USDJPY – A Global Repricing Phase, Not a Random MoveWhen I look at USDJPY, this move doesn’t feel random to me. It looks like part of a broader global adjustment phase rather than something driven by this pair alone.

Price Context:

Price spent a long time reacting from a major supply zone before showing a clear structure shift. Since then, the market has been respecting an ascending channel, with higher highs and higher lows.

Why this move makes sense:

As global risk sentiment shifts and interest rate expectations change, currencies often move together. That’s why similar moves are visible across multiple FX pairs, this is a broad-based repricing, not a pair-specific reaction.

Current Structure:

The recent pullback into demand and trend support looks like a healthy retracement, not a breakdown. As long as this structure holds, the broader trend remains intact.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk.

M-forex

GBP/AUD: Corrective Rally, Downtrend IntactGBP/AUD is trading in a clear bearish Elliott Wave structure on the 4H timeframe. The market has already completed a strong impulsive decline and is currently moving in a Wave 4 corrective pullback, which is happening inside a downward channel and near key Fibonacci retracement levels. This correction looks weak and corrective, suggesting sellers are still in control. As long as price remains below the invalidation level around 2.0050 , the bearish bias stays valid. The expectation is for the correction to finish soon, followed by Wave 5 to the downside, targeting the lower channel area and the 1.96–1.95 zone. Overall, the trend remains bearish, and any short-term bounce is likely a selling opportunity before the next leg lower.

Stay tuned!

@Money_Dictators

Thank you :)

Update on the previous EURUSD bullish setup idea.The price and market is following through almost as we expected , although the price made its new gap and support zone at : "1.18554" and is willing to go to our structural previous daily high at :1.19206.

So far it's still supporting our idea let's see if anything gets different or more precise.

XAUUSD – Brian | H3 Technical AnalysisGold continues to trade within a well-defined bullish structure on the H3 timeframe, supported by strong technical momentum. Price action remains orderly, with impulsive advances followed by controlled pullbacks — a characteristic of a healthy trending market.

From a macro standpoint, geopolitical uncertainty remains elevated after recent comments from President Trump regarding increased U.S. control over strategic military areas in Greenland. While not implying direct occupation, the development adds to broader risk sensitivity and continues to support gold’s role as a defensive asset.

Market Structure & Technical Context (H3)

On the H3 chart, XAUUSD remains firmly above its rising trendline, with market structure defined by higher highs and higher lows. A prior break of structure (BOS) confirmed bullish continuation and opened the door for further expansion.

Key technical areas highlighted on the chart:

A strong impulsive leg followed by corrective pullbacks, consistent with trend continuation.

Fibonacci expansion with the 2.618 extension near the 5005 zone, acting as a major reaction area.

A liquidity pullback zone around 4825, aligned with trendline support and suitable for continuation scenarios.

A lower POC / value area acting as deeper support if volatility increases.

As long as price holds above these demand zones, the broader bullish structure remains intact.

Liquidity & Forward Expectations

Upside liquidity remains available above recent highs, while short-term pullbacks are likely driven by profit-taking rather than structural weakness. The 5000–5005 area represents a key decision zone where price may pause or consolidate before the next directional move.

Trading Bias

Primary bias: Bullish continuation while structure holds

Key zones to monitor:

4825 – liquidity pullback / trend continuation

5000–5005 – major extension & reaction zone

Preferred timeframe: H1–H4

Risk management remains essential, particularly in a market sensitive to sudden news flows.

Refer to the accompanying chart for a detailed view of market structure, liquidity zones, and Fibonacci extensions.

Follow the TradingView channel to receive early updates and join the discussion on market structure and price action.

Intraday Institution Trading in Nifty and Banknifty BANKNIFTY Institutional Behavior

BANKNIFTY moves faster due to lower liquidity + banking stock hedging.

Institutions:

Accumulate ATM options early

Trigger stop hunts near high OI strikes

Expand range post 11:30 AM when gamma pressure builds

High-Probability Institutional Intraday Trades

VWAP Reclaim + OI Unwinding → Trend day setup

High OI Rejection + IV Drop → Mean reversion

Break of Call-Writer Zone with Volume → Momentum expansion

Institutional Rulebook

Trade levels, not emotions

Follow option writers, not candles

Price moves to hurt the maximum number of option holders

Advanced Intraday Institution Option TradingAdvanced Intraday Institutional Option Trading

Institutional intraday option trading focuses on order flow, volatility expansion, and hedging behavior, not prediction. Institutions deploy capital where liquidity, gamma, and vega sensitivity allow fast risk adjustment—usually in near-expiry (0DTE–3DTE) index options.

Institutional Interpretation

Max Call OI at 21,500 → Heavy call writing → Resistance

Rising Put OI at 21,400 → Strong downside hedge → Support

IV spike on Calls above 21,500 → Short covering risk → Breakout fuel

Balanced IV at ATM → Volatility expansion likely

High-Probability Intraday Trades

Gamma Scalping: Buy ATM options when IV expands + price holds VWAP

Directional Break: Long calls above call-writer resistance with OI unwinding

Volatility Fade: Sell options after IV spikes near key levels

Key Rule

Institutions trade structure, not direction.

Retail trades candles. Smart money trades the option chain.

USD/CHF Approaching Breakdown from RangeUSD/CHF is moving in a sideways corrective pattern, not a strong trend. The price is forming an A-B-C-D-E structure, which usually happens before the market makes a bigger move. Right now, price is in the last part of this pattern (wave E) and is sitting near a resistance area, where it has failed to move higher and has started to turn down. This behavior often means sellers are becoming stronger. As long as the price stays below 0.795–0.798 , the outlook remains bearish, and the market is expected to move lower toward the 0.782–0.775 support area. If this move happens, it would complete the corrective pattern after a short pause, and then the market can decide its next big direction.

Stay tuned!

@Money_Dictators

Thank you :)

EURUSD – Breakout From Falling Resistance, Retest Holding WellEUR/USD was trading under a falling resistance trendline for a long time, with sellers consistently stepping in at higher levels. Recently, price managed to break above this trendline, which was the first sign that bearish pressure was easing.

After the breakout, price came back for a retest of the broken structure and previous resistance area. This retest is holding well so far, showing that buyers are defending the level and not allowing price to slip back below the structure.

What stands out here is how price respected the retest and then pushed higher, leaving behind a small imbalance. This often indicates acceptance above the breakout level rather than a false move.

As long as price holds above the retest zone and structure support, the path of least resistance remains to the upside, with higher resistance levels marked on the chart. A clean breakdown below this area would invalidate the bullish view.

This is a structure-based idea, not a prediction. Let price continue to confirm.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk. Please manage risk responsibly.

GBPUSD – Breakout Retest Looks Healthy, Bulls in ControlGBP/USD has been trading below a falling resistance trendline for quite some time. Recently, price managed to break above this trendline, which is the first sign that selling pressure is weakening.

After the breakout, price did not continue straight up. Instead, it came back for a retest, and that retest is holding well so far. This is usually a healthy sign, showing that buyers are willing to step in at higher levels instead of letting price fall back below structure.

What Price Is Telling Us:

Price is respecting the previous resistance as support and forming higher lows. Sellers are trying, but they are unable to push price back below the trendline. This behavior often appears when the market is preparing for continuation rather than reversal.

As long as price holds above this zone, the bullish bias remains intact, with upside levels marked on the chart. A clean breakdown below the structure would invalidate this view.

This is a structure-based idea, not a prediction. Let price do the work.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

USDCHF – Gap Down From Resistance, Price Testing Key Support!USD/CHF was trading near a well-defined resistance zone where price has faced repeated rejection in the past. This clearly showed that sellers were active at higher levels and the market was struggling to sustain upside momentum.

From this resistance, the market opened with a gap down, which often signals aggressive selling and position unwinding rather than a slow intraday move. The gap was also supported by short-term U.S. dollar weakness, as the market adjusted expectations around risk sentiment and interest rates. When dollar weakness aligns with technical resistance, price usually reacts sharply.

After the gap down, price moved lower toward a major support zone, an area where buyers have previously stepped in. This makes the current zone a key decision point, either buyers defend again, or further downside continuation opens up.

This move is a result of both technical rejection and fundamental pressure, not random price action.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Long Term Investment What is Bank Nifty (for long-term view)

Nifty Bank tracks India’s top banking stocks (HDFC Bank, ICICI Bank, SBI, Axis, etc.).

It’s:

🚀 High growth–oriented

📉 More volatile than Nifty 50

💰 Strongly linked to credit growth, interest rates, and the economy

Long-term verdict:

Great for growth if you can tolerate volatility.

Best ways to invest in Bank Nifty for the long term

1️⃣ Bank Nifty Index Mutual Funds (BEST for most people)

Passive funds that track Bank Nifty

Ideal for SIP + long horizon (7–10+ years)

Why this works

No stock picking risk

Lower expense ratio

Automatic rebalancing

👉 Suitable if you want set it and forget it

XAUUSD – H2 Technical AnalysisLiquidity Pullback Within a Strong Bullish Structure | Lana ✨

Gold continues to trade within a well-defined bullish structure on the H2 timeframe. The recent surge was impulsive, followed by a healthy retracement that appears to be rebalancing liquidity rather than signaling a trend reversal.

Price action remains constructive as long as the market respects key structural levels and the ascending trendline.

📈 Market Structure & Trend Context

The overall trend remains bullish, with higher highs and higher lows still intact.

Price continues to respect the ascending trendline, which has acted as reliable dynamic support throughout the uptrend.

The recent pullback occurred after an aggressive upside expansion, fitting the classic sequence:

Impulse → Pullback → Continuation

No clear distribution pattern is visible at this stage. As long as structural support holds, the bias remains BUY on pullbacks, not selling strength.

🔍 Key Technical Zones & Value Areas

Primary Buy POC Zone: 4764 – 4770

This area represents a high-volume node (POC) and aligns closely with the rising trendline.

It is a natural zone where price may rebalance before resuming the bullish trend.

Secondary Value Area (VAL–VAH): 4714 – 4718

A deeper liquidity zone that could act as support if sell pressure temporarily increases.

Near-term resistance: 4843

Acceptance above this level strengthens the continuation scenario.

Psychological reaction zone: 4900

Likely to generate short-term hesitation or profit-taking.

Higher-timeframe expansion targets:

5000 (psychological level)

2.618 Fibonacci extension, where major liquidity may be resting.

🎯 Trading Plan – H2 Structure-Based

✅ Primary Scenario: BUY the Pullback

Buy Entry:

👉 4766 – 4770

Lana prefers to engage only if price pulls back into the POC zone and shows bullish confirmation on H1–H2 (trendline hold, strong rejection of lower prices, or bullish follow-through).

Stop Loss:

👉 4756 – 4758

(Placed ~8–10 points below entry, beneath the POC zone and the ascending trendline)

🎯 Take Profit Targets (Scaled Exits)

TP1: 4843

First resistance zone — partial profit-taking recommended.

TP2: 4900

Psychological level with potential short-term reactions.

TP3: 5000

Major psychological milestone and upside expansion target.

TP4 (extension): 5050 – 5080

Area aligned with the 2.618 Fibonacci extension and higher-timeframe liquidity.

The preferred approach is to scale out gradually and protect the position, adjusting risk as price confirms continuation.

🌍 Macro Context (Brief)

According to Goldman Sachs, central banks in emerging markets are expected to continue diversifying reserves away from traditional assets and into gold.

Average annual central bank gold purchases are projected to reach around 60 tons by 2026, reinforcing structural demand for gold.

This ongoing accumulation supports the idea that pullbacks are more likely driven by positioning and profit-taking, rather than a shift in long-term fundamentals.

🧠 Lana’s View

This remains a pullback within a bullish trend, not a bearish reversal.

The focus stays on buying value at key liquidity zones, not chasing price at highs.

Patience, structure, and disciplined execution remain the edge.

✨ Respect the trend, trade the structure, and let price come to your zone.

XAUUSD – Short-Term Trendline Broken, Focus on Buying Liquidity Market Context

After a strong impulsive rally, Gold has broken below the short-term ascending trendline, signaling a technical correction and liquidity rebalancing phase. However, the higher-timeframe structure remains intact, and the current decline is still viewed as corrective rather than a trend reversal.

From a fundamental perspective, safe-haven demand and a cautious monetary policy outlook continue to support Gold. This keeps deeper pullbacks attractive for institutional accumulation rather than aggressive selling.

Structure & Price Action (H1)

Short-term bullish trendline has been broken → transition into a corrective phase.

No confirmed bearish CHoCH on H1 at this stage.

Price is rotating within a range, targeting liquidity pools below.

Multiple Demand + Liquidity + H1 GAP zones are located beneath current price.

Upper zones remain Supply / Liquidity Sell areas for potential reactions.

Key Levels to Watch

Supply / Liquidity Sell: 4,949 – 4,874

Mid reaction zone: 4,824

Primary BUY zone: 4,755 – 4,729

Deep BUY zone (H1 GAP – Liquidity): 4,665 – 4,600

Trading Plan – MMF Style

Primary Scenario – Buy at Discount

Look for BUY setups at:

BUY zone 1: 4,755 – 4,729

BUY zone 2: 4,665 – 4,600 (H1 GAP & liquidity)

Entries only after clear bullish reactions and structure holding.

Avoid premature entries while price remains mid-range.

Upside Targets

TP1: 4,824

TP2: 4,874

TP3: 4,949 (upper liquidity sweep)

Alternative Scenario

If price fails to reach lower zones and holds above 4,824, wait for a break & retest to re-enter BUY positions in trend direction.

Invalidation

An H1 close below 4,600 invalidates the BUY bias.

Stand aside and reassess overall market structure.

Summary

The broader bullish bias remains intact, while the current move represents a healthy pullback for liquidity absorption. The optimal strategy is patience—BUY at discounted zones with confirmation, not by chasing price.

AUDUSD – Sell From Weak High RejectionPrice swept the weak high at 0.6772 and immediately rejected, confirming a liquidity grab. Structure shifted bearish, and price is now pulling back toward premium levels for a potential continuation down.

🔍 Bias: Bearish

Entry: 0.67722

Stop Loss: 0.67873 (above sweep)

Take Profit:

TP1: 0.67634

Reasoning: Liquidity sweep + bearish structure shift + clean inefficiencies below acting as magnets.

USD/CAD: Elliott Wave Bearish BiasUSD/CAD is showing a bearish Elliott Wave structure on the 4H chart. Price appears to have completed a corrective Wave 2 near the 0.5–0.618 Fibonacci retracement zone, which is a common area for corrections to end. From there, the market has started to turn lower, suggesting the beginning of a new impulsive Wave 3 to the downside, which is usually the strongest bearish wave. As long as price stays below the recent swing high near the retracement zone, the bias remains bearish, with downside targets toward the 1.365–1.360 area. A move above the Wave 2 high would invalidate this count and delay the bearish scenario.

Stay tuned!

@Money_Dictators

Thank you :)

Option TradingRetail and Institutional Option Trading

Retail traders usually focus on buying options, hoping for fast price movement. Institutions, on the other hand, mostly sell options because time decay (Theta) works in their favor.

Key differences:

Retail traders chase momentum and news

Institutions focus on probability, statistics, and data

Retail uses indicators

Institutions use Option Chain, OI, volume, and volatility

Retail looks for big wins

Institutions look for consistent returns

Institutions understand that 90% of options expire worthless, which is why option writing dominates institutional strategies.

XAUUSD (H4) — Bond Selloff, Yields UpPullback Opportunity or Rejection at the Top?

Gold is still holding a bullish structure on the H4 chart, but the rebound in global yields can easily trigger sharp swings around key resistance. Today’s approach is simple: trade the zones, not the noise.

I. Executive Summary

Primary trend: H4 uptrend remains intact.

Trading bias: Prefer BUY on pullbacks into demand; consider SELL only with clear rejection at Fibonacci resistance.

Key zones:

Sell: 4774–4778

Buy: 4666–4670

Value Buy: 4620–4625

Rule: Enter only after zone touch + confirmation (rejection / micro-structure shift).

II. Macro & Fundamentals (optimized & concise)

Global bond selloff: Bond selling is spreading globally; Japan’s 40-year JGB yield hitting 4% signals broad, persistent yield pressure.

US yields rebounding: Higher US yields (10Y–30Y) raise the opportunity cost of holding gold → short-term bearish pressure for XAUUSD.

Risk premium still alive: Geopolitical tension and tariff headlines keep markets sensitive, supporting defensive flows and limiting deep downside.

Fundamental takeaway: Rising yields can drive a pullback, but the broader risk backdrop favors a correction within an uptrend, not a full reversal (unless structure breaks).

III. Technical Structure (from your chart)

1) H4 overview

Price is extended after a strong impulse and is now consolidating, while structure still prints Higher Highs / Higher Lows.

The ascending trendline remains supportive → the higher-probability play is buying dips into demand rather than chasing price.

2) Key zones

Fibonacci Sell zone: 4774 – 4778 (major supply / resistance — profit-taking and rejection risk)

Buy zone: 4666 – 4670 (shallow pullback within trend)

VL / Value Buy: 4620 – 4625 (deeper pullback — higher-quality dip if yields spike again)

Lower support zones remain a contingency for a deeper flush.

IV. Trading Plan (Brian style — 2 scenarios)

⭐️ PRIORITY SCENARIO — BUY (trend continuation)

Idea: As long as the H4 uptrend holds, look to buy pullbacks into demand with confirmation.

Option A — Buy pullback: 4666 – 4670

SL: below 4620 (more conservative: below 4616–4610 depending on volatility/spread)

TP: 4716 – 4740 – 4774 – 4800

Option B — Value Buy (if a deeper sweep happens): 4620 – 4625

SL: below the nearest H4 swing low / below 460x (risk preference dependent)

TP: 4666 – 4716 – 4774 – 4800

Confirmation cues (optional):

Strong rejection wick at the buy zone, or

H1 micro-structure break back to the upside, or

Liquidity sweep then close back above the zone.

⭐️ ALTERNATIVE SCENARIO — SELL (rejection at Fibonacci resistance)

Idea: With yields rising, gold may react sharply at the top — treat this as a reaction trade, not a macro trend reversal call.

Sell zone: 4774 – 4778 (SELL only if price rejects clearly)

SL: above 4788 – 4800

TP: 4740 – 4716 – 4670

Important: If H4 closes and holds above 4778 (acceptance), the bias shifts to buying pullbacks instead of forcing shorts.

Part 1 Technical VS. Institutionalinstitutional trading focuses on large-scale transactions, often executed by financial institutions like banks, hedge funds, or pension funds. They typically have access to significant capital and advanced market insights, and their trades can influence market trends.

On the other hand, technical trading relies on analyzing price charts, patterns, and indicators to make decisions. Technical traders look at historical price movements and use tools like moving averages, support and resistance levels, and oscillators to predict future price movements.

In summary, institutional trading is more about the scale, resources, and market impact, while technical trading is more about patterns, price action, and chart-based strategies.

Technical Analysis Vs Institutional Trading Option Trading Part1Technical Analysis (TA):

Uses charts & indicators to time entries/exits.

Best for directional option trades (calls/puts), short-term moves.

Institutional Trading:

Focuses on liquidity, options flow, open interest, gamma.

Best for selling premium and trading ranges with lower risk.

Bottom line:

👉 TA = when to trade

👉 Institutional = where & why price moves

👉 Best edge = use both together

Professional Reality (Important)

📌 Institutions don’t predict direction — they manage risk

📌 Retail traders try to be right — institutions try to get paid

📌 Options are a probability business, not a prediction game

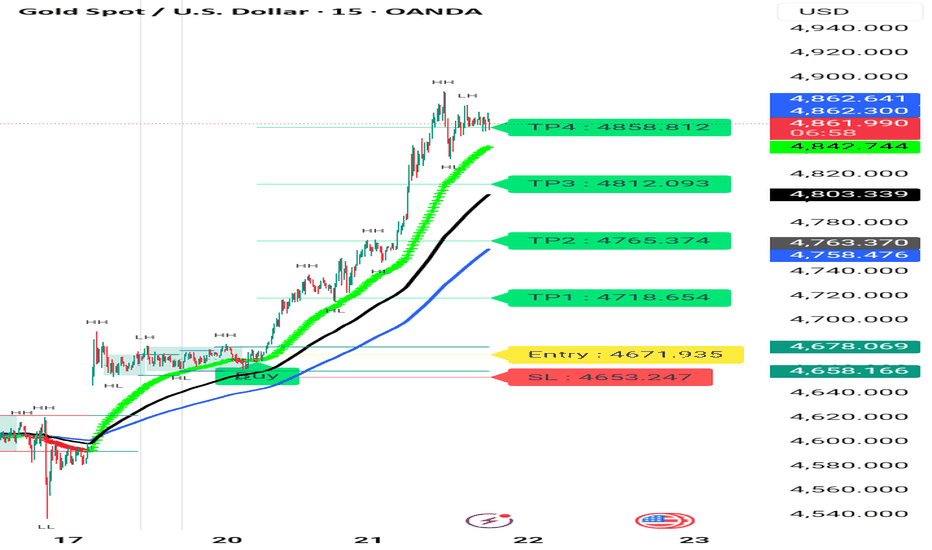

XAUUSD (Gold) – 15M Risk-Reward Based Long SetupGold is currently reacting from a key intraday demand zone after a corrective move within the broader structure. Price has shown rejection from lower levels and is attempting to reclaim structure support.

🔹 Bias: Bullish (Intraday)

🔹 Timeframe: 15 Minutes

🔹 Entry Zone: Demand / Support area

🔹 Stop Loss: Below demand zone (structure invalidation)

🔹 Target: Previous highs / Upper resistance

🔹 RR: Favorable risk-to-reward setup

📌 Confluence Used:

Demand zone support

Previous price reaction area

Structure alignment

Trend channel context

📈 If price holds above the marked support and shows continuation, upside momentum towards the target zone is expected.

⚠️ Invalidation if price closes decisively below the demand zone.

💡 Trade with proper risk management. This is a technical view, not financial advice.

XAUUSD (H4) – Trendline break confirmedXAUUSD (H4) – TRENDLINE BREAK CONFIRMED, NOW IT’S ALL ABOUT BUYING THE DIP.

Macro context

Safe-haven flows are still supporting precious metals as geopolitical uncertainty rises. Headlines around the US–Venezuela situation and political pushback can keep price action reactive, meaning sharp spikes and liquidity sweeps are very possible before the market commits to the next leg.

Technical view (H4)

The bullish structure remains intact: higher highs + higher lows.

Price has broken the trendline/resistance and is holding above the “buy resistance” area around 4550 → a positive sign for continuation.

The 1.618 Fibonacci extension above is a major liquidity magnet, but also a zone where short-term profit-taking can trigger a pullback.

Key levels

Pivot support: 4550–4545

Deeper support: 4475–4455 (balance area inside the rising channel)

Target resistance: 4760–4770 (Fibo 1.618 / “sell Fibonacci” zone)

Trading scenarios

Scenario 1: Trend-following BUY (preferred)

Entry: Buy pullback 4552–4560

SL: 4540

TP1: 4635–4660

TP2: 4720–4740

TP3: 4760–4770

Plan: wait for a clean reaction at the new support after the breakout, then ride the trend.

Scenario 2: Safer BUY after a deeper liquidity sweep

If price dumps hard on thin liquidity/news:

Entry: Buy 4475–4455

SL: 4435

TP: 4550 → 4635 → 4760

Scenario 3: Reaction SELL (short-term only)

Only if there’s a clear rejection at the highs:

Sell zone: 4760–4770

SL: 4785

TP: 4685 → 4635 → 4550

Conclusion

H4 bias stays bullish after the trendline break. The best approach is no chasing — wait for a dip into 4550 to buy with structure. SELL is only a tactical reaction if price rejects hard at the 1.618 extension.

👉 Follow LiamTradingFX to get my XAUUSD plans early every day.