EURUSD | 15M | Smart Money Concept OutlookMarket Structure:

Price is currently delivering a short-term bullish repricing following a displacement from the internal range low near 1.1775. The sequence of higher highs and higher lows confirms an intraday shift in structure, suggesting that buy-side liquidity has been engineered to facilitate a move into premium pricing.

Liquidity Narrative:

The recent impulsive leg cleared multiple internal liquidity pools, including prior equal highs and resting stop clusters. Price is now trading directly into a well-defined supply zone that aligns with a higher-timeframe premium array. This region is a classic smart money distribution pocket where late buyers often become liquidity for institutional positioning.

Order Flow & Imbalance:

The rally shows clear displacement characteristics with minimal overlap, leaving behind inefficiencies that may act as a magnet should price rotate lower. Additionally, the current consolidation beneath resistance resembles a potential buy-side liquidity build-up. A sweep of these highs would complete the liquidity engineering phase before a probable bearish expansion.

POI (Point of Interest):

Premium supply zone: ~1.1830 to 1.1845

Internal resistance acting as a distribution ledge

Untapped sell-side liquidity resting below 1.1780

Execution Model:

The preferred scenario involves a liquidity sweep above the short-term highs followed by bearish market structure shift on the lower timeframe. Confirmation through displacement and fair value gap formation would strengthen the short thesis.

Draw on Liquidity:

If the distribution unfolds as anticipated, price is likely to rebalance toward the sell-side liquidity pool near 1.1775, completing a premium-to-discount delivery cycle.

Invalidation:

Sustained acceptance above the supply zone with strong displacement would indicate continuation, signaling that the market is seeking higher external liquidity rather than distributing.

Summary:

Price is trading in premium territory after a liquidity-driven expansion. The environment favors patience, allowing smart money to reveal intent. Watch the highs carefully; what appears as breakout fuel often becomes the trapdoor.

Fractal

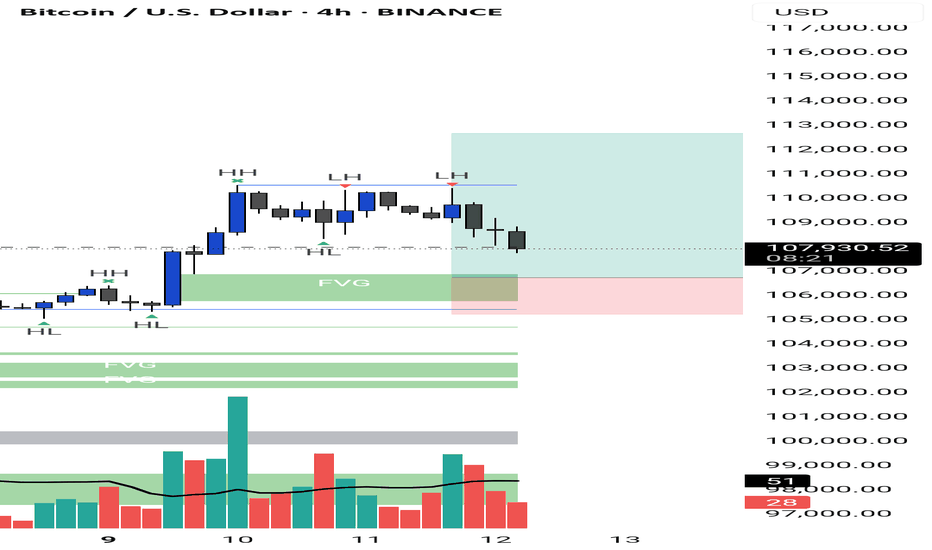

BTCUSD · 15M · SMC UpdateBuy-side liquidity above prior highs has been partially swept.

Rejection from supply shows acceptance failure in premium.

Market is now rotating back toward equilibrium.

LTF Structure

Impulsive move up completed.

Bearish response from supply with follow-through.

Current pullback is corrective, not impulsive.

Bias & Expectation

Favor shorts while price remains below the supply high.

Anticipate continuation lower toward:

Range low / EQ

Prior imbalance

HTF discount zone below

KOTAK Bank: Weekly Liquidity Sweep → H4 MMBM Signals Buy-Side ExI am sharing a trading idea on Kotak Bank based on Smart Money Concepts (SMC).

Price has already taken weekly ERL (External Range Liquidity) and then moved back into IRL (Internal Range Liquidity), indicating a higher-timeframe liquidity grab and potential rebalancing phase.

On the H4 timeframe, price is forming a Market Maker Buy Model (MMBM).

The sell-side curve has been completed, suggesting downside liquidity has been fully taken. After this, price has started transitioning into the buy-side curve, which points toward a possible bullish expansion.

This structure suggests that smart money may now seek buy-side liquidity, provided price continues to respect higher-timeframe structure and holds above key demand areas.

This idea is for educational purposes, and confirmation should be taken using proper entry models, risk management, and market conditions.

NQ1! 14/11/2025 outlookBias → Bearish

Large sell-off yesterday on both S&P 500 and Nasdaq.

Both filled week opening gaps and are holding below.

Another “b-shaped” daily profile yesterday indicating value is lower

Nasdaq closed inside 7th november's value area

Looking for value retest to 24,810 OR low of 24,708.25

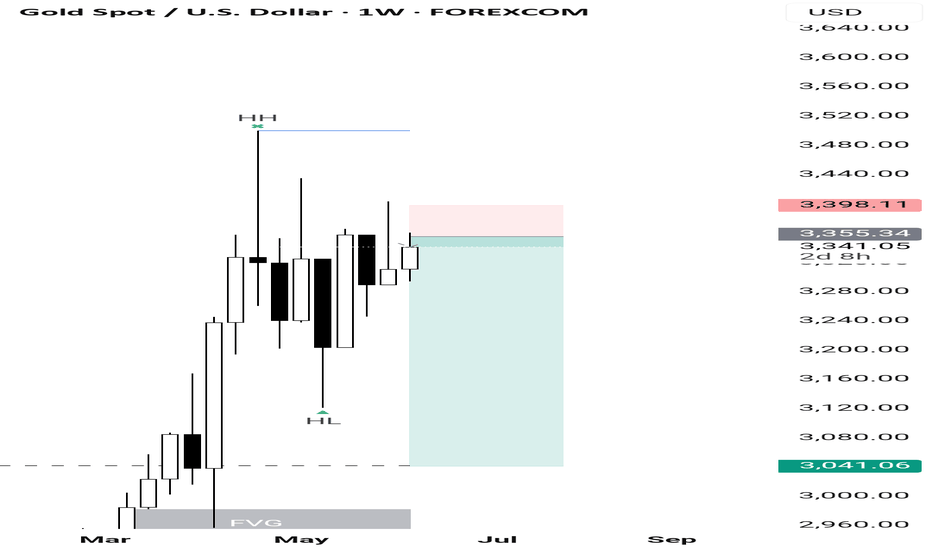

XAUUSD : 06/10/25 - TP hit 1.Entry - NYSE session when FVG + P1 confirmed

2. MSS shift happend in 2 min during NY session

3. Entered during pullback

4. there are no High Resistance in either 4 hour or 1 hour but had one High resistance is there in 30 min TF , hence booked full at ATH

4. Closed full at 1:3

#ICT

Overall trend bullish hence looked for buy setups only

Smart Money Play: Watching HDFC Bank’s Bullish ZoneTrading Idea: HDFC Bank (NSE: HDFCBANK)

Price is currently trading around ₹976 after a recent pullback.

Key Observations:

Break of Structure (BOS) confirms bullish market structure.

Liquidity sweep around recent highs.

Daily Fair Value Gap (FVG) spotted between ₹910–₹930.

Bullish Order Block at ₹800–₹830 acting as strong higher timeframe support.

Plan:

Expecting a retracement into the Daily FVG zone (₹910–₹930).

If price reacts bullishly here, potential upside rally towards ₹1,040+.

Confirmation: Look for bullish reversal candles or demand zone rejections inside FVG.

Risk Management:

Aggressive entry: near FVG zone (₹910–₹930).

Conservative entry: only after bullish confirmation.

Stop-loss: below ₹890.

Targets: First TP at ₹990, extended TP at ₹1,040.

Bias: Bullish (after retracement).

Disclaimer: This is not financial advice. For educational purposes only. Please do your own research or consult with a financial advisor before making any investment decisions.

9 SMS + Market Structure + HTF 🔥 A Simple Strategy That Works: 9 SMA + Market Structure:

Over the last 18 years in the markets, I’ve noticed one common pattern among struggling traders—they jump from strategy to strategy, get caught up in countless indicators, and lose sight of the basics. The truth is, simplicity wins. And the most powerful tool you can master?

👉 Market Structure.

✅ Market Structure 101:

Uptrend: Higher Highs (HH) + Higher Lows (HL)

Downtrend: Lower Highs (LH) + Lower Lows (LL)

Sideways: Ranging or consolidating zones

Once you understand this, trading becomes more visual and logical. And to complement this understanding, I recommend one tool that works across all timeframes:

🔄 The 9 SMA Strategy (Simple Moving Average)

This is not a magic trick—it’s a clean, effective way to stay in sync with the trend. When used with multiple timeframes (Monthly, Weekly, Daily), it becomes a strong confirmation tool.

Let’s take Tata Motors as an example:

📈 Monthly Chart:

Trading above the 9 SMA

Near psychological level ₹1000

Had a rally 3–4 months ago, now consolidating

Not a confirmed breakdown yet – monthly is still holding structure

📊 Weekly Chart:

Just crossing above 9 SMA

Indicates strength building back up

📉 Daily Chart:

Also crossing 9 SMA

Shows possible trend continuation

✅ Double confirmation from Daily + Weekly

➡️ This signals potential swing or positional trade setup

🎯 Key Takeaways:

Follow the Market Structure

Understand HH-HL or LH-LL formations before jumping into trades.

Use the 9 SMA on multiple timeframes

Let smaller timeframes guide the early signs of trend shifts

Avoid complexity

Stick to one simple method and master it.

Risk Management

Never invest all at once.

If you have ₹1,00,000, break it into 4 or 5 parts.

This reduces emotional pressure and helps you stay objective.

📌 Final Thoughts:

Swing and positional trading doesn’t have to be overwhelming. Keep your tools simple, your analysis structured, and your emotions in check.

I have also curated a list of 50 highly liquid F&O stocks based on beta, volatility, volume, and liquidity. If you'd like access to that list, just drop a comment or message, and I’ll be happy to share it with you.

Keep it simple. Stay consistent.

The market rewards discipline, not complexity.

KOTAK BANK - targets 2200 plusKOTAK MAHINDRA BANK - price is 1865

Kotak mahindra bank ,the biggest and unique in its way of working now may act as a proxy to Bank Nifty for playing for upside gains.

1850 levels are very strong supports on monthly and weekly time frames.

these would act as pivots for buying for 2050 and 2200 levels since Bank Nifty is trading at all time highs, also HDFC, ICICI, AXIS all big pvt banks are trading at all time highs.

so buying should be initiated at 1850 for the targets of 2200.

also this stock may safeguard the capital invested in times of declines in the NIFTY - BANK NIFTY and the markets in general.

thanks

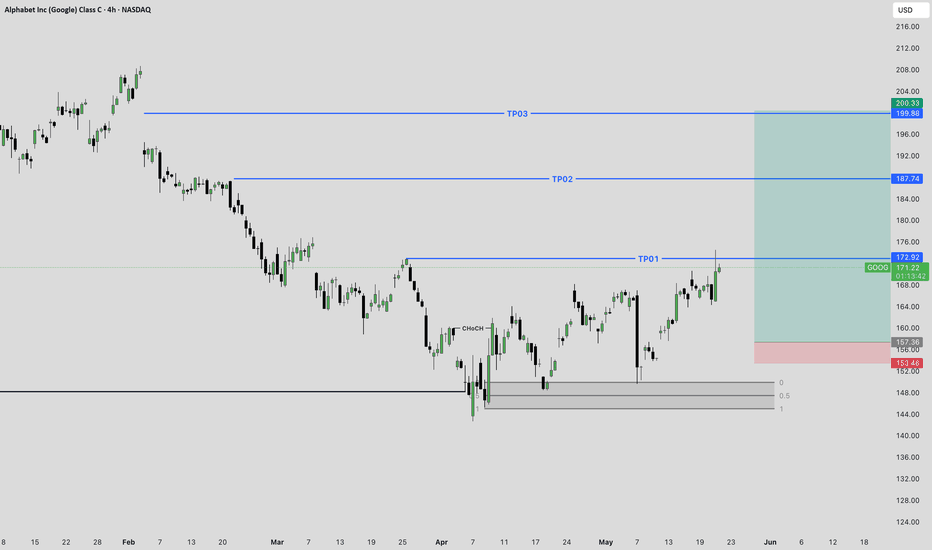

GOOG: Don't Miss This Potential Reversal!GOOG Long Idea

Chart Analysis:

The chart shows Alphabet Inc. (GOOG) on a 4-hour timeframe. After a period of decline from its highs, GOOG appears to be finding support around the "Weekly Liquidity" level. There's also a recent bullish impulse from this area, breaking above some minor resistance. The chart identifies three potential "TP" (Take Profit) levels.

Trading Idea:

Entry: Look for a sustained move above the TP01 level ($172.92) or a clear retest and bounce from the current price area after confirming demand. Given the current price is $171.19, a move above TP01 would confirm further bullish momentum.

Stop Loss: Place a stop loss below the recent lows and the "Weekly Liquidity" zone. The chart suggests a stop loss around $153.48 or $152.00, below the 0.5 and 1 Fibonacci levels from the recent bounce.

Take Profit Targets:

TP01: $172.92 (already near or touched)

TP02: $187.74

TP03: $200.33 - $199.38 (a strong resistance zone)

Rationale:

Weekly Liquidity: The price has found support at a significant weekly liquidity level, suggesting potential for a reversal.

Bullish Structure: The recent price action from the weekly liquidity area shows signs of a bullish structure, with higher lows and a break of minor resistance.

Target Levels: The TP levels are strategically placed at previous resistance zones or significant price levels, offering clear profit targets.

Risk Management:

Risk-Reward: The potential risk-reward ratio for this trade appears favorable if targeting TP02 or TP03.

Position Sizing: Always use appropriate position sizing to manage risk effectively.

Monitor Price Action: Continuously monitor price action for any signs of weakness or reversal, especially around the TP levels.

Disclaimer: This is a trading idea based on the provided chart and should not be considered financial advice. Trading involves substantial risk, and you could lose money. Always conduct your own research and analysis before making any trading decisions.

SIEMENS Trade Setup – Clean Entry & TargetsSIEMENS has just confirmed a bullish structure shift with a strong breakout above the CHoCH level, signaling a fresh impulse wave backed by institutional momentum.

📊 Technical Breakdown:

✅ Confirmed CHoCH on the daily timeframe

✅ Strong breakout candle with volume

✅ Clean mitigation and demand zone around ₹2929–₹2880 (aligned with FVG & 0.5 retracement)

✅ Risk-managed long setup with 2 major targets

🎯 Target 01: ₹3,734

🎯 Target 02: ₹4,217

💡 Trade Plan:

Entry Zone: ₹2929–₹2880

Stop Loss: ₹2780

Target 01: ₹3,734

Target 02: ₹4,217

🧠 Smart Money Logic:

This setup reflects classic price action + smart money concepts with BOS, FVG fill, and liquidity engineering. Watch for confirmation candles near the entry zone before positioning.

Wyckoff Method + Smart Money Concepts (SMC),

❗ Disclaimer:

This analysis is for educational and informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a certified financial advisor before making any investment decisions.

IRFC Ready to Launch: Buy the Dip Before the BreakoutType: Long (Buy the dip)

Entry Zone: ₹115–₹120

Stop Loss: ₹108.75

Targets:

TP1: ₹150

TP2: ₹167

Reason: After accumulation and manipulation, price broke structure (ChoCH). Expecting a retest before bullish move.

Risk-Reward: ~3.3 to 5.1

Strategy: Wyckoff + Smart Money Concepts (SMC)

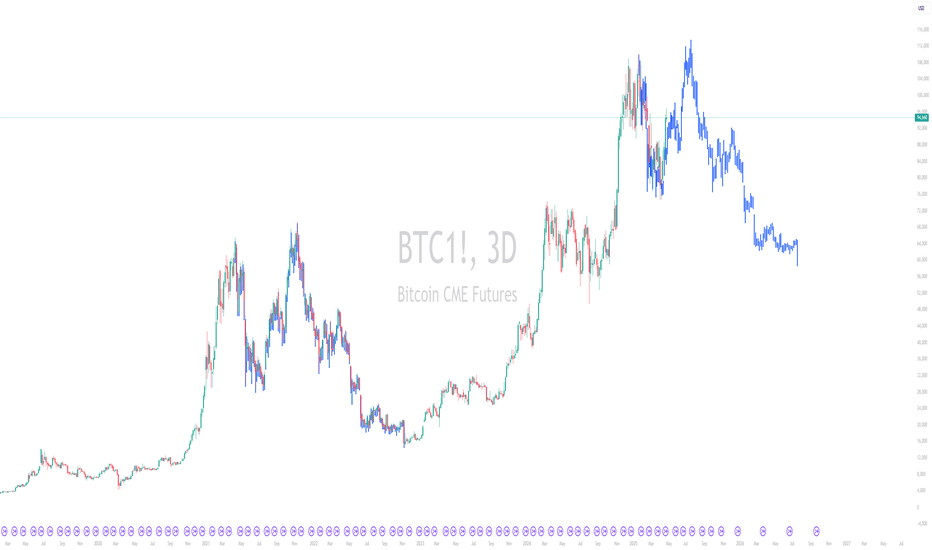

BTC Break or Broke Zone. Watch out How Price Reacts on the ZoneBYBIT:BTCUSD.P BINANCE:BTCUSDT

LONG Entry: 96950-96700 >> Look For

STOP LOSS: 96450:

Retracement toward this area and observe how the candle reacts at this zone.

If price shows pullback and wait for the candle to close in 15M TF.

If price didnt Bounce from the Entry Price area,Then its a confirmed Fake OUT .

If Confirmed,

SHORT : 96600

TP1:95800

TP2:95300

TP3:94700

Disclaimer: DYOR; This Technical Analysis should be used only for educational Purpose only.

Donot Take this as an Investment Advice.

"The Universe is Under No Obligation to Make Sense to You"

Trading Plan for AXIS BANK (NSE)

Timeframe: 4H

Current Price: ₹1,015.60

Bias: Bullish

Entry Strategy:

Ideal Buy Zone: Between ₹970 - ₹996 (buyside liquidity area)

Confirmation: Look for a bullish candle confirmation in this zone before entering.

Target Levels:

Primary Target: ₹1,120

Final Target: ₹1,192 (Sell-side liquidity)

Stop Loss:

Below ₹910 (Strong support and invalidation level)

Risk-Reward Ratio:

Approximately 3:1 (Good R:R setup)

Additional Notes:

Price has broken out from a recent structure and is heading towards liquidity.

A potential retracement to the buy zone could offer a better entry.

Be cautious of market conditions and broader indices movement.