Profit

TRXM19TRX with symmetrical triangle pattern

BUY BUY BUY TRX

Gain with profit 66% PIPS

RIGHT NOW BUY..!!!!

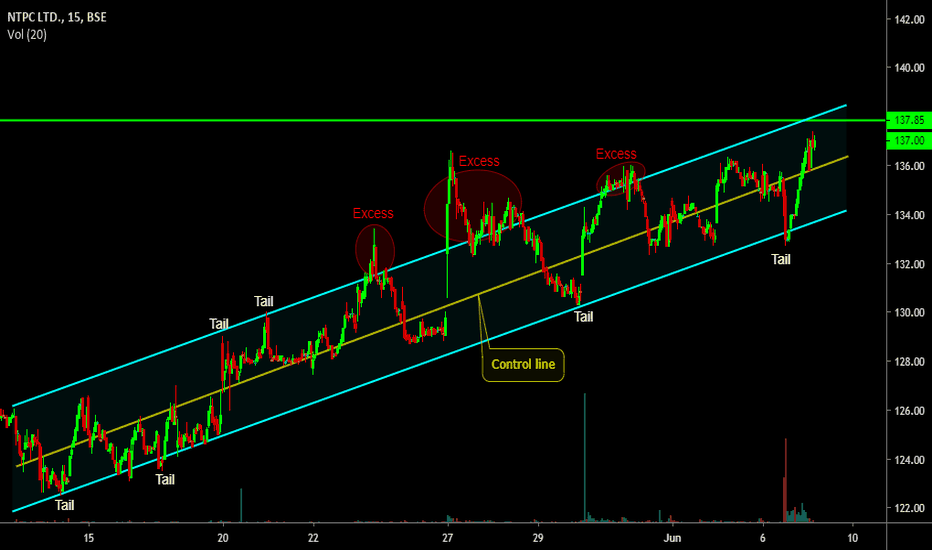

Analyzing the NTPC The best way to learn is to visualize what is being discussed. These profits will not be consistent. You will win some, you will lose some, you will lose some more, depending on how the market is moving. This doesn’t necessarily mean that you cannot make some profits trading with indicators.

Short 137.45

Stop-loss 141.25

Target 132 and 128

Logical levels of TCS In an uptrend, when you buy in excess below value or somewhere in the bottom half of the value area, the take profit level is always at the control price. When an opportunity arises to buy just above the control, the take profit will be at the value high. The protective stop will always be below the tail of the smaller rejection value area on the lower time-frame that is used to enter the trade. The risk will always be smaller than the reward unless you are buying extremely close below the control price.

IMAX Stock analysis long termCompany: Imax

Quote: #IMAX

Buy Target: TBD pending on price action and tapes into earnings

Sell Target: $28-$30

Next Earnings date: April 26th

This Is a 20% gainer we missed last Q from being to conservative we will be looking for an entry ether before or after earnings all pending on the tape such a small float it will be a good read reading the tapes into Friday to see which way this name is going to trade.

Description: IMAX Corporation, together with its subsidiaries, operates as an entertainment technology company that specializes in motion picture technologies and presentations worldwide. It offers cinematic solution comprising proprietary software, theater architecture, and equipment. The company engages in Digital Re-Mastering (DMR) of films into the IMAX format for exhibition in the IMAX theater network; the provision of IMAX premium theater systems to exhibitor customers through sales, long-term leases, and joint revenue sharing arrangements; the distribution of documentary films; the provision of production technical support and film post-production services; the ownership and operation of IMAX theaters; and the provision of camera and other miscellaneous items rental services. It also designs, manufactures, installs, sells, and leases IMAX theater projection system equipment; maintains IMAX theater projection system equipment in the IMAX theater network; distributes and licenses original content investment, IMAX home entertainment, and others; and sells or leases its theater systems to theme parks, private home theaters, tourist destination sites, fairs, and expositions, as well as engages in the after-market sale of projection system parts and 3D glasses. The company markets its theater systems through a direct sales force and marketing staff. It owns or otherwise has rights to trademarks and trade names, which include IMAX, IMAX Dome, IMAX 3D, IMAX 3D Dome, Experience It in IMAX, The IMAX Experience, An IMAX Experience, An IMAX 3DExperience, IMAX DMR, DMR, IMAX nXos, IMAX think big, think big, and IMAX Is Believing, as well as the service mark IMAX THEATRE. As of December 31, 2018, the company had a network of 1,505 IMAX theater systems comprising 1,409 commercial multiplexes, 14 commercial destinations, and 82 institutional facilities operating in 80 countries. IMAX Corporation was founded in 1967 and is headquartered in Mississauga, Canada.

Short Interest:

Short Percent of Float 5.86%

Short percent of increase or Decrease -4%

Analysis Ratings : Stock price Target #IMAX

High : $34

Median : $27

Low : $21.50

Average : $27.04

Current Price : $25.33

Feb 25 - 19 Downgrade Canaccord Genuity Buy - Hold $23

Apr 25 - 19 Upgrade The Benchmark Company Hold - Buy $28

Feb 28 - 18 Reiterated B. Riley FBR, INC. Buy $35-$37.75

Tapes last week: 3/5 wouldve gotten a one however the last two days were very bullish

Please our Facebook and Twitter for more updates.Please subscribe to our Newsletter for more information

Facebook - @SFYBUofficial

Twitter - @SFYBUofficial

CHFJPY: Descending Trend Possible Profits.Hello,

Given the repeated failure of CHFJPY to conquer five-week long resistance lines, the pair is likely to decline to 109.45 and 108.95 supports for now; however, 108.20 could limit the quota's downside to 108.95, if not 108.45 & 107.60 could regain market attention. If the trading to the south continues at all prices below 107.60, the recent low around 106.35 and 106.00 could please the sellers. Meanwhile, successful clearance of 110.05 can trigger the pair to recover to 110.60 and then to the 111.25-35 resistance region. In addition, the successful rally beyond 111.35 allows pairs to target 112.00 and 112.80-90 levels to the north.

Hit like, comment and follow for more details.

GBP NZDGBP NZD - Daily Chart - After seeing a good downtrend, looks like the pair is trying to reverse. Inverted H&S is still in process. Pattern will be confirmed only on breakout. But seeing at the Chart Structure, looks like it will. Patience is the key here. Now as pattern is identified, we will have to wait for breakout before initiating the long trade. Further, though the targets of the Pattern come way above our Resistance Zone, its better to book them at the Resistance Zone itself as the same are in confluence with 0.618 Fibo Retracement

SilverCurrently Silver is within consolidation on Hourly Chart. It has taken support multiple times in the range of 15.450 to 15.550 which is very akin to 0.382 Fibo Retracement from the previous swing low. Till the time its holding onto that support, the chances of breakout above resistance zone increases and we might get a good long entry.

A PRO INDICATOR FOR BITMEX/FOREX/STOCK WITH 90% ACCURACYThis indicator is specially made for BITMEX and FOREX.

It will give u automatic BUY/SELL signals.

You can easily take minimum 20% profit daily from bitmex by this indicator.

TO BUY THIS INDICATOR CONTACT US ON TELEGRAM @marianzs Or U CAN ALSO MESSAGE US ON TRADINGVIEW.

OUR TELEGRAM CHANNEL t.me