Long-term

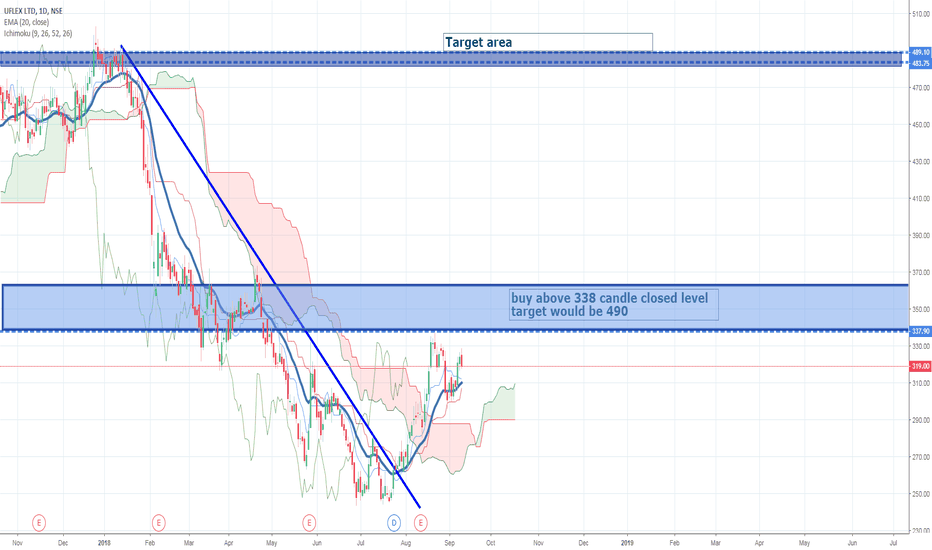

BUY ENTRY AFTER BRAKE OUT CHANNEL TRADECHANNEL TRADING BREAKOUT ENTRY WITH STOP LOSS SWING AND LONG TERM ..LEVELS IN CHART..

NSE:AMARAJABAT

ALong

CLong

Page Industries Ltd. Buy at the target of Rs 28850.0 Trade NivehMy suggests is Page Industries Ltd Buy shares at the target price of 28850.0. Page Industries Ltd. . The current market price of rupees is 23579.1. Market Expert has fixed its period of 1 year, when Page Industries Ltd The price can reach its set target.

For the end quarter 31-12-2018, the report sold by the company is standalone - Rs 738.32 crores, 6.89% up, last quarter sales - from Rs 690.76 crores, and 18.89% over the same quarter last year sales - Rs 621.03 crores From In the latest quarter, the company has net profits after the reported tax of Rs 101.89 crore.

On 31-03-2019, the total amount of the company, 11,153,874 shares is outstanding.

GBPUSD Short term Long Then Big Sell Off !!GU has been in a daily correction since August,2018.

Based on EW count it has been making a flat correction and now C leg of that flat is about to be completed.

Based on price action I'm still anticipating one more move UP to break previous high and then make its way down.

ICICI Bank: Is this the beginning of the end...???ICICI Bank

CMP 337

An interesting observation on a multi year chart

- we are looking at 13 year time frame for ICICI Bank

- each time ICICI Bank came near the upper end of the channel it has terminated its uptrend

- interestingly ICICI Bank has tested & terminated its rally at the upper end of the channel around January time on all the 3 previous occasions

- the correction thereafter has been of the magnitude of more than 30%

Why only January I don't know neither I'm interested in knowing. But what I'm happy about is it certainly helped us manage our trade.

And if you have been Following us you may have noticed that In our previous coverage on ICICI Bank

where we recommended a buy around 349, we twice highlighted to book at least partial profits around 380 levels - once around 377 on 8th Jan and then on 9th Jan at 382 odd levels. There were just mystery blue lines in there.

Well the chart above solves the mystery for you...

Going forward, on any pullback, level of 355-360 should be watched carefully and should not be breached on the upside.

For more such trading ideas and updates Do FOLLOW US & HIT the LIKE button

Take care & safe trading...!!!

EURUSD ANALYSIS!!EURUSD SHORT NOT COMPLETED YET?

EURO has been in a strong downtrend since FEB,18.

Apparently it might be in making of 5 wave structure.

If that's the case then 4 waves are completed and now heading down again for 5th wave.

5th wave of the daily structure is in also making of 5 wave but in that case 4th wave might completed now and now on it is going to complete 5th wave.

And might respect to the 61.8% monthly FIB level then shoot up again.

DIVERGENCE also appriceating the Short.

TRADE SAFE

GOOD LUCK

Tata Motors: Can it find its way back to highway...!!!Tata Motors

CMP 170.65

Last year in Sept 2017 when the stock was around 415 levels, we had highlighted that charts were indicating difficult times ahead for Tata Motors

And

- at current levels and on further dips the stock looks good from long term perspective (and I mean really long.... Can be looked for objectives like retirement planning, child education and so on...)

- it may not be easy road ahead.... (Challenges are Breexit impact on JLR, move towards electric cars, etc)

- but on the potentials and opportunities, with the launch of Harrier early next year we see TOT - transfer of technology (use of Land rover platform), potential improvement in brand image perception, development and work in progress in electric vehicle technology, and the fact that there is less than 50 cars per 1000 person in India reflects tremendous growth potential

- as any economy grows demand for premium and luxury cars come in to focus and with JLR and and potential TOT in future Tata Motors cars, we feel the company is having the right ingredients and product mix to make the most of it...

- coming back to charts in the short term 158-166 needs to be protected

- close above 175.6 may indicate Tata Motors to shift from reverse gear and move forward

- given the points above we see this stock as a buy on every dips

Take care and happy investing!!!