Longterm

BHEL Swing TradeBHEL has given spectacular returns of 280+% in the past 1.5 year and is still looking good for the upcoming months.

It's currently facing resistance from a critical level and a breakout can be seen in the upcoming weeks providing a good swing trade.

Levels:

Entry = Rs 83

Target 1 = Rs 90.20 (~08.5%)

Target 2 = Rs 105.7 (~27.1%)

Target 3 = Rs 120.8 (~45.3%)

Target 4 = Rs 132.1 (~58.9%)

Target 5 = Rs 144.4 (~74.9%)

Note: There is a possibility that the price may retest and take support from T2 or T1 before giving a breakout.

DR Reddy Buy For Long termBuy At CMP

Stop Loss 4445 (CLOSING BASIS)

HEY TRADERS,

THIS PREDICTION IS BASED ON A HARMONIC PATTERN AND THE HARMONIC PATTERN IS 100% ACCURATE AND10000% RISKY BECAUSE IT IS AGAINST THE TREND METHOD...

HOPE YOU ALL FIND SOME VALUE Here...SO, DON'T FORGET TO LIKE AND SHARE THIS POST. DON'T FORGET TO SUBSCRIBE.

COMMENTS WRITE DOWN BELOW OF THIS Chart...

THANK YOU...

~Disclaimer: "I Am Not Sebi Registered Advisor" All views and charts shared in this terminal are purely for knowledge and information purposes only.

BATA INDIA LTD.Bata India, this company has know for it's "AADARSH" chart, it's a clear cut buying/investing opportunity for the stock right now

Reason for buying :

Fundamentally strong company.

If you see the highlighted area with attention,you will see a pattern

the pattern made is called as "LONG TAIL DOJI"

The pattern shows a Strong rejection for a script on downside

This indicates that buyers are in power for the stock currently & this is the indication of a strong buying on a script.

Target : (double) 3400+ in an year

Stoploss: 1600 ( for long term)

Swing Target 1900-1950-2000+

Swing Stoploss 1680.

Close Positions on daily closings only.

SOME OF THE SIGNALS FOR SUUCCESFUL BREAKOUTSZensartech has shown some beautiful indications of long-term bullishness, usually, these types of breakouts sustain for longer periods of time, have a full conviction on these types of trading setups.

Do follow for more trading setups like these

Thanks, if you have any queries/suggestions related to above pattern, feel free to type below in the comment section.

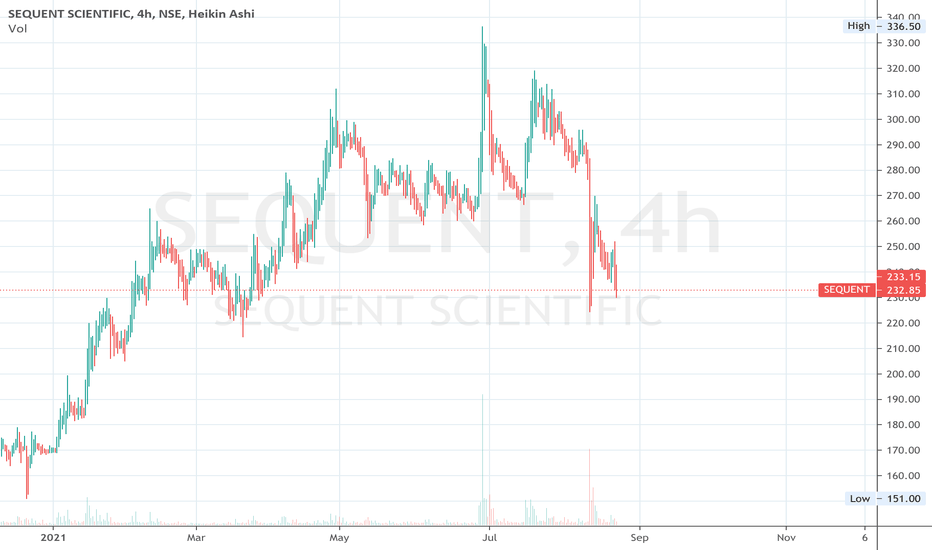

Long Sequent ScientificSequent Scientific

NSE:SEQUENT

Cmp - 232

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 500

T2 - Open, Review at 500

Expected Holding Period - 12 months or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Long Tata Steel BSLTata Steel BSL

NSE:TATASTLBSL

Cmp - 93

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 450

T2 - Open, Review at 450

Expected Holding Period - 2 years or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Pioneer Distilleries Ltd- Weekly Chart- Cup & Handle Breakout Pioneer Distilleries Ltd- Weekly Chart- Cup & Handle Breakout

CMP 149.3 Buy For Target 180-200-230-250-320-400+

SL Below 120 (Long Term Investment)

BUY OPPORTUNITY TLT is a fund that reflects the price of bonds with a maturity of 20 years. It reflects the price of the bonds but not the yield which is inversely proportional to the price. When the interest rate increases the price decreases while when the interest rate decreases the price increases in value.

It is a highly protective asset that helps diversify portfolio risk. It has a long-term bullish statistical bias and is particularly tempting to place in a portfolio. By statistically analyzing the price history (2003 - today) we can consider ourselves in a position of extreme advantage at this moment. During the entire life cycle of the product we can see how the historical maximum drawdown has never exceeded -28% in 800 days. On average, during each drawdown this asset loses 22% of its value in 650 days (approximately). The recovery period (period during which the market recovers the lost ground) is equal to 0.45. This means that on average it takes half the time to recover its losses compared to the time it takes to depreciate. From March 2020 to today it has been within a maximum distance of -25% from the maximum price, exceeding 500 days in drawdown.

Statistically we are in a situation where the chances of further loss of value are very low (in your entire life you have never lost more than 28%). Following the statistical model, it is likely that it will recover its value in less than a year.

If we assume that we are close to a minimum level and that the long term is characterized by a strong upward statistical bias, combined with the fact that the world economic situation is still far from an official recovery and that it will have to wait a little longer before to raise rates, positioning on $TLT is an excellent medium / long term opportunity for part of the core structure of my portfolio.

Let's analyze the data:

- Standard Deviation 10Y = 0.90%

- Standard Deviation 5Y = 0.87%

- Standard Deviation 3Y = 0.83%

The riskiness of the product decreased by about 10% from 2010 to today.

- 10Y yield = + 7%

- 5Y yield = + 3%

- 3Y yield = + 8%

- YTD yield = - 10%

The returns are positive in the medium / long term and negative in the short term (-10% from the beginning of the year).

Correlation: Instrument inversely correlated with the unemployment rate. As the unemployment rate increases, the value of the instrument decreases and vice versa. If we assume that the US is slowly returning to pre-employment at the pre-Covid19 level (thus the unemployment rate is decreasing over time) then we can assume that our tool will appreciate in the medium / long term.

- 3Y Expected Return: + 21%

- Max loss (with hedging): 5%

- Max portfolio loss (in the event that the outcome of this core transaction does not go according to estimates): -0,75%

- % of equity to be dedicated to this operation: 15% of the total portfolio + 7.5% for any hedging = 22.5% of the total portfolio

- Risk /Return = 1:4

Over time, three different situations can arise:

A) Closing the long trade at a loss and closing the hedge in profit, then:

- Potential loss% on the portfolio: - 0.75%

B) Closing the hedging at a loss and profit of the long operation, then:

- Potential gain% on the portfolio: + 2.25%

C) There is no need for the hedging strategy and the instrument meets expectations, then:

- Potential gain% on the portfolio: + 3%

Remember that this is my market vision and should not be interpreted in any way as an investment advice!

Why I am bullish on Airtel - Macro trend analysisThis is a long-term analysis for the telecommunications giant - Bharti Airtel .

There are two primary market trends in the broad perspective :

1. Uptrend/downtrend

2. Accumulation/ Distribution.

The accumulation phase is the boring phase , when smart investors accumulate positions and get in early. the uptrend/mark-up phase is the euphoria phase when the retail market participation increases, indicated by surge in volume, and smart investors slowly start unloading their positions, until the uptrend momentum has subsided, followed by a new accumulation phase and another possible mark-up, or a distribution phase followed by a downtrend, which is also known as a bear market. Till the time price has moved away from the range it has been trading in, we do not know whether the range is accumulative or distributive in nature.

As you can see in the chart, Bharti Airtel has been in an accumulation range for more than 10 years, and it seems as though we have finally successfully managed to break away from the range to the upside. The longer a stock has been in accumulation, the stronger the momentum once price breaks away from the range.

Let us see a stock that has done something similar. It is none other than, Reliance Industries .

You can clearly see how quickly the trend progressed after leaving the accumulation range.

Key takeaway points from the analysis and comparison

1. Airtel has been range bound for a longer period of time as compared to Reliance. This implies that Airtel has spent more time in the accumulation phase.

2. Airtel broke out of the range in early 2020, but threatened to fall back into the range, only to deviate back above and hold the range-high as support for several months. Deviation and reclaim as support is considered a strong bullish sign, indicating that buyers are stepping in to defend the range high as support.

3. Reliance never back-tested its range high as support before its second mark-up phase. Airtel back-testing range high as support is giving buyers more confidence that the stock is ready for price-discovery mode.

4. Volume analysis - Airtel has a better volume profile, with depleting low volume during accumulation phase and a surge in volume upon breakout attempt, and is showing continued volume strength. This setup was not seen in Reliance.

Conclusion

With this we can conclude that Airtel is giving us a nice bullish setup for a long term trend change shift and tackling new all time highs. The Indian stock market has been in a bull run ever since the year 2000, with corrections along the way (two major corrections in 2008 and 2020). As long as this macro bullish structure of the Indian market continues, we can expect Bharti Airtel to perform strongly in the coming years and have a similar run up as compared to Reliance Industries.

Thank you. Do leave a like/comment if you enjoyed the analysis.

Note: This is not financial advise. It is for educational/entertainment purposes only

REDINGTON LOOKS STRONG AFTER GOOD YoY resultREDINGTON after announcing good YoY result yesterday opened with a gap up and is trading above all R3 (Fibonacci).

it has entered into a pervious channel that i had marked before the Small-Cap fall that happened on Wednesday.

today it took support at the lower green support line and moved back up.

also DAILY Heikin Ashi shows strength.

keep an eye out for a breakout above the red line, or a break-down below the green line.

BCLIND is good for Medium to Long TermBLC Industries Ltd.

About

- 44-year-old company engaged in Edible Oil & other related business.

- is one of the largest edible oil complex in North India.

- 8 brands in the edible oil business.

- Largest Grain-based Ethanol supplier in India.

- Consistently generating profitability without any CAPEX.

- Co. also manufactures refineries & machinery along with their business in real estate.

- The Ethanol story & Edible oil story both will be contributing to the growth of the business.

- 5 Year Sales Growth CAGR is 22%

- 5 Year Profit Growth CAGR is 50%

Prospects:

- Govt. has announced that it is planning to incorporate Ethanol in Petrol by 20% by 2023.

- Govt. has recently announced that it will invest around 11k crore in Edible Oil Ecosystem to boost domestic production & cut imports.

Both these will have a positive impact on the company in the coming years.

Insider Buying:

The Board of Directors of BCL Industries Ltd at its meeting held on the 03rd day of August, 2020, has approved the allotment of 50 lakh equity shares at a price of Rs. 60/- per share (including a premium of Rs . 50/- per share), on a preferential basis to 3 specified persons of Promoter Group (i.e. Mrs. Sunita Mittal, Mr. Rajinder Mittal, and Mr. Kushal Mittal) and one specified entity belonging to public category i.e. Rollon Investments Private Limited.

The number of shares allotted to the allottees:

Mrs. Sunita Mittal - 800000 shares (Promoter)

Mr. Rajinder Mittal - 800000 shares (Promoter)

Mr. Kushal Mittal - 1000000 shares (Promoter)

Rollon Investments Private Limited - 2400000 shares (public)

View:

- BCLIND is a relatively small fish in a big pond. It has much room to grow. With consistently good Sales growth & Profit Growth & upcoming sectoral tailwinds, the company should do well.

NIFTY LONG TERM FORECAST nifty elliott wave & fib based forecast i darw

before check my forecast chart checking my previous chart analysis u can easily find why i marked this levels

also that chart link i will added below

maybe u have any doubt about this chart post u r comment i will explain my point of view analysis

Compuage Infocomm - Long term analysis Compuage Infocom Limited, an information technology (IT) and mobility distribution company, trades in computer parts and peripherals, and software and telecom products in India and internationally. The company also provides products support services for IT products.

Levels are marked on the chart

Stock has been following 50 ema and it is acting as amazing support.

Investing in a company with such a small market cap of just 2.118 bi can be very risky, please do your own due diligence strictly.

Some resources that I found useful are:

simplywall.st

simplywall.st

If you like the analysis, do leave a like and follow for more such content coming up.

The analysis is my POV , hope you got bucks in your pocket to consult a financial advisor before investing :P :)

HAPPY TRADING!!!

NAVIN FLUORIBNE READY TO BLAST?There is no need to tell about the quiality of this stock- navin fluorine, it is one of the best available to us, it can be accumulated at every dip for investing and for short term as well, presently it is at its support line and it is supposed to give some pretty attractive returns from here.