map – Trade Scenarios

✅ Golden Harbor (BUY – Priority with trend)

Buy Scalp: 3615 – 3617 | SL: 3598 | TP: 3620 → 3623 → 3626 → 3630 → 36xx

Main Buy Zone: 3597 – 3599 | SL: 3589 | TP: 3660 → 3663 → 3666 → 3670 → 36xx

⚡ Quick Boarding (SELL Scalp – Only at resistance)

Sell Zone 1: 3654 – 3656 | SL: 3662 | TP: 3650 → 3647 → 3644 → 3640 → 36xx

Sell Zone 2 – Storm Breaker Peak (ATH test): 3673 – 3675 | SL: 3682 | TP: 3670 → 3667 → 3664 → 3660 → 36xx

⚓ Captain’s Note

“The interest rate winds from the FED continue to power the Golden sails. Golden Harbor 🏝️ (3597 – 3599) is the safe haven for sailors trusting the bullish tide. Quick Boarding 🚤 (3615 – 3617) is just a short ride before the voyage resumes. Storm Breaker 🌊 (3654 – 3675) may bring big waves, but it’s only suitable for technical scalps – as the main current still carries Gold toward new highs.”

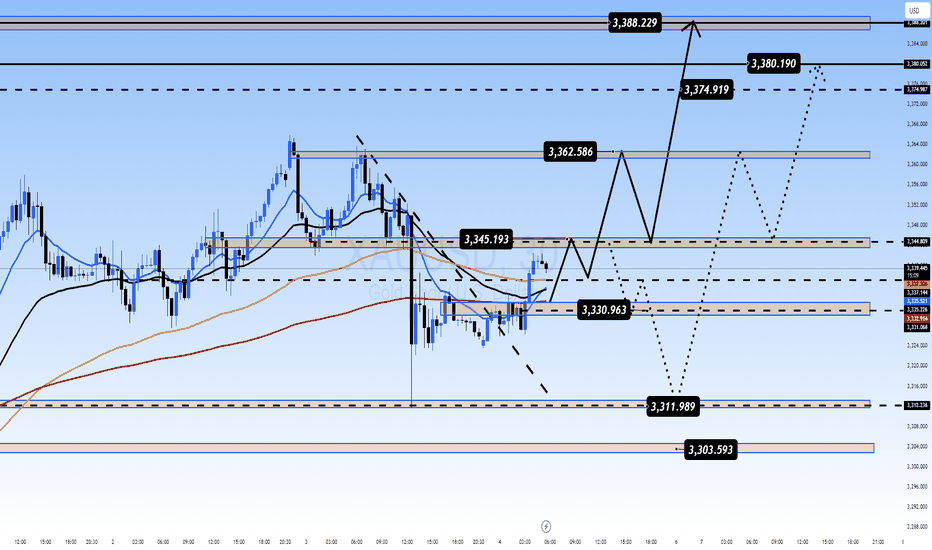

XAUUSD – Market Stays Flat Despite Trump’s Super BillXAUUSD – Market Stays Flat Despite Trump’s Super Bill, Is Gold Quietly Building Momentum?

Gold has entered a narrow consolidation phase after a series of strong macroeconomic catalysts — including the passing of Trump’s Super Bill by the U.S. House of Representatives. But instead of rallying immediately, gold remains flat... and that silence could be louder than it seems.

📰 Macro Recap – Good for USD, Bad for Gold?

The approved Super Bill may weaken the U.S. dollar in the medium term due to rising fiscal deficits. But for now, the market is skeptical, and gold is not reacting as expected.

Meanwhile, the NFP and Unemployment Rate (UR) data came in surprisingly strong last night, reinforcing the possibility that Fed rate cuts may be delayed → A short-term bearish pressure on gold.

With the U.S. Independence Day holiday, market liquidity will likely remain low today, increasing the risk of fake breakouts or stop-hunting volatility.

❗ “No immediate rally doesn’t mean no rally at all.” A retracement to the 3.2xx zone could offer an ideal entry for medium-term longs.

📉 Technical Outlook – XAUUSD

Price has broken above the recent short-term downtrend line and is now testing a critical supply zone around 3344–3345, which may determine today’s intraday direction.

🔍 Key Levels

Major Resistance: 3345 – 3362 – 3374 – 3388 – 3390

Major Support: 3330 – 3312 – 3304 – 3302 – 3298

🟢 Bullish Strategies (Buy Setups)

🔹 BUY Scalp Zone:

3313 – 3311

SL: 3307

TP: 3316 – 3320 – 3325 – 3330 – 3335 – 3340 – 3345 – 3350

🔹 Deep BUY Zone:

3304 – 3302

SL: 3298

TP: 3308 – 3312 – 3316 – 3320 – 3330 – 3340

These zones align with EMA confluence and potential FVG retracements – a solid setup for trend continuation.

🔴 Bearish Strategies (Short-Term Only)

🔹 SELL Scalp Zone:

3362 – 3364

SL: 3368

TP: 3358 – 3354 – 3350 – 3346 – 3340 – 3335 – 3330

🔹 Upper SELL Zone:

3388 – 3390

SL: 3394

TP: 3384 – 3380 – 3376 – 3370 – 3365 – 3360

Consider shorting only with confirmation patterns or bearish signals from lower timeframes.

🧠 Market Sentiment Today

The market seems to be in a wait-and-see mode, consolidating between 3320 – 3340 as traders digest recent macro data. A breakout is likely after the U.S. holiday ends.

Primary Scenario: Look to BUY on deeper pullbacks into support zones.

Alternate Scenario: SELL only for intraday scalps when price rejects key resistance.

💬 What’s Your Take?

Is gold silently accumulating strength for a breakout above 3390?

Or are we about to witness a deeper correction in the coming sessions?

👇 Share your thoughts in the comments and let's discuss it together!

US Dollar Index (DXY) – Pre-FOMC Update💥 US Dollar Index (DXY) – Pre-FOMC Update: Expert Analysis and Trading Strategies 💥

In just a few hours, the Federal Reserve (Fed) will announce its interest rate decision and update its economic projections in the Summary of Economic Projections (SEP). This is a highly anticipated event that will shape trading decisions in the coming weeks. The US Dollar Index (DXY) is currently fluctuating within the 103.00 - 104.00 range, reflecting investor caution ahead of the critical updates.

1. Interest Rate Decision and Its Impact on DXY

The policy rate is expected to remain unchanged at 4.25% - 4.50%. However, the market is more focused on signals about future rate cuts, particularly in 2025.

Chair Jerome Powell's post-meeting speech will be the key driver. The market will closely watch for hints on monetary policy, inflation, and the US economic outlook.

If the Fed adopts a hawkish tone (indicating sustained high rates or even further hikes), the DXY could rally strongly. Conversely, a dovish signal could weaken the USD.

2. Technical Analysis of DXY

🔴 Key Support: 103.18

The DXY is currently under pressure at the 103.18 support level. A break below this level could push the index further down to 103.00 or even 102.50.

This is a crucial zone, as failure to hold here would signal continued USD weakness in the short term.

🟢 Major Resistance: 105.00 and 105.57

If the DXY rebounds from current support levels, the next challenges will be the resistance zones at 105.00 and 105.57.

The 50-day and 200-day Moving Averages (MA) on the daily chart are also key indicators to watch. A break above these MAs could reinforce the bullish trend.

📉 Short-Term Trend:

On the 4H chart, the DXY is in a downtrend, with lower highs and lower lows. However, upcoming macroeconomic factors (the rate decision and Powell’s speech) could trigger a reversal or increased volatility.

Technical indicators like the RSI and MACD are in neutral territory, suggesting the market is awaiting clearer signals.

3. Trading Strategy Before and After the FOMC Decision

🔍 Before the Fed Announcement:

Caution is key. The market may experience mild fluctuations during the wait. Traders should avoid large positions and wait for clearer signals.

Closely monitor key support and resistance levels: 103.18 (support) and 105.00 (resistance).

🔥 After the Fed Announcement:

Scenario 1: Fed Holds Rates and Signals Hawkish Tone

The DXY could rally strongly, targeting resistance levels at 105.00 and 105.57.

Strategy: Look for buy opportunities when the DXY bounces off support or breaks above resistance.

Scenario 2: Fed Signals a Dovish Tone

The DXY could drop sharply, breaking below 103.18 and heading toward 102.50.

Strategy: Look for sell opportunities when the DXY breaks support or fails to surpass resistance.

Scenario 3: Fed Holds Rates Without Clear Signals

The DXY may continue to fluctuate within the 103.00 - 104.00 range.

Strategy: Trade within the range, using identified support and resistance levels.

4. Advice for Investors and Traders

📊 Risk management: Always set appropriate stop-loss and take-profit levels to protect your capital. Post-FOMC volatility can be intense, so prepare mentally and have a solid trading plan.

📰 Stay updated: Keep a close eye on Fed updates and market reactions. Jerome Powell’s speech could create significant trading opportunities.

🛠️ Use technical tools: Combine indicators like RSI, MACD, and Fibonacci to identify precise entry points.

5. Conclusion

Tonight’s FOMC meeting will be a decisive factor for the DXY’s short-term direction. With clear support and resistance levels identified, traders should prepare their strategies to capitalize on market movements.

🚨 Stay tuned for the latest updates on TradingView to ensure you don’t miss any trading opportunities!

Wishing you successful trades and profitable outcomes! 💪💰

Nifty Simple Analysis for 29th November'24Yesterday Nifty opened bullish and immediately fall after 1 hr failed to break 24300 resistance level 4th time in 3 days which shows bears are strong in that area. Nifty took support at 23900 which filled the previous gap created on 25th nov.

check on 15 min candle last low was made at 2.15 pm after that no lower low was made which shows bulls are pusing up but not with force unable to break 24000 level.

Support : 23876,23600

Resistance: 24125,24300

EURUSD - SHORTI opted to enter for short on this pair. Stop-loss orders have their place, and I trusted my eyes more than my heart.

Short Bias for the upcoming week.

- ---------------

**First Scenario - Short:**

First Target: $1.0825

First Target: $1.0805

Entry: $1.0851

Stoploss: $1.0854

**Second Scenario - Long:**

Initial Target: $1.089

Entry: $1.0854

Stoploss: $1.0844

- ---------------

Take into consideration:

Psychological Resistance at $1.086

Psychological Support at $1.08

- ---------------

NFA

DYOR

- ---------------

Good Luck!

⚠️ Caution: Just because I've set my buy and sell position Settings or drawn direction lines on my chart doesn't indicate I've opened a position or am obsessed with a particular bias. This is only a forecast; I don't trade when the price reaches my level; I have rules of engagement. Perhaps the most crucial element is 🆘RISK MANAGEMENT🆘.

Historical Impact of Fed Interest Rates on Dow JonesThe current market cycle looks eerily similar to the 2005 - 2010 era.

Dow started going up after the last rate hike in expectation of a rate cut and eventually peaked around the time the cut started i.e. Sep 2007.

Very similar behaviour is evident in current cycle where market has been rising since the last rate hike. If the Fed cut is expected in June 2024, then there is still some upmove left, but we are close to the top.

P.S.: 1: Numbers mentioned are the rates after the said action.

2: Similar price action was developing in 2015-2020 period, however, it can't be considered as a valid reference on account of COVID crash.

Bank Nifty analysis for 6th FEB'2024Bank nifty traded in a range between 46000 to 45600 today buyers were holding support but no momemtum from buyers end today tried twice to break 46000 but failed!

Major support at 45600 if breaks tomorrow seller can take it to 45300 addtion to that banknifty was showing weakness after 2 pm today & traded below trendline support.

Buyer can show momentum above 46100 - 46200, Tomorrow may be trend day or wide range day.

Support : 45300,45000

Resistance : 46100, 46300

Note : Do your own analysis before making any trade or invesment decesion.

2nd Nov ’23 - When NEWS flows, technical analysis goes for spinNifty Weekly Expiry Analysis

Between the last expiry and today, Nifty has accumulated 299pts ~ 1.59% points. Most importantly it has broken away from the crucial support of 18880. As it stands Nifty is below the resistance of 19310 - but with the momentum it has gathered, seems like it will get tested this weekly series.

Nifty Today’s Analysis

Recap from yesterday: “Check out the daily time frame, does that not look bearish to you? Since we had a red candle today also, it seems like the bearish momentum could build up pretty quickly. We have the FOMC interest rate decision at 23.30 today and US FED comments may spook or lift the markets. Definitely, that will spill over to our markets tomorrow. As of now, SPX is in green trading with gains of 0.53%. Until 18880 is not broken, I wish to maintain my neutral stance.”

Nifty opens today with a gap up of 138pts ~ 0.73%, rallies to 19175 by 09.40. This was totally sponsored by the FED with its FOMC decision & the commentary that followed. Markets in the US got the feeling that this was going to be the last of the hikes and were overjoyed.

We need to get some background on this topic to understand the real impact. Even if the FED says no more hikes, it doesnt mean the rate cuts will begin soon. If the rates are held at this 5.25 to 5.5% for longer - there is nothing bearish like that. So the reaction that is seen now could just be a temporary phenomenon. The longer FED keeps the rates high - the higher the money that will get sucked out of equity. Also, watch the small and medium-scale businesses - they are the first to go under when the cost of borrowing stays high. No, I am not spoiling the bullish party - I am just being practical.

Coming back to India, RBI cannot cut rates when the US holds its line. If we do, more money will flow out from India, further depreciating INR. If RBI also holds the rate at this level long enough - our SME universe will also be impacted.

On the 1hr TF, Nifty has formed an island today. The 3rd hourly candle was quite RED - but the fall was arrested soon enough. The levels have not changed from yesterday, the first resistance is at 19226 and the 2nd one is at 19310. I am staying neutral till 19226 is not taken out, seems like it could be even done in the forenoon session. Visit my tradingview minds section, for updates during trading hours tomorrow.

1st Nov ’23 - Some weakness still persisting - Nifty PostmortemNifty Analysis

Recap from yesterday: “Since we retraced the 38.2% level of 19226 today and the reluctance to go up might be confidence-building for the bears. Also the 23.6% level forms a base for further movements. The issue is that we cannot go outright bearish now, we need further proof of that. Ideally, the 18880 support has to be taken out and that too pretty quickly. Till then I wish to maintain my neutral stance.”

There is some weakness still lingering around. Despite positive closing by US markets yesterday - we were reluctant to go green today. If you look at the 5mts chart above - the price action continues its journey from yesterday.

By 10.00 we hit 19019, but miraculously we gained back those points. From 12.30 to 13.15 we started falling again breaking the last swing low to 19006. Then from 13.45 to close we fell again to a new swing low of 18973. BankNifty was staying pretty strong due to which a big fall was avoided on Nifty. This also ensured that Nifty50 did not break the 18880 support level below which we had to go short.

Check out the daily time frame, does that not look bearish to you? Since we had a red candle today also, it seems like the bearish momentum could build up pretty quickly. We have the FOMC interest rate decision at 23.30 today and US FED comments may spook or lift the markets. Definitely, that will spill over to our markets tomorrow. As of now, SPX is in green trading with gains of 0.53%. Until 18880 is not broken, I wish to maintain my neutral stance.

Federal Bank: Weekly Flag BOA weekly Flag and Pole Pattern is Visible on the Weekly charts of $NSE:FEDERALBNK. One can create a fresh position on Federal Bank around the CMP of Rs,. 136 or below with a stop loss of Rs. 120 for targets of 151/166/181

Exit the position if the stop loss is triggered on WCB.

DO YOU WANT ALL MY RESEARCH FOR FREE THEN DON'T FORGET TO FOLLOW ME.

I AM EAGERLY WAITING FOR YOUR COMMENTS ON THE STUDY...

Disclaimer: Content shared is for information and education purposes only and should not be treated as investment or trading advice. Please do your own analysis or take independent professional financial advice before making any investments based on your own personal circumstances. Investment in securities are subject to market risks, please carry out your due diligence before investing. And last but not the least, past performance is not indicative of future returns.

NIFTY : 02 NOV#NIFTY50

GLOBAL : Global market is underconsolidation mode and next directional move will come after Fed Minutes.

INDIAN : Today market will be in consolidation mode, further aggressive move will happen after the outcome of Fed Minutes.

18000 will act as an strong support for nifty for this week.!

PCR : 2.28 at 18000.

Nifty Stuck in range.Nifty is stuck in a range of 16400-15700 since the past 2 weeks. Yesterday it managed to test the top of the range but failed to give any significant breakout giving a chance for bears to take control again. With so many macro economic pressure's mounting it will be interesting so see how Nifty will react. I believe that the range will continue for the month of May, as June onwards US Fed will begin its Quantitative tightening measures which will be the deciding factor in providing us with a clear picture where the nifty will head next.

Gold clears six-week-old hurdle ahead of US inflation dataGold extends a fortnight-long recovery to stay comfortably beyond the 200-SMA and a horizontal area from early January. The run-up joins bullish MACD signals to suggest further upside but the overbought RSI line pushes buyers to remain cautious until witnessing sustained trading above $1,830. In addition to the key hurdle, gold traders should also keep their eyes on the US Consumer Price Index (CPI) data for January amid Fed’s rate hike concerns.

In case of firmer inflation, the US dollar may consolidate the latest losses and weigh on the gold prices, indicating a pullback towards the 200-SMA near $1,815. Following that, the $1,800 threshold and the 61.8% Fibonacci retracement (Fibo.) of December-January upside, near $1,790 may entertain gold sellers ahead of directing them to a monthly support area surrounding $1,780.

Alternatively, surprise weakness in the price pressure could help gold buyers to overcome the nearby resistance zone and aim for January’s top around $1,853. Though bulls might struggle around the stated hurdle, if not then November 2021 peak close to $1,877 and the $1,900 round figure should return to the charts.

Dow Jones Price Action Momentum Feb to March 22Dow Jones Price Action Momentum for Feb to March Cycle.

As we all know markets has been lit volatile in last 10 days post 15 th January on account of interest rate hike and Fed meeting outcome.

To clear the doubts- I have tried to show the momentum which may happen with the markets based on price action of the Dow Jones.