Ichimokukinkohyo

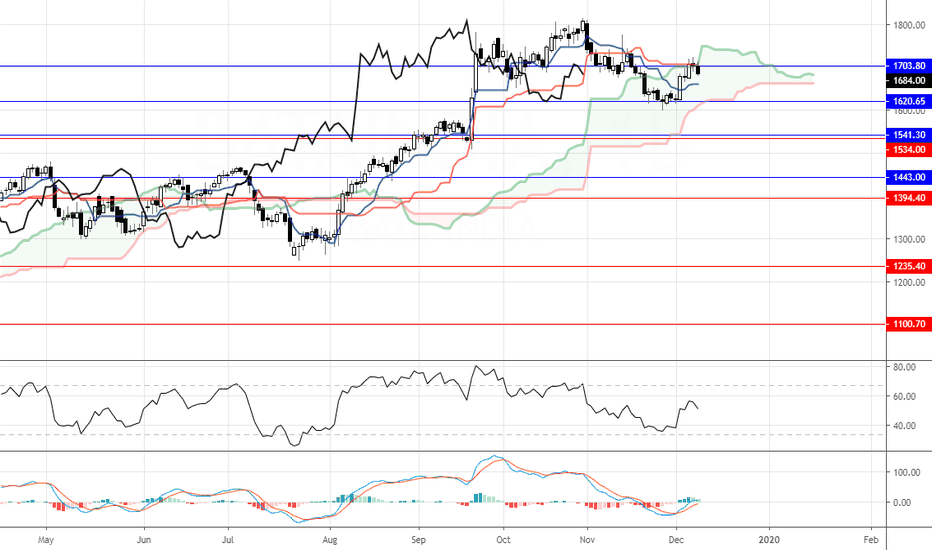

DOUBLE TOP testGOLD with the KUMO (future cloud) now turing positive again and an average bullish TK cross on the daily cud resume its upward bias ..first thing first,,, double top test 1680/1700... weather it will break the top is a secondary question..

Any daily consecutive close below 1570 will invalidate the bullish bias.

12090 will keep providing support to the index breaking below itLike the Banknifty, Nifty is also resting at an support level. 12090 will keep providing support to the index breaking below it Nifty may slide to 11960, 11790 & 11420 levels. While 12300 will act as a strong resistance zone for Nifty. The RSI is into neutral zone between 60-40 levels, while it is also taking resistance at the trend line. The MACD is also facing resistance at zero levels on MACD. The momentum is fading as of now.

. A sustenance above 12290 may push up the prices to .....The index pulled back in a great way after the Middle East tensions. The prices halted at the previous highs. The momentum (RSI) is into a sideways zone and still diverging with the price. A sustenance above 12290 may push up the prices to 12360 – 12500 levels, however any failure to sustain above the levels may push nifty to 11930 where it may find support. The MACD is above zero line (bullish) while RSI has slided between 60-40.

The RSI and MACD are displaying divergence, if the formation is The weekly banknifty chart has closed negative this week, back to back two bearish candles also indicates momentum suppression in the index. 31800 will provide immideate support to the index, giving away this may push the index to 31300 levels. However the trend is still up and any bounce from the support will push banknifty up 32600, 32800 & 33300 finally. The RSI and MACD are displaying divergence, if the formation is not negated in coming sessions then correction is quite probable.

Infosys is ready to follow the overall sector?Infosys was hovering around a very strong resistance from past one month, in today’s move it finally gave a close above the same. If the price is able to sustain above it for a session or two the stock may be ready to scale up further. The weekly prices are above the kumo while same is seen on the daily charts too. The CS is free the prices are expected to move towards 795 area. RSI is now at 60 while MACD has moved above the zero line. Immediate support placed at 720 while critical support at 710. Buying on dips above them makes sense.

Taking support. A breakout needed for continuation.Canbank took resistance at multiple resistance zones and pushed down again. Now the stock is just at a minor resistance moving above it will be a positive sign for the stock in the short term and prices may push to 235 levels. However any failure to hold above it will result into continuation correction.

Bata India: Has the trend bent?The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support. Above 1735 the bearish analysis is negated.

Britannia Industries: Took support and bounced, will it continueBRITANNIA INDUSTRIES: The stock is hovering around a very strong support zone. The RSI bouncing off from 40’s further indicate the momentum support in the stock. MACD is neutral and picking up (though not positive yet). A minor bottle neck is placed at 3130 – 3145 levels, above which 3280 &3360 may be evident.

A very crucial price action bar formed on BPCL todayBPCL: An important candle formation has been printed on the BPCL daily chart. It’s a bear engulfing candle along with a “double key reversal” action. This is a very prominent signal in shift of control from bulls to bears. Also RSI has taken resistance at 60 levels with a bear divergence, a strong loss of momentum! Any further decline especially below 500 can will not be a good news for BPCL bulls.

IDFC at bounced from an important pivot? Move up to continue?IDFC FIRST BANK: The stock has taken support at multiple pivots and bounced with strength. The momentum is positive as shown by MACD as it is above the zero line in positive mode. The RSI is displaying strength above 50 levels on the daily charts. A strong close above 43 will be very positive with stock and it can move to 46 levels. A move below 40.50 will not be favorable for being in long positions.

Bank of India _ PSU banking index set up move up? Momentum signaBANK OF INDIA: Banking stock specially PSU banks have kept up bank nifty. All PSU banks are strongly poised to move up. The prices have moved up from the daily TS, as of now the prices are inside the kumo, once a breakout is registered the Bank of India is expected to reach 83 levels, the next level of resistance. Till the prices are above 63 the analysis stands true.

Bank Nifty made a sensible close by supporting the trend line.BANK NIFTY: Banknifty made a sensible close than the Nifty, the price action supported the breakout trend line and bounced. Also a TS line acted as a good support level. The RSI bounced from the 60 levels, that too is a signature of strength. The lower time frames have to buck up now, the hourly timeframe’s RSI is still wagging between 60-40 levels. 30200 levels on closing basis is important, as long as bank nifty stays above it, the trend in short term shall be positive.

BHEL: Range Shift Bearish to Bullish?BHEL: After a former failure breakout attempt from the clouds, today’s session made an reattempt to breakout. The RSI is into a bullish zone and also managed to form a PR on the daily charts just near 60, indicating strength. The TK is pointing up with MACD above zero indicating bullish strength in the move. As long as the stock stays above 50 the trend up can be considered safe.

We have launched “PRORSI” Trading mobile application providing you the best trading ideas. Download now from Play store or IOS.

PIDILITIND Still sticking to the trend?PIDILITE INDUSTRIES: The stock has recently rendered itself into sideways moves. The prices on the daily charts have drifted below the KS & TS lines, moving towards lead line 2 where it may find support. Breaking below it will not be favorable for the stock in the short term. It may further fall down to 1295 thereafter 1195. The momentum indicators are indicating weakness. . Our “ProRSI moblile trading application has been launched on Play Store and IOS, get high probability trading ideas in equities, futures and options. Download Now.