Igllong

Indraprastha Gas/ IGL Positional Long Setup - IGL is a stock which has a decent or sluggish movement

- Less volatility which also can reduce some volatile moves in your Portfolio

- From a positional perspective keep a stop loss of 390 if you entered around 403 with me

- I think this time the retracement can be a little small and demand-driven

- Enter partially at 406-408 keep your 50% fiat to enter around 394-401

- This way you will have a top-class average and a very good entry as well

- If you find this helpful kindly support.

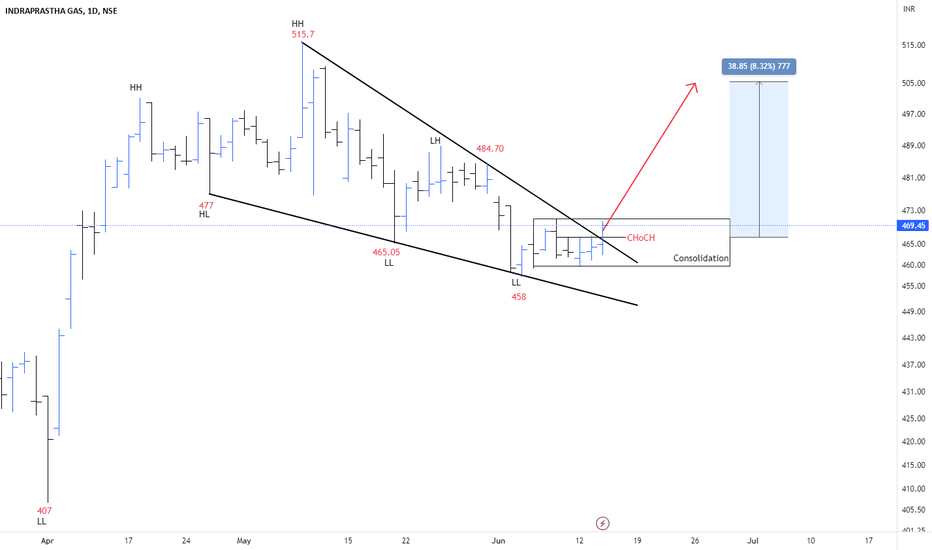

IGL: Bullish Falling Wedge Pattern IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs.

The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 .

Buyers have to break and stay above 504 to increase demand pressure.

Note: Do your own research / discuss it with your advisor

IGL stock to take long entryLong IGL above 435 levels for the target price of 455-460 . All important levels has been marked on the charts. 5 star Trading setup analysis:

1- Star- RSI taken well support at 40 levels sharp V turn.

2- Star- Resistance BO with very strong bullish candle & trading at support level.

3-Star-- After the second BO of marked resistance area well confirmation and can play trade.

4-Star-- Stock trading within channel & trading forming bullish sign from the lower channel.

5- Star-- Stock has been crossed the 50 as well as 200 EMA.

All above setup is good to go for high probability long entry with good risk to reward trade but not 100% full proof .Therefore, more important this setup can also be failed. So the stop loss need to be placed well in advance to avoid any fall in the stock market. This is for your education purpose only. Learn & trade only#.

IGL near a break out of inverted head and shoulder pattern.IGL is looking good for a break out trade as it has been forming an inverted head and shoulder pattern and consolidating near the break out levels.

On the daily time frame, the stock has given a lower wick rejection after testing 20 DMA.

The stock on the weekly time frame has given a bullish moving averages cross over and good targets can be booked in the stock after the break out of the pattern.

3 point confirmation.

1. Consolidation near break out level.

2. Bullish moving averages crossover on weekly time frame.

3. Retest of 20 DMA level.

The markets are in a bull run and the stock can follow the trend once it starts trading above 446 levels.

Targets :- 471, 510

Stop loss :- 438

Wait for the price action near the levels before entering the trade. Intraday and swing trades can be initiated in the stock once the level 446 is crossed convincingly.

IGL: Inverse H&SInverse Head and Shoulders Continuation:

This pattern forms in an extensive upside rally. It consists of a left shoulder, a head, and a right shoulder.

At the end of the left shoulder, a minor correction takes place on the upside which happens on the low volumes comparatively the starting of the left shoulder. After this again a down move can be seen on large volumes forming a head having its bottom is below the left shoulder following an upmove correction on lower volumes & completing the head.

The completion of the head must be above the top of the left shoulder. If the prices rise above the top of the left shoulder then too this pattern remains intact. In the end, the right shoulder is formed usually on smaller volumes comparatively the previous two rallies.

Now if you connect the tops of the left shoulder, head & the right shoulder there will be a formation of the ‘Neckline‘. This line will act as a decision line. If the prices break this neckline & give closing above the line, this will be the confirmation of the breakout of the Inverse head and shoulders pattern.

However, it has been noticed that after breaking of the neckline the prices again attracted towards this neckline. We say this phenomenon as a retest of the neckline which will add some more confidence while trading this pattern.

After retesting if the prices again start rising, this will be the final confirmation of the up move as shown above.

The bookish target of this pattern is taken as the vertical price range from the bottom of the head to the neckline & the bookish Stop loss should be the bottom of the right shoulder. However this stop loss can be big, so it is advised to keep a stop loss of 4-5% of the price range below the neckline.

TRADING STRATEGY:

Buy on cmp add on dips , keeping SL of 410 look for the measured target of 500-505 region

Flag and pole formation in IGL. IGL has formed a flag and pole pattern on the daily time frame.

Nifty oil and gas index has been trading around the recent high and IGL stock can give a good moment following the index.

There is bullish moving average cross over on the daily time frame.

3 point confirmation.

1. Flag and pole pattern.

2. Bullish cross over.

3. Index trading near the recent highs.

A swing or intraday trades can be initiated after the break out of the flag.

The view on the stock is bullish and only take a trade on the break out of the flag.

Target :- 440, 460, 471

Stop loss :- 415

Stock will follow the index, keep a look at the oil and gas index too.

[Positional] IGL Long IdeaIGL has created a very good 'Flagpole Pennant pattern on daily basis.

There was sharp upmove observed from the levels of 350 -440 (8 aug - 16 Aug). After that the stock has been consolidating only from last 10 sessions and the range is getting smaller and smaller creating a pennant.

What Is a Pennant?

- A pennant is a type of continuation pattern.

- When there is a huge movement in the stock, it forms a flagpole like structure- a very straight up move of more than 3 huge bullish candles.

- After this strong up move there is a little break to buying and consolidation begins - consolidation creates a triangle shape attached to a pole - called as pennant.

- Pennant formation normally says that there is still some buying left and this is just a break and the trend will again continue in the same direction as the initial large movement if it breaks on the same side as initial trend.

We are supposed to enter the trade once the price breaks out of this consolidation triangle - Pennant. It is advised to only take trades in the direction of the initial trend. Stop loss can be the low of the penannt.

Entry:- 424-430 (whenever price breaks the pennant on daily closing candle basis)

SL:- 402 (low of the Pennant)

Target :- 477

IGL Bouncing off at Multiple SupportsIGL is bouncing off again from its medium term support, same as it did a month and a half ago. The stock bounced off this support the last time, went to the resistance at 580 and came back to its support. The stock's price action today is indicative of a bounce again at this trend line and 200DMA support. The candle formation is also of 'morning star' type with gap up today and volume support. We are bullish on this stock and can see the price going back to 580 resistance zone.

Simple Trade Setup | IGL | 12-10-2021 [INTRADAY]NSE:IGL

Observations:

1) On 1 day time frame, we can see that now it is at very critical level range.

It is make it or break it, now. If it took support then we can see good reversal for uptrend. But if it fails then the down move continue.

Please refer below chart : 1 day Time Frame.

2) On 1 hour time frame, we can see hidden bullish divergence as price is made lower low but RSI made higher low.

Please refer below chart : 1 hour Time Frame.

-------------------------------------

Trade Setup for Date 12-10-2021:

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.

🔥 IGL. What You Are Getting By this view ,Tell us in comment.NSE:IGL

let's make this analysis a bit interactive.

As per this technical analysis #igl share at support if we can find reversal at this levels then igl share might fly from here.

Tell us in comment what you are getting from this view.

******whatever charts or levels sharing here are just for educational purpose only, not a recommendation. Please do your own analysis before taking any trade on them. We are not SEBI registered.

Simple Trade Setup | IGL | 04-10-2021 [INTRADAY]NSE:IGL

Observations:

1) On Daily time frame it has closed above 200DMA which is placed at 529.62 level.

Please refer below chart : Daily Time Frame.

2) On Daily time frame, it made morning star candlestick pattern.

For positional long trade for short/mid term, one can take positon on breakout of 535 level for target of 558,571,590 with SL of 520.

Please refer below chart : Daily Time Frame.

-------------------------------------

Trade Setup for Date 04-10-2021:

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respsective level considering how price action works near that level.