Gbpusdidea

FOMC Minutes in the Charts: EUR/USD & GBP/USD FOMC Minutes in the Charts: EUR/USD & GBP/USD

During their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

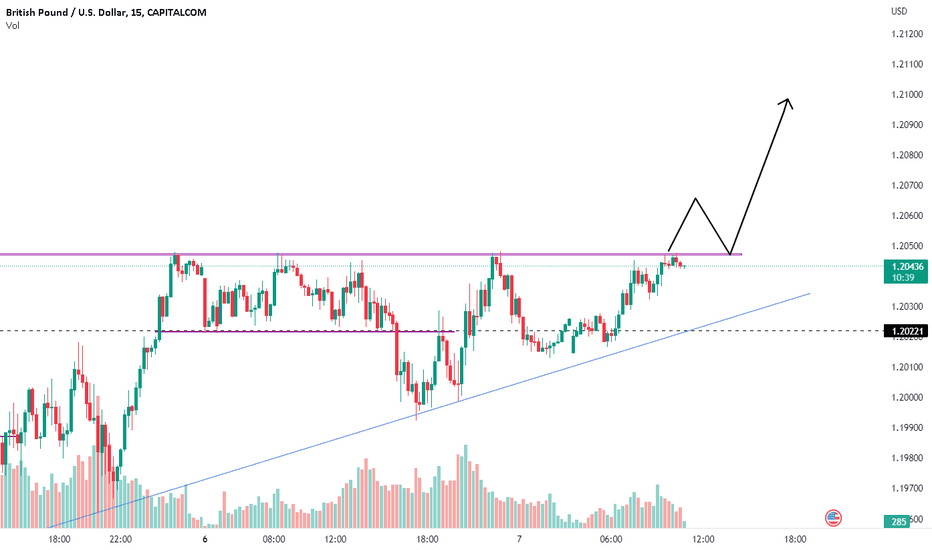

GBPUSD CAPITALCOM:GBPUSD

As you can see in GBPUSD pair is in consolidation since Dec 22 (long time ) and now it is near to the resistance, if it rejects the resistance level and come down then we can plan for sell side with the conformation of pull back entries. Plan your trade accordingly.... (4 HR time frame)

GBPUSD Downtrend movement; RISK :Reward Ratio=2.9 #FOREX#GBP #USD #GBPUSD, #NASDAQ, #CURRENCY, #CURREYPAIRS, #FOREX @GBPUSD

#GBPUSD DOWNWARD movement potential with risk: reward ratio 2.9.

SELL at 1.1985 with SL 1.2060 and Target is 1.17750

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

The when, why, and how sterling reaches parityIn just two trading days, the probability that the sterling will fall to parity against the US dollar increased to 60% on Sept. 26 from 32% on Sept. 23 after the UK government's announcement of new tax cuts elevated concerns for the country's economy.

Bloomberg estimates that the GBP/USD will have equal value before the end of 2022, based on sterling-dollar implied volatility . The value of the sterling was $1.0350 as of Sept. 26, marking a record low for the currency.

Economists believe that the slump in the pound could force UK's central bank to enact another interest rate increase in order to support the currency, The Guardian reported. Capital Economics UK Economist Paul Dales told the paper that the Bank of England could raise interest by 100 basis points or 150 basis points.

The weakness in the pound is being exacerbated by fears the UK economy is entering a recession after inflation breached the 10% mark in July, marking a record-high for the country. It elicited a promise from the Bank of England that it will "respond forcefully, as necessary" to curb the growth in the prices of goods and services.

The path to parity

The downward movement of the sterling follows the UK government's announcement of new tax cuts, fueling the concerns of investors and economists that the four-nation country's debt will reach unaffordable levels and further fuel inflation . It also comes after the Bank of England increased rates by 50 basis points, lower compared with the 75 basis-point hike of the US Federal Reserve .

The government intends to finance its tax cuts with debt worth tens of billions in sterling. The UK Debt Management Office is planning to raise an additional 72 billion pounds before next April, raising the financing remit in 2022-2023 to 234 billion pounds.

Deutsche Bank UK Economist Sanjay Raja said the tax cuts were adding to medium-term inflationary pressures and were "raising the risk of a near-term balance of payment crisis."

Vasileios Gkionakis, a Citi analyst, echoed sentiments that the move will bring the sterling to parity with the US dollar , noting that "the UK will find it increasingly difficult to finance this deficit amidst such a deteriorating economic backdrop; something has to give, and that something will eventually be a much lower exchange rate."

"Sterling is in the firing line as traders are turning their backs on all things British," said David Madden, a market analyst at Equiti Capital. "There is a creeping feeling the extra government borrowing that is in the pipeline will severely weigh on the UK economy."

If it comes to pass, what then?

The implications of the sterling being at parity with the US dollar boil down to how and where the money is being spent. When the euro was at parity with the dollar, there were winners and losers and the same could be expected if ever the sterling is at the same value as the dollar.

For trading and exporters, the change in the exchange rate will surely be noticeable. In the US, a stronger dollar would mean lower prices on imported goods, which could help cool down inflation . The opposite could be anticipated for the UK as previous payments would afford lesser products if the two currencies are at parity.

Accordingly, US companies doing business in the UK will see revenue from those businesses shrink if they bring back earnings in pounds to the US. However, if pound earnings are used in the UK, the exchange rate becomes less of an issue.

GBPUSD | Good Sell opportunityIf you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.