Relative Strength Index (RSI)

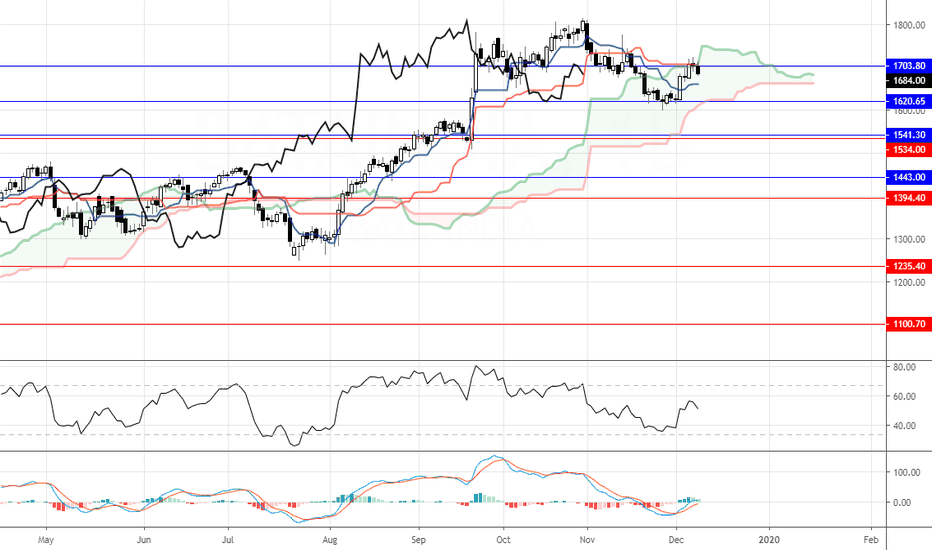

BATA India Mean Reversion Setup

- Self explanatory & Annotated Chart

- Key Levels are Marked

- Enter at BO level @ 1340

- Exit at Target level @ 1445 , approx 7-8% upside

- Time Frame is few Days

- Stop Loss level for Risk as per your choice also mentioned

- High probability setup based on AVWAP Study + Multi Time Frame + Pattern + RSI

- Stock is Bullish on all time frames for a Mean Reversion (am not posting charts of other time frames but have a look for yourself)

Good Luck :)

If you find this Trade Idea helpful, please Like, Comment & follow me on Twitter to keep updated with my Trading activity & new ideas.

Note: I rarely post Ideas on Trading View platform (have only recently started)

BEST TRADING STRATEGY ON TRADING VIEW BIND BACK TESTEDThis video is about blind testing the world's best script on TV and see if it still generates the net profit of 4000-15000% of net profit in just 1.5 years . This means 40 to 150 times of initial investment in just 1.5 years. You can ofcourse deduct the fee/commission part of platforms and some more but still, this is too much. What I have done here is developed a pine script which when I applied to any market pair on cryptocurrency market generates staggering profits in just 1.5 years. Today, to make it purely blind I have used a mobile application to generate random numbers first and then with that number I select the market pair and apply my script to see the back testing results. Results are still the same as we saw in my first video about the script. Also, I discussed various ways people can take advantage of the script. People can either buy it and apply it own their own on any number of charts on any market and generate signals/calls for trading automatically or they can chose to go for Copy Trading Service where they don't have to do anything but just subscribe to my Copy Trading Services and grow with me and relax while my script does the job for both of us. For details you can message me or email me.

WRX is BULLISH AFRSI shows it is oversold right now. Aroon Indicator is indicating a trend reversal. And there's a major support at the current price. I'm going all in on this. See you on the other side !

The stock has taken support at the critical level, below thisWe can see that the stock has taken support at the critical level, below this the stock may fall badly & resume it’s trend down. The RSI is holding on to the 40 levels, we may expect the hammer to work and prices should move ahead from this level. The probable target zones in short term may be around 450 & 500 levels while closing below 285 will be not good.

Cummins displaying strength, may face resistance near...Cumminsind stayed strong and managed to register a close above an important pivot level. 600 will serve as another resistance in the coming week above which the stock can rally hard "bohot hard" Also noticing an inverse H&S in the stock. The swing of right shoulder can be kept as a stop loss. The RSI has started moving into the 60's and MACD is above the zero line. The momentum is painting a positive picture.

The RSI and MACD are displaying divergence, if the formation is The weekly banknifty chart has closed negative this week, back to back two bearish candles also indicates momentum suppression in the index. 31800 will provide immideate support to the index, giving away this may push the index to 31300 levels. However the trend is still up and any bounce from the support will push banknifty up 32600, 32800 & 33300 finally. The RSI and MACD are displaying divergence, if the formation is not negated in coming sessions then correction is quite probable.

This 12200 levels will serve as minor supportThe index has been consolidating in a sideways range since last two weeks. A triangle pattern is visible on the daily charts, the breakout is yet to occur. The prices are holding the TS line support tightly. This 12200 levels will serve as minor support while 12070 the KS line is an important support. Any redound should take place from these supports. Nifty is set to move to 12310, 12380 & 12500 levels. But when we look at the RSI, the momentum seems to lose its strength, I would really like the RSI to break up from the 60 levels which it is tested a multiple number of times.

Glenmark showing signs of institutional presence. Taking support after breakout on 18th November is a good sign confirming the institutional presence in the stock. The stock is now setting up tone for a strong move up with supporting volumes and momentum. The RSI is positive into the bullish zone and MACD well above the neutral zone with positive bias. Longer term targets are close to 485 levels!

Mid Caps showing signs of recovery. Shopping List!The MID Cap index took support and bounced back. The level from which the index bounced was very strong inflection point. Two back to back bullish candle with good volumes indicates real interest in the stock. Moreover there is a long term positive signal in RSI and MACD is positive with bullish bias. All these indicate that mid caps may pick up pace in coming weeks.

Bank Nifty close to 31000. It's a important support level.In my last Friday’s update I mentioned that we may see banknifty trading at 31000 levels. The index registered a close at 31160 today. Now it’s trading close to a support level the KS line. A major support is at 30600. Most of the time KS acts as a very good support for prices, so a bounce from it is not ruled out. 31600 will be the decider level for coming sessions, a strong close above it will only result in trend resumption. The RSI is pointing down while MACD lags upside momentum.

Bata India: Has the trend bent?The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support. Above 1735 the bearish analysis is negated.

Trading close to a very important level. NIFTY: Nifty took beating from the bears in the last two sessions. Now at a very key juncture, a break and close below the 12000 levels have shattered the physiological support levels, still the bullish nature is not wiped out fully, if the fall continues the index may tumble to 11420 levels, again the levels I am mentioning may be vague & outrageous but still they are valid as long as selling in prominent. A minor support may be seen at 11790 below which the above targets on the downside is open.